please answer parts A-C:

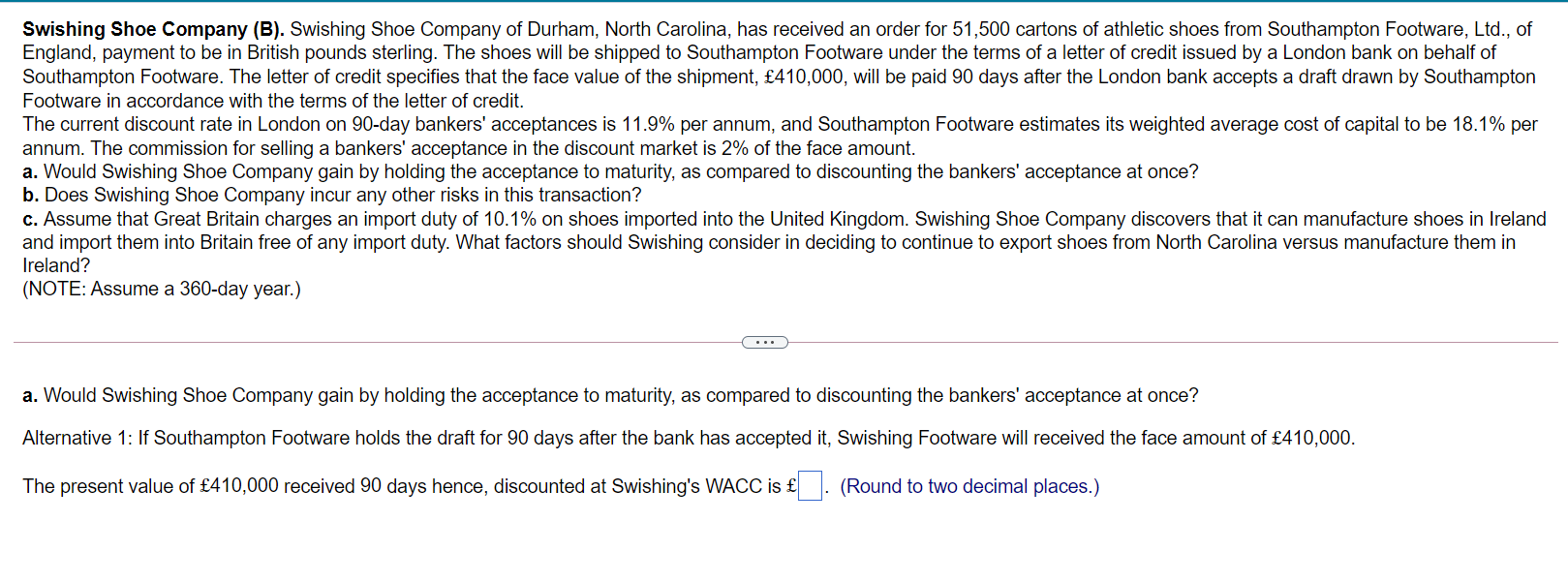

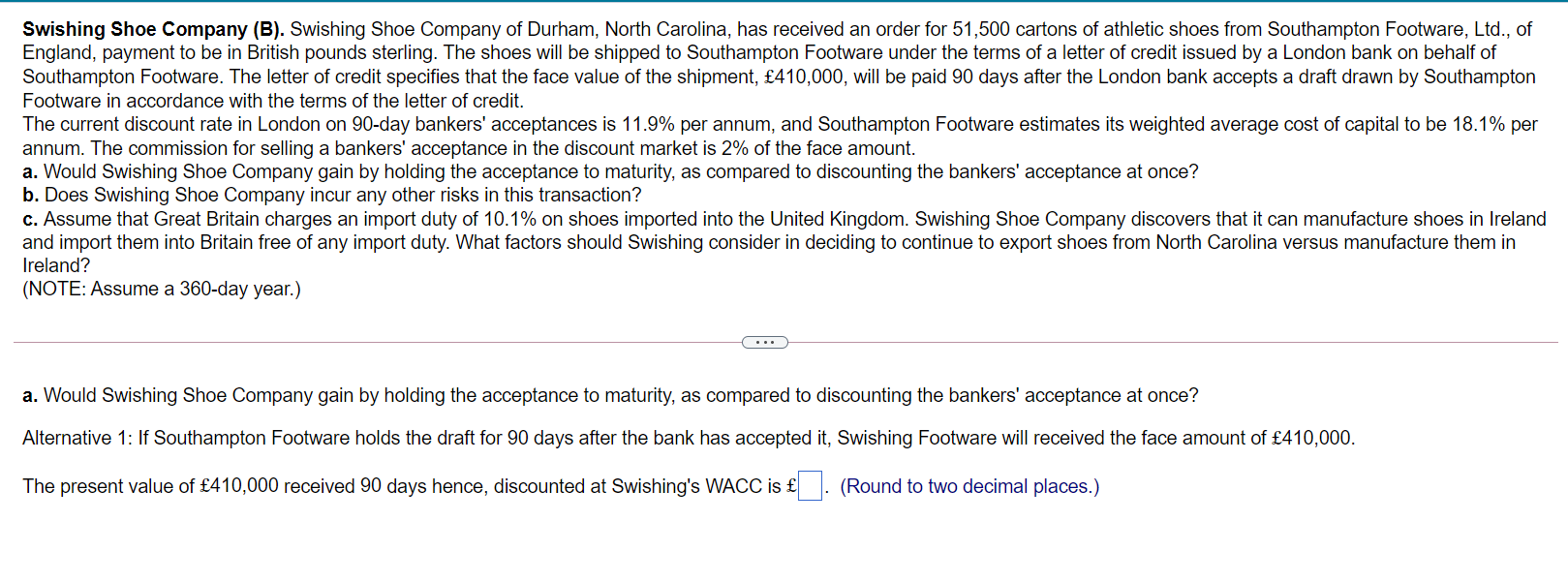

Swishing Shoe Company (B). Swishing Shoe Company of Durham, North Carolina, has received an order for 51,500 cartons of athletic shoes from Southampton Footware, Ltd., of England, payment to be in British pounds sterling. The shoes will be shipped to Southampton Footware under the terms of a letter of credit issued by a London bank on behalf of Southampton Footware. The letter of credit specifies that the face value of the shipment, 410,000, will be paid 90 days after the London bank accepts a draft drawn by Southampton Footware in accordance with the terms of the letter of credit. The current discount rate in London on 90-day bankers' acceptances is 11.9% per annum, and Southampton Footware estimates its weighted average cost of capital to be 18.1% per annum. The commission for selling a bankers' acceptance in the discount market is 2% of the face amount. a. Would Swishing Shoe Company gain by holding the acceptance to maturity, as compared to discounting the bankers' acceptance at once? b. Does Swishing Shoe Company incur any other risks in this transaction? c. Assume that Great Britain charges an import duty of 10.1% on shoes imported into the United Kingdom. Swishing Shoe Company discovers that it can manufacture shoes in Ireland and import them into Britain free of any import duty. What factors should Swishing consider in deciding to continue to export shoes from North Carolina versus manufacture them in Ireland? (NOTE: Assume a 360-day year.) a. Would Swishing Shoe Company gain by holding the acceptance to maturity, as compared to discounting the bankers' acceptance at once? Alternative 1: If Southampton Footware holds the draft for 90 days after the bank has accepted it, Swishing Footware will received the face amount of 410,000. The present value of 410,000 received 90 days hence, discounted