Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer problem 5 using a financial calculator, show your work. Uusinesses will 10. Scenario Analysis [LO2] You are at work when a co-worker excitedly

please answer problem 5 using a financial calculator, show your work.

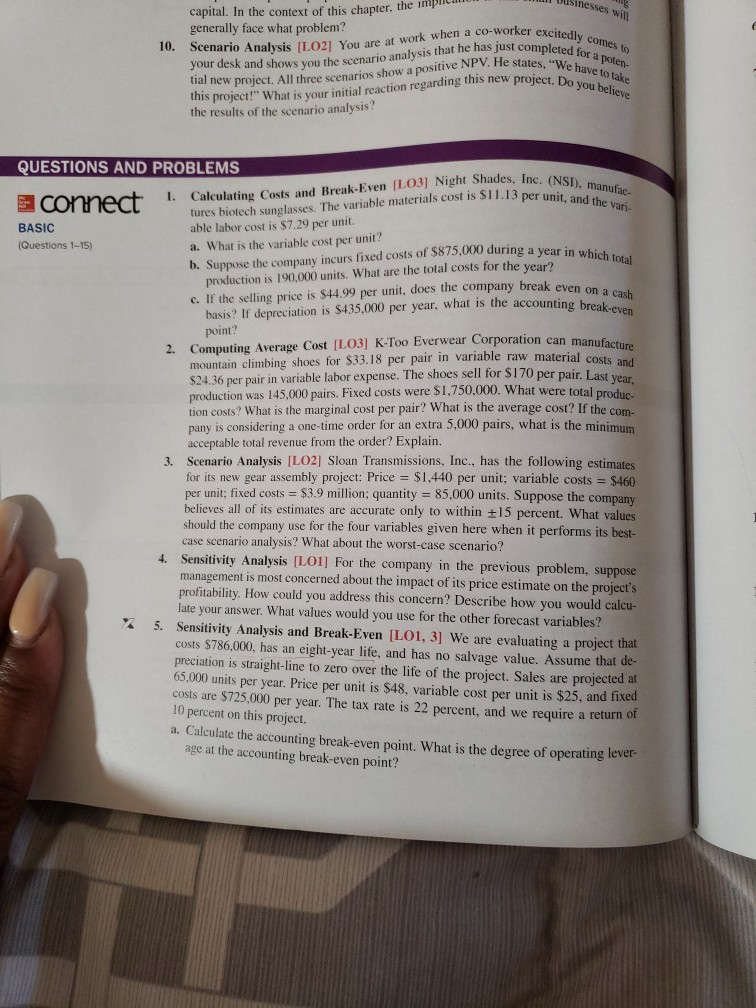

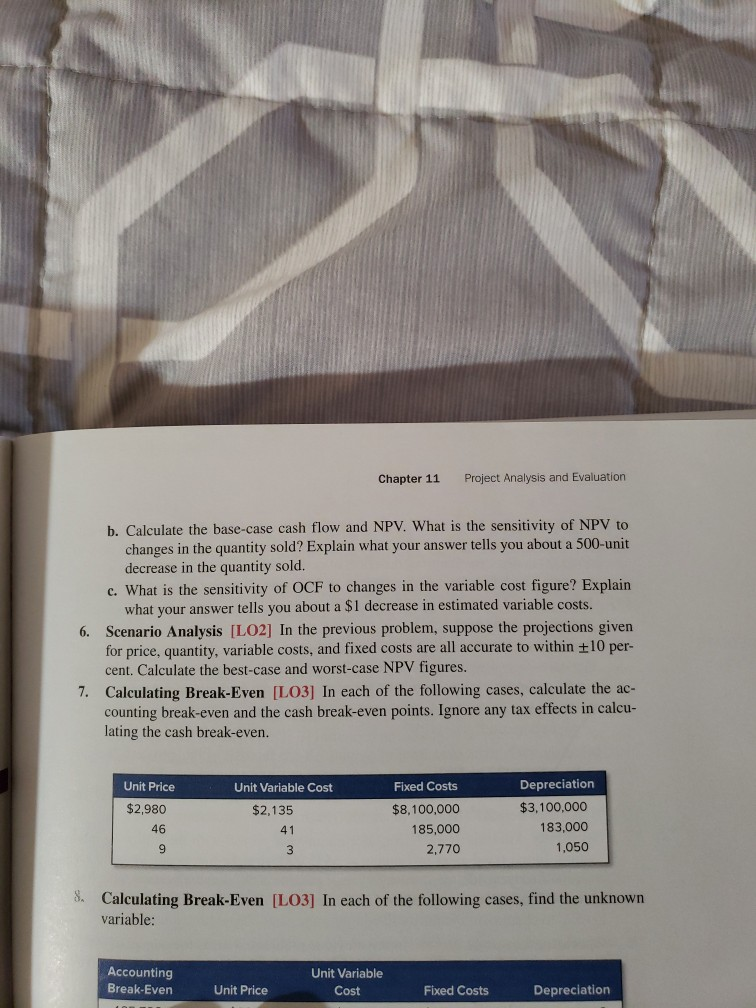

Uusinesses will 10. Scenario Analysis [LO2] You are at work when a co-worker excitedly comes to your desk and shows you the scenario analysis that he has just completed for a poten- tial new project. All three scenarios show a positive NPV. He states, "We have to take this project! What is your initial reaction regarding this new project. Do you believe 1. Calculating Costs and Break-Even [103] Night Shades, Inc. (NSi), manufac- tures biotech sunglasses. The variable materials cost is SI1.13 per unit, and the vari- c. If the selling price is $44.99 per unit, does the company break even on a cash capital. In the context of this chapter, the imp generally face what problem? the results of the scenario analysis? QUESTIONS AND PROBLEMS connect BASIC able labor cost is $7.29 per unit (Questions 1-15) a. What is the variable cost per unit? production is 190,000 units. What are the total costs for the year? basis? If depreciation is 8435,000 per year, what is the accounting break-even point? 2. Computing Average Cost [LO3] K-Too Everwear Corporation can manufacture mountain climbing shoes for $33.18 per pair in variable raw material costs and $24.36 per pair in variable labor expense. The shoes sell for $170 per pair. Last year, production was 145,000 pairs. Fixed costs were $1,750,000. What were total produc- tion costs? What is the marginal cost per pair? What is the average cost? If the com- pany is considering a one-time order for an extra 5,000 pairs, what is the minimum acceptable total revenue from the order? Explain. 3. Scenario Analysis [LO2] Sloan Transmissions, Inc., has the following estimates for its new gear assembly project: Price = $1,440 per unit; variable costs = $460 per unit; fixed costs = $3.9 million; quantity = 85,000 units. Suppose the company believes all of its estimates are accurate only to within 15 percent. What values should the company use for the four variables given here when it performs its best- case scenario analysis? What about the worst-case scenario? 