Answered step by step

Verified Expert Solution

Question

1 Approved Answer

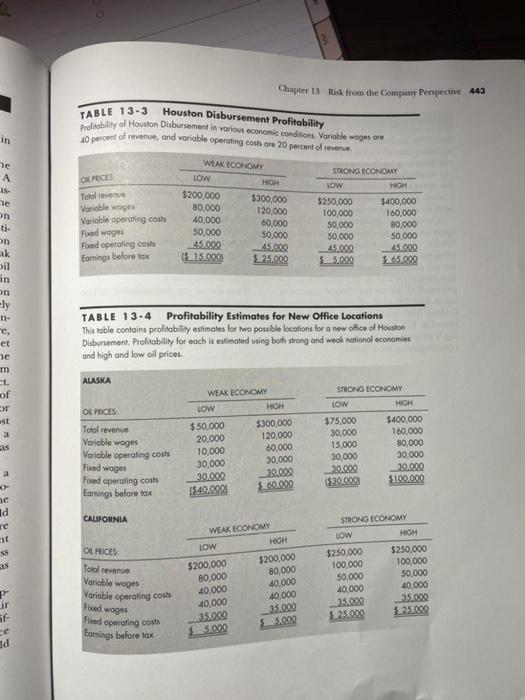

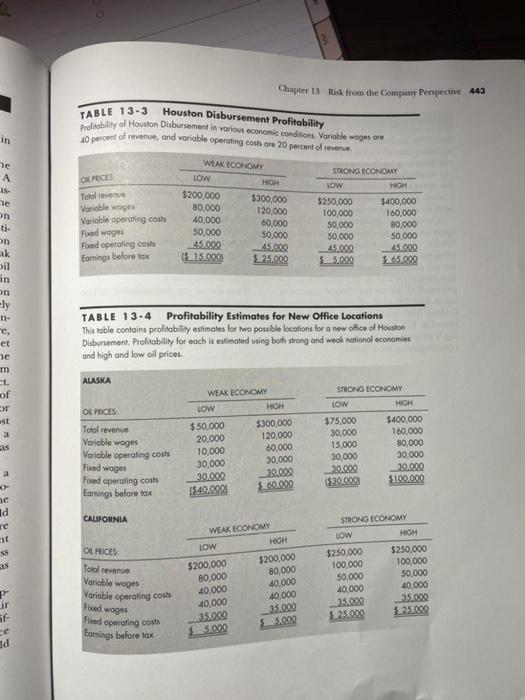

Please answer question 3 Chapter 13 Risk from the Company Perspective 443 TABLE 13-3 Houston Disbursement Profitability profobility of Howton Diabursement in various economic conditions.

