Answered step by step

Verified Expert Solution

Question

1 Approved Answer

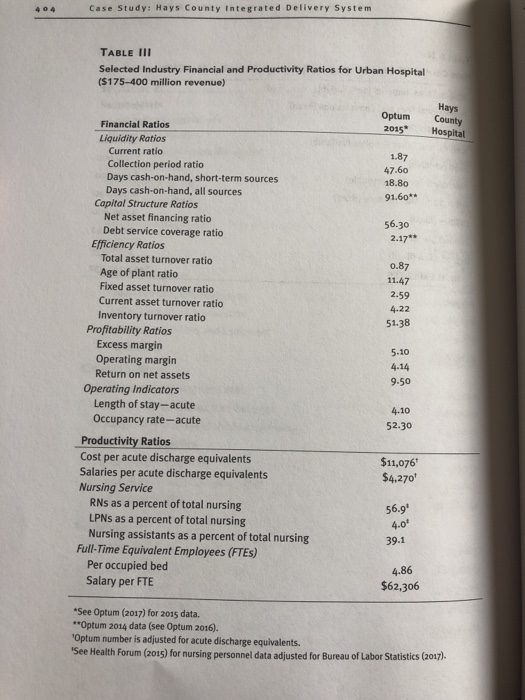

Please answer question 8 using ratio analysis with benchmarks found in Table III and identify strengths of operations). Analyze the financial statements ating for the