4. Sensitivity Analysis (L01] For the company in the previous problem, suppose management is most concerned about the impact of its price estimate on the project's profitability. How could you address this concern? Describe how you would calcu- late your answer. What values would you use for the other forecast variables? x 5. Sensitivity Analysis and Break-Even [LO1, 3] We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that de- preciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. a. Calculate the accounting break-even point. What is the degree of operating lever- age at the accounting break-even point? Chapter 11 Project Analysis and Evaluation b. Calculate the base-case cash flow and NPV. What is the sensitivity of NPV to changes in the quantity sold? Explain what your answer tells you about a 500-unit decrease in the quantity sold. c. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. 6. Scenario Analysis [LO2] In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within 10 per- cent. Calculate the best-case and worst-case NPV figures. 7. Calculating Break-Even [LO3] In each of the following cases, calculate the ac- counting break-even and the cash break-even points. Ignore any tax effects in calcu- lating the cash break-even. Unit Variable Cost $2,135 Unit Price $2,980 46 9 Fixed Costs $8,100,000 185.000 2.770 Depreciation $3,100,000 183,000 1.050 41 3 8. Calculating Break-Even [LO3] In each of the following cases, find the unknown variable: Accounting Break-Even Unit Variable Cost Unit Price Fixed Costs Depreciation Uusinesses will 10. Scenario Analysis [LO2] You are at work when a co-worker excitedly comes to your desk and shows you the scenario analysis that he has just completed for a poten- tial new project. All three scenarios show a positive NPV. He states, "We have to take this project! What is your initial reaction regarding this new project. Do you believe 1. Calculating Costs and Break-Even [103] Night Shades, Inc. (NSi), manufac- tures biotech sunglasses. The variable materials cost is SI1.13 per unit, and the vari- c. If the selling price is $44.99 per unit, does the company break even on a cash capital. In the context of this chapter, the imp generally face what problem? the results of the scenario analysis? QUESTIONS AND PROBLEMS connect BASIC able labor cost is $7.29 per unit (Questions 1-15) a. What is the variable cost per unit? production is 190,000 units. What are the total costs for the year? basis? If depreciation is 8435,000 per year, what is the accounting break-even point? 2. Computing Average Cost [LO3] K-Too Everwear Corporation can manufacture mountain climbing shoes for $33.18 per pair in variable raw material costs and $24.36 per pair in variable labor expense. The shoes sell for $170 per pair. Last year, production was 145,000 pairs. Fixed costs were $1,750,000. What were total produc- tion costs? What is the marginal cost per pair? What is the average cost? If the com- pany is considering a one-time order for an extra 5,000 pairs, what is the minimum acceptable total revenue from the order? Explain. 