Please answer Q3 parts A,B,C. The Audit report is on page 19 under AR.2. The audit work papers are on pages 109-129. Help would be greatly appreciated!

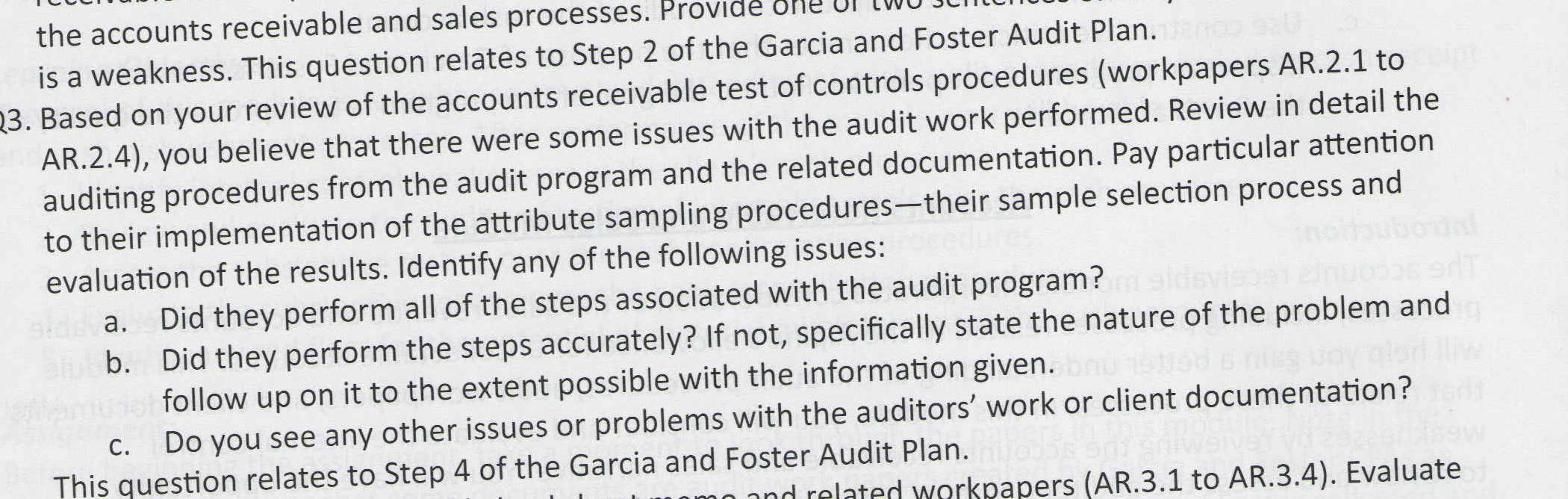

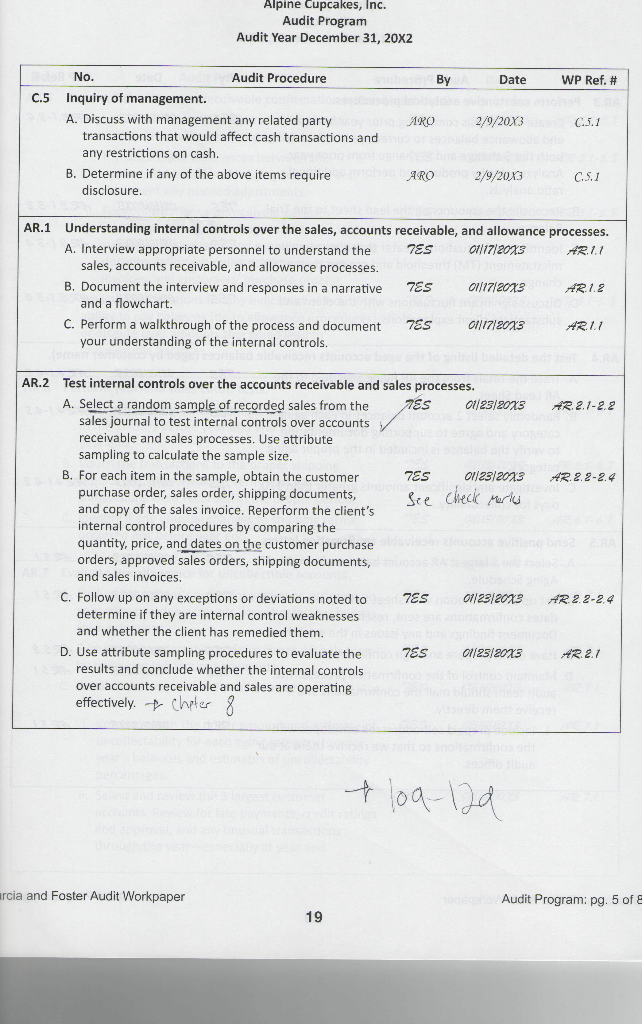

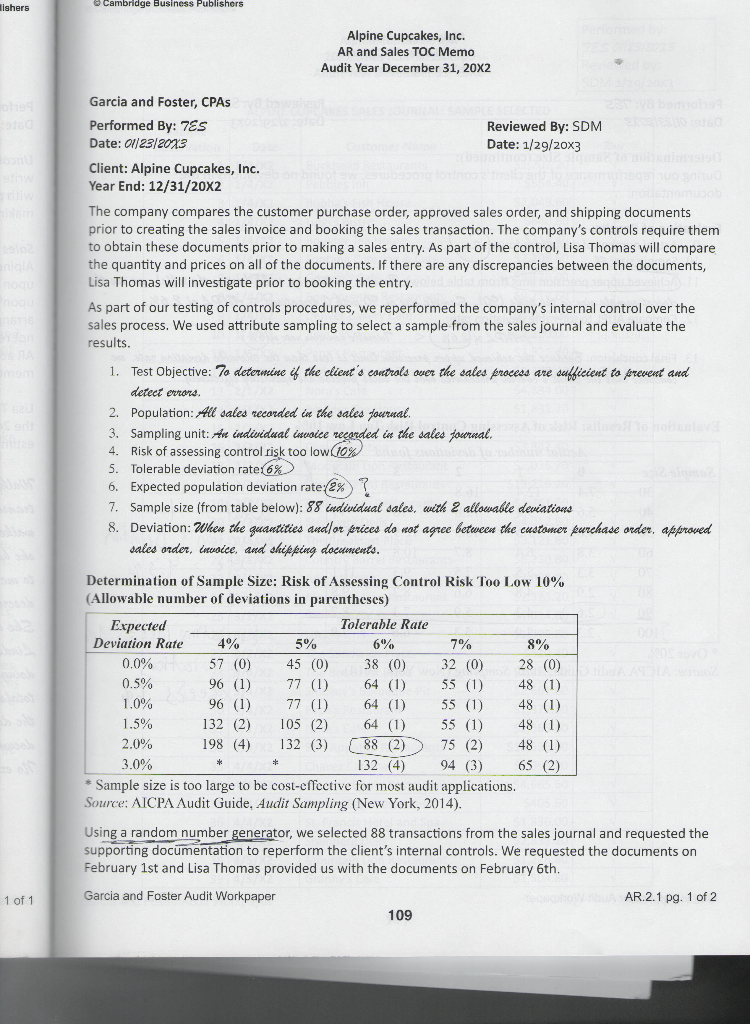

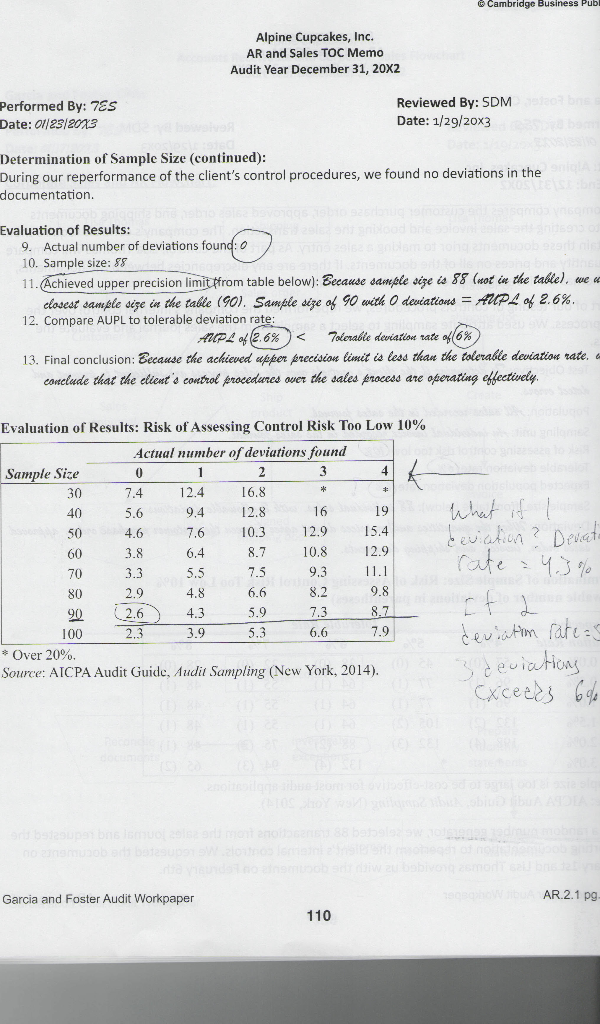

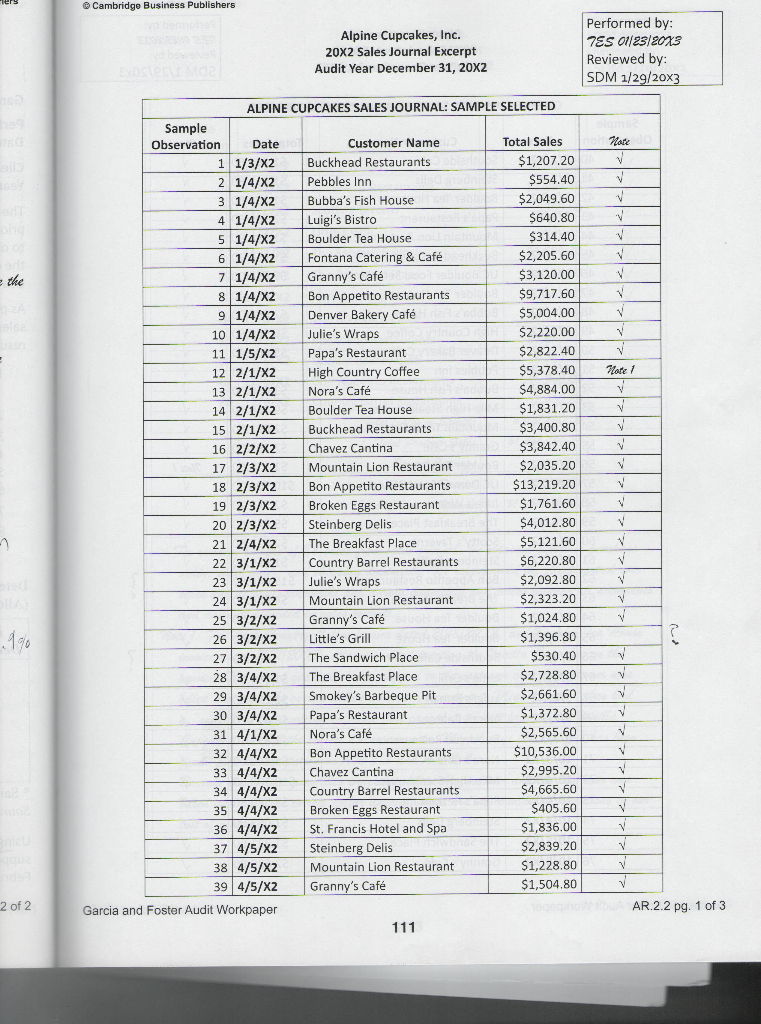

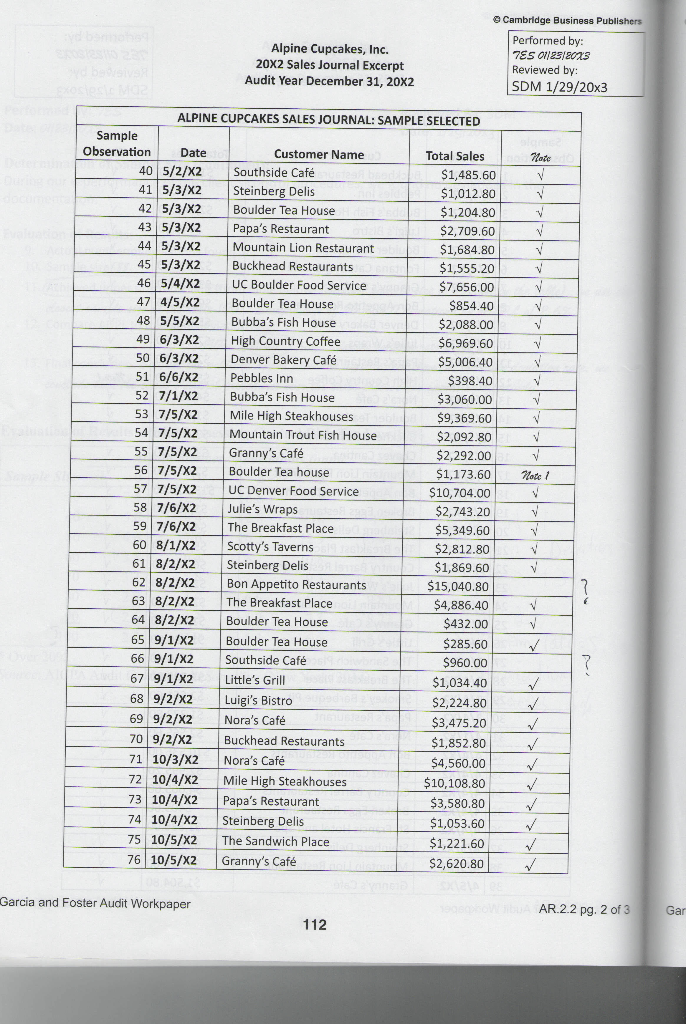

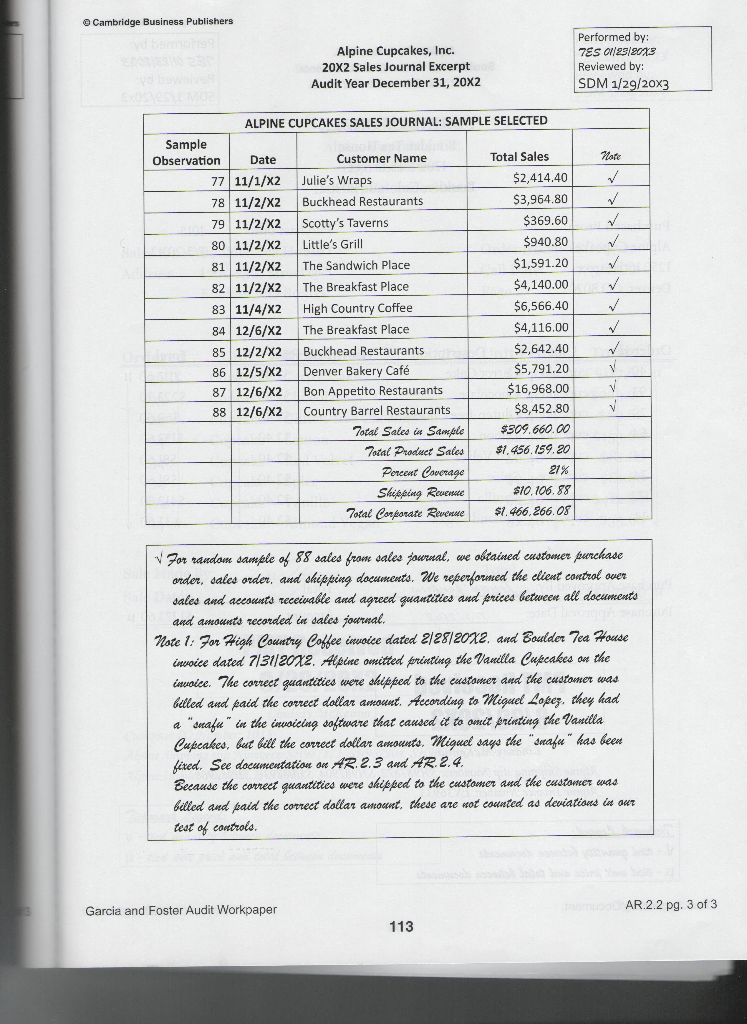

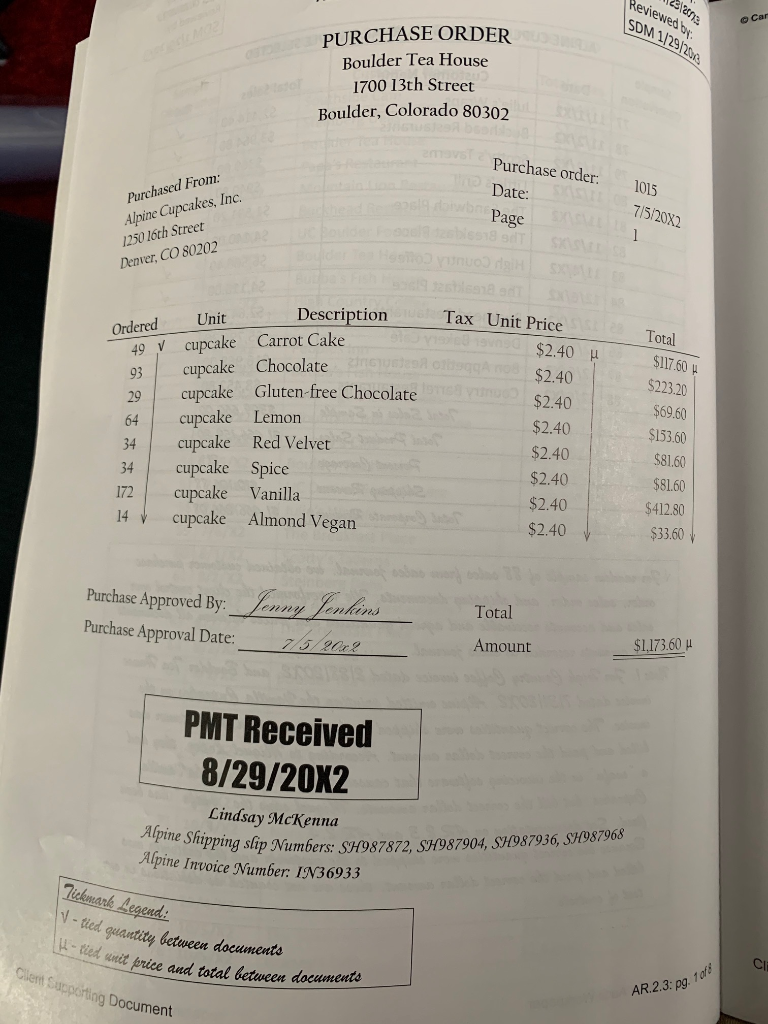

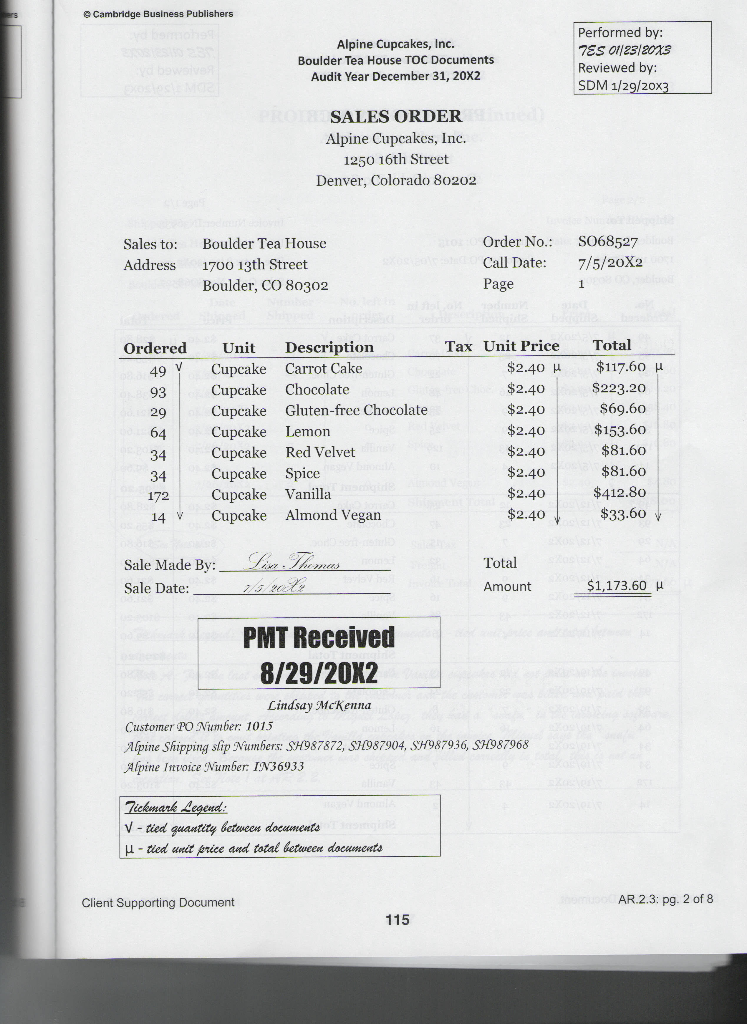

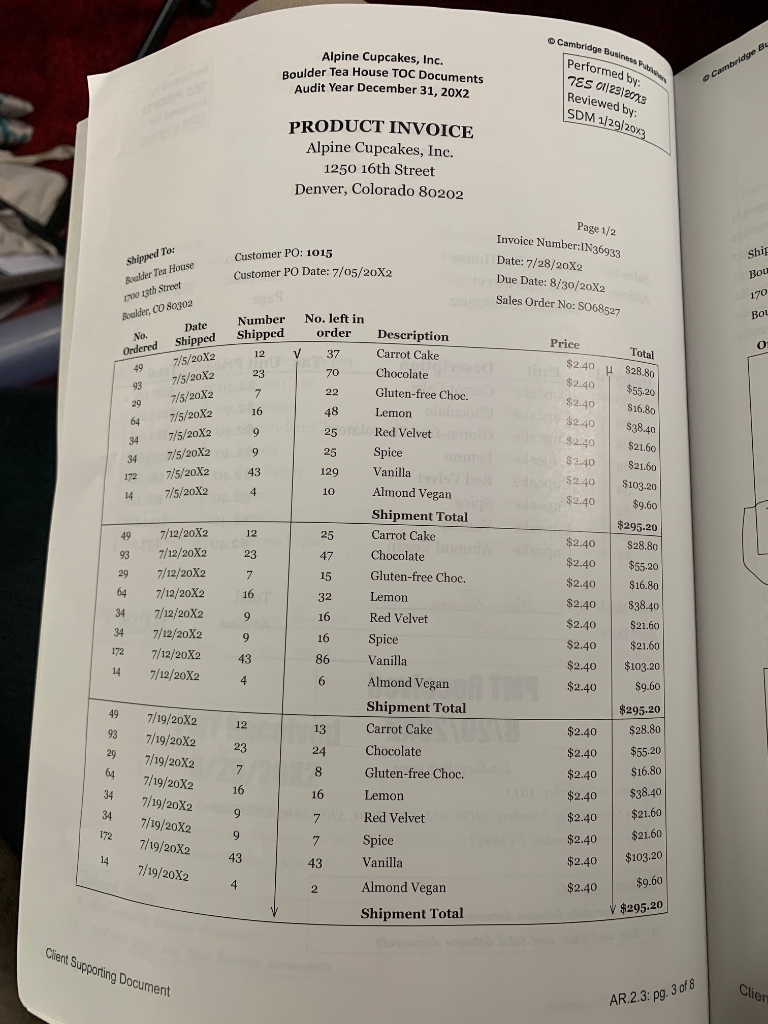

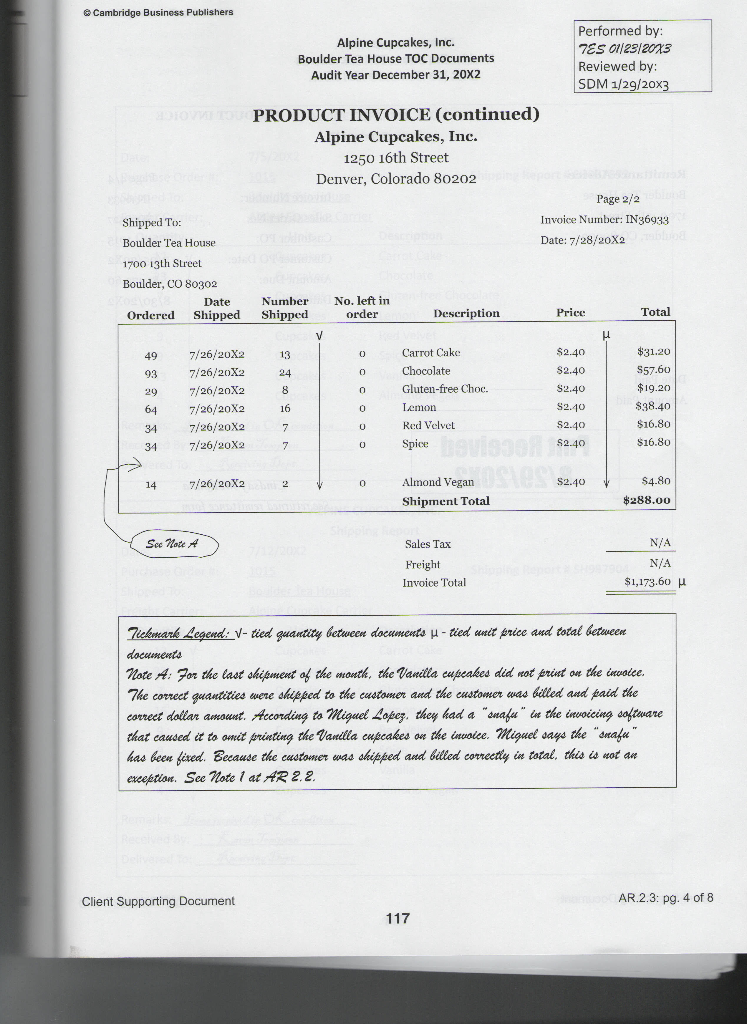

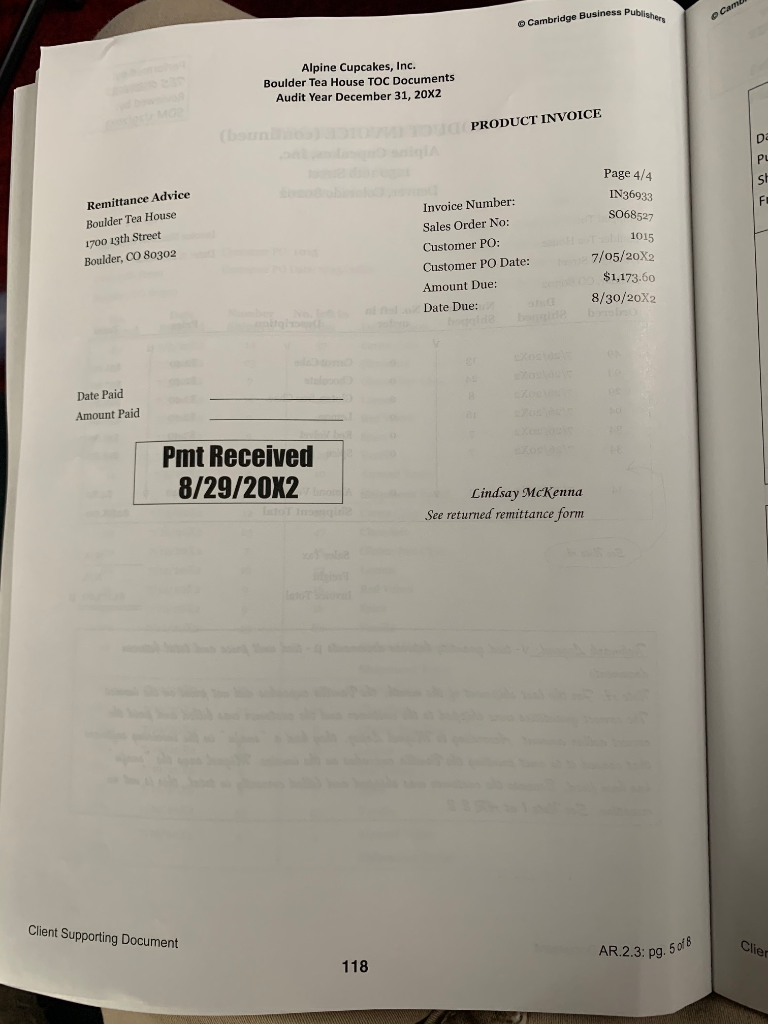

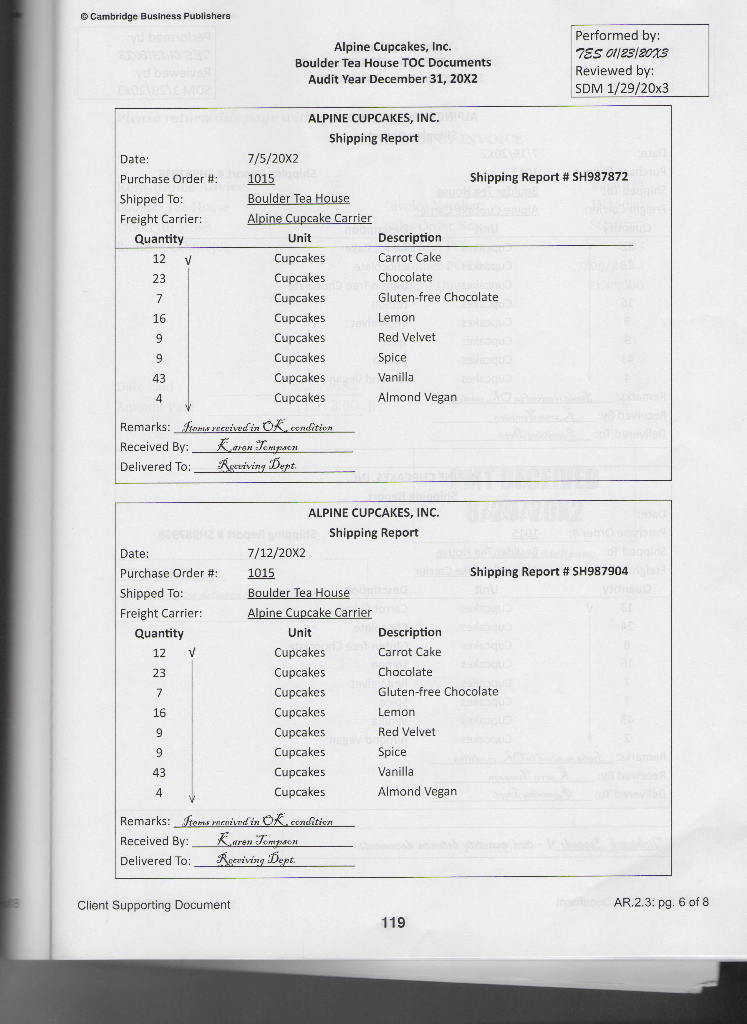

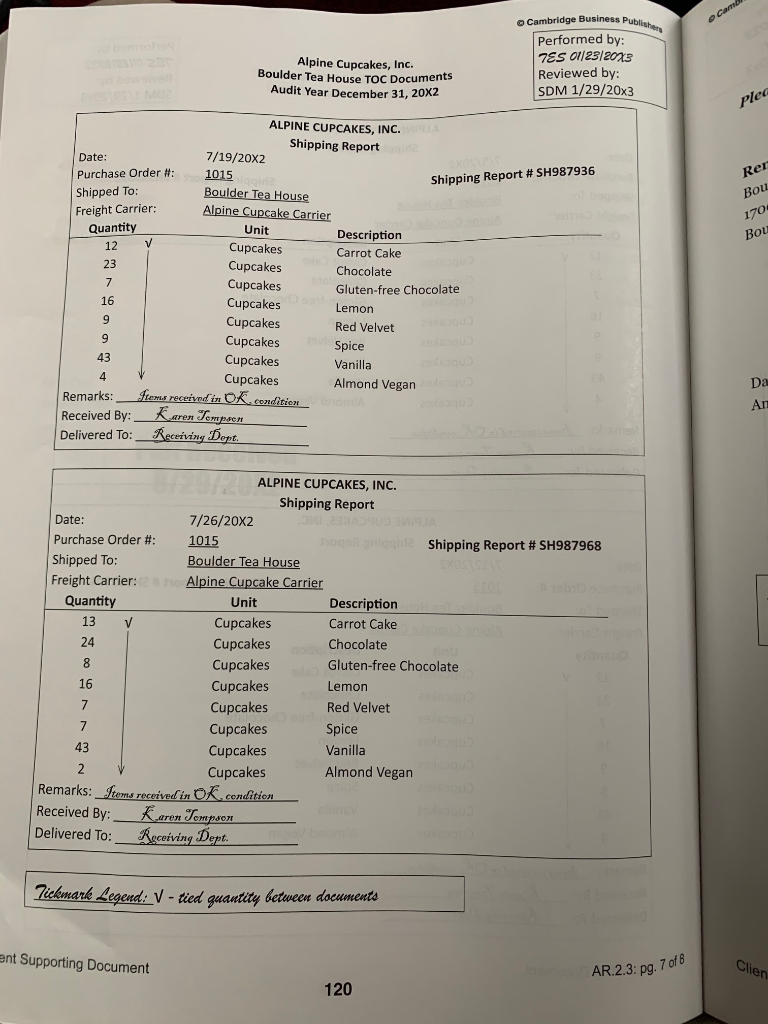

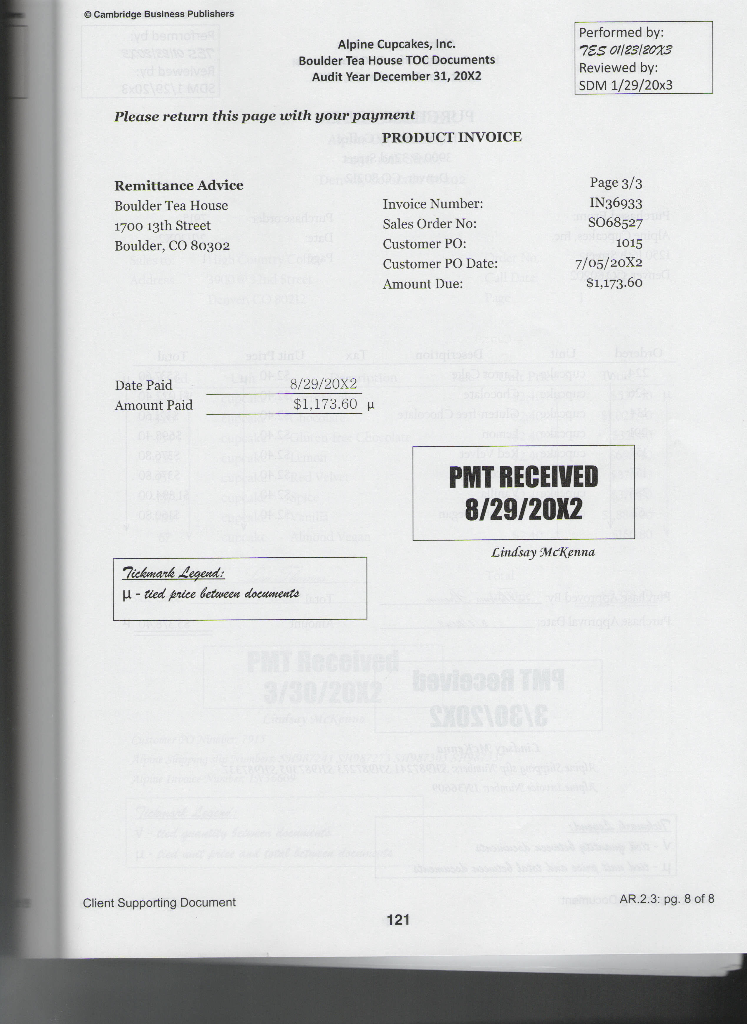

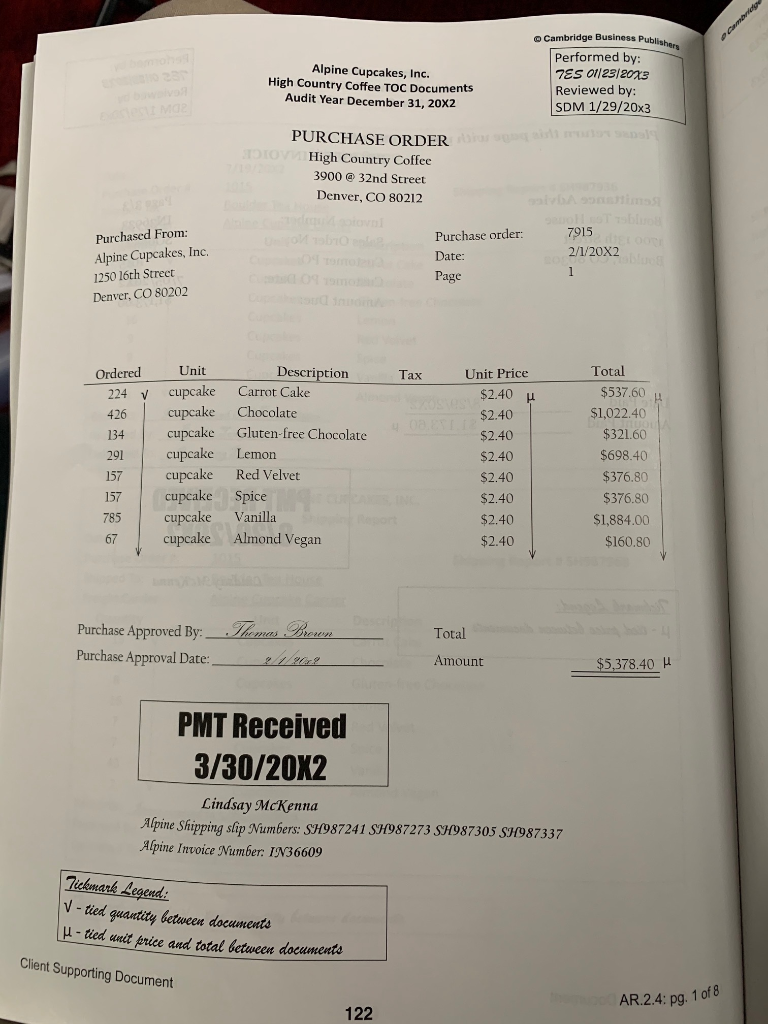

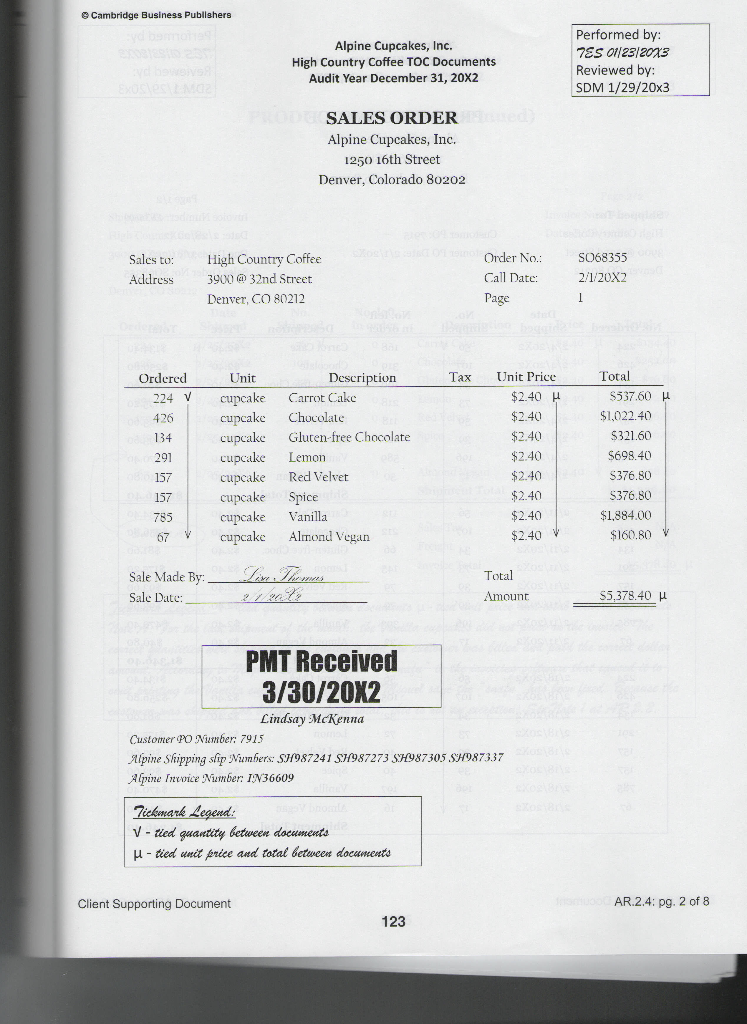

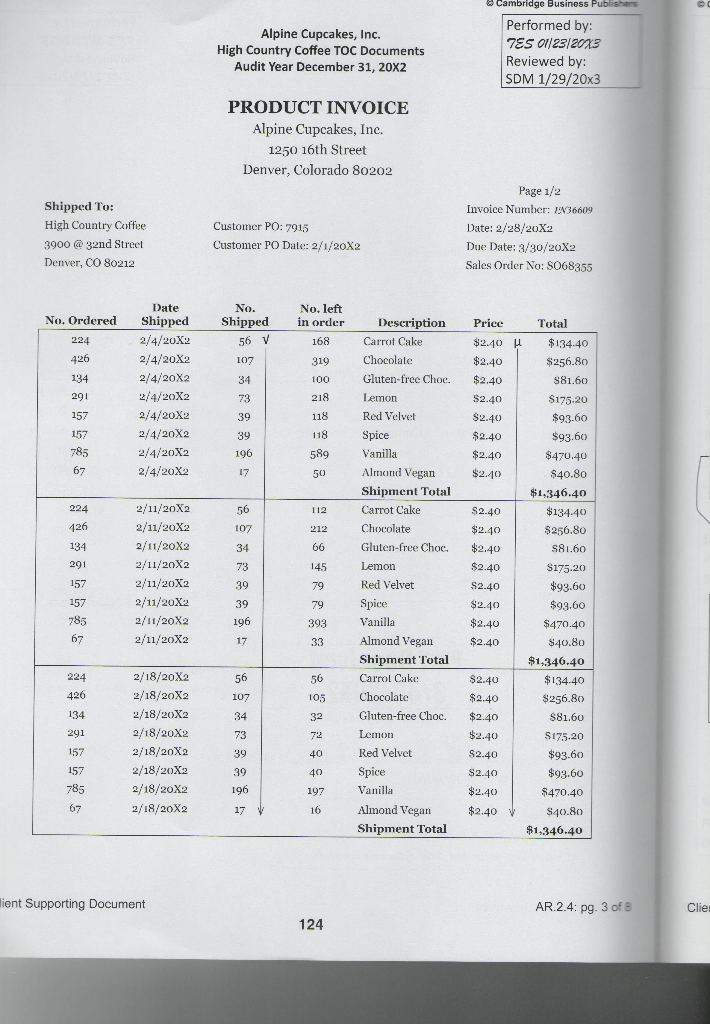

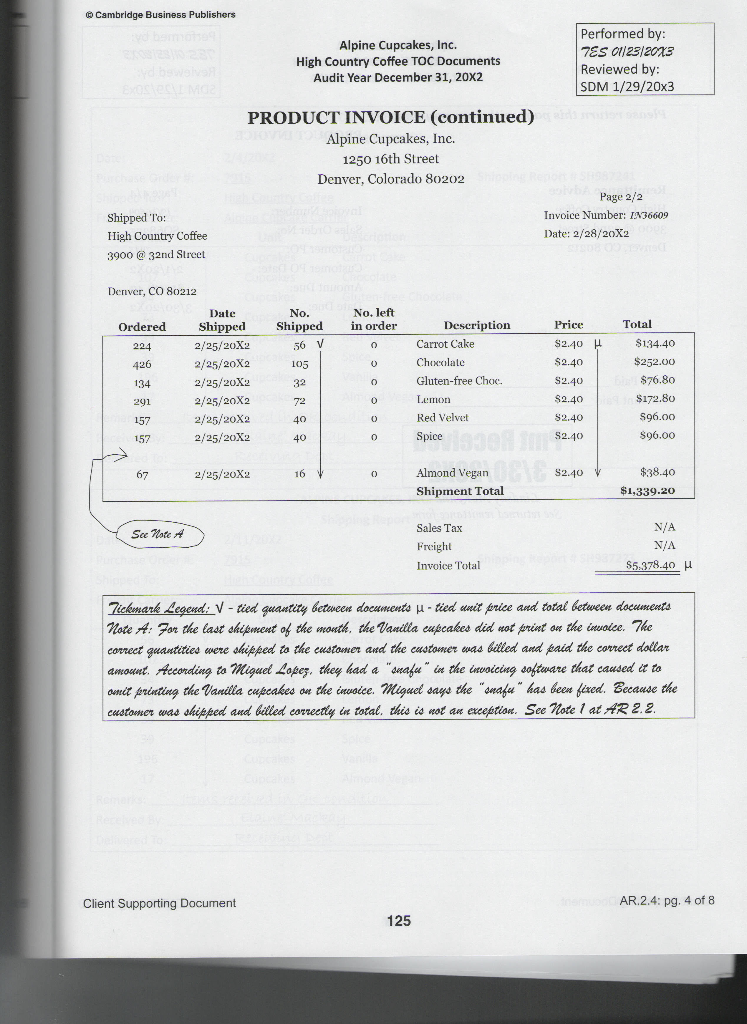

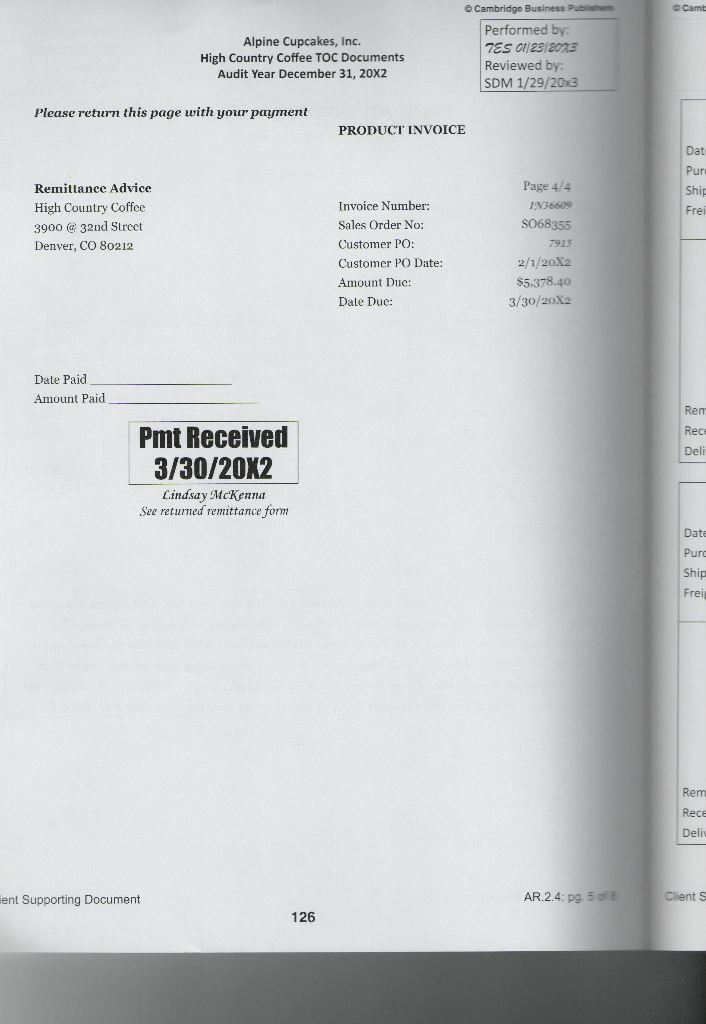

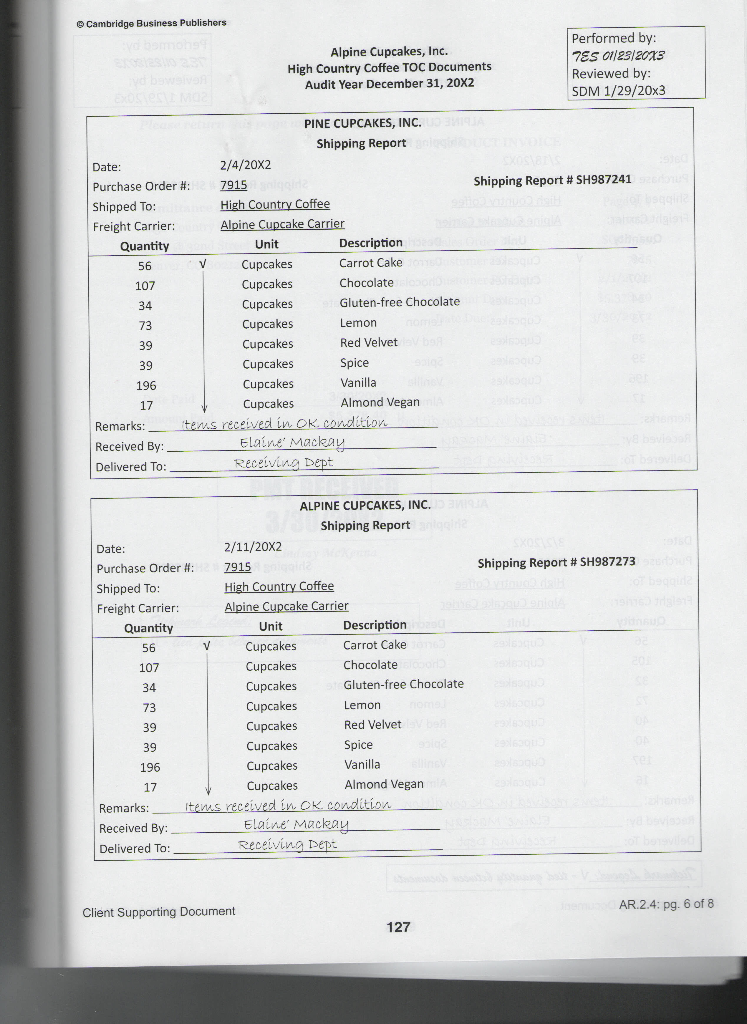

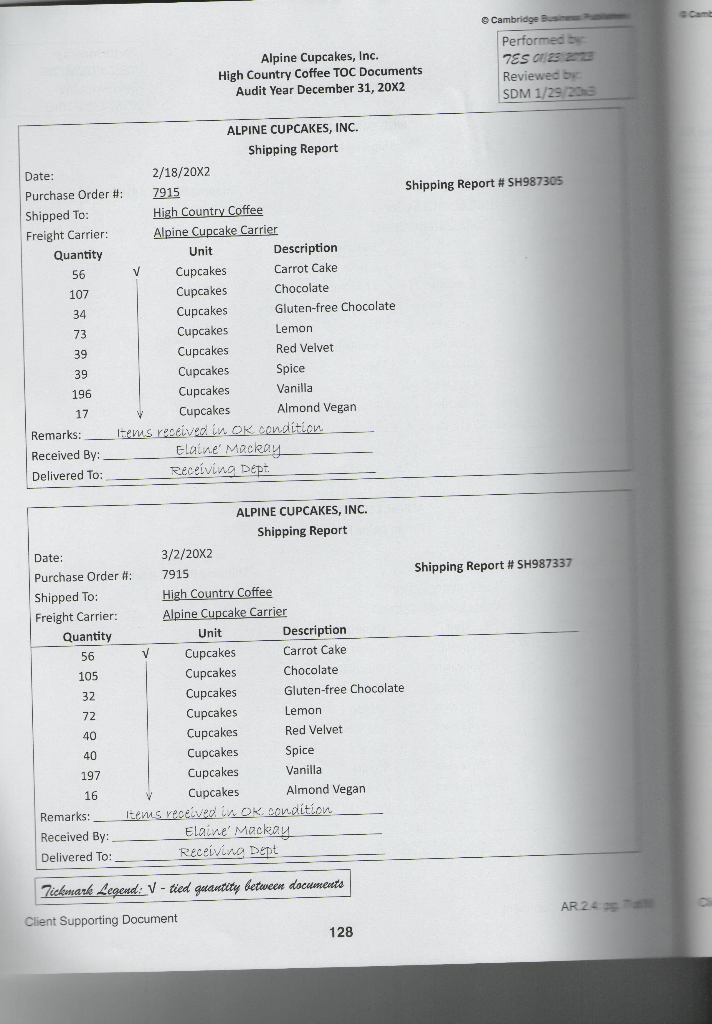

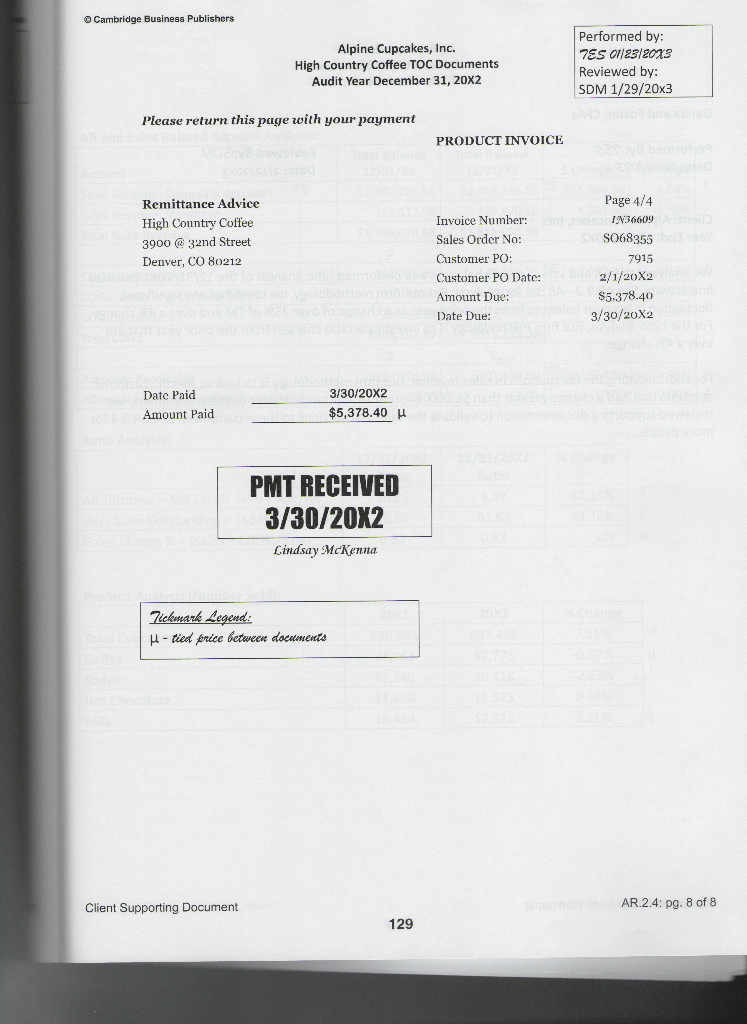

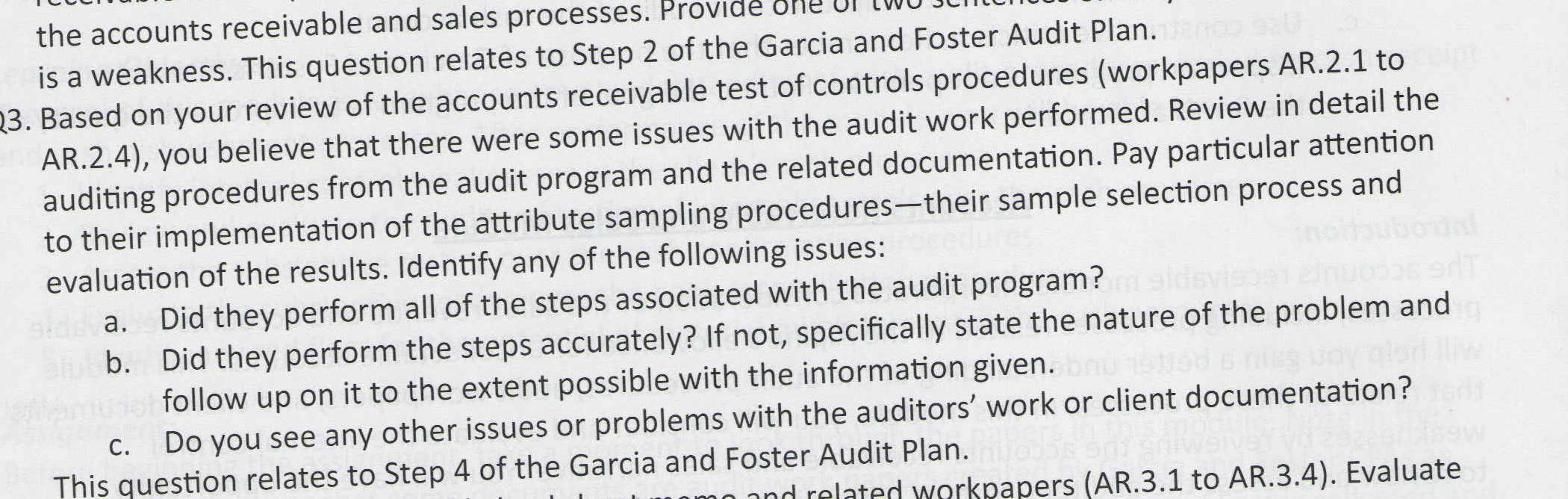

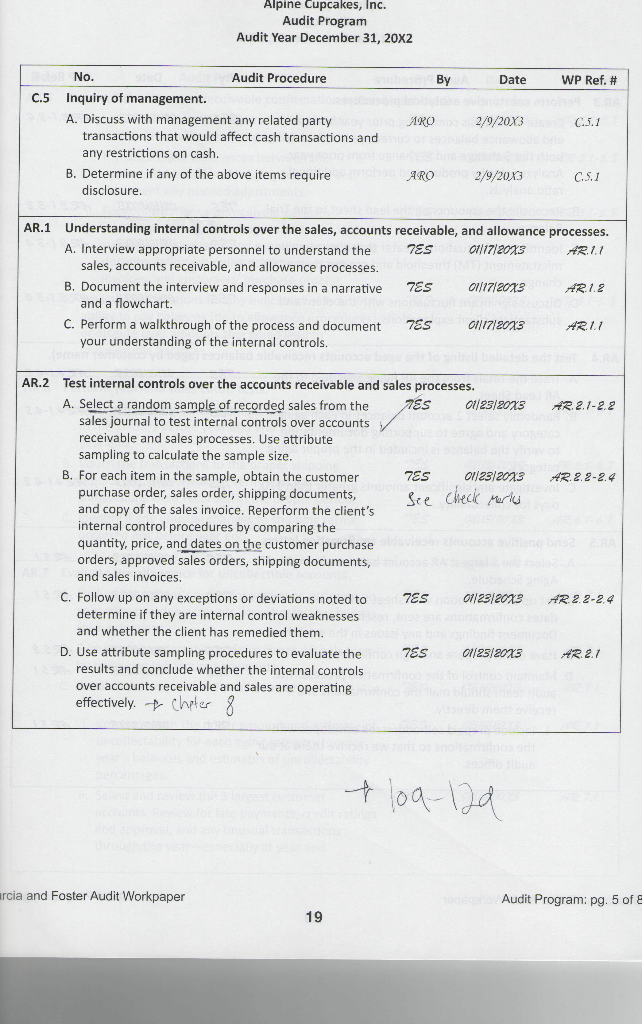

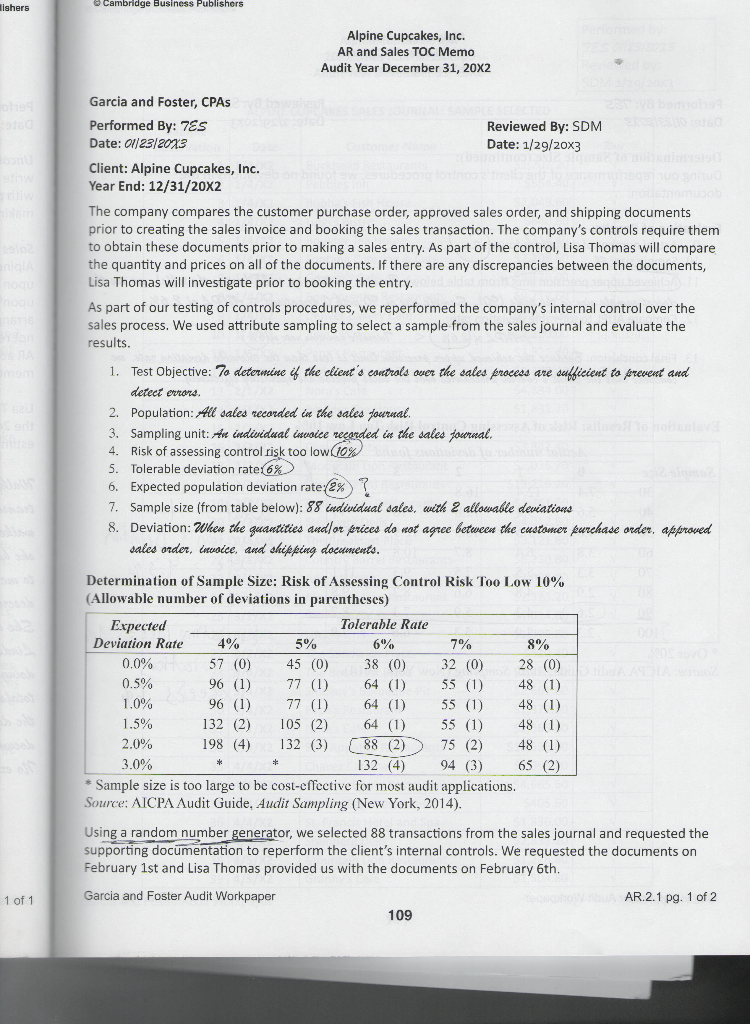

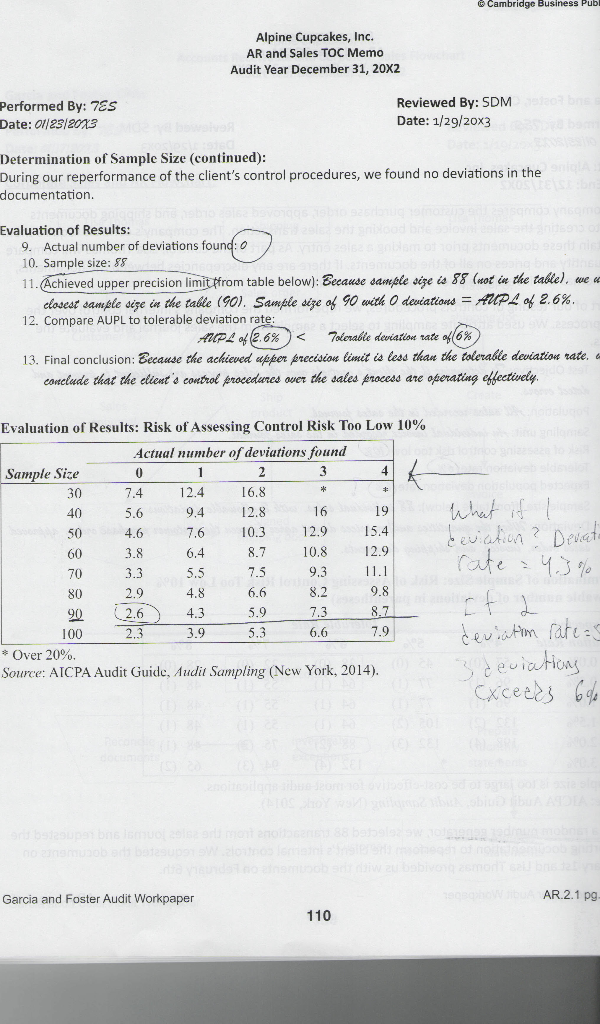

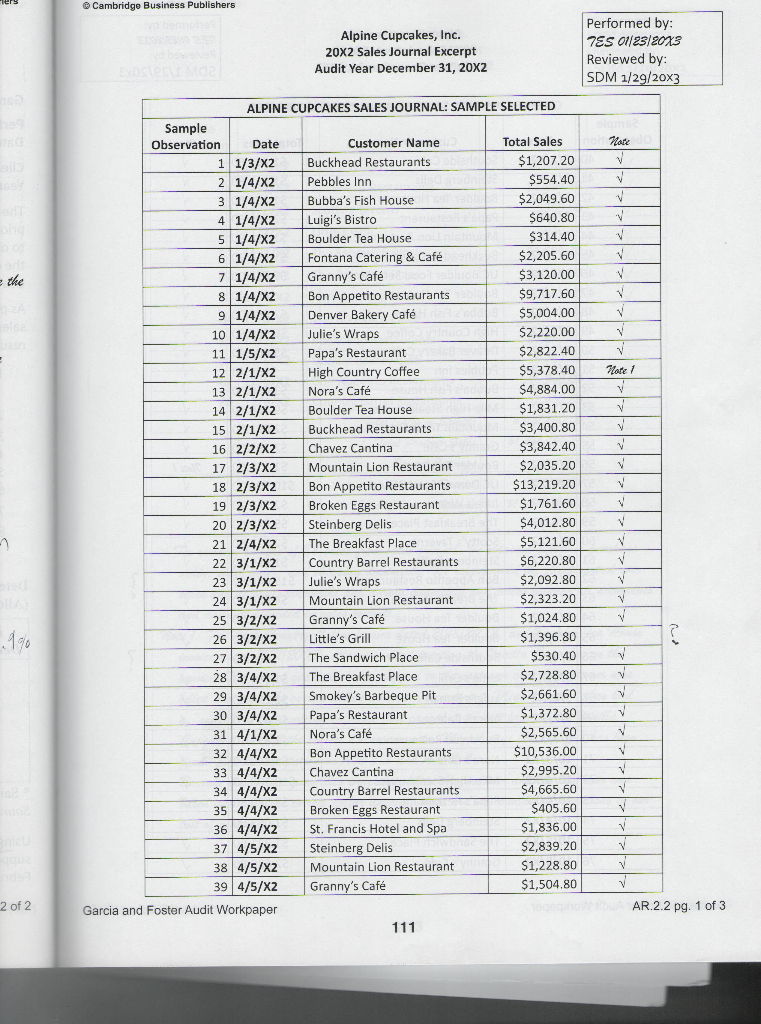

