Answered step by step

Verified Expert Solution

Question

1 Approved Answer

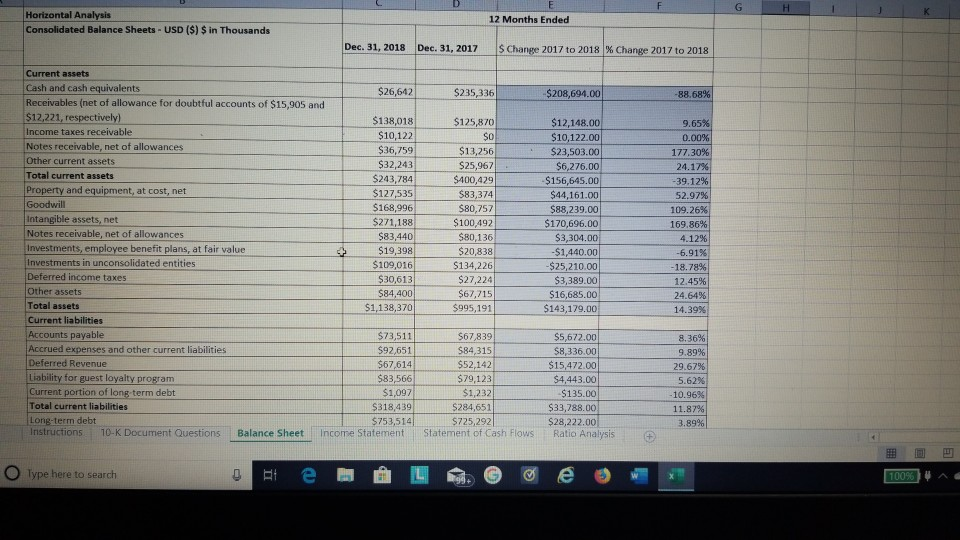

please answer question 5. thanks please see attachment. 12 Months Ended Horizontal Analysis Consolidated Balance Sheets - USD ($) $ in Thousands Dec 31, 2018

please answer question 5. thanks please see attachment.

