Answered step by step

Verified Expert Solution

Question

1 Approved Answer

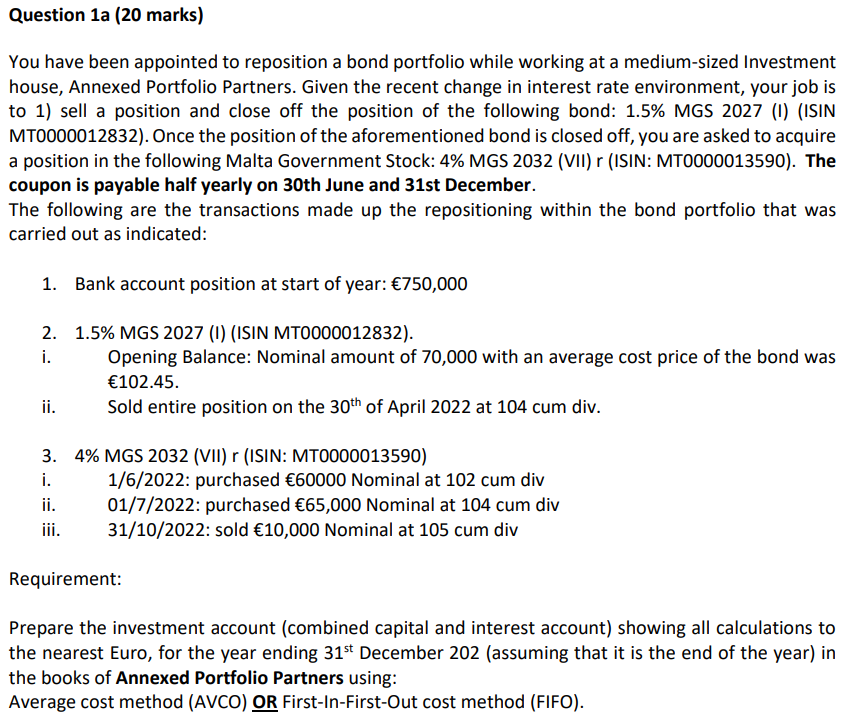

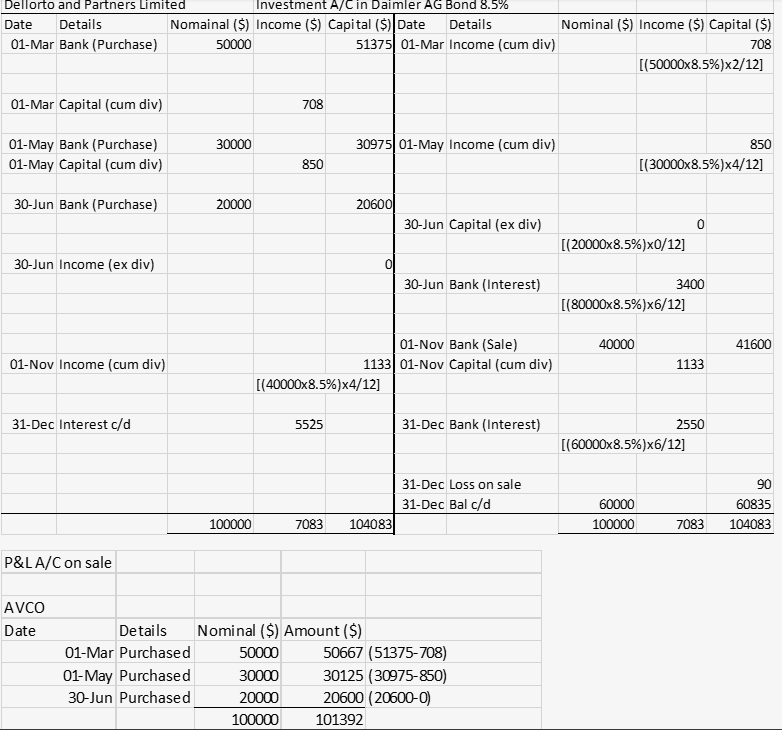

PLEASE ANSWER QUESTION 1a WITH DETAILED EXPLANATION. A LIKE WILL FOLLOW. PLEASE USE THE FORMAT PRESENTED IN THE PICTURE BELOW TO ANSWER THE QUESTION ABOVE.THE

PLEASE ANSWER QUESTION 1a WITH DETAILED EXPLANATION. A LIKE WILL FOLLOW.

