PLEASE ANSWER QUESTION 2

ANSWER TO QUESTION 1

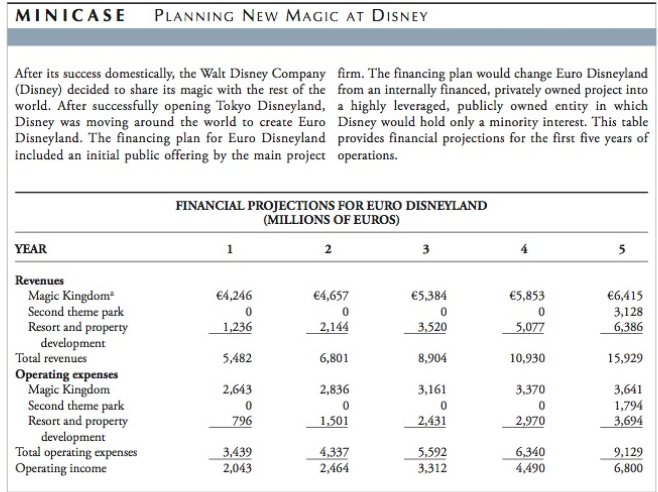

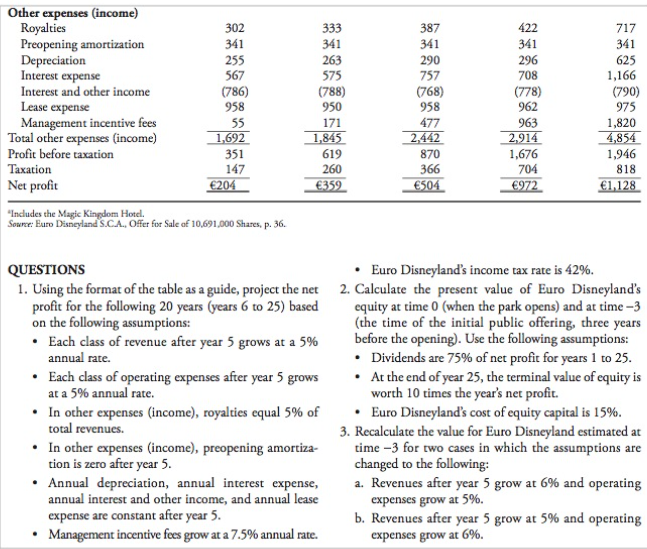

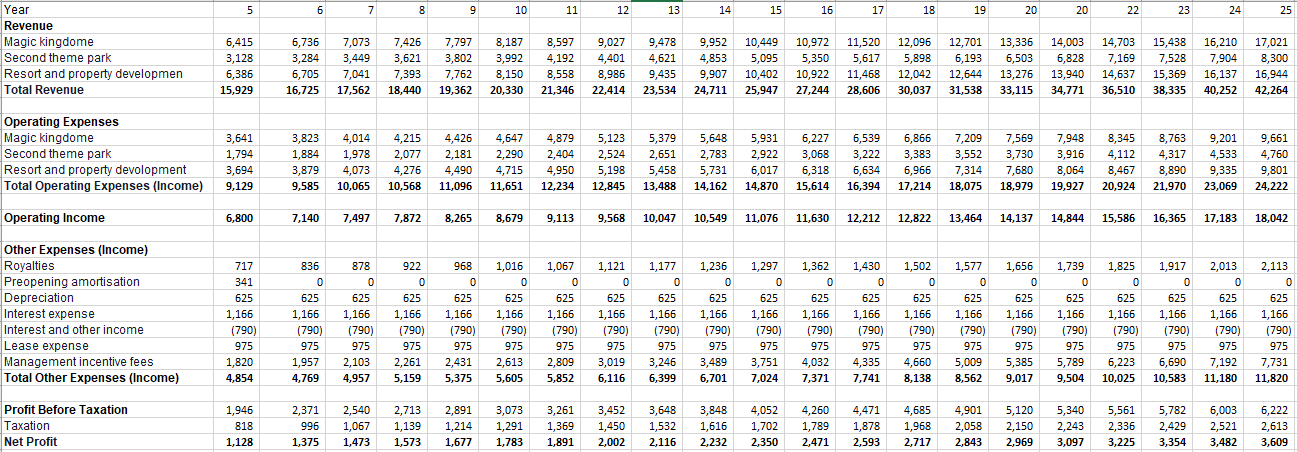

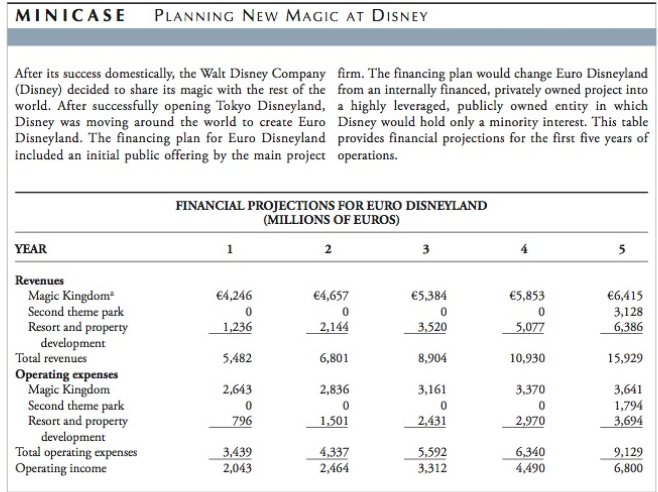

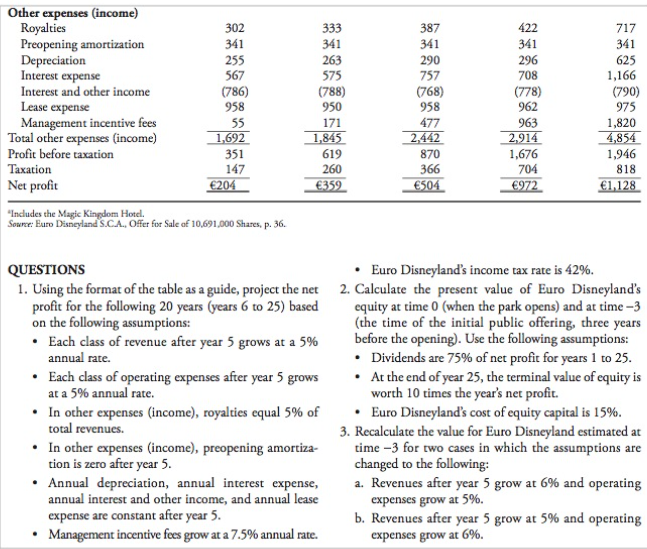

MINICASE PLANNING NEw MAGIC AT DISNEY After its success domestically, the Walt Disney Company firm. The financing plan would change Euro Disneyland (Disney) decided to share its magic with the rest of the from an internally financed, privately owned project into world. After successfully opening Tokyo Disneyland, a highly leveraged, publicly owned entity in which Disney was moving around the world to create Euro Disney would hold only a minority interest. This table Disneyland. The financing plan for Euro Disneyland provides financial projections for the first five years of included an initial public offering by the main project operations. FINANCIAL PROJECTIONS FOR EURO DISNEYLAND (MILLIONS OF EUROS) 1 2 3 YEAR 5 4,246 0 | 1,236 4,657 0 2,144 5,384 0 3,520 5,853 0 5,077 6,415 3,128 6,386 5,482 6,801 8,904 10,930 15,929 Revenues Magic Kingdom Second theme park Resort and property development Total revenues Operating expenses Magic Kingdom Second theme park Resort and property development Total operating expenses Operating income 3,161 2,643 0 796 2,836 0 1,501 3,370 0 2,970 3,641 1,794 3,694 2,431 3,439 2,043 4,337 2,464 5,592 3,312 6,340 4,490 9,129 6,800 Other expenses (income) Royalties Preopening amortization Depreciation Interest expense Interest and other income Lease expense Management incentive fees Total other expenses (income) Profit before taxation Taxation Net profit 302 341 255 567 (786) 958 55 1,692 351 147 204 333 341 263 575 (788) 950 171 1,845 619 260 352 33.8623 387 341 290 757 (768) 958 477 2,442 870 366 504 BERABER 422 341 296 708 (778) 962 963 2,914 1,676 704 972 ESS 717 341 625 1,166 (790) 975 1,820 4,854 1,946 818 1,128 "Includes the Magic Kingdom Hotel Source: Euro Disneyland S.CA.Offer for Sale of 10,691,000 Shares, p. 36. QUESTIONS Euro Disneyland's income tax rate is 42%. 1. Using the format of the table as a guide, project the net 2. Calculate the present value of Euro Disneyland's profit for the following 20 years (years 6 to 25) based equity at time 0 (when the park opens) and at time - 3 on the following assumptions: (the time of the initial public offering, three years Each class of revenue after year 5 grows at a 5% before the opening). Use the following assumptions: annual rate. Dividends are 75% of net profit for years 1 to 25. Each class of operating expenses after year 5 grows At the end of year 25, the terminal value of equity is at a 5% annual rate. worth 10 times the year's net profit. In other expenses (income), royalties equal 5% of Euro Disneyland's cost of equity capital is 15%. total revenues. 