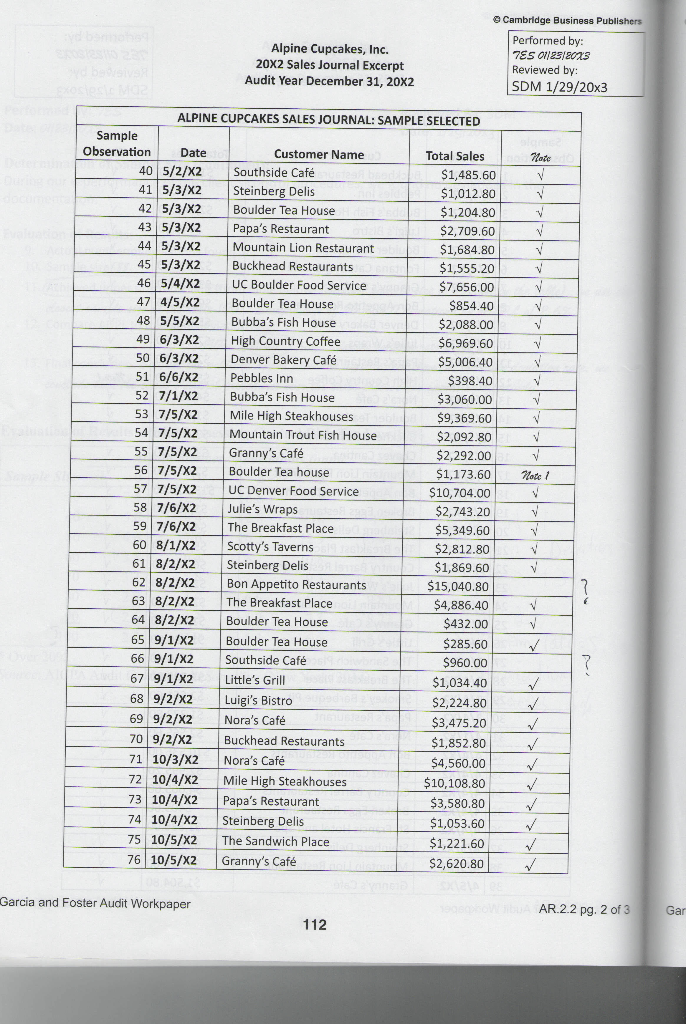

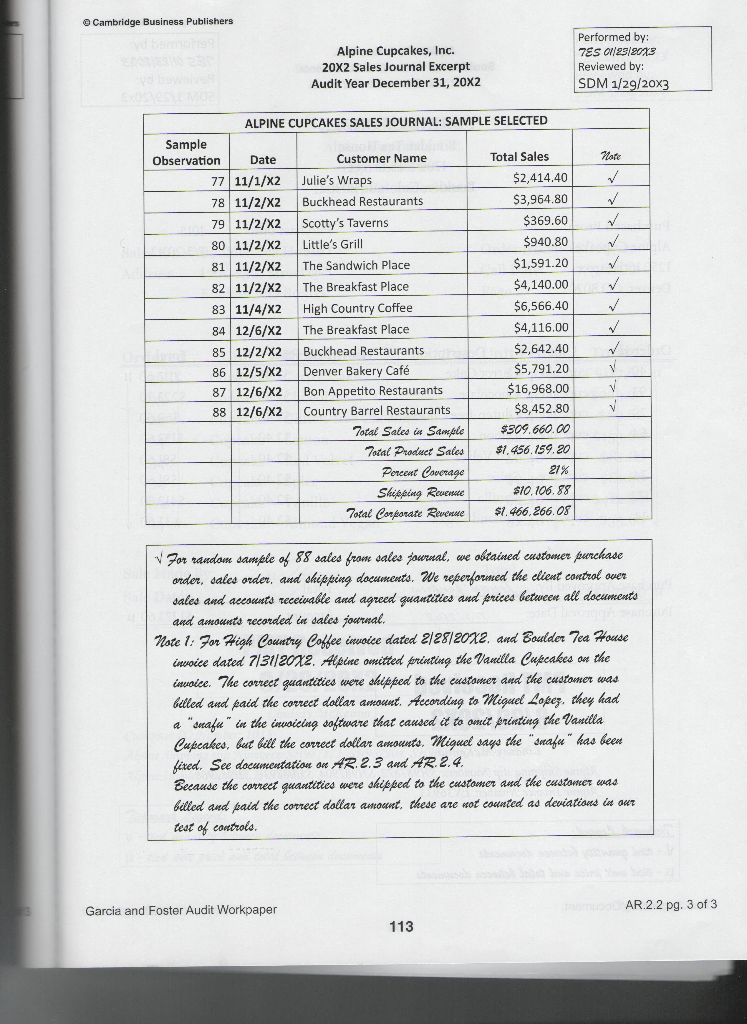

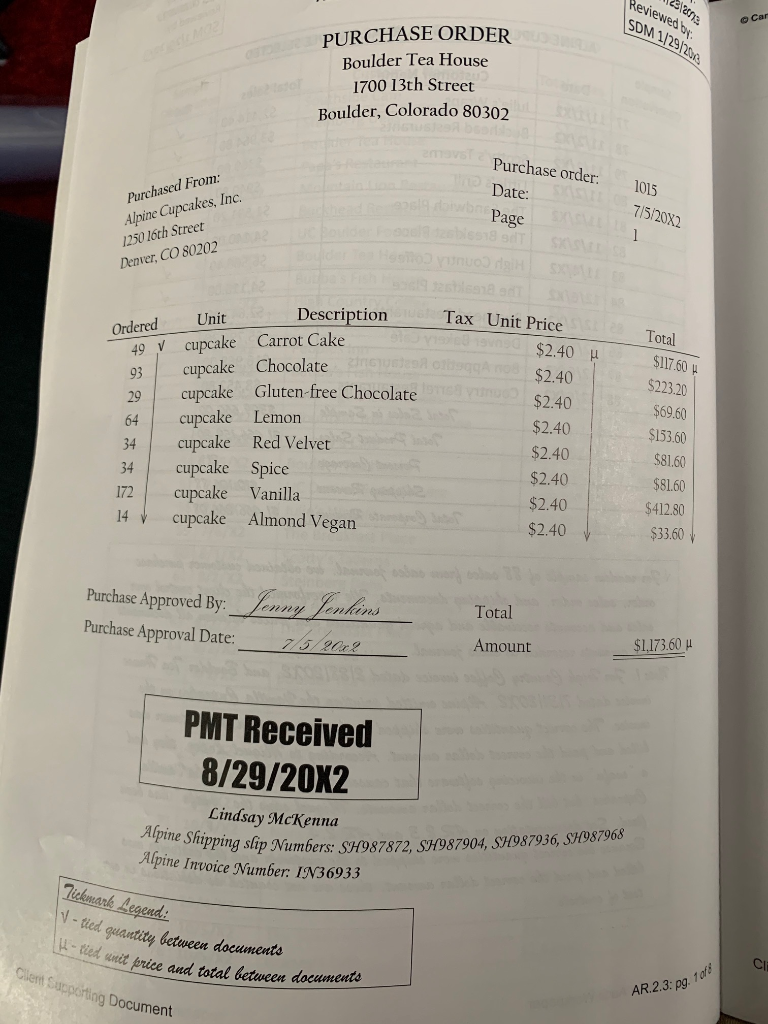

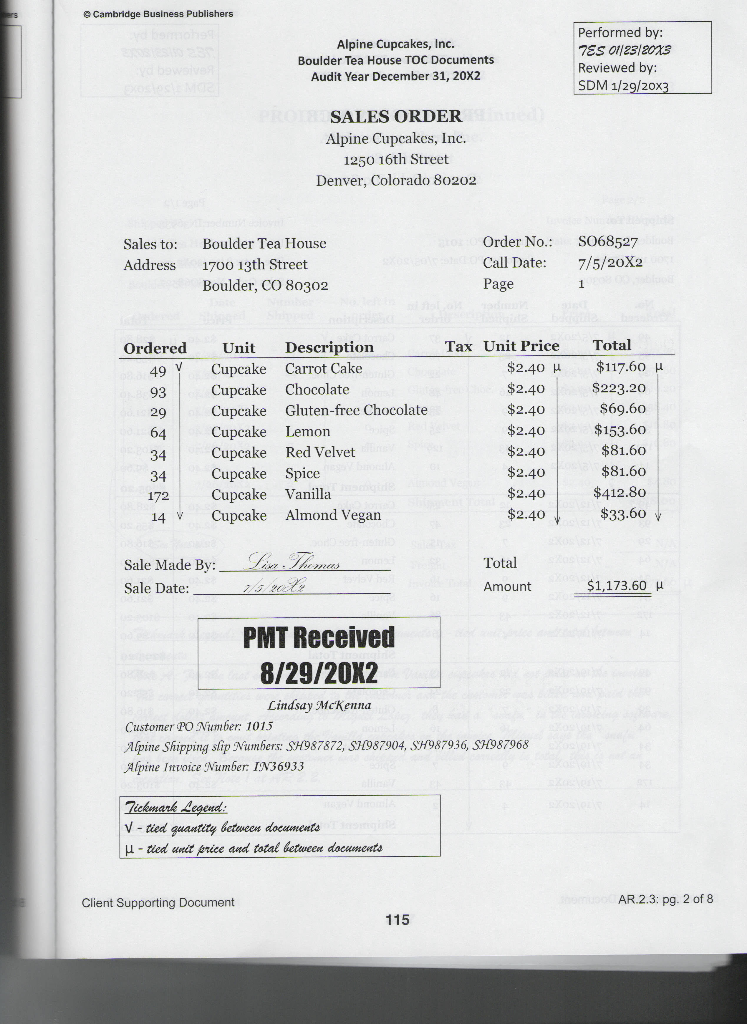

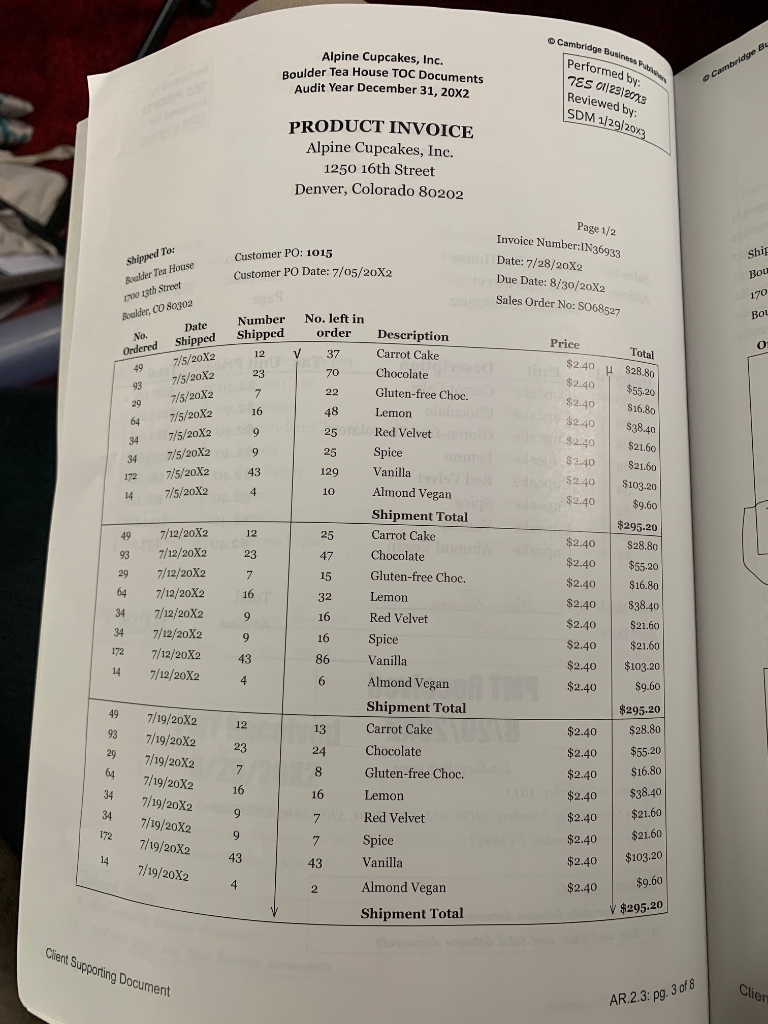

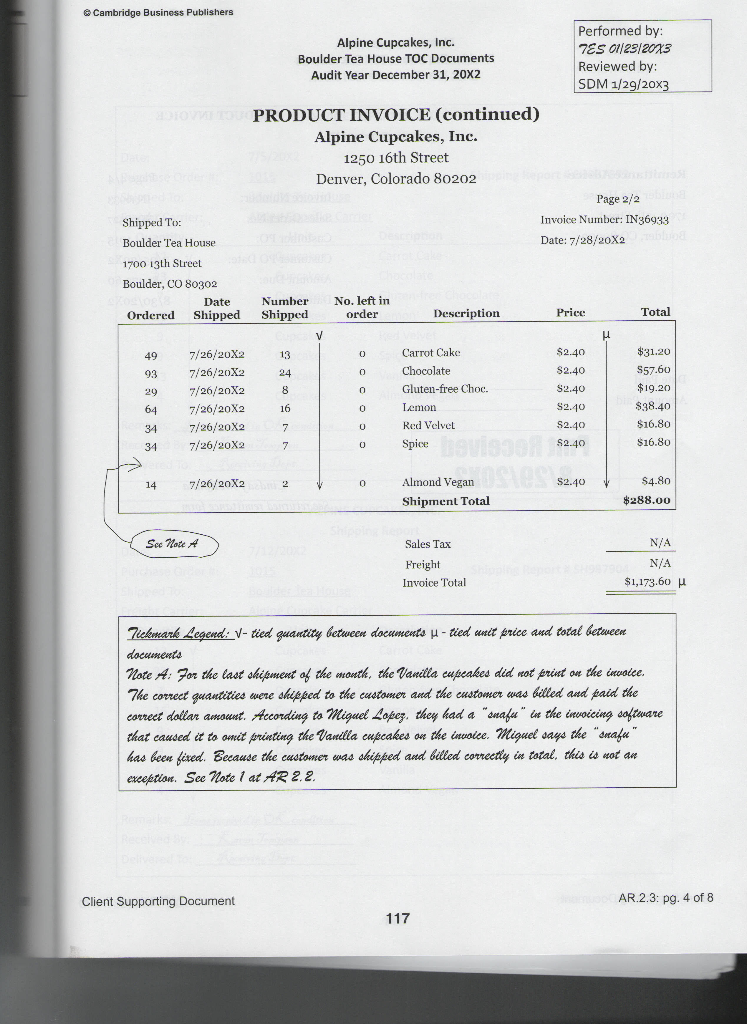

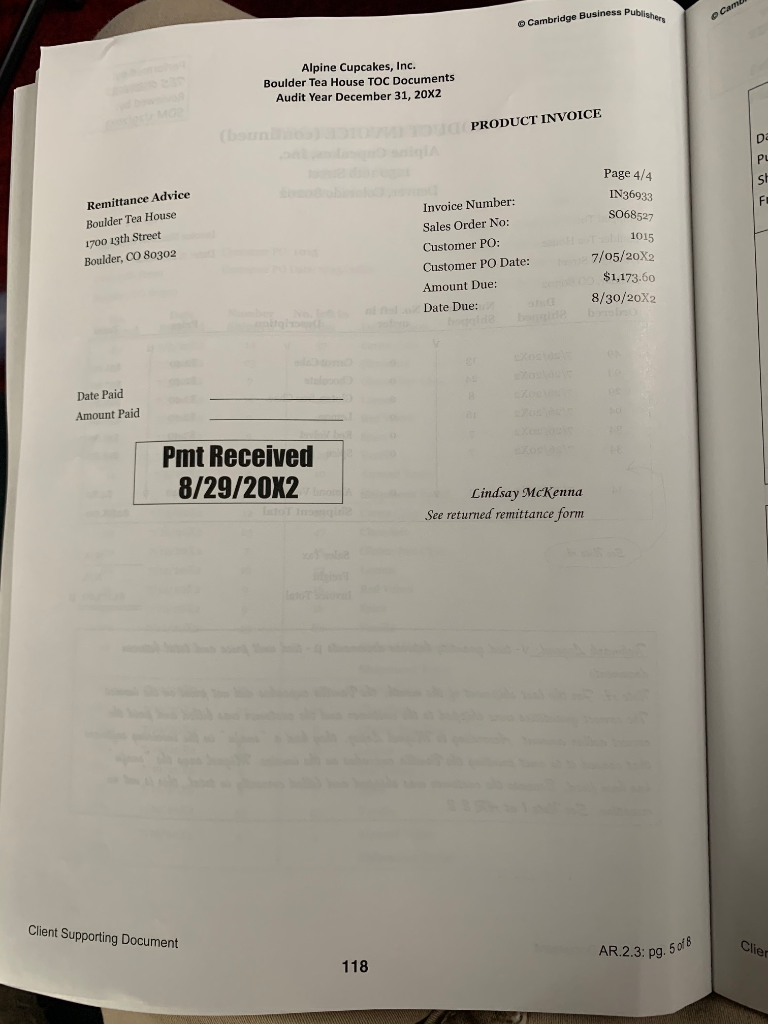

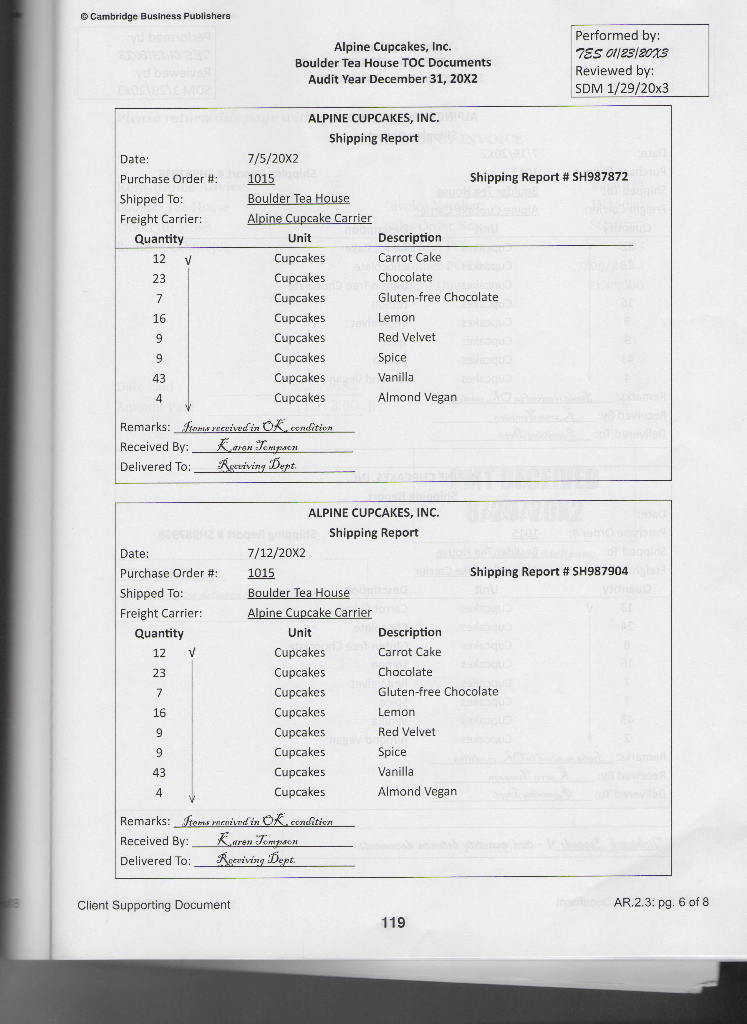

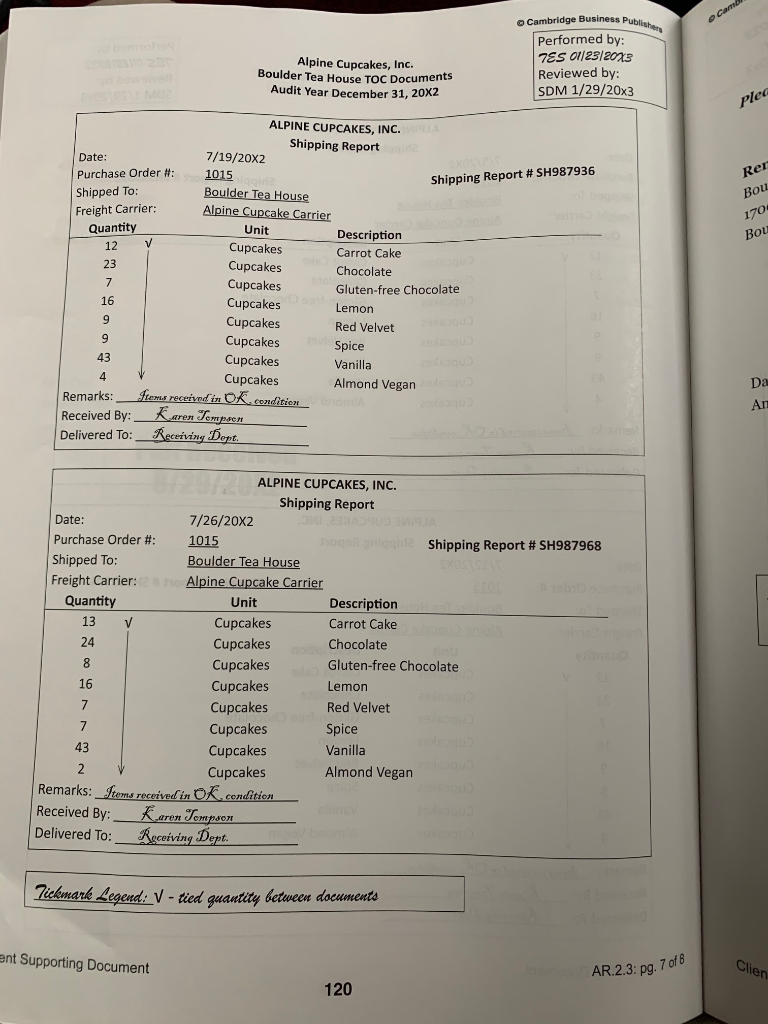

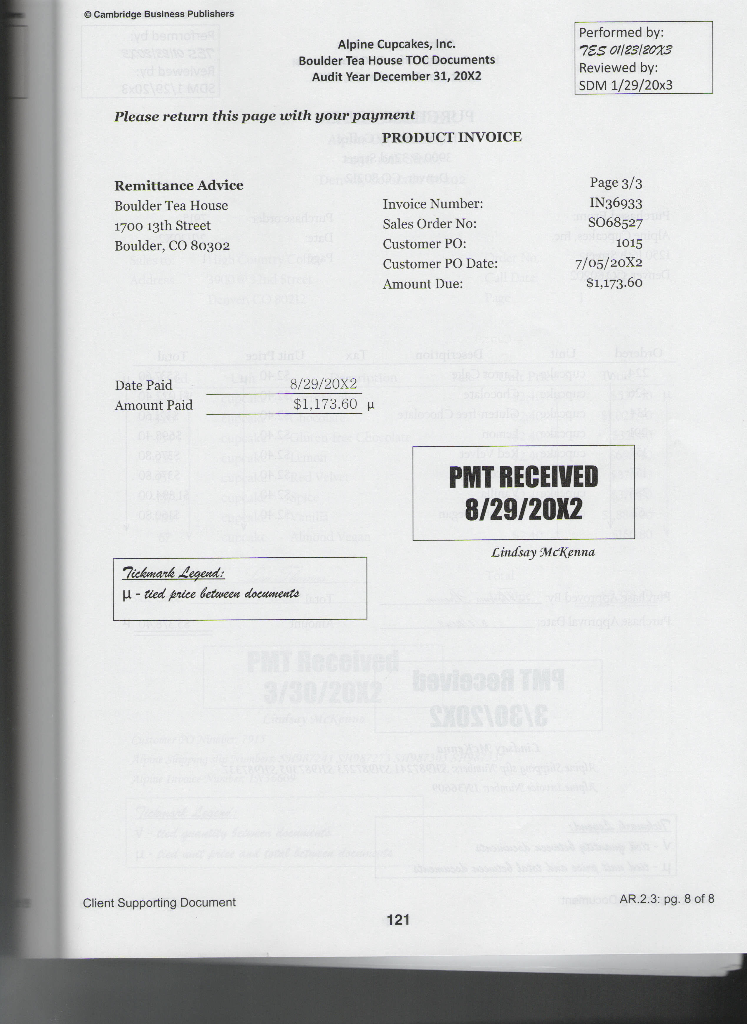

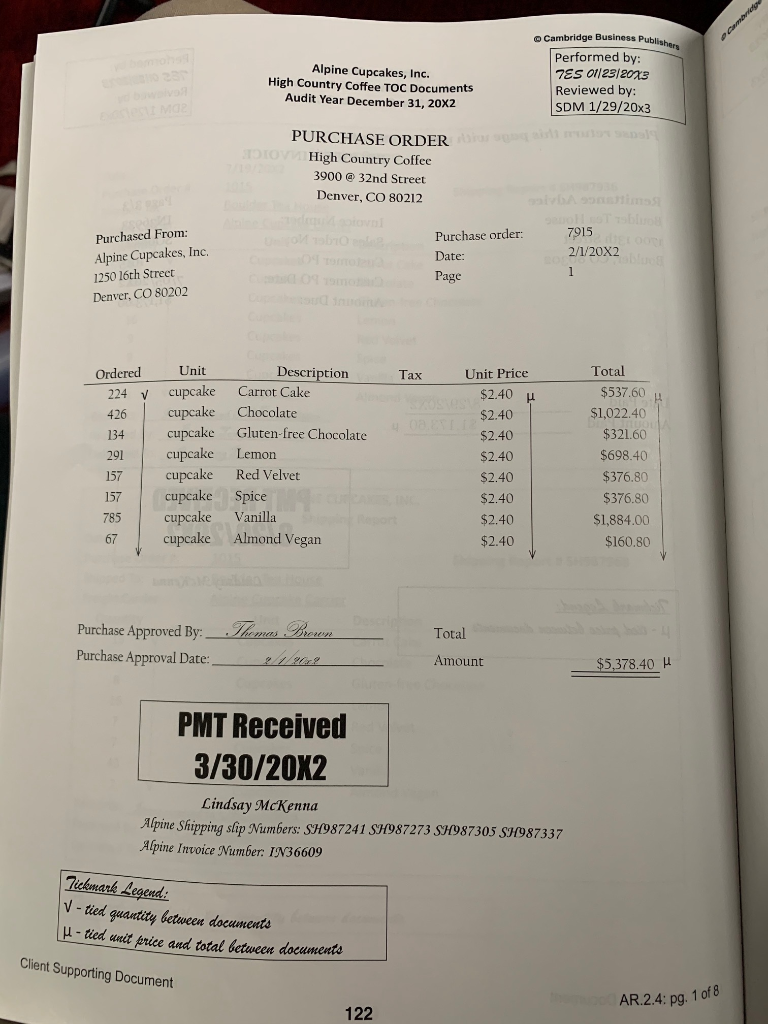

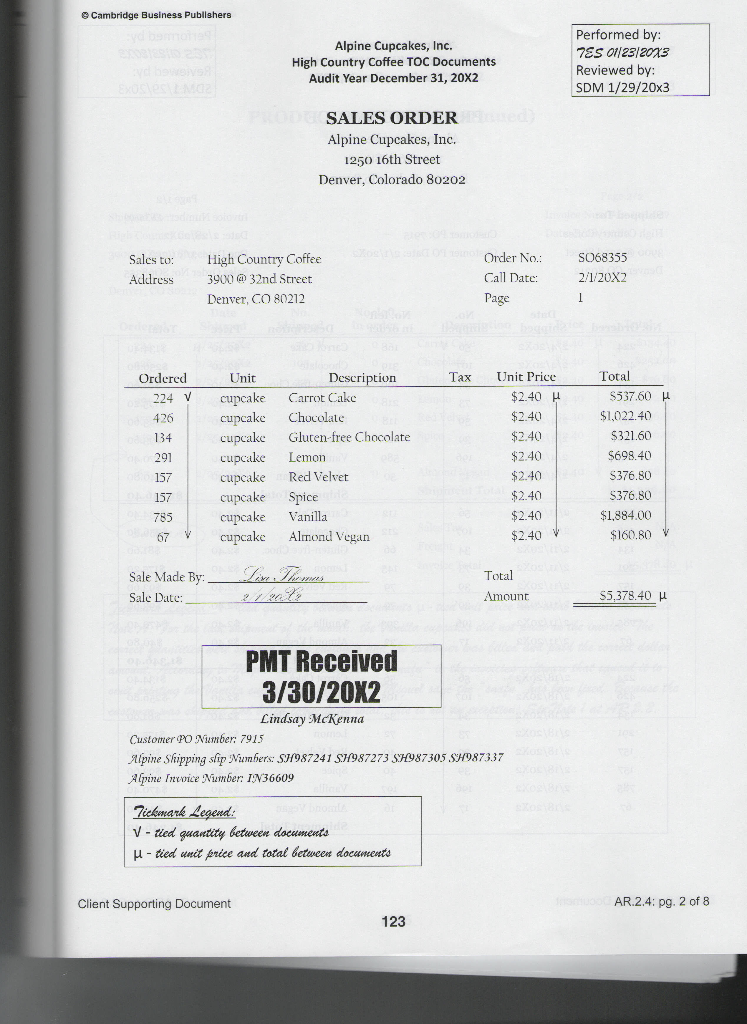

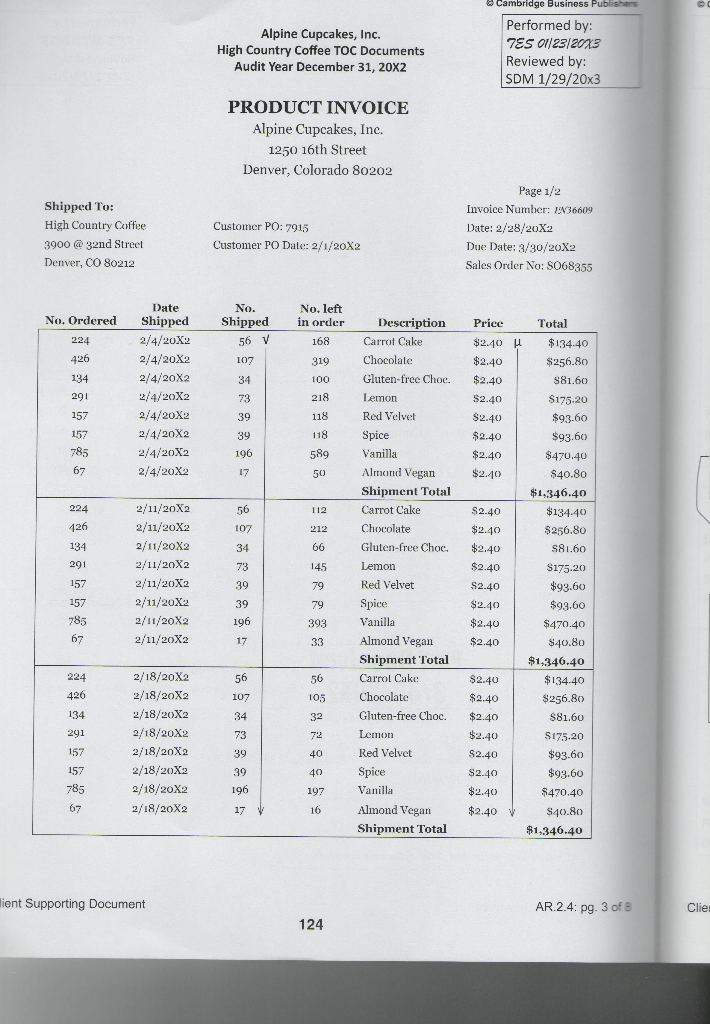

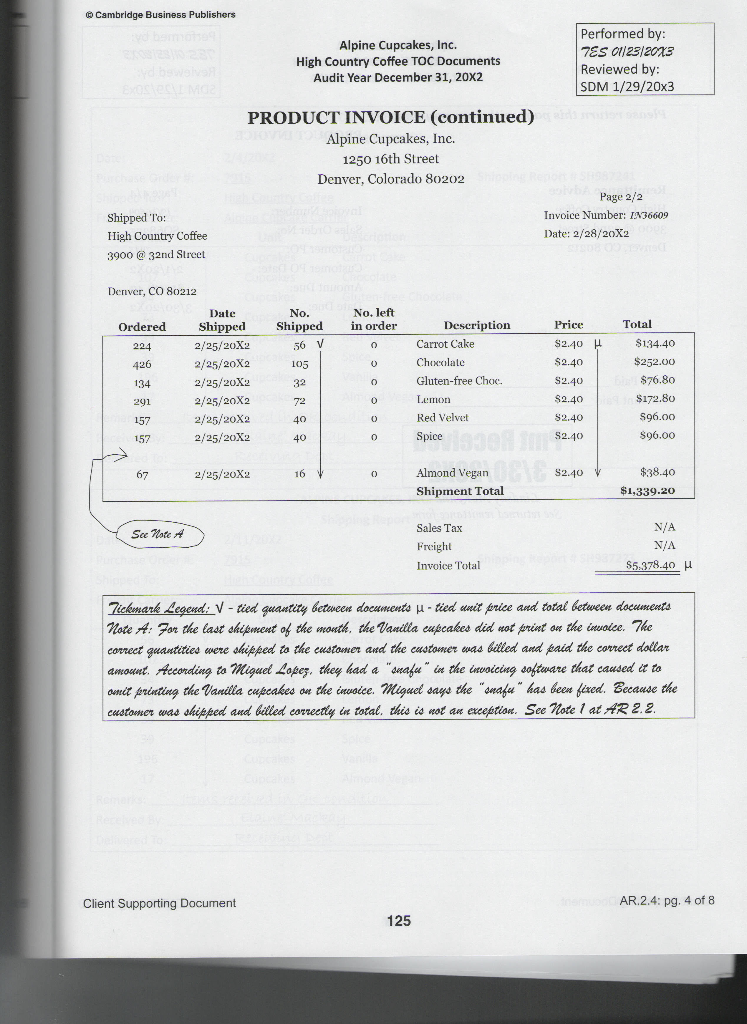

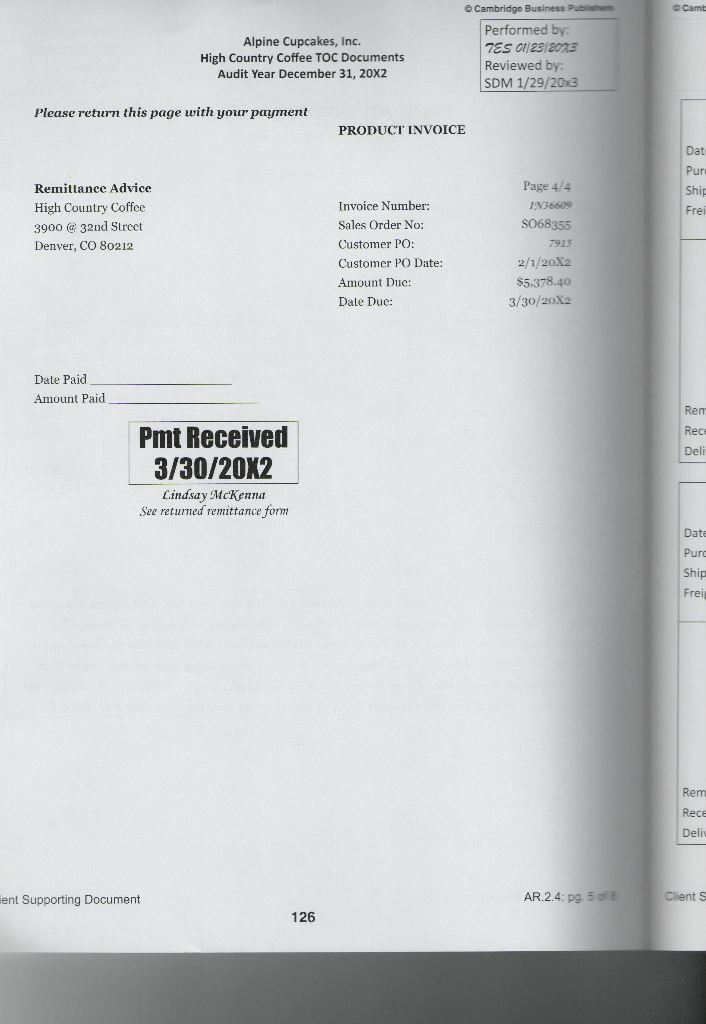

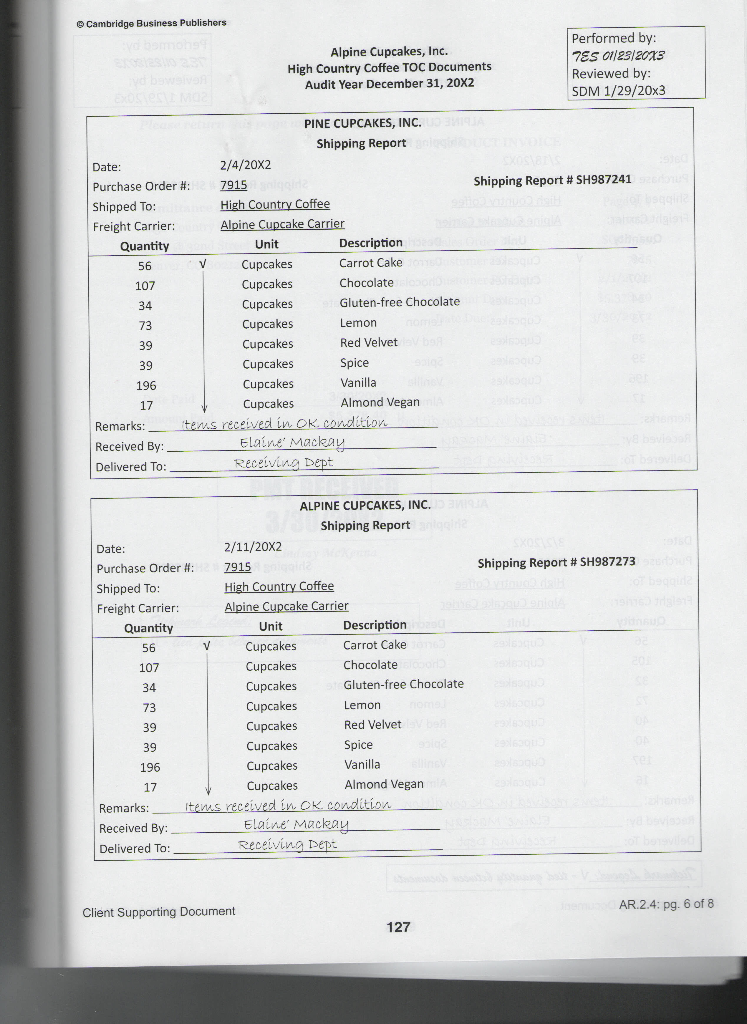

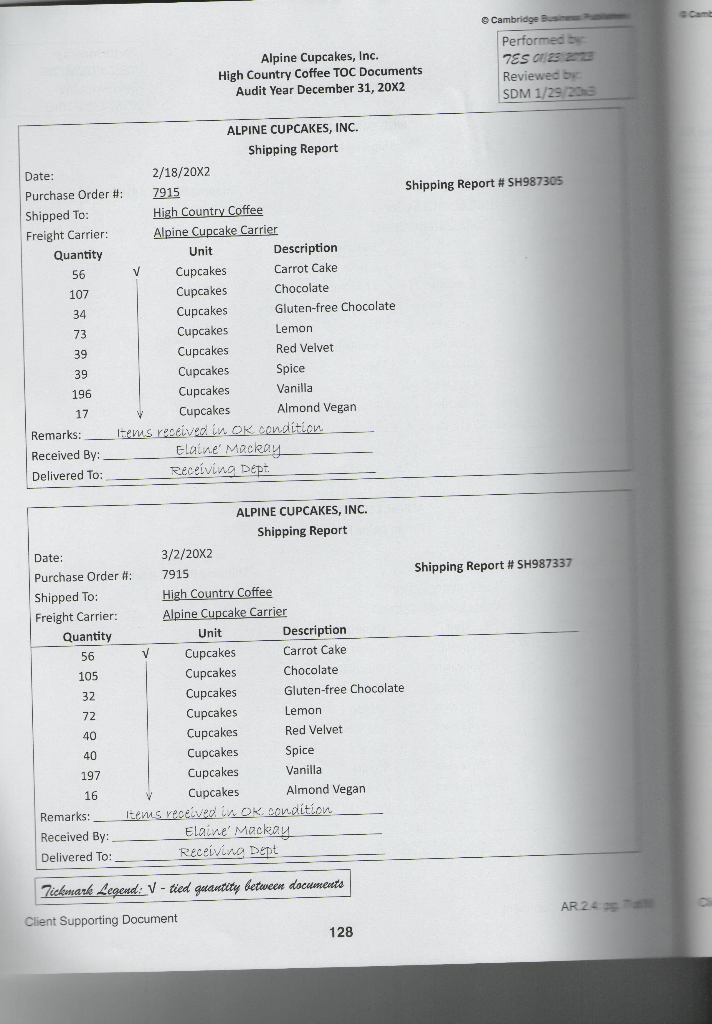

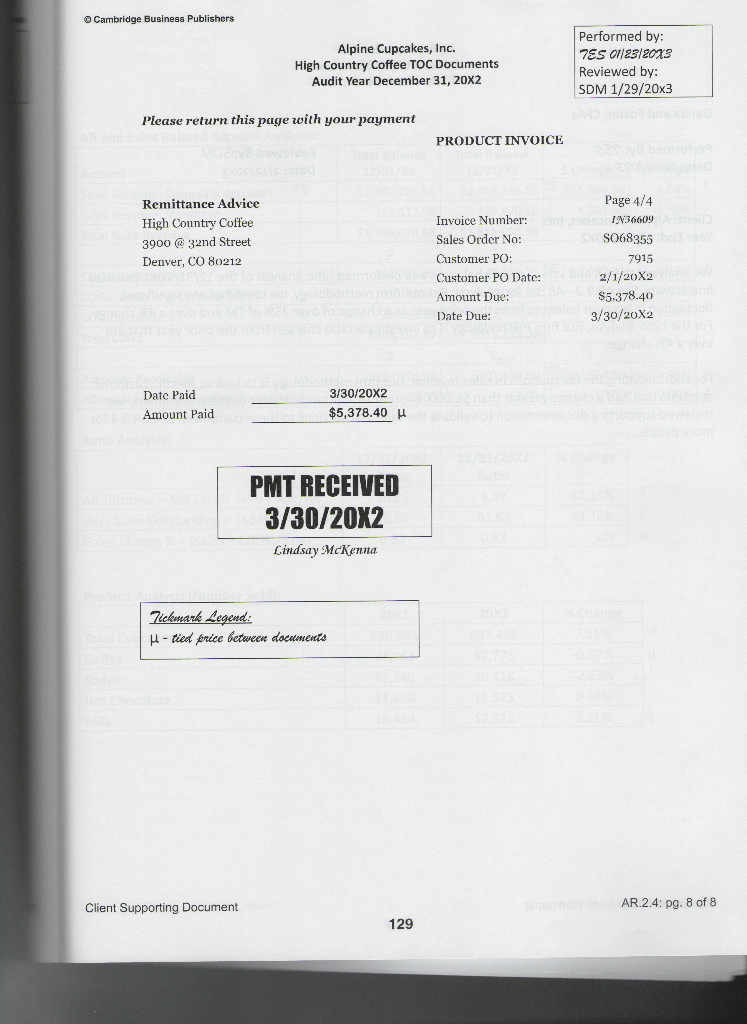

the accounts Pecelvable aha sales processes. Provlae one or two one is a weakness. This question relates to Step 2 of the Garcia and Foster Audit Plan. 13. Based on your review of the accounts receivable test of controls procedures (workpapers AR.2.1 to AR.2.4), you believe that there were some issues with the audit work performed. Review in detail the auditing procedures from the audit program and the related documentation. Pay particular attention to their implementation of the attribute sampling procedurestheir sample selection process and evaluation of the