Please answer question 8

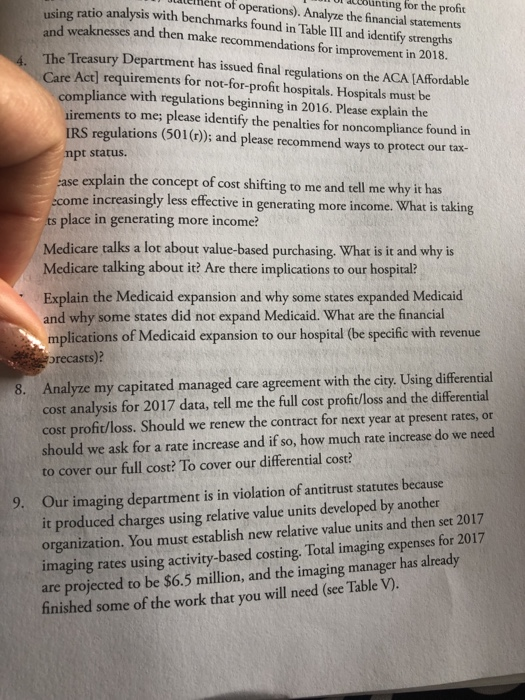

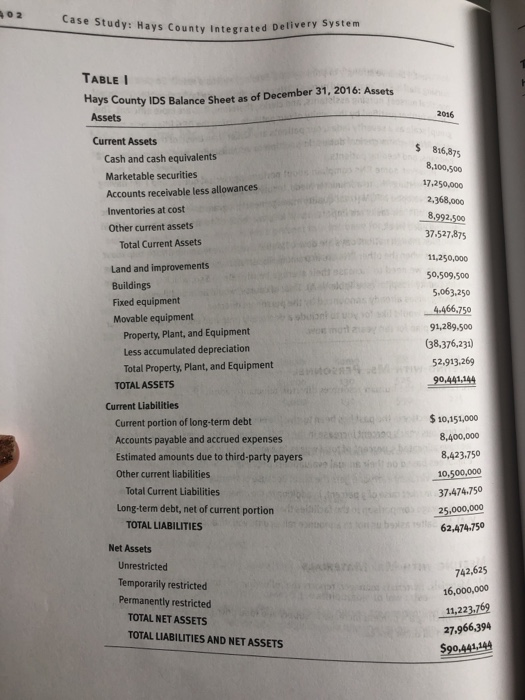

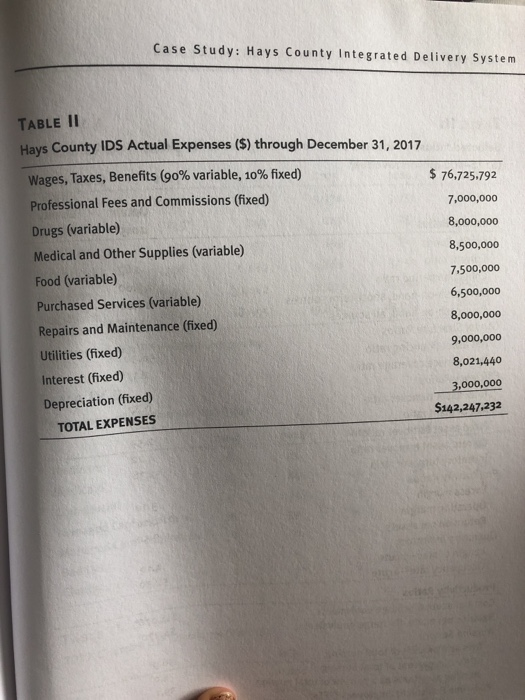

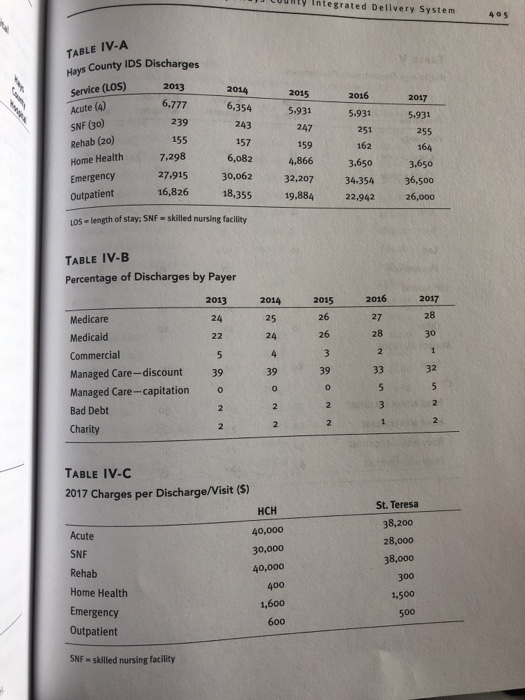

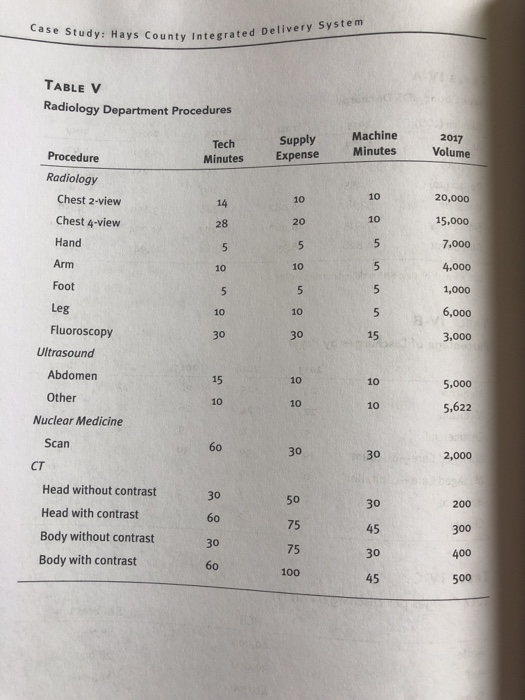

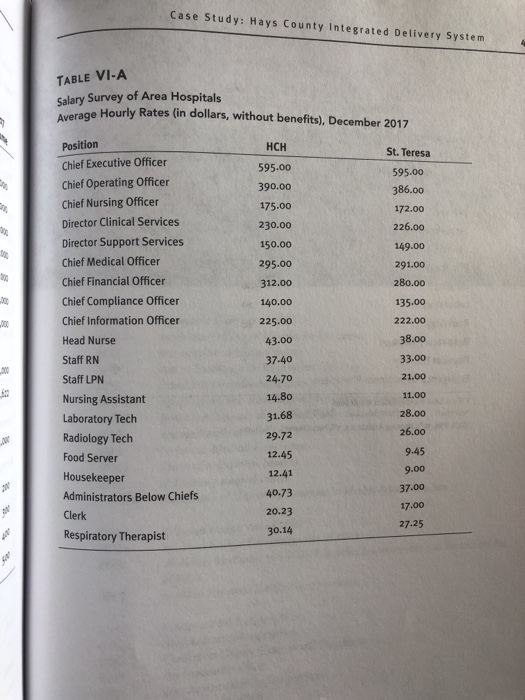

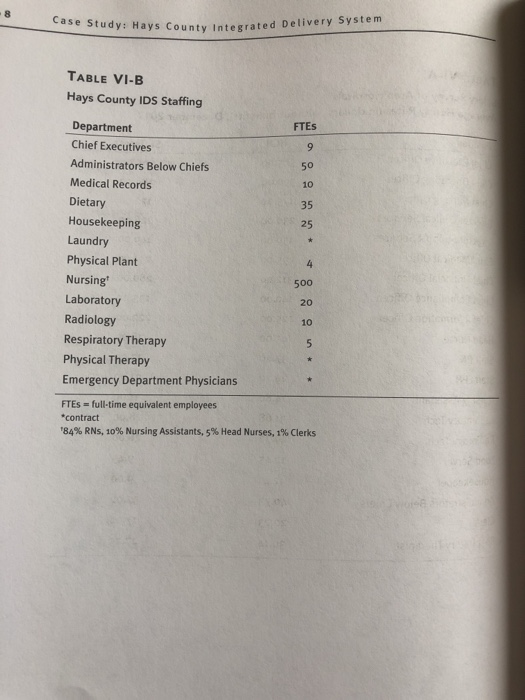

using ratio analysis with benchmarks found in Table III and identify strengths of operations). Analyze the financial statements ating for the profit and weaknesses and then make recommendations for improvement in 2018. The Treasury Department has issued final regulations on the ACA [Affordable Care Act] requirements for not-for-profit hospitals. Hospitals must be compliance with regulations beginning in 2016. Please explain the irements to me; please identify the penalties for noncompliance found in IRS regulations (501(r)); and please recommend ways to protect our tax- mpt status. ase explain the concept of cost shifting to me and tell me why it has ecome increasingly less effective in generating more income. What is taking ts place in generating more income? Medicare talks a lot about value-based purchasing. What is it and why is Medicare talking about it? Are there implications to our hospital? Explain the Medicaid expansion and why some states expanded Medicaid and why some states did not expand Medicaid. What are the financial mplications of Medicaid expansion to our hospital (be specific with revenue precasts)? 8. Analyze my capitated managed care agreement with the city. Using differential cost analysis for 2017 data, tell me the full cost profit/loss and the differential cost profit/loss. Should we renew the contract for next year at present rates, or should we ask for a rate increase and if so, how much rate increase do we need to cover our full cost? To cover our differential cost? 9. Our imaging department is in violation of antitrust statutes because it produced charges using relative value units developed by another organization. You must establish new relative value units and then set 2017 imaging rates using activity-based costing. Total imaging expenses for 2017 are projected to be $6.5 million, and the imaging manager has already finished some of the work that you will need (see Table V). 402 Case Study: Hays County Integrated Delivery System TABLE I Hays County IDS Balance Sheet as of December 31, 2016: Assets 2016 Assets Current Assets $ 816,875 Cash and cash equivalents 8,100,500 Marketable securities 17,250,000 Accounts receivable less allowances 2,368,000 Inventories at cost 8,992.500 Other current assets 37.527.875 Total Current Assets 11,250,000 Land and improvements 50,509.500 Buildings 5,063,250 Fixed equipment 4.466,750 Movable equipment 91,289,500 Property, Plant, and Equipment (38,376,231) Less accumulated