Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question 4 Question 4 Jingle Ltd. and Bell Ltd. belong to the same industry. A snapshot of some of their financial information is

please answer question 4

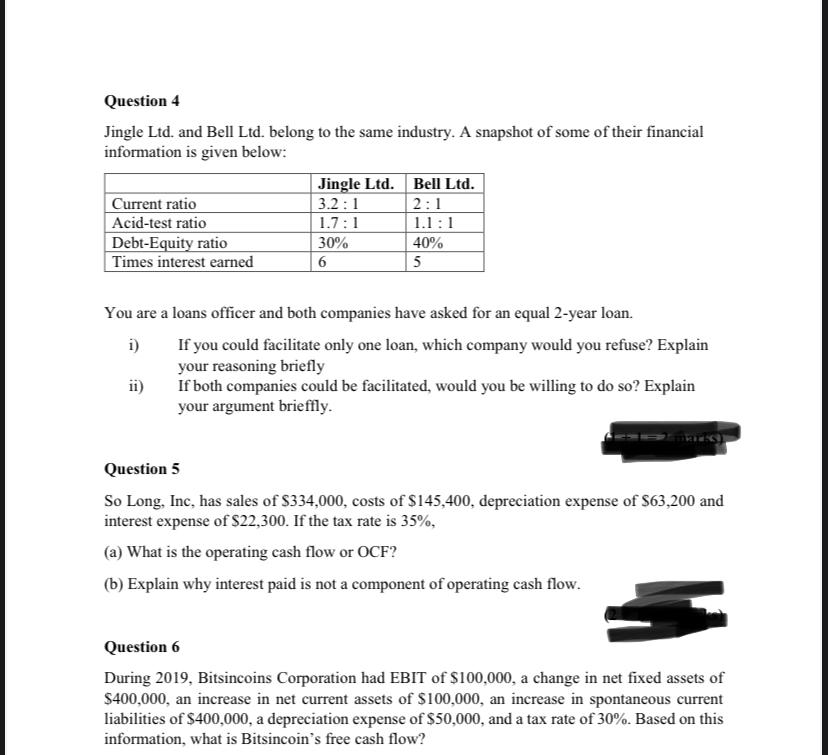

Question 4 Jingle Ltd. and Bell Ltd. belong to the same industry. A snapshot of some of their financial information is given below: Jingle Ltd. Bell Ltd. Current ratio 3.2:1 2:1 Acid-test ratio 1.7:1 1.1:1 Debt-Equity ratio 30% 40% Times interest earned 6 5 You are a loans officer and both companies have asked for an equal 2-year loan. i) If you could facilitate only one loan, which company would you refuse? Explain your reasoning briefly ii) If both companies could be facilitated, would you be willing to do so? Explain your argument brieffly. Question 5 So Long, Inc, has sales of $334,000, costs of $145,400, depreciation expense of $63,200 and interest expense of $22,300. If the tax rate is 35%, (a) What is the operating cash flow or OCF? (b) Explain why interest paid is not a component of operating cash flow. Question 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started