Answered step by step

Verified Expert Solution

Question

1 Approved Answer

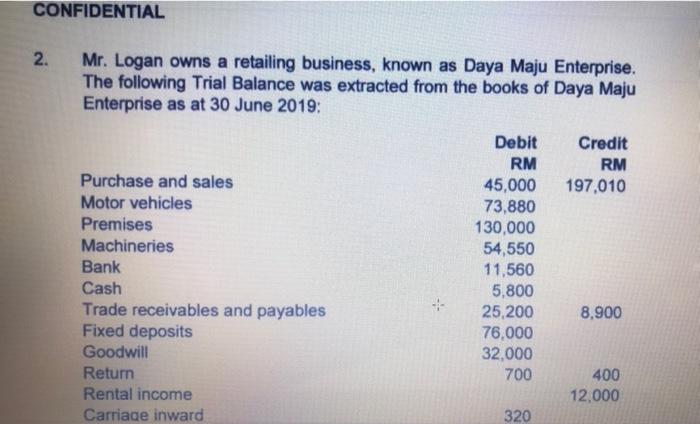

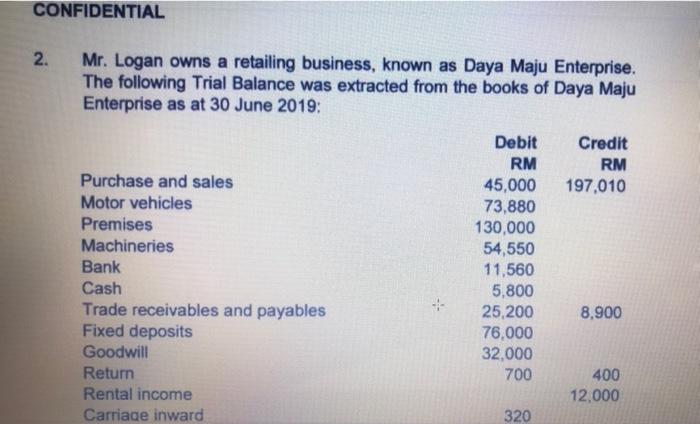

Please answer question 2 (a) based on 16 marks given CONFIDENTIAL 2. Mr. Logan owns a retailing business, known as Daya Maju Enterprise. The following