results. Identify any of the following issues: a. Did they perform all of the steps associated with the audit program? b. Did they perform the steps accurately? If not, specifically state the nature of the problem and follow up on it to the extent possible with the information given. C. Do you see any other issues or problems with the auditors' work or client documentation? This question relates to Step 4 of the Garcia and Foster Audit Plan. Semnand related work aners (AR 31 to AR 34 Evaluate Alpine Cupcakes, Inc. Audit Program Audit Year December 31, 20X2 By Date WP Ref. # C.5 ARO2 /9/20x3 (5.1 No. Audit Procedure Inquiry of management. A. Discuss with management any related party transactions that would affect cash transactions and any restrictions on cash. B. Determine if any of the above items require disclosure. ARO 2/9/20X3 0 .5.1 AR.1 Understanding internal controls over the sales, accounts receivable, and allowance processes. A. Interview appropriate personnel to understand the TES 01/17/2013 2.1.1 sales, accounts receivable, and allowance processes. B. Document the interview and responses in a narrative 785 01/17/2013 AR.1.2 and a flowchart. C. Perform a walkthrough of the process and document 785 01/17/2073 your understanding of the internal controls. AR.2 7.2.1-2.2 R.2.2-2.4 Test internal controls over the accounts receivable and sales processes. A. Select a random sample of recorded sales from the 7ES 01/23/2013 sales journal to test internal controls over accounts receivable and sales processes. Use attribute sampling to calculate the sample size. B. For each item in the sample, obtain the customer 785 01/23/2013 purchase order, sales order, shipping documents, See check meris and copy of the sales invoice. Reperform the client's internal control procedures by comparing the quantity, price, and dates on the customer purchase orders, approved sales orders, shipping documents, and sales invoices. C. Follow up on any exceptions or deviations noted to 785 01/25/2013 determine if they are internal control weaknesses and whether the client has remedied them. D. Use attribute sampling procedures to evaluate the 755 01/23/2013 results and conclude whether the internal controls over accounts receivable and sales are operating effectively. Chpter 8 AR.2.2-2.4 + 109-12a rcia and Foster Audit Workpaper Audit Program: pg. 5 of 8 lishers Cambridge Business Publishers Alpine Cupcakes, Inc. AR and Sales TOC Memo Audit Year December 31, 20X2 Garcia and Foster, CPAS Performed By: 7ES Reviewed By: SDM Date: 01/23/2013 Date: 1/29/20x3 Client: Alpine Cupcakes, Inc. Year End: 12/31/20X2 The company compares the customer purchase