3. Scenario Analysis [LO2] Sloan Transmissions, Inc., has the following estimates for its new gear assembly project: Price = $1,440 per unit; variable costs = $460 per unit; fixed costs = $3.9 million; quantity = 85,000 units. Suppose the company believes all of its estimates are accurate only to within 15 percent. What values should the company use for the four variables given here when it performs its best- case scenario analysis? What about the worst-case scenario? 4. Sensitivity Analysis (L01] For the company in the previous problem, suppose management is most concerned about the impact of its price estimate on the project's profitability. How could you address this concern? Describe how you would calcu- late your answer. What values would you use for the other forecast variables? x 5. Sensitivity Analysis and Break-Even [LO1, 3] We are evaluating a project that costs $786,000, has an eight-year life, and has no salvage value. Assume that de- preciation is straight-line to zero over the life of the project. Sales are projected at 65,000 units per year. Price per unit is $48, variable cost per unit is $25, and fixed costs are $725,000 per year. The tax rate is 22 percent, and we require a return of 10 percent on this project. a. Calculate the accounting break-even point. What is the degree of operating lever- age at the accounting break-even point? Chapter 11 Project Analysis and Evaluation b. Calculate the base-case cash flow and NPV. What is the sensitivity of NPV to changes in the quantity sold? Explain what your answer tells you about a 500-unit decrease in the quantity sold. c. What is the sensitivity of OCF to changes in the variable cost figure? Explain what your answer tells you about a $1 decrease in estimated variable costs. 6. Scenario Analysis [LO2] In the previous problem, suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within 10 per- cent. Calculate the best-case and worst-case NPV figures. 7. Calculating Break-Even [LO3] In each of the following cases, calculate the ac- counting break-even and the cash break-even points. Ignore any tax effects in calcu- lating the cash break-even. Unit Variable Cost $2,135 Unit Price $2,980 46 9 Fixed Costs $8,100,000 185.000 2.770 Depreciation $3,100,000 183,000 1.050 41 3 8. Calculating Break-Even [LO3] In each of the following cases, find the unknown variable: Accounting Break-Even Unit Variable Cost Unit Price Fixed Costs DepreciationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started