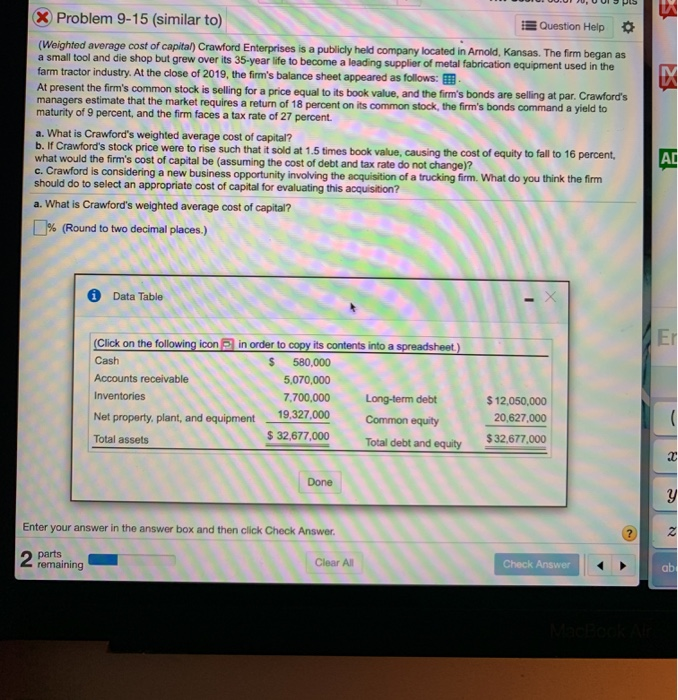

PLEASE ANSWER PARTS A-C!

