Answered step by step

Verified Expert Solution

Question

1 Approved Answer

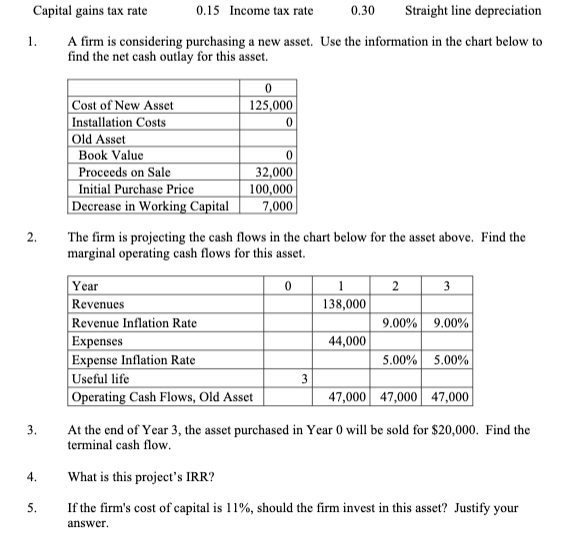

Please answer question #4. Thank you. 0.30 Capital gains tax rate 0.15 Income tax rate Straight line depreciation 1. A firm is considering purchasing a

Please answer question #4.

Thank you.

0.30 Capital gains tax rate 0.15 Income tax rate Straight line depreciation 1. A firm is considering purchasing a new asset. Use the information in the chart below to find the net cash outlay for this asset. 2. 0 Cost of New Asset 125,000 Installation Costs 0 Old Asset Book Value 0 Proceeds on Sale 32,000 Initial Purchase Price 100,000 Decrease in Working Capital 7,000 The firm is projecting the cash flows in the chart below for the asset above. Find the marginal operating cash flows for this asset. Year 0 1 2 3 Revenues 138,000 Revenue Inflation Rate 9.00% 9.00% Expenses 44,000 Expense Inflation Rate 5.00% 5.00% Useful life 3 Operating Cash Flows, Old Asset 47,000 47,000 47,000 At the end of Year 3, the asset purchased in Year 0 will be sold for $20,000. Find the terminal cash flow. 3. 4. What is this project's IRR? If the firm's cost of capital is 11%, should the firm invest in this asset? Justify your answer. 5. 0.30 Capital gains tax rate 0.15 Income tax rate Straight line depreciation 1. A firm is considering purchasing a new asset. Use the information in the chart below to find the net cash outlay for this asset. 2. 0 Cost of New Asset 125,000 Installation Costs 0 Old Asset Book Value 0 Proceeds on Sale 32,000 Initial Purchase Price 100,000 Decrease in Working Capital 7,000 The firm is projecting the cash flows in the chart below for the asset above. Find the marginal operating cash flows for this asset. Year 0 1 2 3 Revenues 138,000 Revenue Inflation Rate 9.00% 9.00% Expenses 44,000 Expense Inflation Rate 5.00% 5.00% Useful life 3 Operating Cash Flows, Old Asset 47,000 47,000 47,000 At the end of Year 3, the asset purchased in Year 0 will be sold for $20,000. Find the terminal cash flow. 3. 4. What is this project's IRR? If the firm's cost of capital is 11%, should the firm invest in this asset? Justify your answer. 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started