Answered step by step

Verified Expert Solution

Question

1 Approved Answer

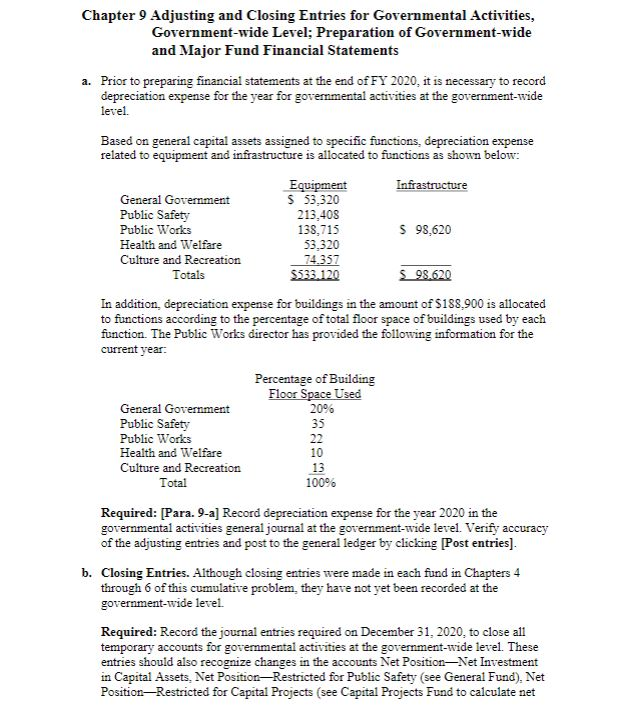

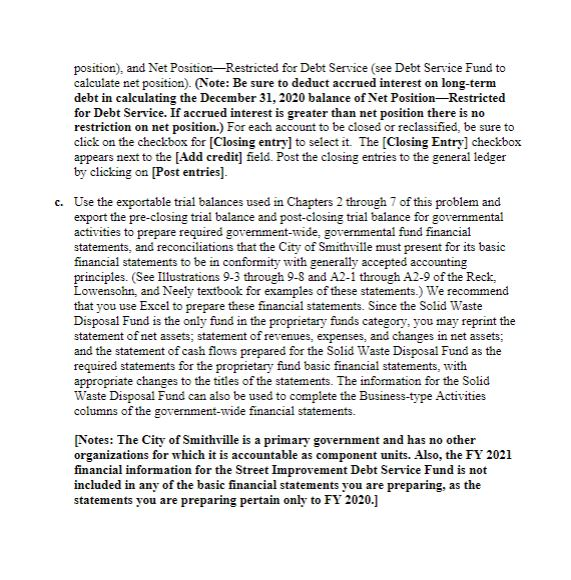

Please answer Part A) with Journal Entries using these available accounts: Cash Taxes Receivable-Current Allowance for Uncollectible Current Taxes Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent

Please answer Part A) with Journal Entries using these available accounts:

| Cash | ||

| Taxes Receivable-Current | ||

| Allowance for Uncollectible Current Taxes | ||

| Taxes Receivable-Delinquent | ||

| Allowance for Uncollectible Delinquent Taxes | ||

| Interest and Penalties Receivable on Taxes | ||

| Allowance for Uncollectible Interest and Penalties | ||

| Due from Federal Government | ||

| Due from State Government | ||

| Accrued Sales Taxes Receivable | ||

| Interest Receivable on Investments | ||

| Internal Receivables from Business-Type Activities | ||

| Inventory of Supplies | ||

| Investments | ||

| Land | ||

| Improvements other than Buildings | ||

| Accumulated Depreciation-Improvements other than Buildings | ||

| Infrastructure | ||

| Accumulated Depreciation-Infrastructure | ||

| Buildings | ||

| Accumulated Depreciation-Buildings | ||

| Equipment | ||

| Accumulated Depreciation-Equipment | ||

| Construction in Progress | ||

| Deferred Outflows of Resources | ||

| Vouchers Payable | ||

| Tax Anticipation Notes Payable | ||

| Due to Federal Government | ||

| Due to State Government | ||

| Contracts Payable | ||

| Contracts Payable-Retained Percentage | ||

| Accrued Interest Payable on Long-Term Debt | ||

| Judgments Payable | ||

| Internal Payables to Business-Type Activities | ||

| Current Portion of Long-Term Debt | ||

| Serial Bonds Payable | ||

| Deferred Serial Bonds Payable | ||

| Premium on Deferred Serial Bonds Payable | ||

| Deferred Inflows of Resources | ||

| Net Position-Net Investment in Capital Assets | ||

| Net Position-Restricted for General Government | ||

| Net Position-Restricted for Public Safety | ||

| Net Position-Restricted for Public Works | ||

| Net Position-Restricted for Health and Welfare | ||

| Net Position-Restricted for Culture and Recreation | ||

| Net Position-Restricted for Capital Projects | ||

| Net Position-Restricted for Debt Service | ||

| Net Position-Unrestricted | ||

| Program Revenues-General Government-Charges for Services | ||

| Program Revenues-General Government-Operating Grants and Contributions | ||

| Program Revenues-General Government-Capital Grants and Contributions | ||

| Program Revenues-Public Safety-Charges for Services | ||

| Program Revenues-Public Safety-Operating Grants and Contributions | ||

| Program Revenues-Public Safety-Capital Grants and Contributions | ||

| Program Revenues-Public Works-Charges for Services | ||

| Program Revenues-Public Works-Operating Grants and Contributions | ||

| Program Revenues-Public Works-Capital Grants and Contributions | ||

| Program Revenues-Health and Welfare-Charges for Services | ||

| Program Revenues-Health and Welfare-Operating Grants and Contributions | ||

| Program Revenues-Health and Welfare-Capital Grants and Contributions | ||

| Program Revenues-Culture and Recreation-Charges for Services | ||

| Program Revenues-Culture and Recreation-Operating Grants and Contributions | ||

| Program Revenues-Culture and Recreation-Capital Grants and Contributions | ||

| General Revenues-Taxes-Real Property | ||

| General Revenues-Taxes-Sales | ||

| General Revenues-Interest and Penalties on Taxes | ||

| General Revenues-Miscellaneous | ||

| General Revenues-Investment Earnings | ||

| General Revenues-Change in Fair Value of Investments | ||

| Expenses-General Government | ||

| Expenses-Public Safety | ||

| Expenses-Public Works | ||

| Expenses-Health and Welfare | ||

| Expenses-Culture and Recreation | ||

| Expenses-Interest on Long-Term Debt |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started