depreciation 52.913,269 Total Property, Plant, and Equipment JantoeR 90,441,144 TOTAL ASSETS Current Liabilities $ 10,151,000 Current portion of long-term debt 8,400,000 Accounts payable and accrued expenses Estimated amounts due to third-party payers 8,423.750 Other current liabilities 10,500,000 Total Current Liabilities 37-474-750 Long-term debt, net of current portion 25,000,000 62,474-750 TOTAL LIABILITIES Net Assets Unrestricted 742,625 Temporarily restricted 16,000,000 Permanently restricted 11,223.769 TOTAL NET ASSETS 27.966,394 TOTAL LIABILITIES AND NET ASSETS $9,441,144 Case Study: Hays County Integrated Delivery System TABLE II Hays County IDS Actual Expenses ($) through December 31, 2017 Wages, Taxes, Benefits (90% variable, 10% fixed) $ 76,725,792 Professional Fees and Commissions (fixed) 7,000,000 Drugs (variable) Medical and Other Supplies (variable) ,000,000 8,500,000 Food (variable) 7.500,000 Purchased Services (variable) 6,500,000 8,000,000 Repairs and Maintenance (fixed) Utilities (fixed) 9,000,000 8,021,440 Interest (fixed) 3,000,000 Depreciation (fixed) $142,247,232 TOTAL EXPENSES Case Study: Hays County Integrated Delivery System TABLE V Radiology Department Procedures Machine Supply Expense 2017 Volume Tech Minutes Procedure Minutes Radiology 10 Chest 2-view 20,000 10 14 Chest 4-view 10 15,000 20 28 Hand 7,000 5. Arm 10 4,000 10 Foot 1,000 Leg 6,000 10 10 Fluoroscopy 30 30 15 3,000 Ultrasound Abdomen 15 10 10 5,000 Other 10 10 10 5,622 Nuclear Medicine Scan 60 30 30 2,000 CT Head without contrast 30 50 30 200 Head with contrast 60 75 45 300 Body without contrast 30 75 30 400 Body with contrast 60 100 45 500 Case Study: Hays County Integrated Delivery System TABLE VI-A Salary Survey of Area Hospitals Average Hourly Rates (in dollars, without benefits), December 2017 Position HCH St. Teresa Chief Executive Officer 595.00 595.00 Chief Operating Officer 390.00 386.00 Chief Nursing Officer 175.00 172.00 Director Clinical Services 230.00 226.00 Director Support Services 150.00 149.00 Chief Medical Officer 295.00 291.00 Chief Financial Officer 280.00 312.00 Chief Compliance Officer 140.00 135.00 Chief Information Officer 222.00 225.00 00 38.00 Head Nurse 43.00 Staff RN 37-40 33.00 21.00 Staff LPN 24-70 14.80 11.00 Nursing Assistant 28.00 31.68 Laboratory Tech Radiology Tech 26.00 29.72 9.45 12.45 Food Server 9.00 12.41 Housekeeper 37.00 40.73 Administrators Below Chiefs 17.00 20.23 Clerk 27.25 30.14 Respiratory Therapist 8. Case Stud y: Hays County Integrated Delivery System TABLE VI-B Hays County IDS Staffing Department FTES Chief Executives Administrators Below Chiefs 50 Medical Records 10 Dietary 35 Housekeeping 25 Laundry Physical Plant Nursing 500 Laboratory 20 Radiology 10 Respiratory Therapy 5. Physical Therapy Emergency