Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer question B, C and D. thank you tho. love you QUESTION 3 (8 marks) Amazing Ltd, manufactures the joint products, Mirakle and Norakle,

Please answer question B, C and D. thank you tho. love you

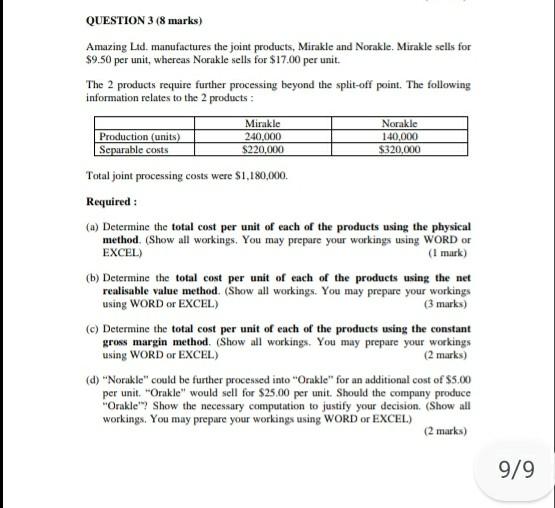

QUESTION 3 (8 marks) Amazing Ltd, manufactures the joint products, Mirakle and Norakle, Mirakle sells for $9.50 per unit, whereas Norakle sells for $17.00 per unit. The 2 products require further processing beyond the split-off point. The following information relates to the 2 products: Mirakle Norakle Production (units) 240,000 140,000 Separable costs $220,000 $320,000 Total joint processing costs were $1,180,000. Required: (a) Determine the total cost per unit of each of the products using the physical method. (Show all workings. You may prepare your working using WORD or EXCEL) (1 mark) (b) Determine the total cost per unit of each of the products using the net realisable value method. (Show all workings. You may prepare your workings using WORD or EXCEL) (3 marks) (c) Determine the total cost per unit of each of the products using the constant gross margin method. (Show all workings. You may prepare your workings using WORD or EXCEL) (2 marks) (d) "Norakle" could be further processed into "Orakle" for an additional cost of $5.00 per unit. "Orakle" would sell for $25.00 per unit. Should the company produce "Orakle"? Show the necessary computation to justify your decision. (Show all workings. You may prepare your workings using WORD or EXCEL) (2 marks) 9/9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started