Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer problem by filling out an actual IRS 2020 Form 1040 & Schedule D & posting a screenshot of the filled out forms. Thank

Please answer problem by filling out an actual IRS 2020 Form 1040 & Schedule D & posting a screenshot of the filled out forms. Thank you

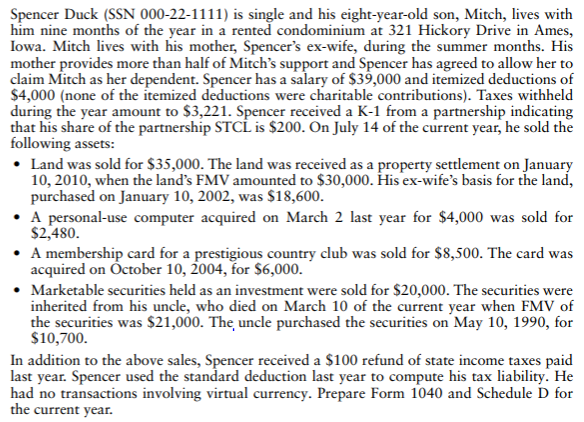

Spencer Duck (SSN 000-22-1111) is single and his eight-year-old son, Mitch, lives with him nine months of the year in a rented condominium at 321 Hickory Drive in Ames, Iowa. Mitch lives with his mother, Spencer's ex-wife, during the summer months. His mother provides more than half of Mitch's support and Spencer has agreed to allow her to claim Mitch as her dependent. Spencer has a salary of $39,000 and itemized deductions of $4,000 (none of the itemized deductions were charitable contributions). Taxes withheld during the year amount to $3,221. Spencer received a K-1 from a partnership indicating that his share of the partnership STCL is $200. On July 14 of the current year, he sold the following assets: Land was sold for $35,000. The land was received as a property settlement on January 10, 2010, when the land's FMV amounted to $30,000. His ex-wife's basis for the land, purchased on January 10, 2002, was $18,600. A personal-use computer acquired on March 2 last year for $4,000 was sold for $2,480. A membership card for a prestigious country club was sold for $8,500. The card was acquired on October 10, 2004, for $6,000. Marketable securities held as an investment were sold for $20,000. The securities were inherited from his uncle, who died on March 10 of the current year when FMV of the securities was $21,000. The uncle purchased the securities on May 10, 1990, for $10,700. In addition to the above sales, Spencer received a $100 refund of state income taxes paid last year. Spencer used the standard deduction last year to compute his tax liability. He had no transactions involving virtual currency. Prepare Form 1040 and Schedule D for the current year. Spencer Duck (SSN 000-22-1111) is single and his eight-year-old son, Mitch, lives with him nine months of the year in a rented condominium at 321 Hickory Drive in Ames, Iowa. Mitch lives with his mother, Spencer's ex-wife, during the summer months. His mother provides more than half of Mitch's support and Spencer has agreed to allow her to claim Mitch as her dependent. Spencer has a salary of $39,000 and itemized deductions of $4,000 (none of the itemized deductions were charitable contributions). Taxes withheld during the year amount to $3,221. Spencer received a K-1 from a partnership indicating that his share of the partnership STCL is $200. On July 14 of the current year, he sold the following assets: Land was sold for $35,000. The land was received as a property settlement on January 10, 2010, when the land's FMV amounted to $30,000. His ex-wife's basis for the land, purchased on January 10, 2002, was $18,600. A personal-use computer acquired on March 2 last year for $4,000 was sold for $2,480. A membership card for a prestigious country club was sold for $8,500. The card was acquired on October 10, 2004, for $6,000. Marketable securities held as an investment were sold for $20,000. The securities were inherited from his uncle, who died on March 10 of the current year when FMV of the securities was $21,000. The uncle purchased the securities on May 10, 1990, for $10,700. In addition to the above sales, Spencer received a $100 refund of state income taxes paid last year. Spencer used the standard deduction last year to compute his tax liability. He had no transactions involving virtual currency. Prepare Form 1040 and Schedule D for the current yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started