Answered step by step

Verified Expert Solution

Question

1 Approved Answer

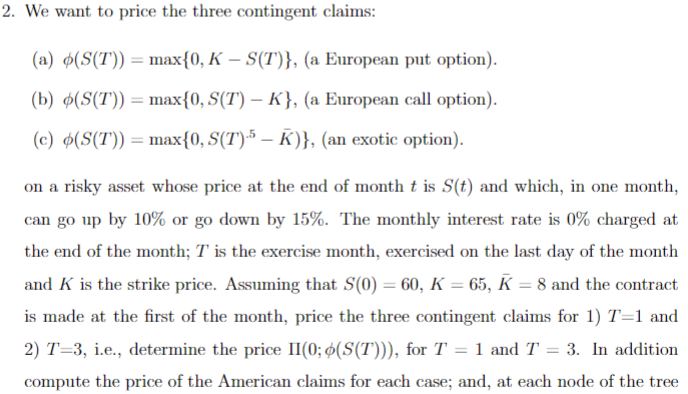

Please answer problem 3 only!!! We want to price the three contingent claims: (a) (S(T))=max{0,KS(T)}, (a European put option). (b) (S(T))=max{0,S(T)K}, (a European call option).

Please answer problem 3 only!!!

We want to price the three contingent claims: (a) (S(T))=max{0,KS(T)}, (a European put option). (b) (S(T))=max{0,S(T)K}, (a European call option). (c) (S(T))=max{0,S(T).5K)}, (an exotic option). on a risky asset whose price at the end of month t is S(t) and which, in one month, can go up by 10% or go down by 15%. The monthly interest rate is 0% charged at the end of the month; T is the exercise month, exercised on the last day of the month and K is the strike price. Assuming that S(0)=60,K=65,K=8 and the contract is made at the first of the month, price the three contingent claims for 1) T=1 and 2) T=3, i.e., determine the price (0;(S(T))), for T=1 and T=3. In addition compute the price of the American claims for each case; and, at each node of the tree specify the replicating/self financing portfolio that results. Also argue why one should accept the value of the replicating portfolio at each node as the price of the claim. 3. Consider the above problem. For the call option, draw out the binary tree (a) when T=4 and a 3% dividend is paid on the price of the asset every two periods; and (b) when a constant dividend of $2.00 is paid each two periodsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started