Answered step by step

Verified Expert Solution

Question

1 Approved Answer

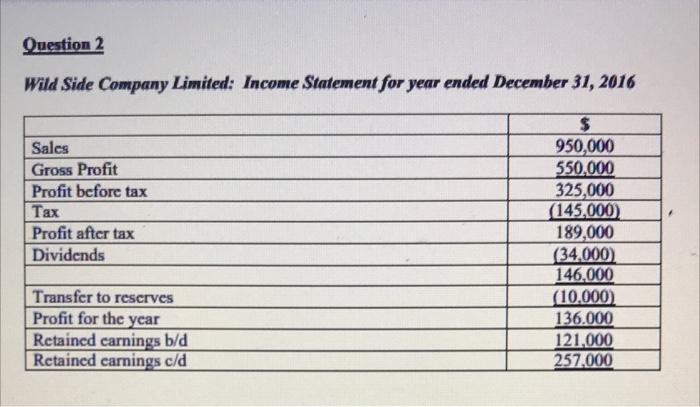

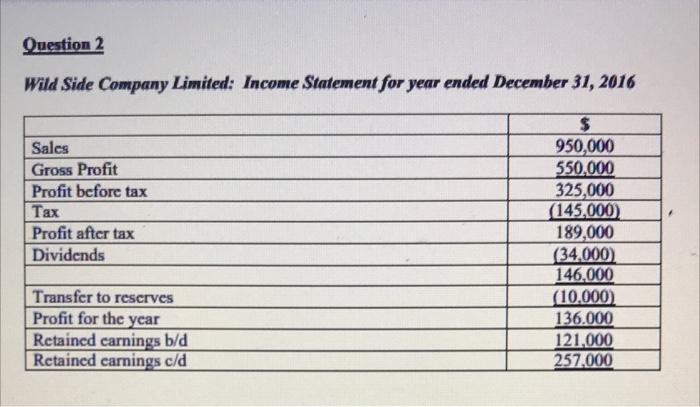

please answer Question 2 Wild Side Company Limited: Income Statement for year ended December 31, 2016 Sales Gross Profit Profit before tax Tax Profit after

please answer

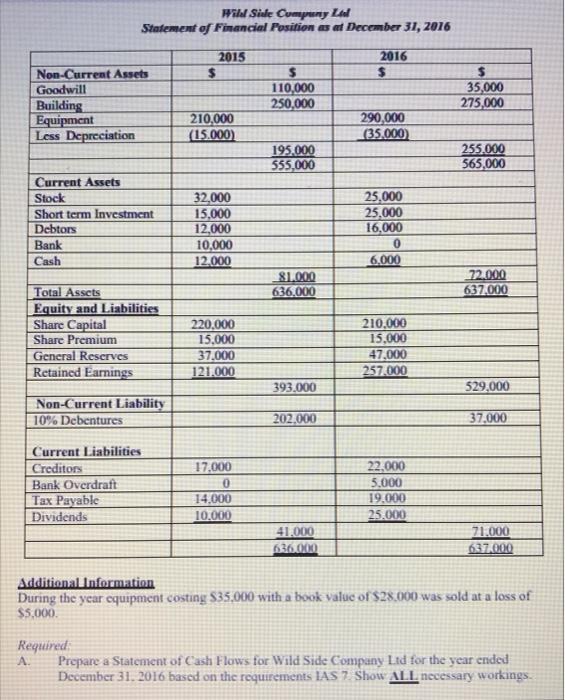

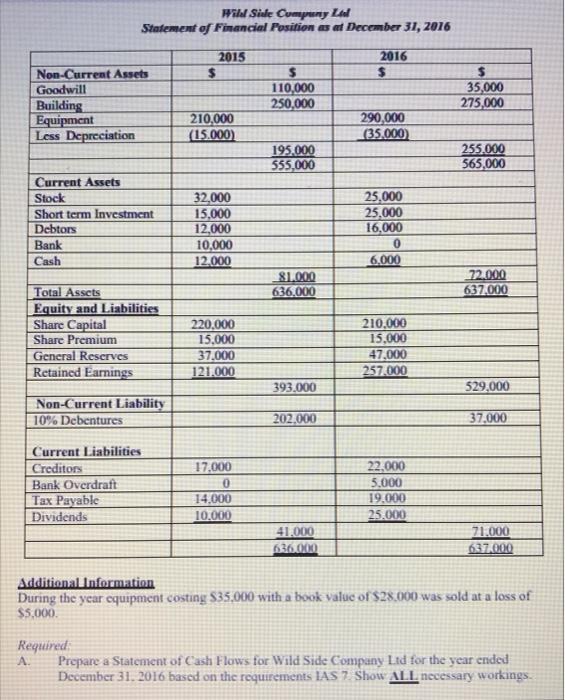

Question 2 Wild Side Company Limited: Income Statement for year ended December 31, 2016 Sales Gross Profit Profit before tax Tax Profit after tax Dividends $ 950,000 550.000 325,000 (145,000) 189,000 (34,000) 146,000 (10.000) 136.000 121.000 257,000 Transfer to reserves Profit for the year Retained carnings b/d Retained carnings c/d Hill Side Cumpany La Statement of Financial Position as of December 31, 2016 2016 2015 $ Non-Current Assets Goodwill Building Equipment Less Depreciation $ 110,000 250,000 $ 35,000 275,000 210,000 (15.000) 290,000 (35.000 195.000 555,000 255.000 565,000 Current Assets Stock Short term Investment Debtors Bank Cash 32,000 15.000 12,000 10.000 12.000 25,000 25,000 16,000 0 6,000 81.000 636.000 72.000 637.000 Total Assets Equity and Liabilities Share Capital Share Premium General Reserves Retained Earnings 220.000 15,000 37.000 121.000 210.000 15,000 47.000 257.000 393.000 529,000 Non-Current Liability 10% Debentures 202.000 37,000 Current Liabilities Creditors Bank Overdraft Tax Payable Dividends 17.000 0 14.000 10.000 22.000 5.000 19.000 25.000 41.000 636.000 71.000 637.000 Additional Information During the year equipment costing $35,000 with a book value of $28.000 was sold at a loss of $5,000. Required A. Prepare a Statement of Cash Flows for Wild Side Company Lid for the year ended December 31, 2016 based on the requirements IAS 7 Shou ALL necessary workings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started