Please answer question below:

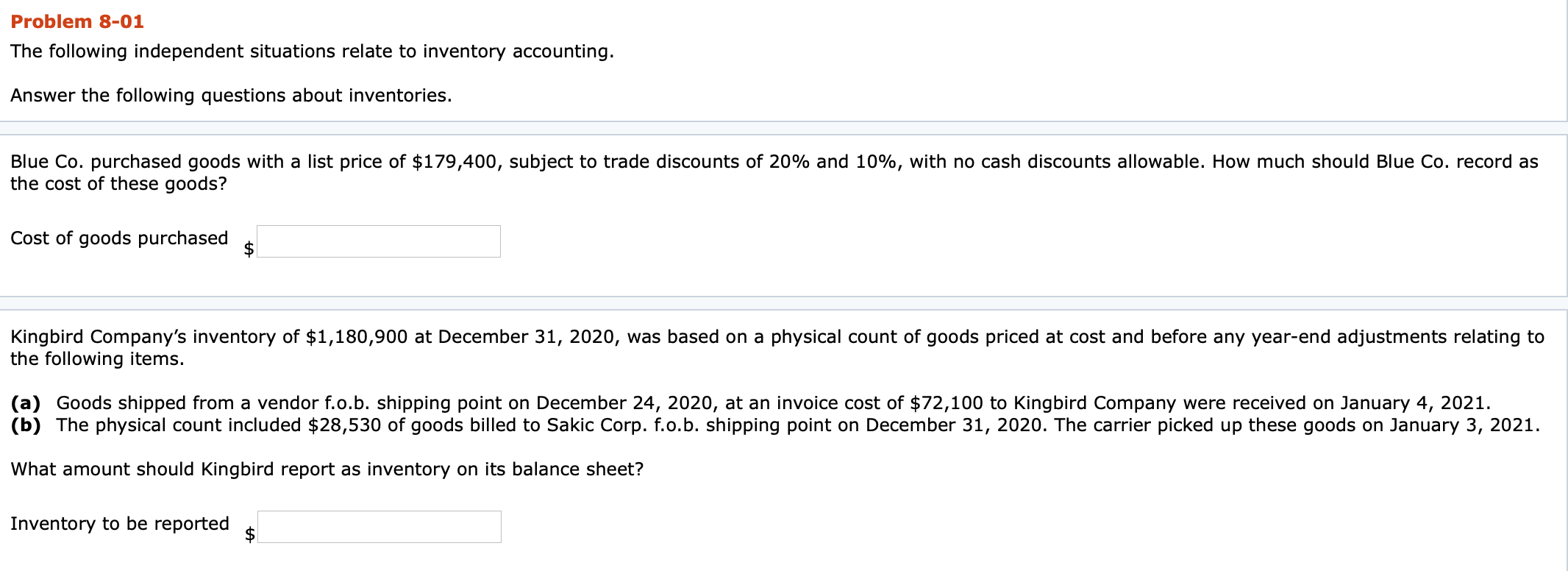

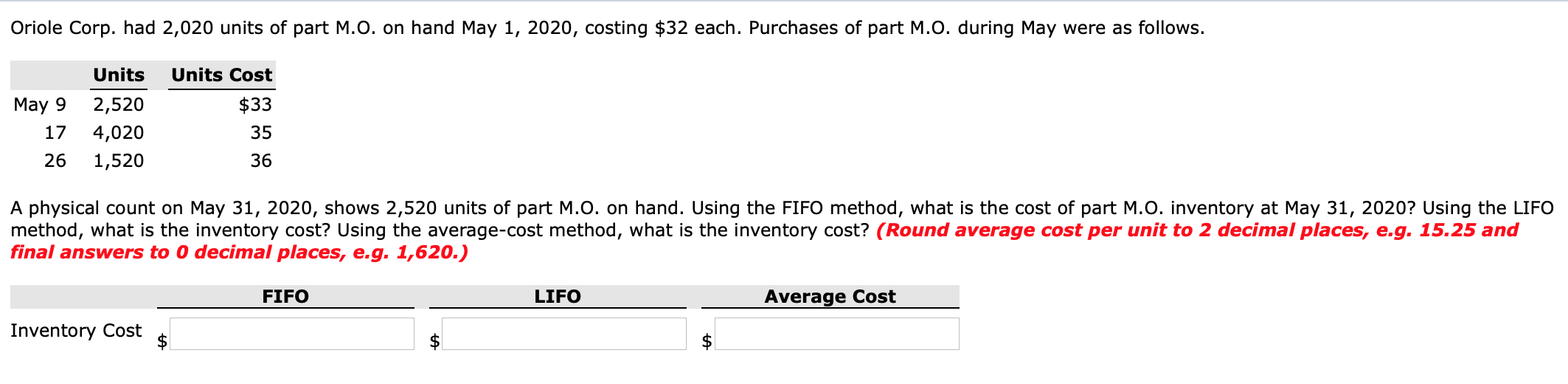

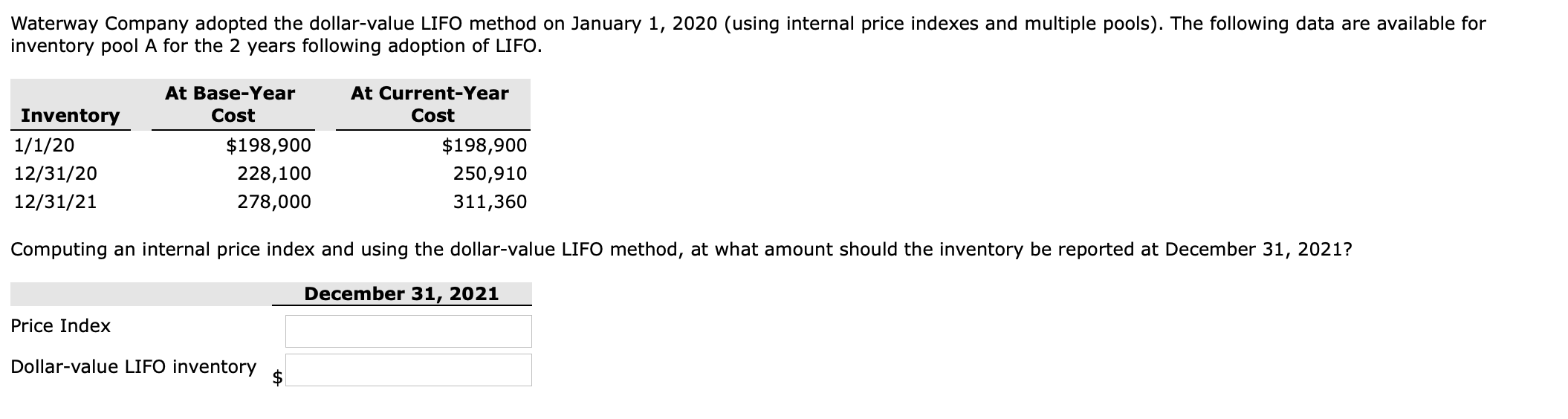

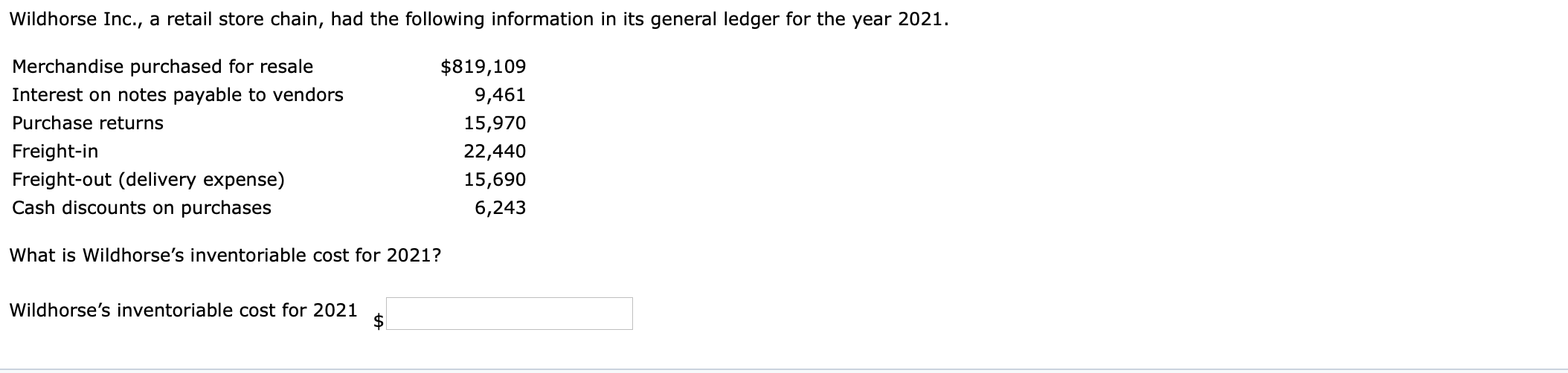

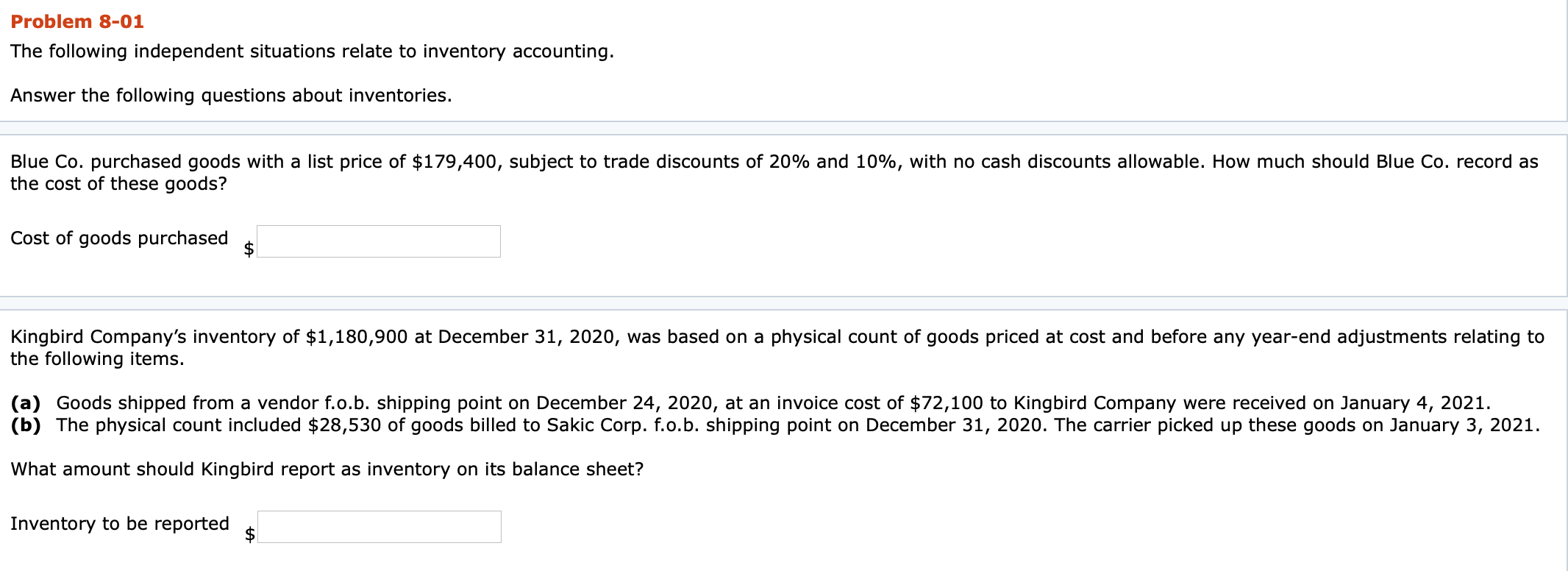

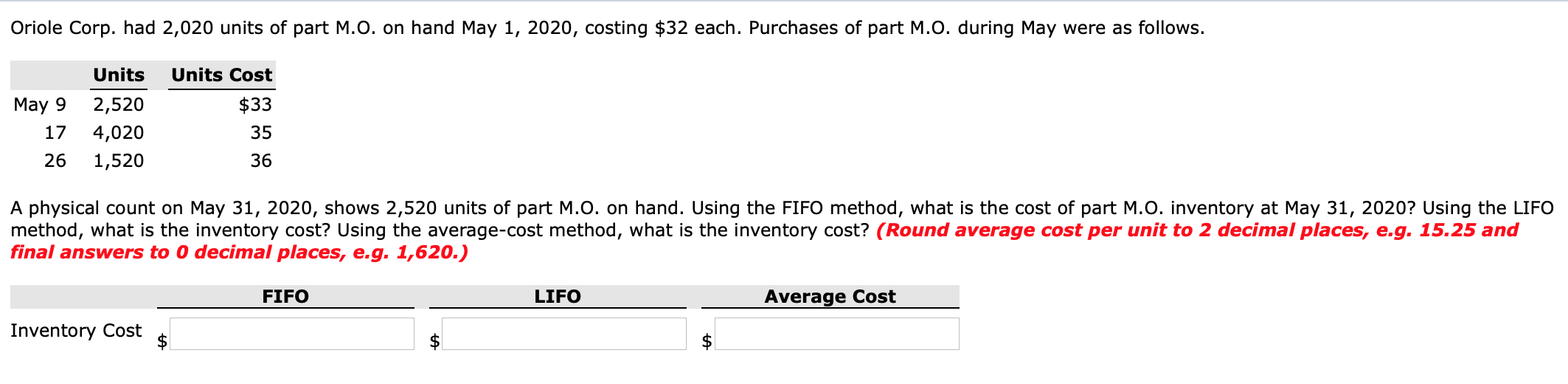

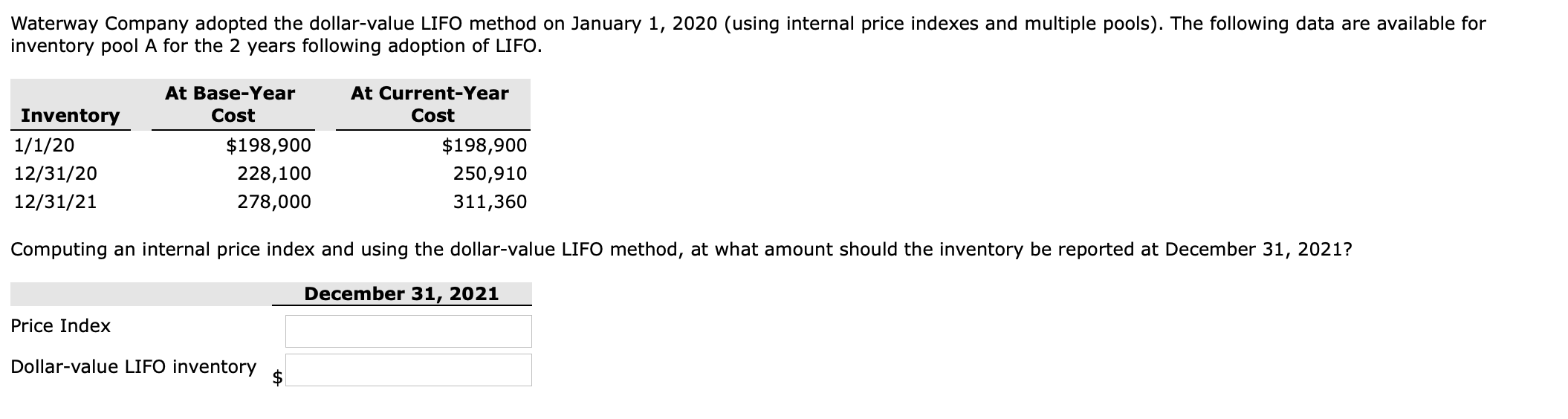

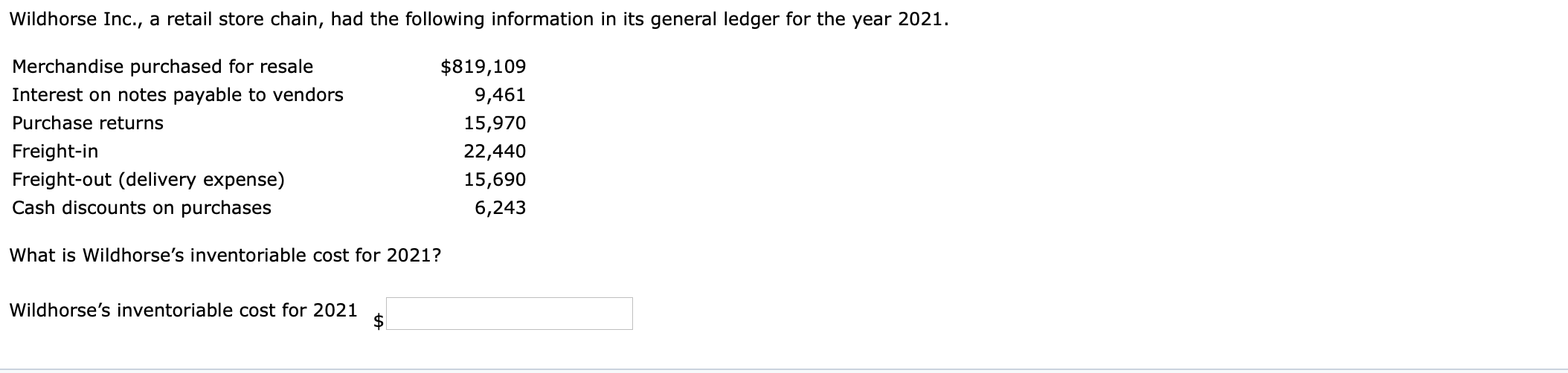

Problem 8-01 The following independent situations relate to inventory accounting. Answer the following questions about inventories. Blue Co. purchased goods with a list price of $179,400, subject