order, approved sales order, and shipping documents prior to creating the sales invoice and booking the sales transaction. The company's controls require them to obtain these documents prior to making a sales entry. As part of the control, Lisa Thomas will compare the quantity and prices on all of the documents. If there are any discrepancies between the documents, Lisa Thomas will investigate prior to booking the entry. As part of our testing of controls procedures, we reperformed the company's internal control over the sales process. We used attribute sampling to select a sample from the sales journal and evaluate the results. 1. Test Objective: 70 determine if the client's controls over the sales process are sufficient to prevent and detect errors. 2. Population: All sales recorded in the sales pourual, 3. Sampling unit: individual invoice recorded in the sales journal. 4. Risk of assessing control risk too low 10% 5. Tolerable deviation rate:6% 6. Expected population deviation rate:2% ? 7. Sample size (from table below): 88 individual sales, with 2 allowable deviations 8. Deviation: When the guantities and/or prices do not agree between the customer purchase order, approved sales order, cavalce, and shipping documents. Determination of Sample Size: Risk of Assessing Control Risk Too Low 10% (Allowable number of deviations in parentheses) Expected Tolerable Rate Deviation Rate 4% 5% 6% 7% 8% 0.0% 57 (0) 45 (0) 38 (0) 32 (0) 28 (0) 0.5% 96 (1) 77 (1) 64 (1) 55 (1) 48 (1) 1.0% 96 (1) 77 (1) 64 (1) 55 (1) 48 (1) 1.5% 132 (2) 105 (2) 64 (1) 55 (1) 48 (1) 2.0% 198 (4) 132 (3) 88 (2) 75 (2) 3.0% 132 (4) 94 (3) 65 (2) * Sample size is too large to be cost-effective for most audit applications, Source: AICPA Audit Guide, Audit Sampling (New York, 2014). Using a random number generator, we selected 88 transactions from the sales journal and requested the supporting documentation to reperform the client's internal controls. We requested the documents on February 1st and Lisa Thomas provided us with the documents on February 6th, 1 of 1 Garcia and Foster Audit Workpaper AR.2.1 pg. 1 of 2 109 Cambridge Business Pub Alpine Cupcakes, Inc. AR and Sales TOC Memo Audit Year December 31, 20X2 Performed By: 785 Date: 01/23/2013 Reviewed By: SDM Date: 1/29/20x3 Determination of Sample Size (continued): During our reperformance of the client's control procedures, we found no deviations in the documentation Evaluation of Results: 9. Actual number of deviations found: 10. Sample size: 55 11. Achieved upper precision limit from table below): Because dame ble sge is 88 (not in the table), we closest sample dege in the table (901. Sample size of 90 with deviations = AUPA of 2.6%. 