Answered step by step

Verified Expert Solution

Question

1 Approved Answer

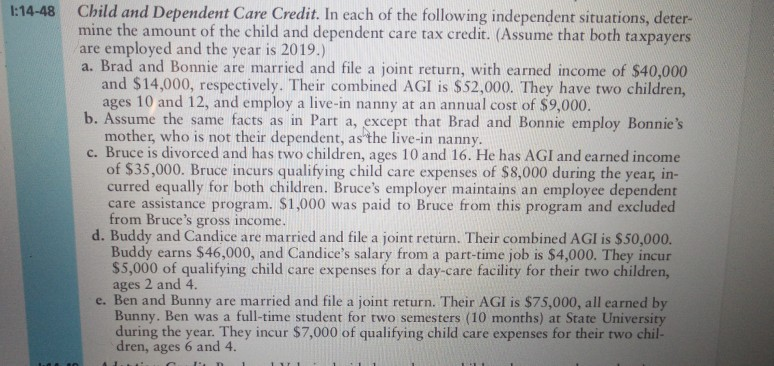

please answer question 14-48, a thru e. 1:14-48 Child and Dependent Care Credit. In each of the following independent situations, deter- mine the amount of

please answer question 14-48, a thru e.

1:14-48 Child and Dependent Care Credit. In each of the following independent situations, deter- mine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2019.) a. Brad and Bonnie are married and file a joint return, with earned income of $40,000 and $14,000, respectively. Their combined AGI is $52,000. They have two children, ages 10 and 12, and employ a live-in nanny at an annual cost of $9,000. b. Assume the same facts as in Part a, except that Brad and Bonnie employ Bonnie's mother, who is not their dependent, as the live-in nanny. c. Bruce is divorced and has two children, ages 10 and 16. He has AGI and earned income of $35,000. Bruce incurs qualifying child care expenses of $8,000 during the year, in- curred equally for both children. Bruce's employer maintains an employee dependent care assistance program. $1,000 was paid to Bruce from this program and excluded from Bruce's gross income. d. Buddy and Candice are married and file a joint return. Their combined AGI is $50,000. Buddy earns $46,000, and Candice's salary from a part-time job is $4,000. They incur $5,000 of qualifying child care expenses for a day-care facility for their two children, ages 2 and 4. e. Ben and Bunny are married and file a joint return. Their AGI is $75,000, all earned by Bunny. Ben was a full-time student for two semesters (10 months) at State University during the year. They incur $7,000 of qualifying child care expenses for their two chil dren, ages 6 and 4. 1:14-48 Child and Dependent Care Credit. In each of the following independent situations, deter- mine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2019.) a. Brad and Bonnie are married and file a joint return, with earned income of $40,000 and $14,000, respectively. Their combined AGI is $52,000. They have two children, ages 10 and 12, and employ a live-in nanny at an annual cost of $9,000. b. Assume the same facts as in Part a, except that Brad and Bonnie employ Bonnie's mother, who is not their dependent, as the live-in nanny. c. Bruce is divorced and has two children, ages 10 and 16. He has AGI and earned income of $35,000. Bruce incurs qualifying child care expenses of $8,000 during the year, in- curred equally for both children. Bruce's employer maintains an employee dependent care assistance program. $1,000 was paid to Bruce from this program and excluded from Bruce's gross income. d. Buddy and Candice are married and file a joint return. Their combined AGI is $50,000. Buddy earns $46,000, and Candice's salary from a part-time job is $4,000. They incur $5,000 of qualifying child care expenses for a day-care facility for their two children, ages 2 and 4. e. Ben and Bunny are married and file a joint return. Their AGI is $75,000, all earned by Bunny. Ben was a full-time student for two semesters (10 months) at State University during the year. They incur $7,000 of qualifying child care expenses for their two chil dren, ages 6 and 4Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started