Answered step by step

Verified Expert Solution

Question

1 Approved Answer

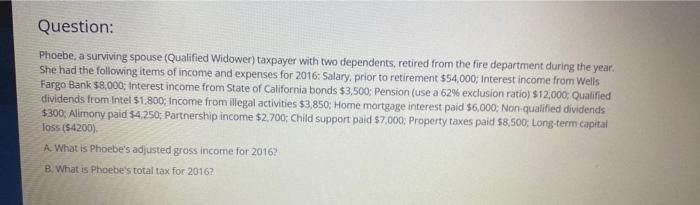

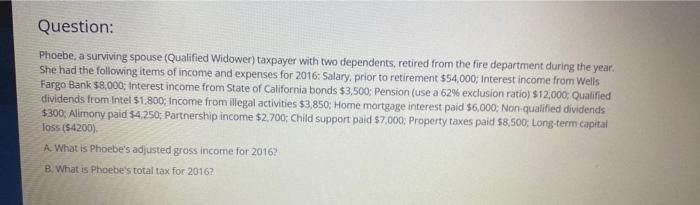

please answer part a and b and show step by step answer Question: Phoebe, a surviving spouse (Qualified Widower) taxpayer with two dependents, retired from

please answer part a and b and show step by step answer

Question: Phoebe, a surviving spouse (Qualified Widower) taxpayer with two dependents, retired from the fire department during the year. She had the following items of income and expenses for 2016: Salary, prior to retirement $54.000, Interest income from Wells Fargo Bank 58.000, Interest income from State of California bonds $3.500; Pension (use a 62% exclusion ratio) $12,000; Qualified dividends from Intel $1,800, Income from illegal activities $3,850; Home mortgage interest paid $6,000; Non-qualified dividends $300; Alimony paid $4,250; Partnership income $2.700; Child support paid $7,000: Property taxes paid $8,500; Long-term capital loss (54200). A What is Phoebe's adjusted gross income for 2016? B. What is Phoebe's total tax for 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started