Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question 1 MFRS133 (Question 1) GOL Bhd. has in issue 15,500,000 ordinary shares. On 1 Jan 2019, GOL Bhd. issued 5,000,000 (at a

please answer question 1

MFRS133

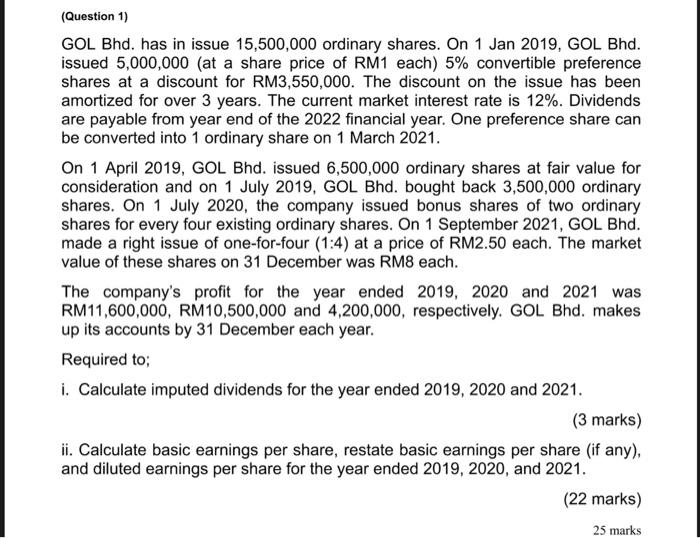

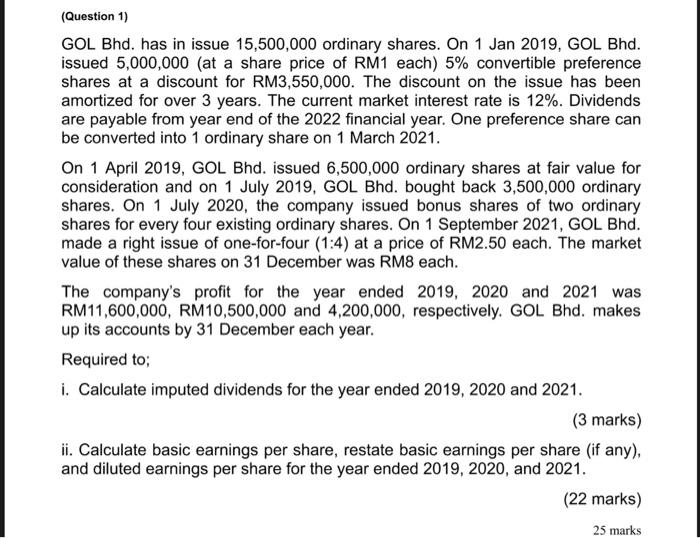

(Question 1) GOL Bhd. has in issue 15,500,000 ordinary shares. On 1 Jan 2019, GOL Bhd. issued 5,000,000 (at a share price of RM1 each) 5% convertible preference shares at a discount for RM3,550,000. The discount on the issue has been amortized for over 3 years. The current market interest rate is 12%. Dividends are payable from year end of the 2022 financial year. One preference share can be converted into 1 ordinary share on 1 March 2021. On 1 April 2019, GOL Bhd. issued 6,500,000 ordinary shares at fair value for consideration and on 1 July 2019, GOL Bhd. bought back 3,500,000 ordinary shares. On 1 July 2020, the company issued bonus shares of two ordinary shares for every four existing ordinary shares. On 1 September 2021, GOL Bhd. made a right issue of one-for-four (1:4) at a price of RM2.50 each. The market value of these shares on 31 December was RM8 each. The company's profit for the year ended 2019, 2020 and 2021 was RM11,600,000, RM10,500,000 and 4,200,000, respectively. GOL Bhd. makes up its accounts by 31 December each year. Required to; i. Calculate imputed dividends for the year ended 2019, 2020 and 2021. (3 marks) ii. Calculate basic earnings per share, restate basic earnings per share (if any), and diluted earnings per share for the year ended 2019, 2020, and 2021. (22 marks) 25 marks (Question 1) GOL Bhd. has in issue 15,500,000 ordinary shares. On 1 Jan 2019, GOL Bhd. issued 5,000,000 (at a share price of RM1 each) 5% convertible preference shares at a discount for RM3,550,000. The discount on the issue has been amortized for over 3 years. The current market interest rate is 12%. Dividends are payable from year end of the 2022 financial year. One preference share can be converted into 1 ordinary share on 1 March 2021. On 1 April 2019, GOL Bhd. issued 6,500,000 ordinary shares at fair value for consideration and on 1 July 2019, GOL Bhd. bought back 3,500,000 ordinary shares. On 1 July 2020, the company issued bonus shares of two ordinary shares for every four existing ordinary shares. On 1 September 2021, GOL Bhd. made a right issue of one-for-four (1:4) at a price of RM2.50 each. The market value of these shares on 31 December was RM8 each. The company's profit for the year ended 2019, 2020 and 2021 was RM11,600,000, RM10,500,000 and 4,200,000, respectively. GOL Bhd. makes up its accounts by 31 December each year. Required to; i. Calculate imputed dividends for the year ended 2019, 2020 and 2021. (3 marks) ii. Calculate basic earnings per share, restate basic earnings per share (if any), and diluted earnings per share for the year ended 2019, 2020, and 2021. (22 marks) 25 marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started