Answered step by step

Verified Expert Solution

Question

1 Approved Answer

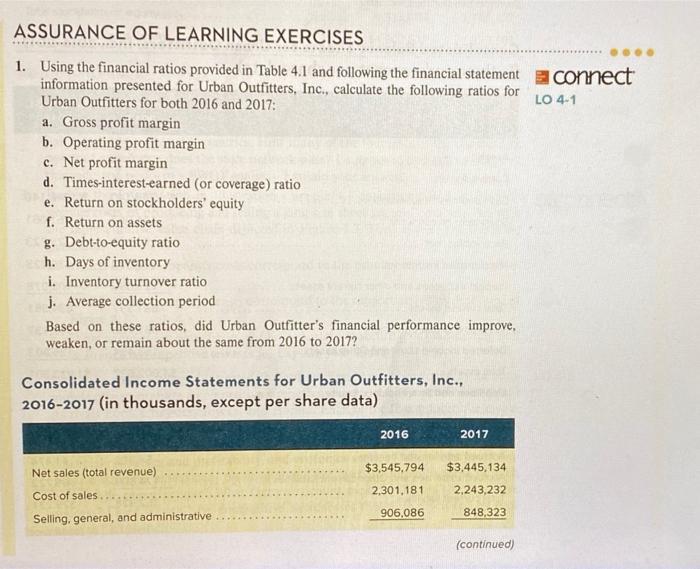

please answer quedtion one parts a-j i really need help. God bless ASSURANCE OF LEARNING EXERCISES 1. Using the financial ratios provided in Table 4.1

