Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER QUESTION B ONLY, THANKS Rehfuss Motors is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was

PLEASE ANSWER QUESTION B ONLY, THANKS

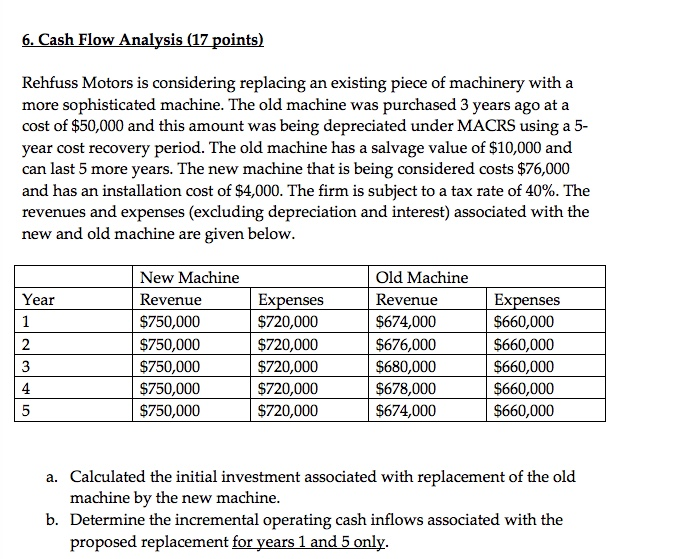

Rehfuss Motors is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was purchased 3 years ago at a cost of $50,000 and this amount was being depreciated under MACRS using a 5-year cost recovery period. The old machine has a salvage value of $10,000 and can last 5 more years. The new machine that is being considered costs $76,000 and has an installation cost of $4,000. The firm is subject to a tax rate of 40%. The revenues and expenses (excluding depreciation and interest) associated with the new and old machine are given below. a. Calculated the initial investment associated with replacement of the old machine by the new machine. b. Determine the incremental operating cash inflows associated with the proposed replacement for years 1 and 5 onlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started