to trade discounts of 20% and 10%, with no cash discounts allowable. How much should Blue Co. record as the cost of these goods? Cost of goods purchased Kingbird Company's inventory of $1,180,900 at December 31, 2020, was based on a physical count of goods priced at cost and before any year-end adjustments relating to the following items. (a) Goods shipped from a vendor f.o.b. shipping point on December 24, 2020, at an invoice cost of $72,100 to Kingbird Company were received on January 4, 2021. (b) The physical count included $28,530 of goods billed to Sakic Corp. fo.b. shipping point on December 31, 2020. The carrier picked up these goods on January 3, 2021. What amount should Kingbird report as inventory on its balance sheet? Inventory to be reported Oriole Corp. had 2,020 units of part M.O. on hand May 1, 2020, costing $32 each. Purchases of part M.O. during May were as follows. Units Units Cost May 9 17 2,520 4,020 1,520 $33 35 26 36 A physical count on May 31, 2020, shows 2,520 units of part M.o. on hand. Using the FIFO method, what is the cost of part M.o. inventory at May 31, 2020? Using the LIFO method, what is the inventory cost? Using the average-cost method, what is the inventory cost? (Round average cost per unit to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 1,620.) FIFO LIFO Average Cost Inventory Cost $ Waterway Company adopted the dollar-value LIFO method on January 1, 2020 (using internal price indexes and multiple pools). The following data are available for inventory pool A for the 2 years following adoption of LIFO. At Base-Year Cost At Current-Year Cost Inventory 1/1/20 12/31/20 12/31/21 $198,900 228,100 278,000 $198,900 250,910 311,360 Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at December 31, 2021? December 31, 2021 Price Index Dollar-value LIFO inventory Wildhorse Inc., a retail store chain, had the following information in its general ledger for the year 2021. Merchandise purchased for resale Interest on notes payable to vendors Purchase returns Freight-in Freight-out (delivery expense) Cash discounts on purchases $819,109 9,461 15,970 22,440 15,690 6,243 What is Wildhorse's inventoriable cost for 2021? Wildhorse's inventoriable cost for 2021