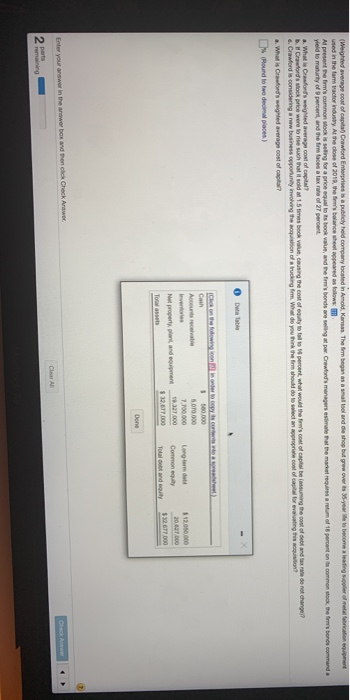

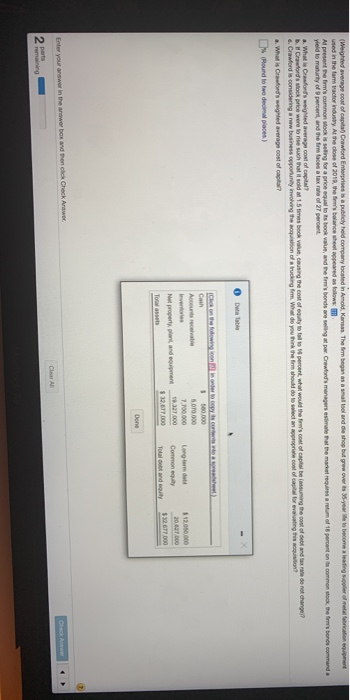

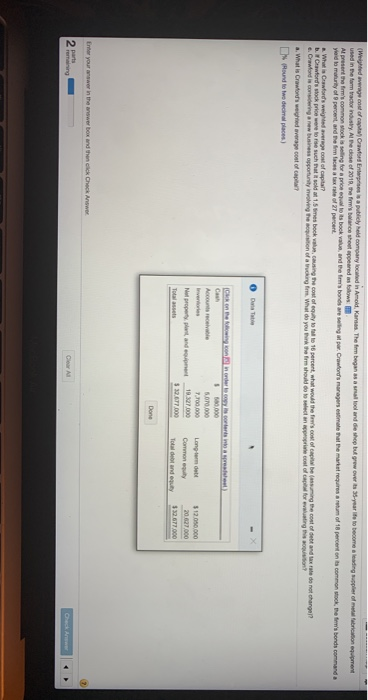

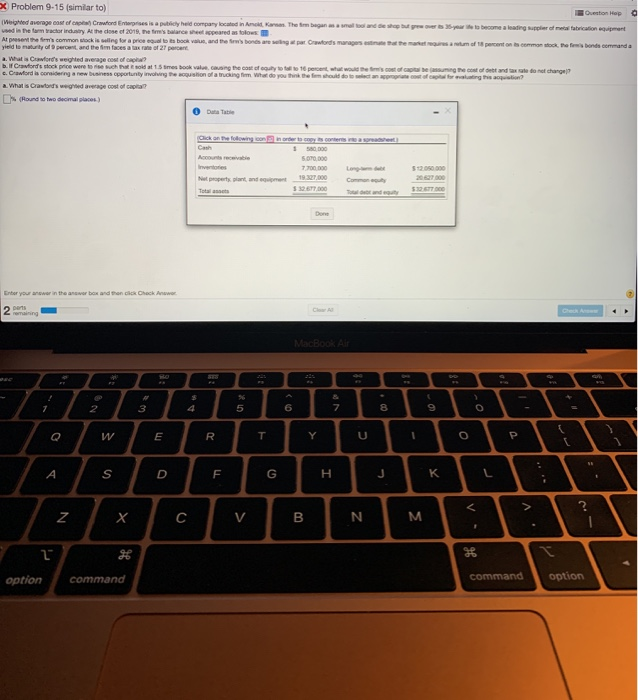

(Weighted average cost of capita Crawford Enterpr ise public held company located in Arnold, K . The firm began as a small and die shop but grow over you to become a leading of metal abrication e t used in the farm tractor industry. At the chose of 2018, the balance sheetpeared as follows: At present per common M isseling for a price equal tots book value and the firsbonds wres p o Crowford rangers est at the market requires a retum of 16 percent on a common the bones commande yield to malurry of percent, and the firm faces a law of 27 percent a. What is Crawford's weighted average cost of capital b. Crawford's price were to rise such that it sold 15 times book au, causing the cost of equity to follow percent would the cost of capital be i ng the f and e do not changer c. Crawford is considering a new business opportunity involving the acquisition of a trucking firm What do you think the firm should do to proprie cost of capital for evaluating this ? a. What is C r e ed average cost of capita 1 Hound to two decimal places) O Dela Table $ 500.000 Acrecevable $ 12,000,000 20. 000 and event- 17.000 Long-term dat CHINH 4 t Totalt and equity Nel property Total assets Enter your anwar in the work and on Check Awo (Weighted average cost of capital Crawford Enterprises is a publicly held company located in mod Ka The firm began as a tool and die shop but grew over to year life to become a ating ople of t i ment used in the form actor industry. Althose of 2018. The first shoot appeared as Al present the common stocking for a price equal to book and the fm'bonds wig por Crawford's managers that the matters aream of 18 percent on a common stock the few bonde comanda do mounty of percent and the images a re of 27 percent. Wes Crawford's weighted average cost of capital? b. Chwords or were lors such a mes book w i ng the cost of tool to 16 percent of the few's cost of carbon the cost of oubt and are not changer? . Crawford scoring new business opportunity waving the notion of a trucking . What do you r should do to an act of capital for evaluating the on? a. What is Crawford weighed average cost of capita Hound to two decimal places) O Dia $12.050.000 Nel property and en Long terdet Corony Total and 5 32.677.000 Enter your answer in the answer box and then click Check Answer 2 Problem 9-15 (similar to) Questo po words ar e s um of som e bonde comanda din the form tractor industry Althesef 2018, The B e a rd At present the common wackiewing for a price to book and the yield to maturity of percent, and their faces a la mane of 27 percent What is Core's where of b. If Crawford's stock price were wchod 1 mes book van to c. Crawford is considering new business opportunity on the long a. What is Crawo weed cost of capital Roundwoma ) OD p of e of charge We t s the cod its u 2 command option option command X Problem 9-15 (similar to) Question Help (Weighted average cost of capital) Crawford Enterprises is a publicly held company located in Amold, Kansas. The firm began as a small tool and die shop but grew over its 35-year life to become a leading supplier of metal fabrication equipment used in the farm tractor industry. At the close of 2019, the firm's balance sheet appeared as follows: At present the firm's common stock is selling for a price equal to its book value, and the firm's bonds are selling managers estimate that the market requires a return of 18 percent on its common stock, the firm's bonds command a yield to maturity of 9 percent, and the firm faces a tax rate of 27 percent. a. What is Crawford's weighted average cost of capital? b. If Crawford's stock price were to rise such that it sold at 1.5 times book value, causing the cost of equity to fall to 16 percent. what would the firm's cost of capital be (assuming the cost of debt and tax rate do not change)? c. Crawford is considering a new business opportunity involving the acquisition of a trucking firm. What do you think the firm should do to select an appropriate cost of capital for evaluating this acquisition? a. What is Crawford's weighted average cost of capital? % (Round to two decimal places.) Data Table $ (Click on the following icon in order to copy its contents into a spreadsheet.) Cash 580,000 Accounts receivable 5,070,000 Inventories 7.700,000 Long-term debt Net property, plant, and equipment 19,327.000 Common equity $ 32,677,000 Total assets Total debt and equity $12,050,000 20,627.000 $32,677,000 Enter your answer in the answer box and then click Check Answer 2 parts 2 remaining