Department Physicians FTES = full-time equivalent employees *contract "84% RNs, 10% Nursing Assistants, 5% Head Nurses, 1% Clerks using ratio analysis with benchmarks found in Table III and identify strengths of operations). Analyze the financial statements ating for the profit and weaknesses and then make recommendations for improvement in 2018. The Treasury Department has issued final regulations on the ACA [Affordable Care Act] requirements for not-for-profit hospitals. Hospitals must be compliance with regulations beginning in 2016. Please explain the irements to me; please identify the penalties for noncompliance found in IRS regulations (501(r)); and please recommend ways to protect our tax- mpt status. ase explain the concept of cost shifting to me and tell me why it has ecome increasingly less effective in generating more income. What is taking ts place in generating more income? Medicare talks a lot about value-based purchasing. What is it and why is Medicare talking about it? Are there implications to our hospital? Explain the Medicaid expansion and why some states expanded Medicaid and why some states did not expand Medicaid. What are the financial mplications of Medicaid expansion to our hospital (be specific with revenue precasts)? 8. Analyze my capitated managed care agreement with the city. Using differential cost analysis for 2017 data, tell me the full cost profit/loss and the differential cost profit/loss. Should we renew the contract for next year at present rates, or should we ask for a rate increase and if so, how much rate increase do we need to cover our full cost? To cover our differential cost? 9. Our imaging department is in violation of antitrust statutes because it produced charges using relative value units developed by another organization. You must establish new relative value units and then set 2017 imaging rates using activity-based costing. Total imaging expenses for 2017 are projected to be $6.5 million, and the imaging manager has already finished some of the work that you will need (see Table V). 402 Case Study: Hays County Integrated Delivery System TABLE I Hays County IDS Balance Sheet as of December 31, 2016: Assets 2016 Assets Current Assets $ 816,875 Cash and cash equivalents 8,100,500 Marketable securities 17,250,000 Accounts receivable less allowances 2,368,000 Inventories at cost 8,992.500 Other current assets 37.527.875 Total Current Assets 11,250,000 Land and improvements 50,509.500 Buildings 5,063,250 Fixed equipment 4.466,750 Movable equipment 91,289,500 Property, Plant, and Equipment (38,376,231) Less accumulated depreciation 52.913,269 Total Property, Plant, and Equipment JantoeR 90,441,144 TOTAL ASSETS Current Liabilities $ 10,151,000 Current portion of long-term debt 8,400,000 Accounts payable