Please answer Part (a),(b) & (c)

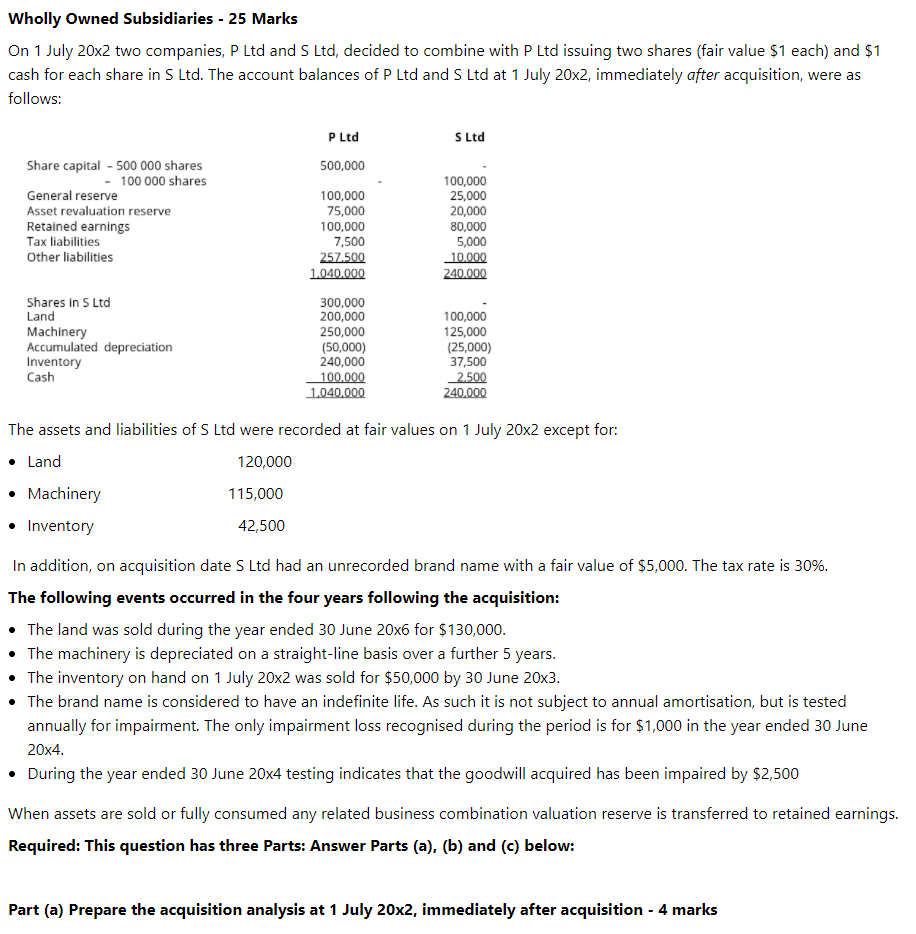

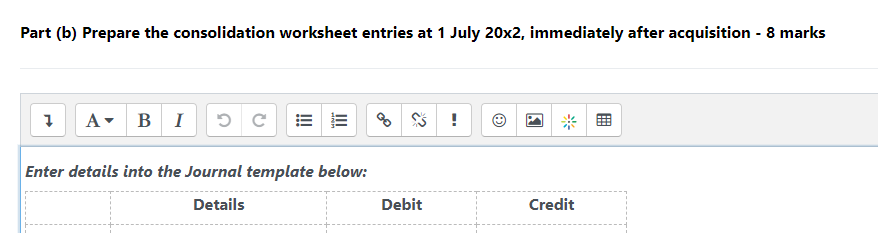

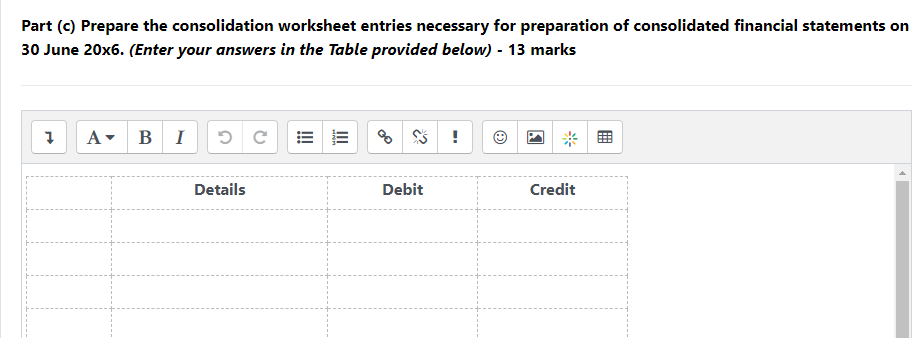

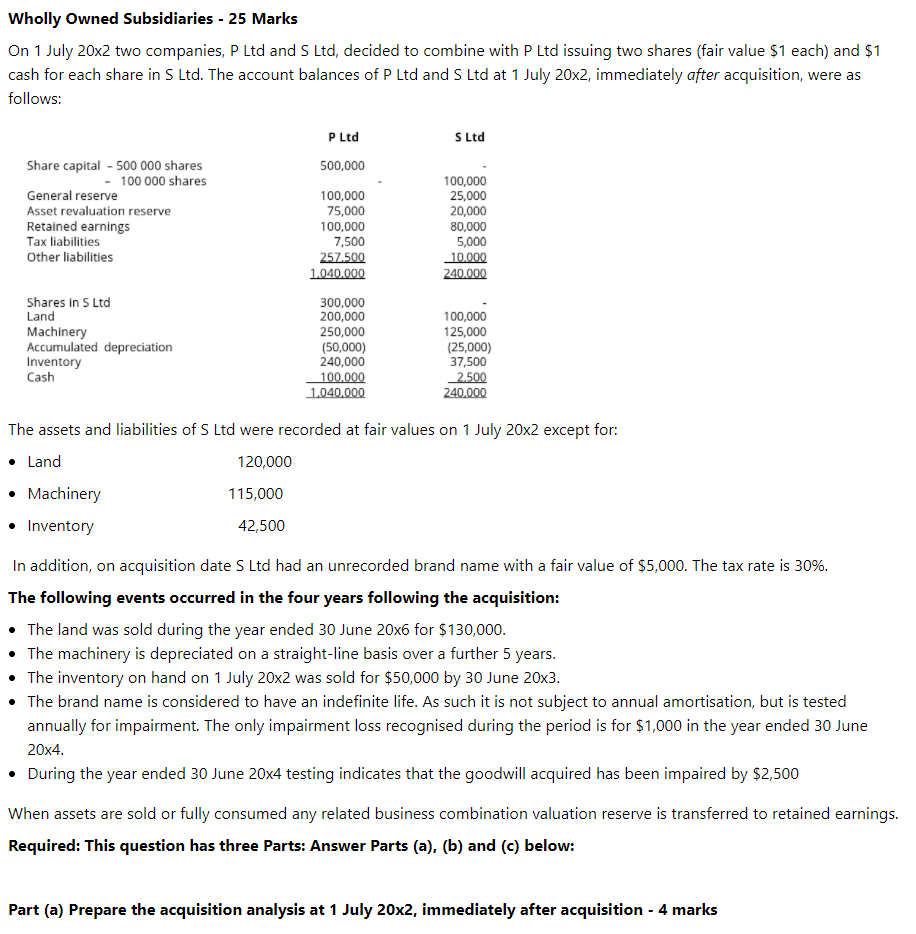

Wholly Owned Subsidiaries - 25 Marks On 1 July 20x2 two companies, P Ltd and S Ltd, decided to combine with P Ltd issuing two shares (fair value $1 each) and $1 cash for each share in S Ltd. The account balances of P Ltd and S Ltd at 1 July 20x2, immediately after acquisition, were as follows: S Ltd P Ltd 500,000 Share capital - 500 000 shares 100 000 shares General reserve Asset revaluation reserve Retained earnings Tax liabilities Other liabilities 100,000 25,000 20,000 80,000 5,000 10.000 240.000 Shares in S Ltd Land Machinery Accumulated depreciation Inventory Cash 100,000 75,000 100,000 7,500 257.500 1.040.000 300,000 200,000 250,000 (50,000) 240,000 100,000 1.040.000 100,000 125,000 (25,000) 37,500 2.500 240.000 The assets and liabilities of S Ltd were recorded at fair values on 1 July 20x2 except for: Land 120,000 Machinery 115,000 Inventory 42,500 In addition, on acquisition date S Ltd had an unrecorded brand name with a fair value of $5,000. The tax rate is 30%. The following events occurred in the four years following the acquisition: The land was sold during the year ended 30 June 20x6 for $130,000. The machinery is depreciated on a straight-line basis over a further 5 years. The inventory on hand on 1 July 20x2 was sold for $50,000 by 30 June 20x3. The brand name is considered to have an indefinite life. As such it is not subject to annual amortisation, but is tested annually for impairment. The only