3. Recalculate the value for Euro Disneyland estimated at In other expenses (income), preopening amortiza- time-3 for two cases in which the assumptions are tion is zero after year 5. changed to the following: Annual depreciation, annual interest expense, a. Revenues after year 5 grow at 6% and operating annual interest and other income, and annual lease expenses grow at 5%. expense are constant after year 5. b. Revenues after year 5 grow at 5% and operating Management incentive fees grow at a 7.5% annual rate. expenses grow at 6%. 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 20 22 23 24 25 Year Revenue Magic kingdome Second theme park Resort and property developmen Total Revenue 6,415 3,128 6,386 15.929 6,736 3,284 6,705 16.725 7,073 3,449 7,041 17,562 7,426 3,621 7,393 18,440 7,797 3,802 7,762 19,362 8,187 3,992 8,150 20,330 8,597 4,192 8,558 21,346 9,027 4,401 8,986 22,414 9,478 4,621 9,435 23,534 9,952 4,853 9,907 24,711 10,449 5,095 10,402 25,947 10,972 5,350 10,922 27,244 11,520 5,617 11,468 28,606 12,096 5,898 12,042 30,037 12,701 6,193 12,644 31,538 13,336 6,503 13,276 33,115 14,003 6,828 13,940 34,771 14,703 7,169 14,637 36,510 15,438 7,528 15,369 38,335 16,210 7,904 16,137 40,252 17,021 8,300 16,944 42,264 Operating Expenses Magic kingdome Second theme park Resort and property devolopment Total Operating Expenses (Income) 3,641 1,794 3,694 9,129 3,823 1,884 3,879 4,014 1,978 4,073 10,065 4,215 2,077 4,276 10,568 4,426 2,181 4,490 11,096 4,647 2,290 4,715 11,651 4,879 2,404 4,950 12,234 5,123 2,524 5,198 12,845 5,379 2,651 5,458 13,488 5,648 2,783 5,731 14,162 5,931 2,922 6,017 14,870 6,227 3,068 6,318 15,614 6,539 3,222 6,634 16,394 6,866 3,383 6,966 17,214 7,209 3,552 7,314 18,075 7,569 3,730 7,680 18,979 7,948 3,916 8,064 19,927 8,345 4,112 8,467 20,924 8,763 4,317 8,890 21,970 9,201 4,533 9,335 23,069 9,661 4,760 9,801 24,222 9,585 Operating Income 6,800 7,140 7,497 7,872 8,265 8,679 9,113 9,568 10,047 10,549 11,076 11,630 12,212 12,822 13,464 14,137 14,844 15,586 16,365 17,183 18,042 1,502 1,177 0 1,577 0 0 625 625 Other Expenses (Income) Royalties