Please answer question 1b, thanks.

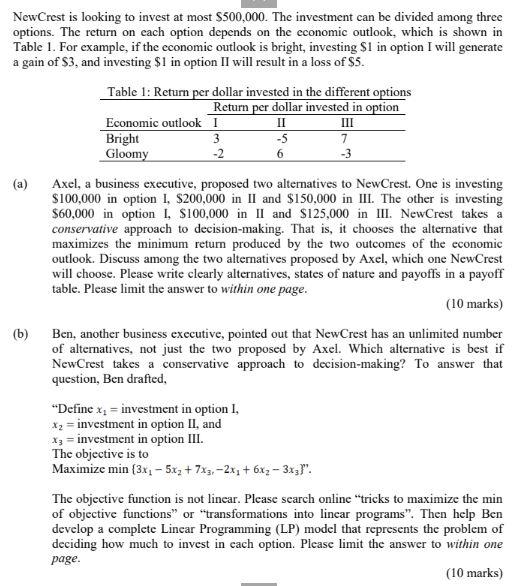

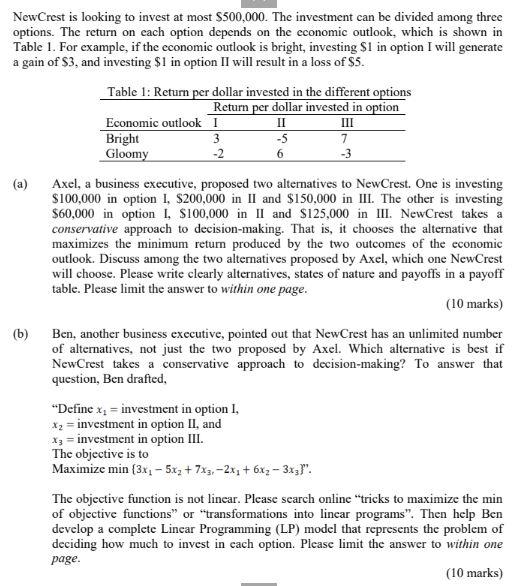

NewCrest is looking to invest at most $500,000. The investment can be divided among three options. The return on each option depends on the economic outlook, which is shown in Table 1. For example, if the economic outlook is bright, investing $1 in option I will generate a gain of $3, and investing $1 in option II will result in a loss of $5. Table 1: Return per dollar invested in the different options Return per dollar invested in option Economic outlook 1 II III Bright 3 -5 7 Gloomy 6 (6) Axel, a business executive, proposed two alternatives to New Crest. One is investing $100,000 in option I, $200,000 in II and $150,000 in III. The other is investing $60,000 in option 1, $100,000 in II and $125,000 in III. NewCrest takes a conservative approach to decision-making. That is, it chooses the alternative that maximizes the minimum retum produced by the two outcomes of the economic outlook. Discuss among the two alternatives proposed by Axel, which one NewCrest will choose. Please write clearly alternatives, states of nature and payoffs in a payoff table. Please limit the answer to within one page. (10 marks) Ben, another business executive, pointed out that NewCrest has an unlimited number of alternatives, not just the two proposed by Axel. Which alternative is best if NewCrest takes a conservative approach to decision-making? To answer that question, Ben drafted, "Define x = investment in option 1, x2 = investment in option II, and x3 = investment in option III. The objective is to Maximize min (3x, - 5x2 + 7x3,-2x+ 6x2 3x,)". The objective function is not linear. Please search online "tricks to maximize the min of objective functions" or "transformations into lincar programs". Then help Ben develop a complete Linear Programming (LP) model that represents the problem of deciding how much to invest in cach option. Please limit the answer to within one page. (10 marks) NewCrest is looking to invest at most $500,000. The investment can be divided among three options. The return on each option depends on the economic outlook, which is shown in Table 1. For example, if the economic outlook is bright, investing $1 in option I will generate a gain of $3, and investing $1 in option II will result in a loss of $5. Table 1: Return per dollar invested in the different options Return per dollar invested in option Economic outlook 1 II III Bright 3 -5 7 Gloomy 6 (6) Axel, a business executive, proposed two alternatives to New Crest. One is investing $100,000 in option I, $200,000 in II and $150,000 in III. The other is investing $60,000 in option 1, $100,000 in II and $125,000 in III. NewCrest takes a conservative approach to decision-making. That is, it chooses the alternative that maximizes the minimum retum produced by the two outcomes of the economic outlook. Discuss among the two alternatives proposed by Axel, which one NewCrest will choose. Please write clearly alternatives, states of nature and payoffs in a payoff table. Please limit the answer to within one page. (10 marks) Ben, another business executive, pointed out that NewCrest has an unlimited number of alternatives, not just the two proposed by Axel. Which alternative is best if NewCrest takes a conservative approach to decision-making? To answer that question, Ben drafted, "Define x = investment in option 1, x2 = investment in option II, and x3 = investment in option III. The objective is to Maximize min (3x, - 5x2 + 7x3,-2x+ 6x2 3x,)". The objective function is not linear. Please search online "tricks to maximize the min of objective functions" or "transformations into lincar programs". Then help Ben develop a complete Linear Programming (LP) model that represents the problem of deciding how much to invest in cach option. Please limit the answer to within one page. (10 marks)