Please answer question 2 (a) based on 16 marks given

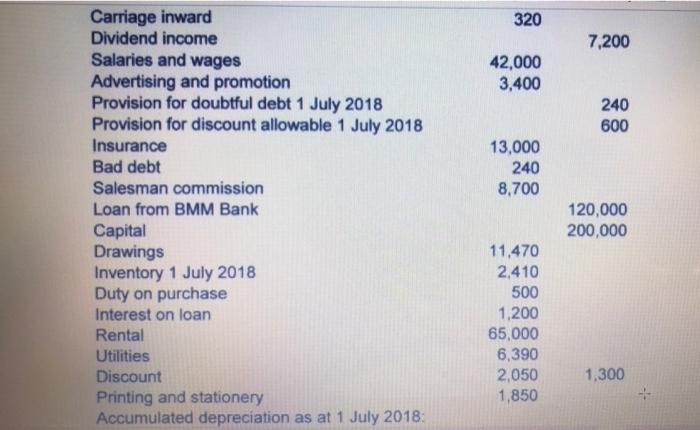

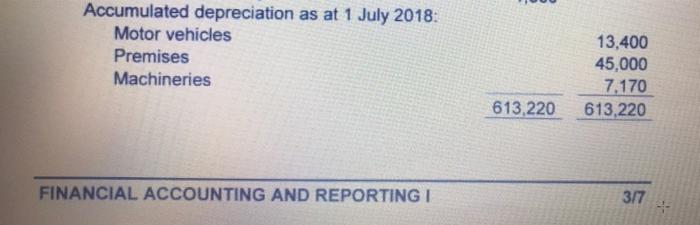

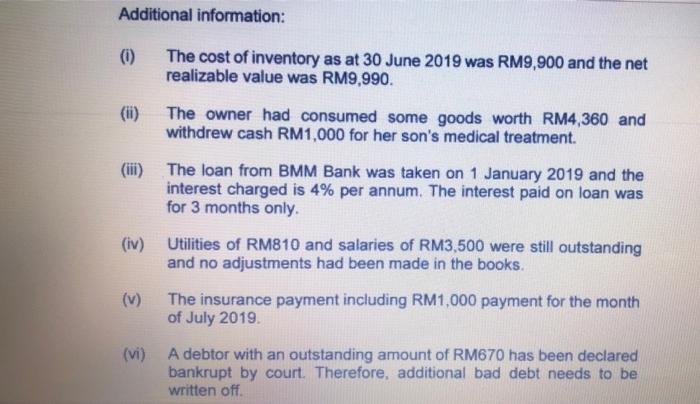

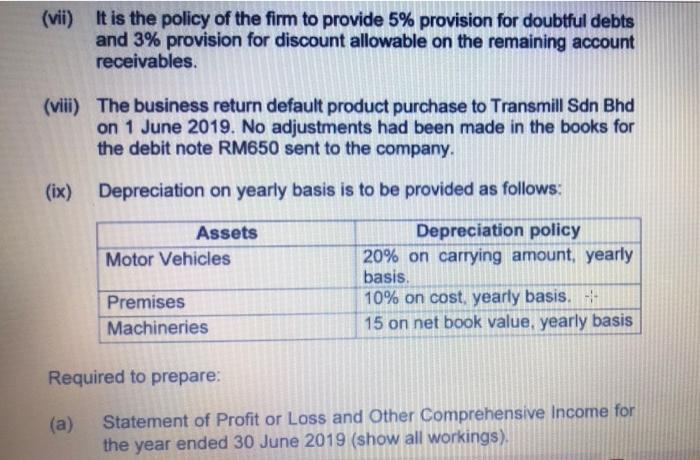

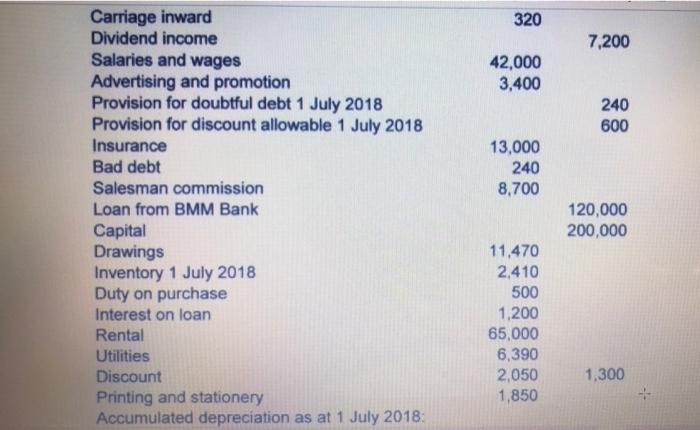

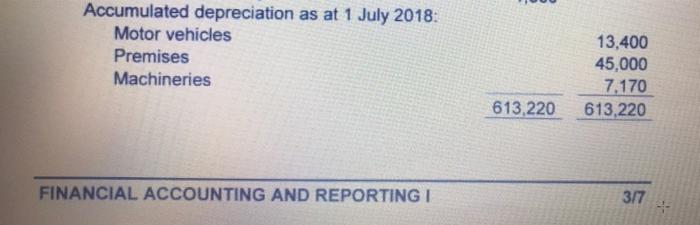

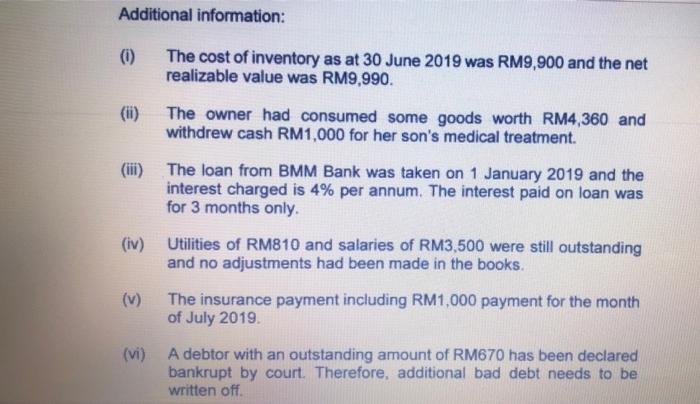

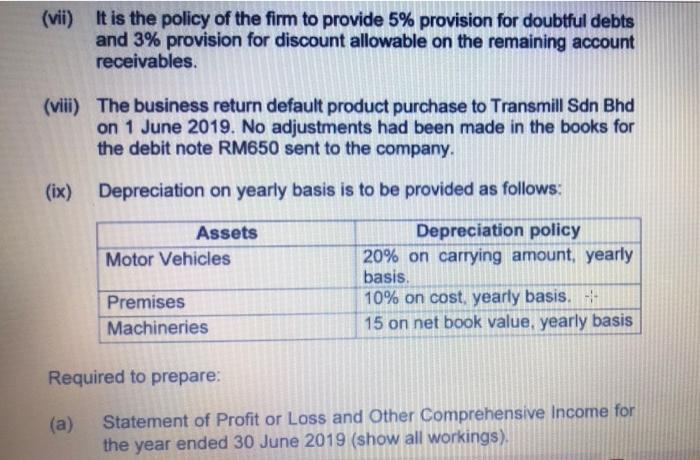

CONFIDENTIAL 2. Mr. Logan owns a retailing business, known as Daya Maju Enterprise. The following Trial Balance was extracted from the books of Daya Maju Enterprise as at 30 June 2019: Credit RM 197,010 Purchase and sales Motor vehicles Premises Machineries Bank Cash Trade receivables and payables Fixed deposits Goodwill Return Rental income Carriage inward Debit RM 45,000 73,880 130,000 54,550 11,560 5,800 25,200 76,000 32,000 700 8,900 400 12.000 320 320 7,200 42,000 3,400 240 600 13,000 240 8,700 Carriage inward Dividend income Salaries and wages Advertising and promotion Provision for doubtful debt 1 July 2018 Provision for discount allowable 1 July 2018 Insurance Bad debt Salesman commission Loan from BMM Bank Capital Drawings Inventory 1 July 2018 Duty on purchase Interest on loan Rental Utilities Discount Printing and stationery Accumulated depreciation as at 1 July 2018: 120,000 200,000 11,470 2,410 500 1,200 65,000 6,390 2,050 1,850 1,300 Accumulated depreciation as at 1 July 2018: Motor vehicles Premises Machineries 13,400 45,000 7,170 613,220 613,220 FINANCIAL ACCOUNTING AND REPORTING I 3/7 Additional information: (0) The cost of inventory as at 30 June 2019 was RM9,900 and the net realizable value was RM9,990. The owner had consumed some goods worth RM4,360 and withdrew cash RM1,000 for her son's medical treatment. (ii) (iii) The loan from BMM Bank was taken on 1 January 2019 and the interest charged is 4% per annum. The interest paid on loan was for 3 months only. (iv) Utilities of RM810 and salaries of RM3,500 were still outstanding and no adjustments had been made in the books. (v) The insurance payment including RM1,000 payment for the month of July 2019 (vi) A debtor with an outstanding amount of RM670 has been declared bankrupt by court. Therefore, additional bad debt needs to be written off. (vii) It is the policy of the firm to provide 5% provision for doubtful debts and 3% provision for discount allowable on the remaining account receivables. (viii) The business return default product purchase to Transmill Sdn Bhd on 1 June 2019. No adjustments had been made in the books for the debit note RM650 sent to the company. (ix) Depreciation on yearly basis is to be provided as follows: Assets Motor Vehicles Depreciation policy 20% on carrying amount, yearly basis 10% on cost, yearly basis. 15 on net book value, yearly basis Premises Machineries Required to prepare: (a) Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019 (show all workings) 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started