Please answer question 3

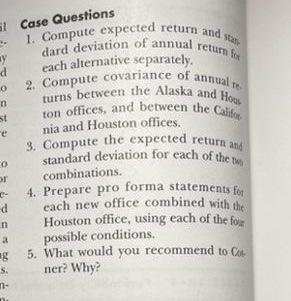

Chapter 13 Risk from the Company Perspective 443 TABLE 13-3 Houston Disbursement Profitability profobility of Howton Diabursement in various economic conditions. Variablewoget om 10 percent of revenue, and variable operating cohore 20 percent of revenue in OPECES Tolol revenue Variable wages Variable operating costs Fixed wogos Fixed operating costs Earnings before tox WEAK ECONOMY Low HIGH $200,000 3300,000 80.000 120,000 40,000 60,000 50,000 50,000 45.000 45.000 15.000 $225.000 STRONG ECONOMY LOW HIGH $250,000 $400,000 100,000 160,000 50,000 80,000 50.000 50,000 45.000 45.000 5.000 165,000 he A 15- ac on - on ak il in on Ely n- e, et he m t. of or st TABLE 13-4 Profitability Estimates for New Office Locations This table contains profitability estimates for two posible locations for a new office of Houston Diabursement. Profitability for each is estimated using both strong and wook notional economies and high and low oil prices ALASKA STRONG ECONOMY LOW HIGH OL PRICES Total revence Variable woges Variable operating costs WEAK ECONOMY LOW HOH $50,000 $300,000 20,000 120,000 10,000 60,000 30,000 30,000 30.000 30.000 $40.000 $75,000 30,000 15,000 30,000 30.000 $20.000 $400,000 160,000 80,000 30.000 10.000 $100.000 Fund woges a Fixed operating costs Earnings before tox ne id re ht CAUFORNIA OL PRICES 15 Toral revenue Vorimble woges WEAK ECONOMY LOW HIGH $200,000 $200,000 80,000 80,000 40,000 40,000 40,000 40,000 35.000 35.000 $5.00 $_35.000 STRONG ECONOMY Low HIGH $250,000 $250,000 100,000 100,000 50.000 50,000 40,000 40,000 35.000 35.000 $.25.000 5.25.000 Variable operating costs Foed woges P ir f ce id Fixed operating costs Earnings before tax si Case Questions d o n St re 1. Compute expected return and dard deviation of annual return to each alternative separately. 2. Compute covariance of annual turns between the Alaska and How ton offices, and between the Caio nia and Houston offices, 3. Compute the expected return and standard deviation for each of the 4. Prepare pro forma statements for each new office combined with the Houston office, using each of the fole possible conditions 5. What would you recommend to co ner? Why? CO or combinations. c- d n a ag 5. - Chapter 13 Risk from the Company Perspective 443 TABLE 13-3 Houston Disbursement Profitability profobility of Howton Diabursement in various economic conditions. Variablewoget om 10 percent of revenue, and variable operating cohore 20 percent of revenue in OPECES Tolol revenue Variable wages Variable operating costs Fixed wogos Fixed operating costs Earnings before tox WEAK ECONOMY Low HIGH $200,000 3300,000 80.000 120,000 40,000 60,000 50,000 50,000 45.000 45.000 15.000 $225.000 STRONG ECONOMY LOW HIGH $250,000 $400,000 100,000 160,000 50,000 80,000 50.000 50,000 45.000 45.000 5.000 165,000 he A 15- ac on - on ak il in on Ely n- e, et he m t. of or st TABLE 13-4 Profitability Estimates for New Office Locations This table contains profitability estimates for two posible locations for a new office of Houston Diabursement. Profitability for each is estimated using both strong and wook notional economies and high and low oil prices ALASKA STRONG ECONOMY LOW HIGH OL PRICES Total revence Variable woges Variable operating costs WEAK ECONOMY LOW HOH $50,000 $300,000 20,000 120,000 10,000 60,000 30,000 30,000 30.000 30.000 $40.000 $75,000 30,000 15,000 30,000 30.000 $20.000 $400,000 160,000 80,000 30.000 10.000 $100.000 Fund woges a Fixed operating costs Earnings before tox ne id re ht CAUFORNIA OL PRICES 15 Toral revenue Vorimble woges WEAK ECONOMY LOW HIGH $200,000 $200,000 80,000 80,000 40,000 40,000 40,000 40,000 35.000 35.000 $5.00 $_35.000 STRONG ECONOMY Low HIGH $250,000 $250,000 100,000 100,000 50.000 50,000 40,000 40,000 35.000 35.000 $.25.000 5.25.000 Variable operating costs Foed woges P ir f ce id Fixed operating costs Earnings before tax si Case Questions d o n St re 1. Compute expected return and dard deviation of annual return to each alternative separately. 2. Compute covariance of annual turns between the Alaska and How ton offices, and between the Caio nia and Houston offices, 3. Compute the expected return and standard deviation for each of the 4. Prepare pro forma statements for each new office combined with the Houston office, using each of the fole possible conditions 5. What would you recommend to co ner? Why? CO or combinations. c- d n a ag 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started