Answered step by step

Verified Expert Solution

Question

1 Approved Answer

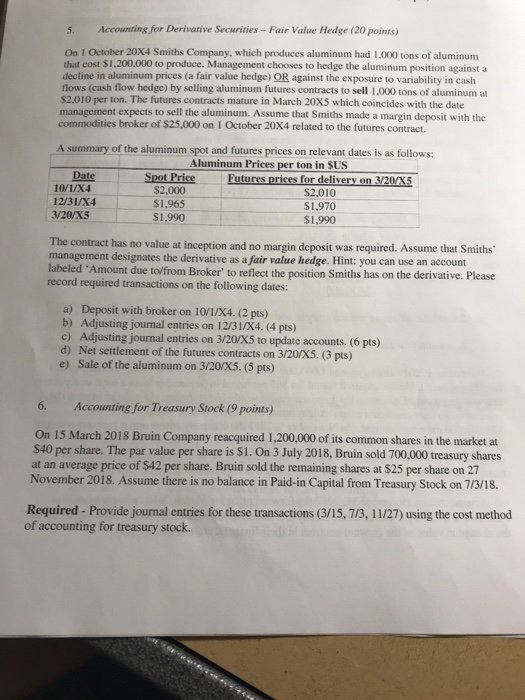

Please answer question 5 5. Accounting for Derivative Securities -Fair Value Hedge (20 points) On 1 October 20X4 Smiths Company. which produces aluminum had 1,000

Please answer question 5

5. Accounting for Derivative Securities -Fair Value Hedge (20 points) On 1 October 20X4 Smiths Company. which produces aluminum had 1,000 tons of aluminum that cost $1,200.000 to produce. Management chooses to hedge the aluminum position against a decline in aluminum prices (a fair value hedge) OR against the exposure to variability in cash flows (cash flow hedge) by selling aluminum futures contracts to sell 1,000 tons of aluminum at S2.010 per ton. The futures contracts mature in March 20X5 which coincides with the date management expects to sell the aluminum. Assume that Smiths made a margin deposit with the commodities broker of $25,000 on I October 20X4 related to the futures contract. A summary of the aluminum spot and futures prices on relevant dates is as follows: Aluminum Prices per ton in SUS Date IO/X4 12/31/X4 3/20VX5 Spot Price Futures prices for delivery on 3/20KS $2,000 $1,965 $1,990 $2,010 $1,970 $1,990 contract has no value at inception and no margin deposit was required. Assume that Smiths management designates the derivative as a fair value hedge. Hint: you can use an account labeled 'Amount due to/from Broker' to reflect the position Smiths has on the derivative. Please record required transactions on the following dates: a) Deposit with broker on 10/1/X4. (2 pts) b) Adjusting journal entries on 12/31/X4. (4 pts) c) Adjusting journal entries on 3/20/X5 to update accounts. (6 pts) d) Net settlement of the futures contracts on 3/20/x5. (3 pts) e) Sale of the aluminum on 3/20/X5. (5 pts) 6. Accounting for Treasury Stock (9 points) On 15 March 2018 Bruin Company reacquired 1,200,000 of its common shares in the market at S40 per share. The par value per share is S1. On 3 July 2018, Bruin sold 700,000 treasury shares at an average price of $42 per share. Bruin sold the remaining shares at $25 per share on 27 November 2018. Assume there is no balance in Paid-in Capital from Treasury Stock on 7/3/18. Required - Provide journal entries for these transactions (3/15, 7/3, 11/27) using the cost method of accounting for treasury stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started