Preopening amortisation Depreciation Interest expense Interest and other income Lease expense Management incentive fees Total Other Expenses (Income) 717 341 625 1,166 (790) 975 1,820 4,854 836 0 625 1,166 (790) 975 1,957 4,769 878 0 625 1,166 (790) 975 2,103 4,957 922 0 625 1,166 (790) 975 2,261 5,159 968 0 625 1,166 (790) 975 2,431 5,375 1,016 0 625 1,166 (790) 975 2,613 5,605 1,067 0 625 1,166 (790) 975 2,809 5,852 1,121 0 625 1,166 (790) 975 3,019 6,116 1,236 0 625 1,166 (790) 975 3,489 6,701 1,166 (790) 975 3,246 6,399 1,297 0 625 1,166 (790) 975 3,751 7,024 1,362 0 625 1,166 (790) 975 4,032 7,371 1,430 0 625 1,166 (790) 975 4,335 7,741 1,656 0 625 1,166 (790) 975 625 1,166 (790) 975 4,660 8,138 1,166 (790) 975 5,009 8,562 1,739 0 625 1,166 (790) 975 5,789 9,504 1,825 0 625 1,166 (790) 975 6,223 10,025 1,917 0 625 1,166 (790) 975 6,690 10,583 2,013 0 625 1,166 (790) 975 7,192 11,180 2,113 0 625 1,166 (790) 975 7,731 11,820 5,385 9,017 Profit Before Taxation Taxation Net Profit 1,946 818 1,128 2,371 996 1,375 2,540 1,067 1,473 2,713 1,139 1,573 2,891 1,214 1,677 3,073 1,291 1,783 3,261 1,369 1,891 3,452 1,450 2,002 3,648 1,532 2,116 3,848 1,616 2,232 4,052 1,702 2,350 4,260 1,789 2,471 4,471 1,878 2,593 4,685 1,968 2,717 4,901 2,058 2,843 5,120 2,150 2,969 5,340 2,243 3,097 5,561 2,336 3,225 5,782 2,429 3,354 6,003 2,521 3,482 6,222 2,613 3,609 MINICASE PLANNING NEw MAGIC AT DISNEY After its success domestically, the Walt Disney Company firm. The financing plan would change Euro Disneyland (Disney) decided to share its magic with the rest of the from an internally financed, privately owned project into world. After successfully opening Tokyo Disneyland, a highly leveraged, publicly owned entity in which Disney was moving around the world to create Euro Disney would hold only a minority interest. This table Disneyland. The financing plan for Euro Disneyland provides financial projections for the first five years of included an initial public offering by the main project operations. FINANCIAL PROJECTIONS FOR EURO DISNEYLAND (MILLIONS OF EUROS) 1 2 3 YEAR 5 4,246 0 | 1,236 4,657 0 2,144 5,384 0 3,520 5,853 0 5,077 6,415 3,128 6,386 5,482 6,801 8,904 10,930 15,929 Revenues Magic Kingdom Second theme park Resort and property development Total revenues Operating expenses Magic Kingdom Second theme park Resort and property development Total operating expenses Operating income 3,161 2,643 0 796 2,836 0 1,501 3,370 0 2,970 3,641 1,794 3,694 