Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer Q6. numbers from q5 are provided to help answer Q6 Q6. Consider, again, the data from Q5.: On AUG 12, 2022 a speculator

please answer Q6. numbers from q5 are provided to help answer Q6

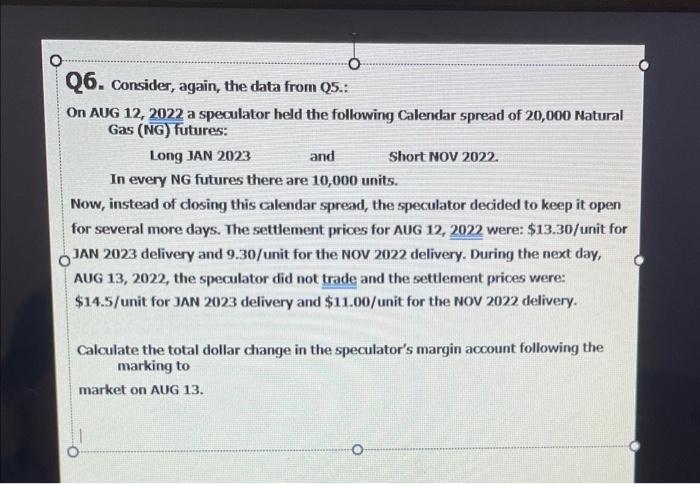

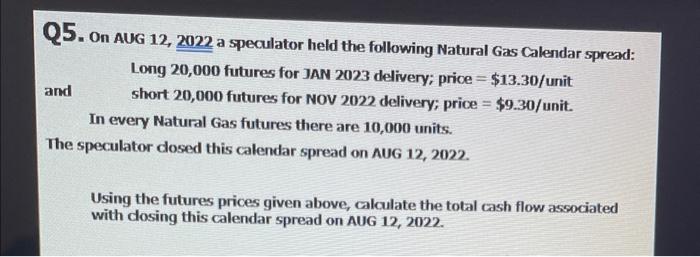

Q6. Consider, again, the data from Q5.: On AUG 12, 2022 a speculator held the following Calendar spread of 20,000 Natural Gas (NG) futures: Long JAN 2023 and Short NOV 2022. In every NG futures there are 10,000 units. Now, instead of closing this calendar spread, the speculator decided to keep it open for several more days. The settlement prices for AUG 12, 2022 were: $13.30 /unit for JAN 2023 delivery and 9.30 /unit for the NOV 2022 delivery. During the next day, AUG 13, 2022, the speculator did not trade and the settlement prices were: $14.5 /unit for JAN 2023 delivery and $11.00 /unit for the NOV 2022 delivery. Calculate the total dollar change in the speculator's margin account following the marking to market on AUG 13. Q5. On AUG 12, 2022 a speculator held the following Natural Gas Calendar spread: Long 20,000 futures for JAN 2023 delivery; price =$13.30 /unit short 20,000 futures for NOV 2022 delivery; price =$9.30/ unit. In every Natural Gas futures there are 10,000 units. The speculator dosed this calendar spread on AUG 12, 2022. Using the futures prices given above, calculate the total cash flow associated with dosing this calendar spread on AuG 12, 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started