please answer quedtion one parts a-j i really need help. God bless

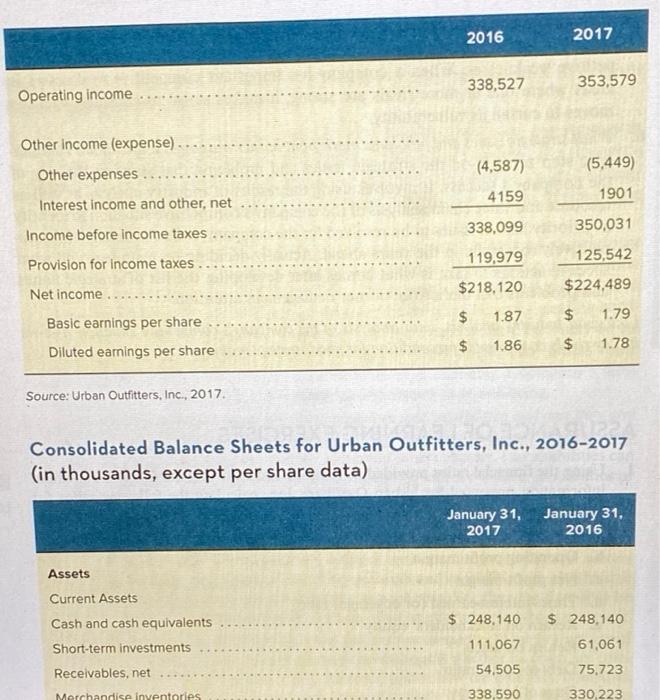

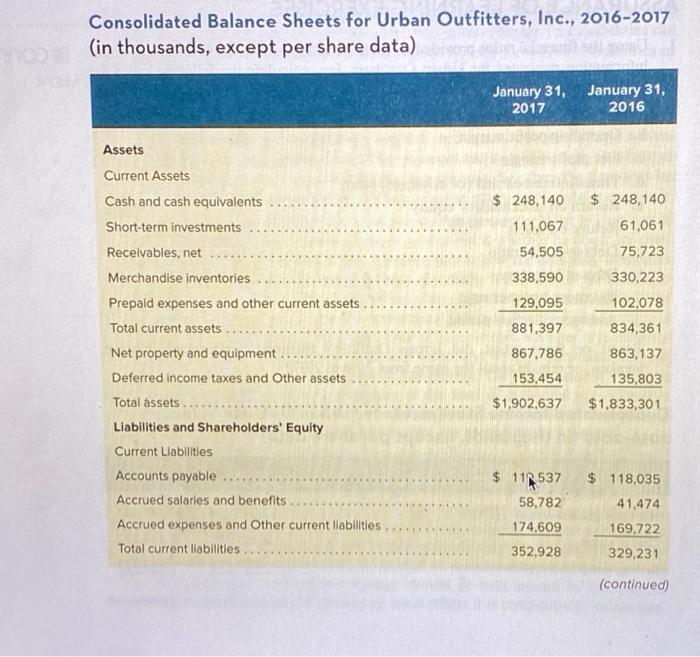

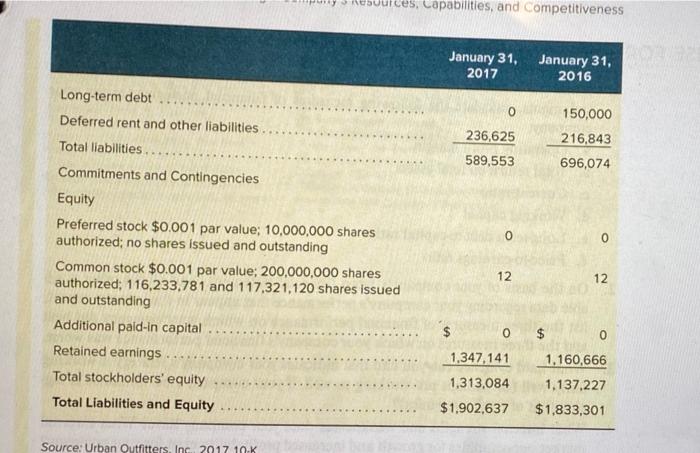

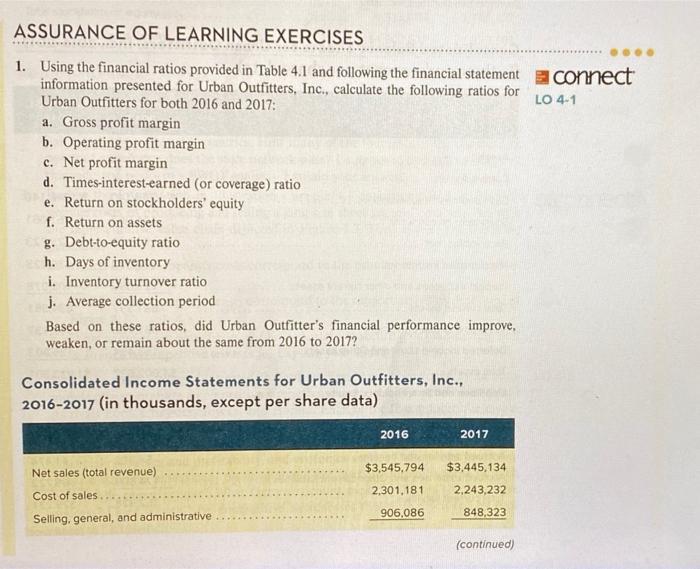

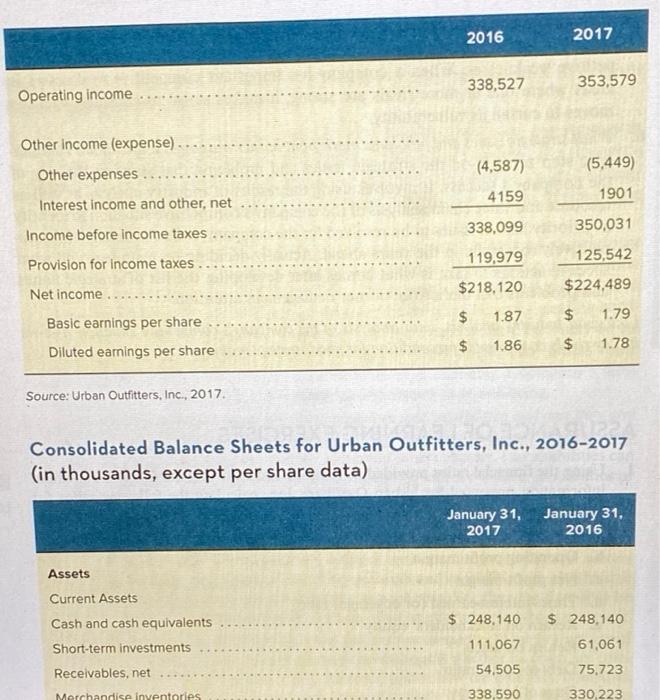

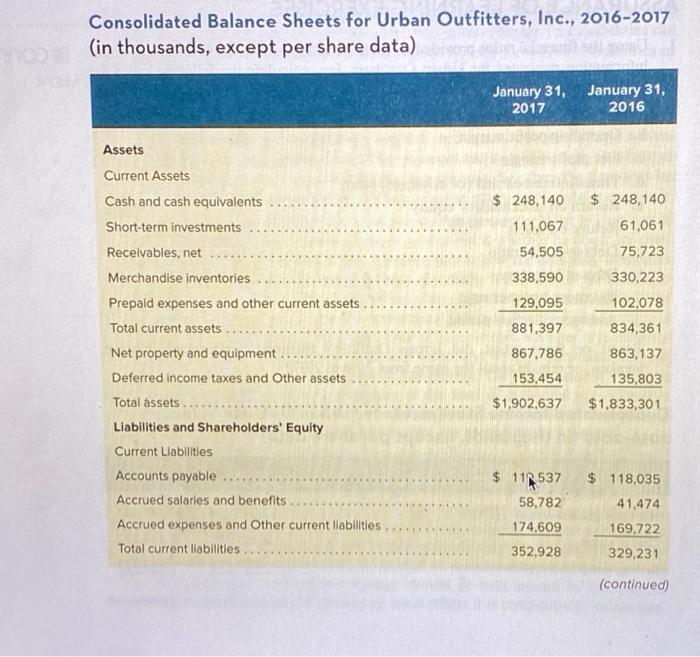

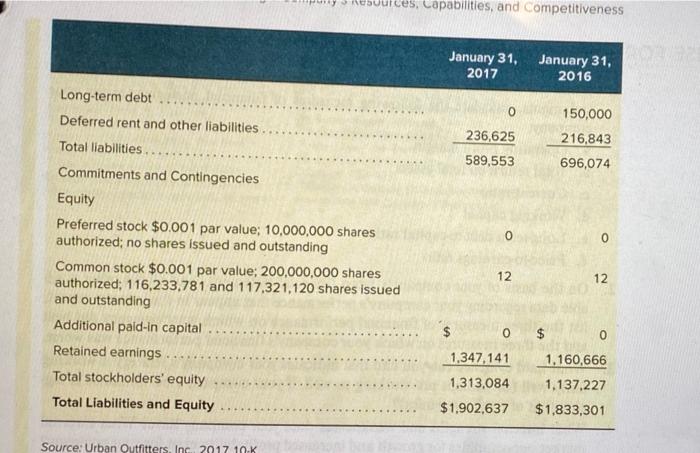

ASSURANCE OF LEARNING EXERCISES 1. Using the financial ratios provided in Table 4.1 and following the financial statement connect information presented for Urban Outfitters, Inc., calculate the following ratios for Urban Outfitters for both 2016 and 2017: LO 4-1 a. Gross profit margin b. Operating profit margin c. Net profit margin d. Times-interest-earned (or coverage) ratio e. Return on stockholders' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio j. Average collection period Based on these ratios, did Urban Outfitter's financial performance improve. weaken, or remain about the same from 2016 to 2017? Consolidated Income Statements for Urban Outfitters, Inc., 2016-2017 (in thousands, except per share data) 2016 2017 $3,545,794 $3,445,134 2.301,181 2,243,232 Net sales (total revenue) Cost of sales Selling, general, and administrative 906,086 848,323 (continued) 2016 2017 338,527 353,579 Operating income Other Income (expense) ... (4,587) (5,449) Other expenses 4159 1901 Interest income and other, net 338,099 350,031 Income before income taxes 119.979 125,542 Provision for income taxes $218,120 $224,489 $ 1.87 $ 1.79 Net income Basic earnings per share Diluted earnings per share $ 1.86 $ 1.78 Source: Urban Outfitters, Inc., 2017 Consolidated Balance Sheets for Urban Outfitters, Inc., 2016-2017 (in thousands, except per share