12. Compare AUPL to tolerable deviation rate: AUP242.6%) Tolerable deviation rate of 6% 13. Final conclusion: Eecause the achieved upper precision limit is less than the folerable deviation nate. conclude that the client's control procedures aver the sales process are operating effectively, Evaluation of Results: Risk of Assessing Control Risk Too Low 10% Actual number of deviations found Sample Size 0 1 2 3 7.4 12.4 deviation? Deviat rate : 4.3% 40 5.6 9.4 12.8 16 19 50 4.6 7.6 10.3 12.9 15.4 60 3 .8 6.4 8.7 10.8 12.9 70 3.3 5.5 7.5 9.3 11.1 80 2.9 4.8 6.6 8.2 9.8 90 2. 6 4 .3 5.9 7.3 8.7 100 2. 3 3 . 9 5 .3 6.6 7.9 * Over 20% Source: AICPA Audit Guide, Audit Sampling (New York, 2014). De deviation rates 3 deviations exceeds 69 Garcia and Foster Audit Workpaper AR.2.1 pg 110 Cambridge Business Publishers Alpine Cupcakes, Inc. 20X2 Sales Journal Excerpt Audit Year December 31, 20X2 Performed by: 7ES 01/23/2013 Reviewed by: SDM 1/29/20x3 Hati Note ALPINE CUPCAKES SALES JOURNAL: SAMPLE SELECTED Sample Observation Date Customer Name Total Sales 1 1/3/X2 Buckhead Restaurants $1,207.20 2 1/4/X2 Pebbles Inn $554.40 3 1/4/X2 Bubba's Fish House $2,049.60 4 1/4/X2 Luigi's Bistro $640.80 5 1/4/X2 Boulder Tea House $314.40 6 1/4/X2 Fontana Catering & Caf $2,205.60 7 1/4/X2 