impairment loss recognised during the period is for $1,000 in the year ended 30 June 20x4. During the year ended 30 June 20x4 testing indicates that the goodwill acquired has been impaired by $2,500 When assets are sold or fully consumed any related business combination valuation reserve is transferred to retained earnings. Required: This question has three Parts: Answer Parts (a), (b) and (c) below: Part (a) Prepare the acquisition analysis at 1 July 20x2, immediately after acquisition - 4 marks Part (b) Prepare the consolidation worksheet entries at 1 July 20x2, immediately after acquisition - 8 marks 1 A- B 1 ! Enter details into the Journal template below: Details Debit Credit Part (0) Prepare the consolidation worksheet entries necessary for preparation of consolidated financial statements on 30 June 20x6. (Enter your answers in the Table provided below) - 13 marks 7 A B 1 !!! III ! Details Debit Credit Wholly Owned Subsidiaries - 25 Marks On 1 July 20x2 two companies, P Ltd and S Ltd, decided to combine with P Ltd issuing two shares (fair value $1 each) and $1 cash for each share in S Ltd. The account balances of P Ltd and S Ltd at 1 July 20x2, immediately after acquisition, were as follows: S Ltd P Ltd 500,000 Share capital - 500 000 shares 100 000 shares General reserve Asset revaluation reserve Retained earnings Tax liabilities Other liabilities 100,000 25,000 20,000 80,000 5,000 10.000 240.000 Shares in S Ltd Land Machinery Accumulated depreciation Inventory Cash 100,000 75,000 100,000 7,500 257.500 1.040.000 300,000 200,000 250,000 (50,000) 240,000 100,000 1.040.000 100,000 125,000 (25,000) 37,500 2.500 