data) January 31, January 31, 2017 2016 Assets Current Assets $ 248,140 Cash and cash equivalents Short-term investments $ 248,140 61,061 111,067 Receivables, net 75,723 54,505 338,590 Merchandise inventories 330,223 Consolidated Balance Sheets for Urban Outfitters, Inc., 2016-2017 (in thousands, except per share data) January 31, 2017 January 31, 2016 Assets $ 248,140 $ 248,140 111.067 61,061 75,723 54,505 330,223 338,590 129,095 881.397 102,078 Current Assets Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories Prepaid expenses and other current assets Total current assets Net property and equipment Deferred income taxes and Other assets Total assets Liabilities and Shareholders' Equity Current Liabilities Accounts payable ...... Accrued salaries and benefits Accrued expenses and Other current liabilitles Total current liabilities 867,786 153,454 834,361 863,137 135,803 $1.833,301 $1,902,637 $ 11 537 58,782 $ 118,035 41,474 169,722 329,231 174,609 352,928 (continued) buulces, Capabilities, and competitiveness January 31, 2017 January 31, 2016 0 150,000 216,843 236,625 589,553 696,074 o 0 Long-term debt Deferred rent and other liabilities Total liabilities. Commitments and Contingencies Equity Preferred stock $0.001 par value; 10,000,000 shares authorized; no shares issued and outstanding Common stock $0.001 par value: 200,000,000 shares authorized: 116,233,781 and 117,321,120 shares issued and outstanding Additional paid-in capital Retained earnings Total stockholders' equity Total Liabilities and Equity 12 12 $ 0 $ 0 1.347,141 1.160,666 1,313,084 1.137,227 $1,902,637 $1,833,301 Source: Urban Outfitters, Inc. 2017 10 K

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started