Please answer part A and B fully and correctly. This is very important and I thank you for your help!!

A.

B.

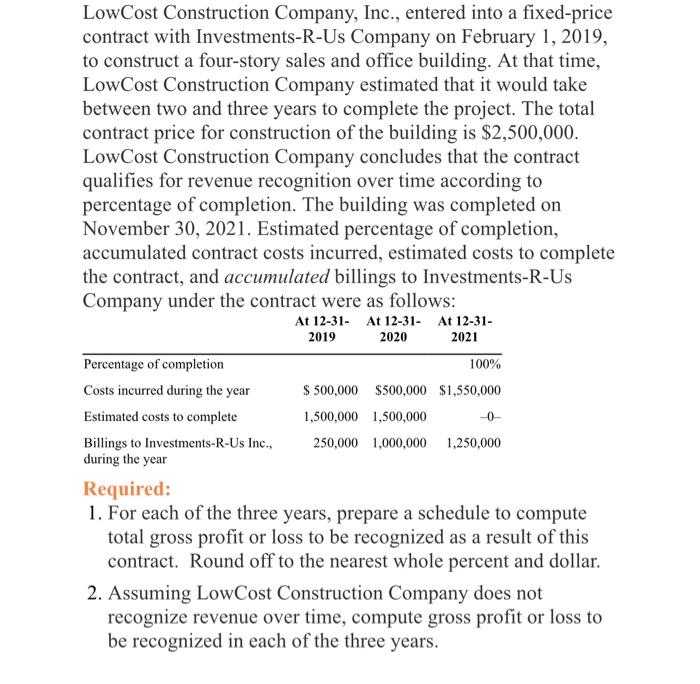

Loyola Company, a kitchen appliances manufacturer sells 10 washing machines to a dealer for $30,000 in one signed contract. Additionally, Loyola Company offered a $500 cash incentive (price reduction per machine purchased) to the dealer for all machines purchased within two weeks leading to the July 4th holiday. The sale includes three years of maintenance for each of the machines. The standalone selling price of the washing machines is $30,000 and the standalone selling price of the maintenance contract is $2,000. Loyola company purchased the machines at a combined total of $25,000. In answering the following questions, round each amount to the nearest whole dollar. Instructions 1. How many performance obligations are in this contract? 2. Allocate the transaction price to the performance obligations identified in \#1 assuming the machines were sold on July 1st (within the offer time). LowCost Construction Company, Inc., entered into a fixed-price contract with Investments-R-Us Company on February 1, 2019, to construct a four-story sales and office building. At that time, LowCost Construction Company estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $2,500,000. LowCost Construction Company concludes that the contract qualifies for revenue recognition over time according to percentage of completion. The building was completed on November 30, 2021. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Investments-R-Us Company under the contract were as follows: 1. For each of the three years, prepare a schedule to compute total gross profit or loss to be recognized as a result of this contract. Round off to the nearest whole percent and dollar. 2. Assuming LowCost Construction Company does not recognize revenue over time, compute gross profit or loss to be recognized in each of the three years. Loyola Company, a kitchen appliances manufacturer sells 10 washing machines to a dealer for $30,000 in one signed contract. Additionally, Loyola Company offered a $500 cash incentive (price reduction per machine purchased) to the dealer for all machines purchased within two weeks leading to the July 4th holiday. The sale includes three years of maintenance for each of the machines. The standalone selling price of the washing machines is $30,000 and the standalone selling price of the maintenance contract is $2,000. Loyola company purchased the machines at a combined total of $25,000. In answering the following questions, round each amount to the nearest whole dollar. Instructions 1. How many performance obligations are in this contract? 2. Allocate the transaction price to the performance obligations identified in \#1 assuming the machines were sold on July 1st (within the offer time). LowCost Construction Company, Inc., entered into a fixed-price contract with Investments-R-Us Company on February 1, 2019, to construct a four-story sales and office building. At that time, LowCost Construction Company estimated that it would take between two and three years to complete the project. The total contract price for construction of the building is $2,500,000. LowCost Construction Company concludes that the contract qualifies for revenue recognition over time according to percentage of completion. The building was completed on November 30, 2021. Estimated percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Investments-R-Us Company under the contract were as follows: 1. For each of the three years, prepare a schedule to compute total gross profit or loss to be recognized as a result of this contract. Round off to the nearest whole percent and dollar. 2. Assuming LowCost Construction Company does not recognize revenue over time, compute gross profit or loss to be recognized in each of the three years