240.000 The assets and liabilities of S Ltd were recorded at fair values on 1 July 20x2 except for: Land 120,000 Machinery 115,000 Inventory 42,500 In addition, on acquisition date S Ltd had an unrecorded brand name with a fair value of $5,000. The tax rate is 30%. The following events occurred in the four years following the acquisition: The land was sold during the year ended 30 June 20x6 for $130,000. The machinery is depreciated on a straight-line basis over a further 5 years. The inventory on hand on 1 July 20x2 was sold for $50,000 by 30 June 20x3. The brand name is considered to have an indefinite life. As such it is not subject to annual amortisation, but is tested annually for impairment. The only impairment loss recognised during the period is for $1,000 in the year ended 30 June 20x4. During the year ended 30 June 20x4 testing indicates that the goodwill acquired has been impaired by $2,500 When assets are sold or fully consumed any related business combination valuation reserve is transferred to retained earnings. Required: This question has three Parts: Answer Parts (a), (b) and (c) below: Part (a) Prepare the acquisition analysis at 1 July 20x2, immediately after acquisition - 4 marks Part (b) Prepare the consolidation worksheet entries at 1 July 20x2, immediately after acquisition - 8 marks 1 A- B 1 ! Enter details into the Journal template below: Details Debit Credit Part (0) Prepare the consolidation worksheet entries necessary for preparation of consolidated financial statements on 30 June 20x6. (Enter your answers in the Table provided below) - 13 marks 7 A B 1 !!! III ! Details Debit Credit