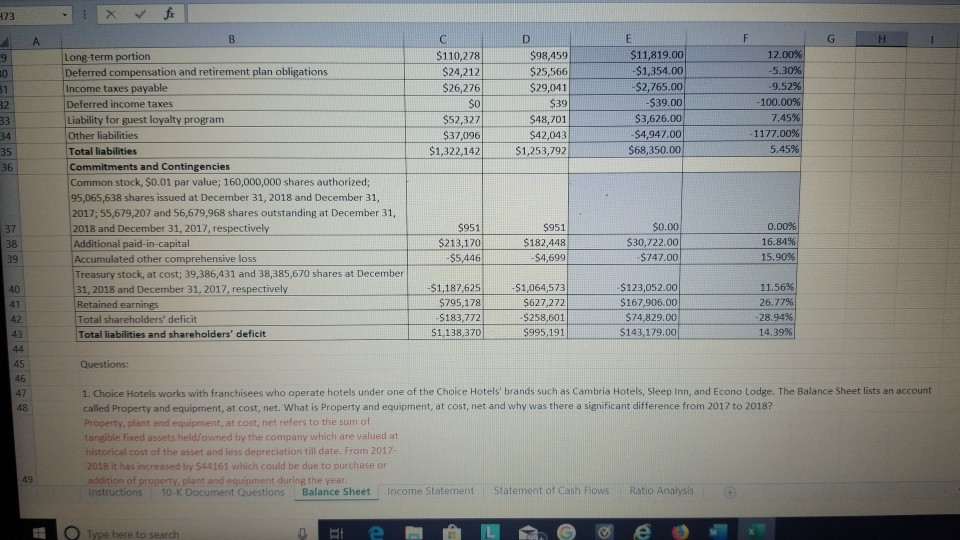

12 Months Ended Horizontal Analysis Consolidated Balance Sheets - USD ($) $ in Thousands Dec 31, 2018 Dec 31, 2017 Change 2017 to 2018 % Change 2017 to 2018 $235,336 $208,694.00 -88.68% . Current assets Cash and cash equivalents $26,642 Receivables (net of allowance for doubtful accounts of $15,905 and $12,221, respectively) $138,018 Income taxes receivable $10,122 Notes receivable, net of allowances $36,759 Other current assets $32,243 Total current assets $243,784 Property and equipment, at cost, net $127,535 Goodwill $168,996 Intangible assets, net $271,188 Notes receivable, net of allowances $83,440 Investments, employee benefit plans, at fair value $19,398 Investments in unconsolidated entities $109,016 Deferred income taxes $30,613 Other assets $84,400 Total assets $1,138,370 Current liabilities Accounts payable $73,511 Accrued expenses and other current liabilities $92,651 Deferred Revenue $67,614 Liability for guest loyalty program $83,566 Current portion of long term debt $1,097 Total current liabilities $318,439 Long-term debt $753,514 Instructions 10-K Document Questions Balance Sheet Income Statement $125,870 $0 $13,256 $25,967 $400,429 $83,374 $80,757 $100,492 $80,136 $20,838 $134,226 $27,224 $67,715 $995,191 $12,148.00 $10,122.00 $23,503.00 $6,276.00 $156,645.00 $44,161.00 $88,239.00 $170,696,00 $3,304.00 -$1,440.00 $25,210.00 $3,389.00 $16,685.00 $143,179.00 9.65% 0.00% 177.30% 24.17% -39.12% 52.97% 109.26% 169.86% 4.12% -6.91% - 18.78% 12.45% 24.64% 14.39% 8.36% $67,839 584 315 $52,142 $79,123 $1,232 $284,651 $725,292 Statement of Cash Flows $5,672.00 $8,336.00 $15.472.00 $4,443.00 $135.00 $33,788.00 $28,222.00 Ratio Analysis 989% 29.67% 5.62% -10.96% 11.87% 3.89% Type here to search Det e L . e 100% na $110,278 $24,212 $26,276 SO $52,327 $37,096 $1,322,142 $98,459 $25,566 $29,041 $39 $48,701 $42,043 $1,253,792 $11,819.00 $1,354.00 -$2,765.00 -$39.00 $3,626.00 -$4,947.00 $68,350.00 12.00% -5.30% -9.52% -100.00% 7.45% 1177.00% 5.45%6 Long-term portion Deferred compensation and retirement plan obligations Income taxes payable Deferred income taxes Liability for guest loyalty program Other liabilities Total liabilities Commitments and Contingencies Common stock, S0.01 par value; 160,000,000 shares authorized; 95,065,638 shares issued at December 31, 2018 and December 31, 2017; 55,679,207 and 56,679,968 shares outstanding at December 31, 2018 and December 31, 2017, respectively Additional paid-in-capital Accumulated other comprehensive loss Treasury stock, at cost; 39,386,431 and 38,385,670 shares at December 31, 2018 and December 31, 2017, respectively Retained earnings Total shareholders' deficit Total liabilities and shareholders' deficit $0.00 $951 $213,170 -$5,446 $951 $182,448 -54,699 $30,722.00 $747.00 0.00% 16.84% 15.9096 -$1,187,625 $795,178 $183,772 $1,138,370 -$1,064,573 $627,272 $258,601 $995,191 $123,052.00 $167.906.00 $74,829.00 $143,179.00 11.56% 26.77% -28.94% 14.39% Questions: 1. Choice Hotels works with franchisees who operate hotels under one of the Choice Hotels' brands such as Cambria Hotels, Sleep Inn, and Econo Lodge. The Balance Sheet lists an account called Property and equipment, at cost, net. What is Property and equipment, at cost, net and why was there a significant difference from 2017 to 2018? Property, plant and equipment, at cost, net refers to the sum of tangible forced assets held owned by the company which are valued at historical cost of the asset and less depreciation till date. From 2017- 2018 it has increased by 544161 which could be due to purchase or addition of property, plant and equipment during the year. Instructions 10-K Document Questions Balance Sheet Income Statement Statement of Cash Flows Ratio Analysis O Type here to search e 5. What is the most significant trend based on your horizontal analysis over this three-year period? Why? Instructions 10-K Document Questions Balance Sheet Income Statement Statement of Cash Flows Ratio Analysis O Type here to search 0 Hi e la ai | . e 3 12 Months