and accrued expenses Estimated amounts due to third-party payers 8,423.750 Other current liabilities 10,500,000 Total Current Liabilities 37-474-750 Long-term debt, net of current portion 25,000,000 62,474-750 TOTAL LIABILITIES Net Assets Unrestricted 742,625 Temporarily restricted 16,000,000 Permanently restricted 11,223.769 TOTAL NET ASSETS 27.966,394 TOTAL LIABILITIES AND NET ASSETS $9,441,144 Case Study: Hays County Integrated Delivery System TABLE II Hays County IDS Actual Expenses ($) through December 31, 2017 Wages, Taxes, Benefits (90% variable, 10% fixed) $ 76,725,792 Professional Fees and Commissions (fixed) 7,000,000 Drugs (variable) Medical and Other Supplies (variable) ,000,000 8,500,000 Food (variable) 7.500,000 Purchased Services (variable) 6,500,000 8,000,000 Repairs and Maintenance (fixed) Utilities (fixed) 9,000,000 8,021,440 Interest (fixed) 3,000,000 Depreciation (fixed) $142,247,232 TOTAL EXPENSES Case Study: Hays County Integrated Delivery System TABLE V Radiology Department Procedures Machine Supply Expense 2017 Volume Tech Minutes Procedure Minutes Radiology 10 Chest 2-view 20,000 10 14 Chest 4-view 10 15,000 20 28 Hand 7,000 5. Arm 10 4,000 10 Foot 1,000 Leg 6,000 10 10 Fluoroscopy 30 30 15 3,000 Ultrasound Abdomen 15 10 10 5,000 Other 10 10 10 5,622 Nuclear Medicine Scan 60 30 30 2,000 CT Head without contrast 30 50 30 200 Head with contrast 60 75 45 300 Body without contrast 30 75 30 400 Body with contrast 60 100 45 500 Case Study: Hays County Integrated Delivery System TABLE VI-A Salary Survey of Area Hospitals Average Hourly Rates (in dollars, without benefits), December 2017 Position HCH St. Teresa Chief Executive Officer 595.00 595.00 Chief Operating Officer 390.00 386.00 Chief Nursing Officer 175.00 172.00 Director Clinical Services 230.00 226.00 Director Support Services 150.00 149.00 Chief Medical Officer 295.00 291.00 Chief Financial Officer 280.00 312.00 Chief Compliance Officer 140.00 135.00 Chief Information Officer 222.00 225.00 00 38.00 Head Nurse 43.00 Staff RN 37-40 33.00 21.00 Staff LPN 24-70 14.80 11.00 Nursing Assistant 28.00 31.68 Laboratory Tech Radiology Tech 26.00 29.72 9.45 12.45 Food Server 9.00 12.41 Housekeeper 37.00 40.73 Administrators Below Chiefs 17.00 20.23 Clerk 27.25 30.14 Respiratory Therapist 8. Case Stud y: Hays County Integrated Delivery System TABLE VI-B Hays County IDS Staffing Department FTES Chief Executives Administrators Below Chiefs 50 Medical Records 10 Dietary 35 Housekeeping 25 Laundry Physical Plant Nursing 500 Laboratory 20 Radiology 10 Respiratory Therapy 5. Physical Therapy Emergency Department Physicians FTES = full-time equivalent employees *contract "84% RNs, 10% Nursing Assistants, 5% Head Nurses, 1% Clerks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started