Please answer question 3 a,b,c

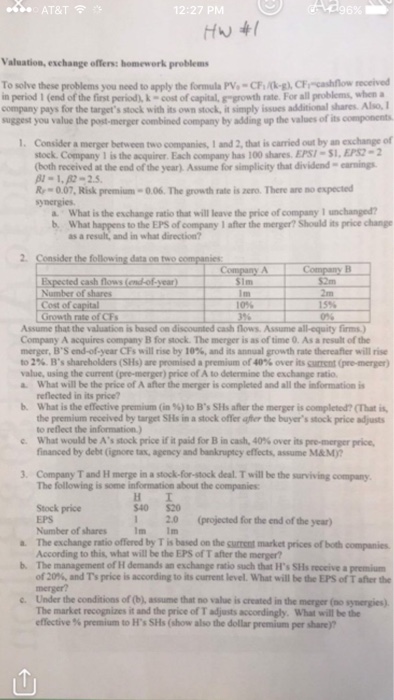

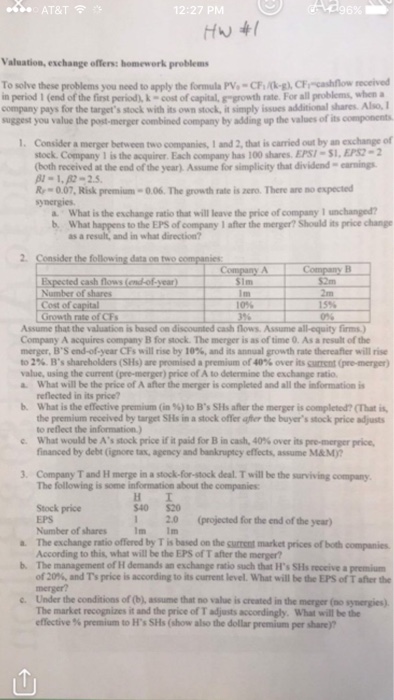

To solve these problems you need to apply the formula PV_0 = CF_1/(k-g), CF_1 cashflow received in period 1 (end of the first period), k-cost of capital, g-growth rate. For all problems, when a company pays for the target's stock with its own stock, it simply issues additional shares. Also, I suggest you value the post-merger combined company by adding up the values of its components. Consider a merger between two companies, 1 and 2, that is carried out by an exchange of stock Company 1 is the acquirer. Each company has 100 shares. EPSI - SI, EPS2 - 2 (both received at the end of the year). Assume for simplicity that dividend - earnings. beta_1 = 1, beta_2 = 2.5. R_1 = 0.07, Risk premium -0.06. The growth rate is zero. There are no expected synergies. a. What is the exchange ratio that will leave the price of company 1 unchanged? b. What happens to the EPS of company 1 after the merger? Should its price change as a result, and in what direction? Consider the following data on two Company: Assume that the valuation is based on discounted cash flows Assume all-equity firms.) Company A acquires company B for stock. The merger is as of time 0. As a result of the merger, B'S' end-of-year CFs will rise by 10%, und its annual growth rate thereafter will rise to 2% B's shareholders (SHs) are promised a premium of 40% over its current (pre-merger) value, using the current (pre-merger) price of A to determine the exchange ratio. a What will be the price of A after the merger is completed and all the information is reflected in its price? b. What is the effective premium (in %)to B's SHs after the merger is completed?(That is, the premium received by target SHs in a stock offer after the buyer's stock price adjusts to reflect the information.) c. What would be A's stock price if it paid for B in cash, 40% over its pre-merger price, financed by debt (ignore tax, agency and bankruptcy effects, assume M&M)? Company T and H merge in a stock-for-stock deal. T will be the surviving company. The following is some information about the companies: a. The exchange ratio offered by T is based on the current market prices of both companies According to this, what will be the EPS of T after the merger? b. The management of H demands an exchange ratio such that H's SHs receive a premium of 20% and T's price is according to its current level. What will be merger? c. Under the conditions of (b), assume that no value is created in the merger (no synergies). The market recognizes it and the price of T adjusts accordingly. What will be the effective % premium to H's SHS (show also the dollar premium per share)

Please answer question 3 a,b,c

Please answer question 3 a,b,c