Answered step by step

Verified Expert Solution

Question

1 Approved Answer

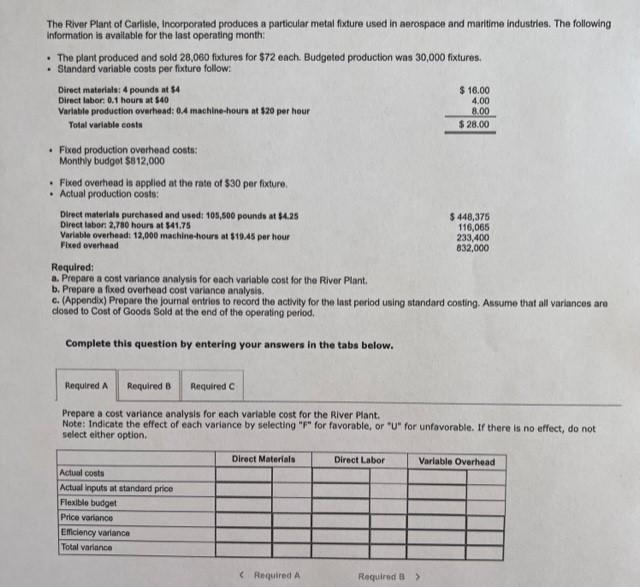

PLEASE ANSWER PART A The River Plant of Cartisle, Incorporated produces a particular metal fixture used in aerospace and maritime industries. The following Information is

PLEASE ANSWER PART A

The River Plant of Cartisle, Incorporated produces a particular metal fixture used in aerospace and maritime industries. The following Information is available for the last operating month: - The plant produced and sold 28,060 fixtures for $72 each. Budgeted production was 30,000 fixtures. - Standard variable costs per fixture follow: Required: a. Prepare a cost variance analysis for each variable cont for the River Plant. b. Prepare a fixed overtead cost variance analyais. c. (Appendix) Prepare the journal entries to record the activity for the last pariod using standard costing. Aswume that all variances are closed to Cost of Goods Sold at the end of the operating period. Complete this question by entering your answers in the tabs below. Prepare a cost variance analysis for each variable cost for the River Plant. Note: Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select elther optionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started