2,431 3,439 2,043 4,337 2,464 5,592 3,312 6,340 4,490 9,129 6,800 Other expenses (income) Royalties Preopening amortization Depreciation Interest expense Interest and other income Lease expense Management incentive fees Total other expenses (income) Profit before taxation Taxation Net profit 302 341 255 567 (786) 958 55 1,692 351 147 204 333 341 263 575 (788) 950 171 1,845 619 260 352 33.8623 387 341 290 757 (768) 958 477 2,442 870 366 504 BERABER 422 341 296 708 (778) 962 963 2,914 1,676 704 972 ESS 717 341 625 1,166 (790) 975 1,820 4,854 1,946 818 1,128 "Includes the Magic Kingdom Hotel Source: Euro Disneyland S.CA.Offer for Sale of 10,691,000 Shares, p. 36. QUESTIONS Euro Disneyland's income tax rate is 42%. 1. Using the format of the table as a guide, project the net 2. Calculate the present value of Euro Disneyland's profit for the following 20 years (years 6 to 25) based equity at time 0 (when the park opens) and at time - 3 on the following assumptions: (the time of the initial public offering, three years Each class of revenue after year 5 grows at a 5% before the opening). Use the following assumptions: annual rate. Dividends are 75% of net profit for years 1 to 25. Each class of operating expenses after year 5 grows At the end of year 25, the terminal value of equity is at a 5% annual rate. worth 10 times the year's net profit. In other expenses (income), royalties equal 5% of Euro Disneyland's cost of equity capital is 15%. total revenues. 3. Recalculate the value for Euro Disneyland estimated at In other expenses (income), preopening amortiza- time-3 for two cases in which the assumptions are tion is zero after year 5. changed to the following: Annual depreciation, annual interest expense, a. Revenues after year 5 grow at 6% and operating annual interest and other income, and annual lease expenses grow at 5%. expense are constant after year 5. b. Revenues after year 5 grow at 5% and operating Management incentive fees grow at a 7.5% annual rate. expenses grow at 6%. 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 20 22 23 24 25 Year Revenue Magic kingdome Second theme park Resort and property developmen Total Revenue 6,415 3,128 6,386 15.929 6,736 3,284 6,705 16.725 7,073 3,449 7,041 17,562 7,426 3,621 7,393 18,440 7,797 3,802 7,762 19,362 8,187 3,992 8,150 20,330 8,597 4,192 8,558 21,346 9,027 4,401 8,986 22,414 9,478 4,621 9,435 23,534 9,952 4,853 9,907 24,711 10,449 5,095 10,402 25,947 10,972 5,350 10,922 27,244 