at Swishing's WACC is D. (Round to two decimal places.) Swishing Shoe Company (B). Swishing Shoe Company of Durham, North Carolina, has received an order for 51,500 cartons of athletic shoes from Southampton Footware, Ltd., of England, payment to be in British pounds sterling. The shoes will be shipped to Southampton Footware under the terms of a letter of credit issued by a London bank on behalf of Southampton Footware. The letter of credit specifies that the face value of the shipment, 410,000, will be paid 90 days after the London bank accepts a draft drawn by Southampton Footware in accordance with the terms of the letter of credit. The current discount rate in London on 90-day bankers' acceptances is 11.9% per annum, and Southampton Footware estimates its weighted average cost of capital to be 18.1% per annum. The commission for selling a bankers' acceptance in the discount market is 2% of the face amount. a. Would Swishing Shoe Company gain by holding the acceptance to maturity, as compared to discounting the bankers' acceptance at once? b. Does Swishing Shoe Company incur any other risks in this transaction? c. Assume that Great Britain charges an import duty of 10.1% on shoes imported into the United Kingdom. Swishing Shoe Company discovers that it can manufacture shoes in Ireland and import them into Britain free of any import duty. What factors should Swishing consider in deciding to continue to export shoes from North Carolina versus manufacture them in Ireland? (NOTE: Assume a 360-day year.) a. Would Swishing Shoe Company gain by holding the acceptance to maturity, as compared to discounting the bankers' acceptance at once? Alternative 1: If Southampton Footware holds the draft for 90 days after the bank has accepted it, Swishing Footware will received the face amount of 410,000. The present value of 410,000 received 90 days hence, discounted at Swishing's WACC is D. (Round to two decimal places.)