please answer parts b-h

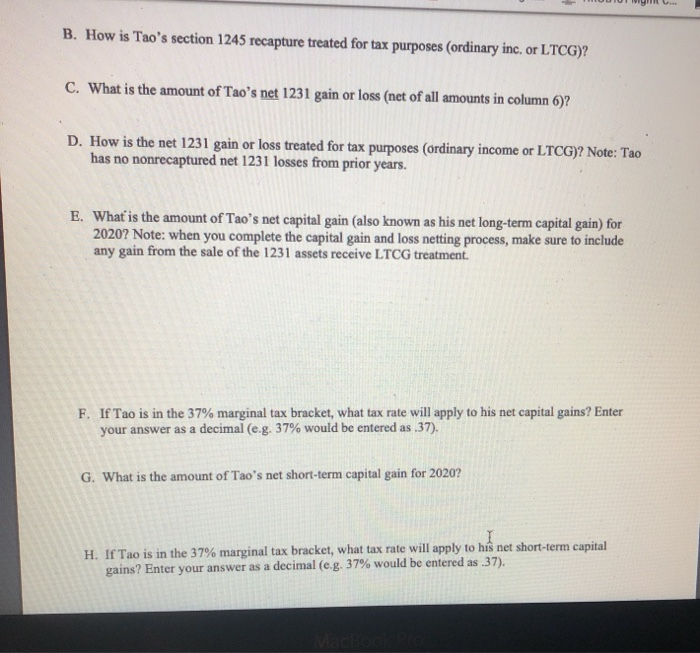

AUW B. How is Tao's section 1245 recapture treated for tax purposes (ordinary inc. or LTCG)? C. What is the amount of Tao's net 1231 gain or loss (net of all amounts in column 6)? D. How is the net 1231 gain or loss treated for tax purposes (ordinary income or LTCG)? Note: Tao has no nonrecaptured net 1231 losses from prior years. E. What is the amount of Tao's net capital gain (also known as his net long-term capital gain) for 2020? Note: when you complete the capital gain and loss netting process, make sure to include any gain from the sale of the 1231 assets receive LTCG treatment. F. If Tao is in the 37% marginal tax bracket, what tax rate will apply to his net capital gains? Enter your answer as a decimal (e.g. 37% would be entered as 37). G. What is the amount of Tao's net short-term capital gain for 2020? H. If Tao is in the 37% marginal tax bracket, what tax rate will apply to his net short-term capital gains? Enter your answer as a decimal (e.g. 37% would be entered as 37). Diylewave! Urgan... HROB101 Mgmt C... 7, please complete that first. Module 8 Activity: Tao purchased a piece of business-use, depreciable personal property (Property 1) several years ago for $100,000. While Tao owned Property 1, he took depreciation deductions of $50,000. Tao sold Property 1 in 2020 for $107,000. Tao also sold the following in 2020: Property 2 (equipment): purchased for $100,000 on January 1, 2016; accumulated depreciation of $90,000; sold for $8,000 Stock A (investment property): gifted to Tao on March 1, 2020 (FMV on date of gift - $8,000; donor's AB = $1,000; donor's HP - 1 month); sold for $9,000 on Dec. 1, 2020 Stock B investment property): gifted to Tao on January 1, 2020 (FMV on date of gift $5,000; donor's AB - $6,000; donor's HP = 3 years); sold for $1,000 on Dec. 1, 2020 Stock C (investment property): purchased for $5,900 on January 1, 2017 & paid acquisition costs of $100; sold for $5,100 on Dec. 1, 2020 & paid selling expenses of $100 A bike (personal-use): purchased for $2,500 in 2017, sold for $500 on Dec. 1, 2020 Complete columns 1 (Type of Asset), 5 (1245 Recapture), 6 (1231 Gain/Loss) and 7 (Capital Gain/Loss & ST/LT) of the following table, then answers Questions A-H. (1) Type of (2) Adjusted (3) Amount (4) Gain/Loss (5) 1245 (6) 1231 Gain/Loss - (7) Capital Asset Basis at Realized on Recognized Recapture NOTE: do not include any Gain/Loss & Time of Sale Sale portion of the recognised gain whether it is ST or LT that is recaptured under rection 1245 Prop $50,000 $107,000 $57,000 N/A Prop $10,000 $8,000 ($2,000) N/A N/A N/A Stock $1,000 $9,000 $8,000 NA Stock $5,000 $1,000 N/A (54,000) ($1,000) N/A N/A Stock $6,000 $5,000 N/A Bike $2,500 $500 N/A N/A N/A