Ended Horizontal Analysis Consolidated Balance Sheets - USD ($) $ in Thousands Dec 31, 2018 Dec 31, 2017 Change 2017 to 2018 % Change 2017 to 2018 $235,336 $208,694.00 -88.68% . Current assets Cash and cash equivalents $26,642 Receivables (net of allowance for doubtful accounts of $15,905 and $12,221, respectively) $138,018 Income taxes receivable $10,122 Notes receivable, net of allowances $36,759 Other current assets $32,243 Total current assets $243,784 Property and equipment, at cost, net $127,535 Goodwill $168,996 Intangible assets, net $271,188 Notes receivable, net of allowances $83,440 Investments, employee benefit plans, at fair value $19,398 Investments in unconsolidated entities $109,016 Deferred income taxes $30,613 Other assets $84,400 Total assets $1,138,370 Current liabilities Accounts payable $73,511 Accrued expenses and other current liabilities $92,651 Deferred Revenue $67,614 Liability for guest loyalty program $83,566 Current portion of long term debt $1,097 Total current liabilities $318,439 Long-term debt $753,514 Instructions 10-K Document Questions Balance Sheet Income Statement $125,870 $0 $13,256 $25,967 $400,429 $83,374 $80,757 $100,492 $80,136 $20,838 $134,226 $27,224 $67,715 $995,191 $12,148.00 $10,122.00 $23,503.00 $6,276.00 $156,645.00 $44,161.00 $88,239.00 $170,696,00 $3,304.00 -$1,440.00 $25,210.00 $3,389.00 $16,685.00 $143,179.00 9.65% 0.00% 177.30% 24.17% -39.12% 52.97% 109.26% 169.86% 4.12% -6.91% - 18.78% 12.45% 24.64% 14.39% 8.36% $67,839 584 315 $52,142 $79,123 $1,232 $284,651 $725,292 Statement of Cash Flows $5,672.00 $8,336.00 $15.472.00 $4,443.00 $135.00 $33,788.00 $28,222.00 Ratio Analysis 989% 29.67% 5.62% -10.96% 11.87% 3.89% Type here to search Det e L . e 100% na $110,278 $24,212 $26,276 SO $52,327 $37,096 $1,322,142 $98,459 $25,566 $29,041 $39 $48,701 $42,043 $1,253,792 $11,819.00 $1,354.00 -$2,765.00 -$39.00 $3,626.00 -$4,947.00 $68,350.00 12.00% -5.30% -9.52% -100.00% 7.45% 1177.00% 5.45%6 Long-term portion Deferred compensation and retirement plan obligations Income taxes payable Deferred income taxes Liability for guest loyalty program Other liabilities Total liabilities Commitments and Contingencies Common stock, S0.01 par value; 160,000,000 shares authorized; 95,065,638 shares issued at December 31, 2018 and December 31, 2017; 55,679,207 and 56,679,968 shares outstanding at December 31, 2018 and December 31, 2017, respectively Additional paid-in-capital Accumulated other comprehensive loss Treasury stock, at cost; 39,386,431 and 38,385,670 shares at December 31, 2018 and December 31, 2017, respectively Retained earnings Total shareholders' deficit Total liabilities and shareholders' deficit $0.00 $951 $213,170 -$5,446 $951 $182,448 -54,699 $30,722.00 $747.00 0.00% 16.84% 15.9096 -$1,187,625 $795,178 $183,772 $1,138,370 -$1,064,573 $627,272 $258,601 $995,191 $123,052.00 $167.906.00 $74,829.00 $143,179.00 11.56% 26.77% -28.94% 14.39% Questions: 1. Choice Hotels works with franchisees who operate hotels under one of the Choice Hotels' brands such as Cambria Hotels, Sleep Inn, and Econo Lodge. The Balance Sheet lists an account called Property and equipment, at cost, net. What is Property and equipment, at cost, net and why was there a significant difference from 2017 to 2018? Property, plant and equipment, at cost, net refers to the sum of tangible forced assets held owned by the company which are valued at historical cost of the asset and less depreciation till date. From 2017- 2018 it has increased by 544161 which could be due to purchase or addition of property, plant and equipment during the year. Instructions 10-K Document Questions Balance Sheet Income Statement Statement of Cash Flows Ratio Analysis O Type here to search e 5. What is the most significant trend based on your horizontal analysis over this three-year period? Why? Instructions 10-K Document Questions Balance Sheet Income Statement Statement of Cash Flows Ratio Analysis O Type here to search 0 Hi e la ai | . e 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started