11,520 5,617 11,468 28,606 12,096 5,898 12,042 30,037 12,701 6,193 12,644 31,538 13,336 6,503 13,276 33,115 14,003 6,828 13,940 34,771 14,703 7,169 14,637 36,510 15,438 7,528 15,369 38,335 16,210 7,904 16,137 40,252 17,021 8,300 16,944 42,264 Operating Expenses Magic kingdome Second theme park Resort and property devolopment Total Operating Expenses (Income) 3,641 1,794 3,694 9,129 3,823 1,884 3,879 4,014 1,978 4,073 10,065 4,215 2,077 4,276 10,568 4,426 2,181 4,490 11,096 4,647 2,290 4,715 11,651 4,879 2,404 4,950 12,234 5,123 2,524 5,198 12,845 5,379 2,651 5,458 13,488 5,648 2,783 5,731 14,162 5,931 2,922 6,017 14,870 6,227 3,068 6,318 15,614 6,539 3,222 6,634 16,394 6,866 3,383 6,966 17,214 7,209 3,552 7,314 18,075 7,569 3,730 7,680 18,979 7,948 3,916 8,064 19,927 8,345 4,112 8,467 20,924 8,763 4,317 8,890 21,970 9,201 4,533 9,335 23,069 9,661 4,760 9,801 24,222 9,585 Operating Income 6,800 7,140 7,497 7,872 8,265 8,679 9,113 9,568 10,047 10,549 11,076 11,630 12,212 12,822 13,464 14,137 14,844 15,586 16,365 17,183 18,042 1,502 1,177 0 1,577 0 0 625 625 Other Expenses (Income) Royalties Preopening amortisation Depreciation Interest expense Interest and other income Lease expense Management incentive fees Total Other Expenses (Income) 717 341 625 1,166 (790) 975 1,820 4,854 836 0 625 1,166 (790) 975 1,957 4,769 878 0 625 1,166 (790) 975 2,103 4,957 922 0 625 1,166 (790) 975 2,261 5,159 968 0 625 1,166 (790) 975 2,431 5,375 1,016 0 625 1,166 (790) 975 2,613 5,605 1,067 0 625 1,166 (790) 975 2,809 5,852 1,121 0 625 1,166 (790) 975 3,019 6,116 1,236 0 625 1,166 (790) 975 3,489 6,701 1,166 (790) 975 3,246 6,399 1,297 0 625 1,166 (790) 975 3,751 7,024 1,362 0 625 1,166 (790) 975 4,032 7,371 1,430 0 625 1,166 (790) 975 4,335 7,741 1,656 0 625 1,166 (790) 975 625 1,166 (790) 975 4,660 8,138 1,166 (790) 975 5,009 8,562 1,739 0 625 1,166 (790) 975 5,789 9,504 1,825 0 625 1,166 (790) 975 6,223 10,025 1,917 0 625 1,166 (790) 975 6,690 10,583 2,013 0 625 1,166 (790) 975 7,192 11,180 2,113 0 625 1,166 (790) 975 7,731 11,820 5,385 9,017 Profit Before Taxation Taxation Net Profit 1,946 818 1,128 2,371 996 1,375 2,540 1,067 1,473 2,713 1,139 1,573 2,891 1,214 1,677 3,073 1,291 1,783 3,261 1,369 1,891 3,452 1,450 2,002 3,648 1,532 2,116 3,848 1,616 2,232 4,052 1,702 2,350 4,260 1,789 2,471 4,471 1,878 2,593 4,685 1,968 2,717 4,901 2,058 2,843 5,120 2,150 2,969 5,340 2,243 3,097 5,561 2,336 3,225 5,782 2,429 3,354 6,003 2,521 3,482 6,222 2,613 3,609