Granny's Caf $3,120.00 8 1/4/X2 Bon Appetito Restaurants $9,717.60 91/4/X2 Denver Bakery Caf $5,004.00 10 1/4/X2 Julie's Wraps $2,220.00 111/5/X2 Papa's Restaurant $2,822.40 122/1/X2 High Country Coffee $5,378.40 13 2/1/X2 Nora's Caf $4,884.00 14 2/1/X2 Boulder Tea House $1,831,20 15 2/1/X2 Buckhead Restaurants $3,400.80 16 2/2/X2 Chavez Cantina $3,842.40 17 2/3/X2 Mountain Lion Restaurant $2,035.20 18 2/3/X2 Bon Appetito Restaurants $13,219.20 19 2/3/X2 Broken Eges Restaurant $1,761.60 20 2/3/X2 Steinberg Delis $4,012.80 21 2/4/X2 The Breakfast Place $5,121.60 22 3/1/X2 Country Barrel Restaurants $6,220.80 23 3/1/X2 Julie's Wraps $2,092.80 24 3/1/X2 Mountain Lion Restaurant $2,323.20 25 3/2/X2 Granny's Caf $1,024.80 26 3/2/X2 Little's Grill $1,396.80 27 3/2/X2 The Sandwich Place $530.40 28 3/4/X2 The Breakfast Place $2,728.80 29 3/4/X2 Smokey's Barbeque Pit w's Barbeque Pit $2,661.60 30 3/4/X2 Papa's Restaurant $1,372.80 31 4/1/X2 Nora's Caf $2,565.60 32 4/4/X2 Bon Appetito Restaurants $10,536.00 33 4/4/X2 Chavez Cantina $2,995.20 34 4/4/X2 Country Barrel Restaurants $4,665.60 35 4/4/X2 Broken Eggs Restaurant $405.60 36 4/4/X2 St. Francis Hotel and Spa $1,836.00 37 4/5/X2 Steinberg Delis $2,839.20 38 4/5/X2 Mountain Lion Restaurant $1,228.80 39 4/5/X2 Granny's Caf $1,504.80 Garcia and Foster Audit Workpaper 111