PLEASE USE THE FORMAT PRESENTED IN THE PICTURE BELOW TO ANSWER THE QUESTION ABOVE.THE PHOTO BELOW IS JUST TO LET YOU KNOW HOW THE QUESTION SHOULD BE STRUCTURED AND PRESENTED. PLEASE IGNORE THE FIGURES

You have been appointed to reposition a bond portfolio while working at a medium-sized Investment house, Annexed Portfolio Partners. Given the recent change in interest rate environment, your job is to 1) sell a position and close off the position of the following bond: 1.5\% MGS 2027 (I) (ISIN MT0000012832). Once the position of the aforementioned bond is closed off, you are asked to acquire a position in the following Malta Government Stock: 4\% MGS 2032 (VII) r (ISIN: MT0000013590). The coupon is payable half yearly on 30th June and 31st December. The following are the transactions made up the repositioning within the bond portfolio that was carried out as indicated: 1. Bank account position at start of year: 750,000 2. 1.5% MGS 2027 (I) (ISIN MT0000012832). i. Opening Balance: Nominal amount of 70,000 with an average cost price of the bond was 102.45. ii. Sold entire position on the 30th of April 2022 at 104 cum div. 3. 4% MGS 2032 (VII) r (ISIN: MT0000013590) i. 1/6/2022 : purchased 60000 Nominal at 102 cum div ii. 01/7/2022 : purchased 65,000 Nominal at 104 cum div iii. 31/10/2022 : sold 10,000 Nominal at 105 cum div Requirement: Prepare the investment account (combined capital and interest account) showing all calculations to the nearest Euro, for the year ending 31st December 202 (assuming that it is the end of the year) in the books of Annexed Portfolio Partners using: Average cost method (AVCO) OR First-In-First-Out cost method (FIFO). Dellorto and Partners Limited Investment A/C in Daimler AG Bond 8.5% P\&LA/C on sale AVCO \begin{tabular}{|r|l|r|r|} \hline \multicolumn{1}{|l|}{ Date } & Details & Nominal (\$) & Amount (\$) \\ \hline 01-Mar & Purchased & 50000 & 50667(51375708) \\ \hline 01-May & Purchased & 30000 & 30125(30975850) \\ \hline 30-Jun & Purchased & 20000 & 20600 \\ \cline { 3 - 4 } & & 100000 & 101392 \\ \hline \end{tabular} You have been appointed to reposition a bond portfolio while working at a medium-sized Investment house, Annexed Portfolio Partners. Given the recent change in interest rate environment, your job is to 1) sell a position and close off the position of the following bond: 1.5\% MGS 2027 (I) (ISIN MT0000012832). Once the position of the aforementioned bond is closed off, you are asked to acquire a position in the following Malta Government Stock: 4\% MGS 2032 (VII) r (ISIN: MT0000013590). The coupon is payable half yearly on 30th June and 31st December. The following are the transactions made up the repositioning within the bond portfolio that was carried out as indicated: 1. Bank account position at start of year: 750,000 2. 1.5% MGS 2027 (I) (ISIN MT0000012832). i. Opening Balance: Nominal amount of 70,000 with an average cost price of the bond was 102.45. ii. Sold entire position on the 30th of April 2022 at 104 cum div. 3. 4% MGS 2032 (VII) r (ISIN: MT0000013590) i. 1/6/2022 : purchased 60000 Nominal at 102 cum div ii. 01/7/2022 : purchased 65,000 Nominal at 104 cum div iii. 31/10/2022 : sold 10,000 Nominal at 105 cum div Requirement: Prepare the investment account (combined capital and interest account) showing all calculations to the nearest Euro, for the year ending 31st December 202 (assuming that it is the end of the year) in the books of Annexed Portfolio Partners using: Average cost method (AVCO) OR First-In-First-Out cost method (FIFO). Dellorto and Partners Limited Investment A/C in Daimler AG Bond 8.5% P\&LA/C on sale AVCO \begin{tabular}{|r|l|r|r|} \hline \multicolumn{1}{|l|}{ Date } & Details & Nominal (\$) & Amount (\$) \\ \hline 01-Mar & Purchased & 50000 & 50667(51375708) \\ \hline 01-May & Purchased & 30000 & 30125(30975850) \\ \hline 30-Jun & Purchased & 20000 & 20600 \\ \cline { 3 - 4 } & & 100000 & 101392 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started