Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question completely, i will upvote if the answer is complete, thank you. Check my won Connor Ltd. is a large private company owned

please answer question completely, i will upvote if the answer is complete, thank you.

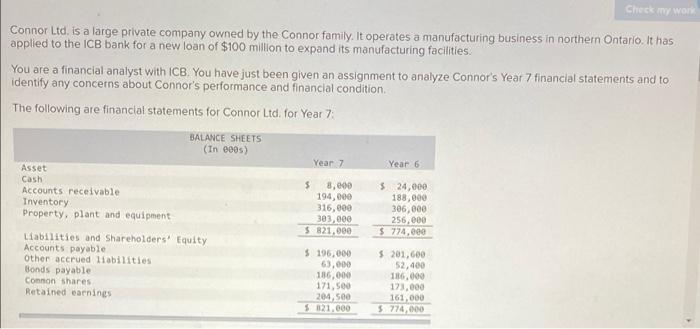

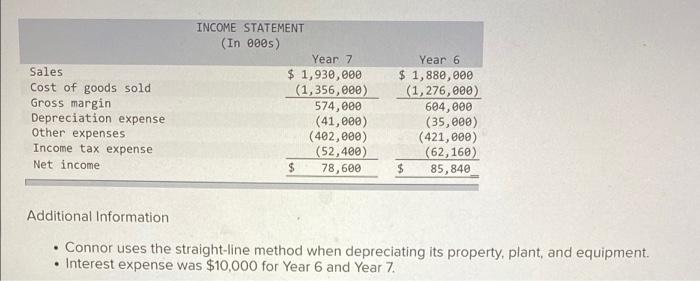

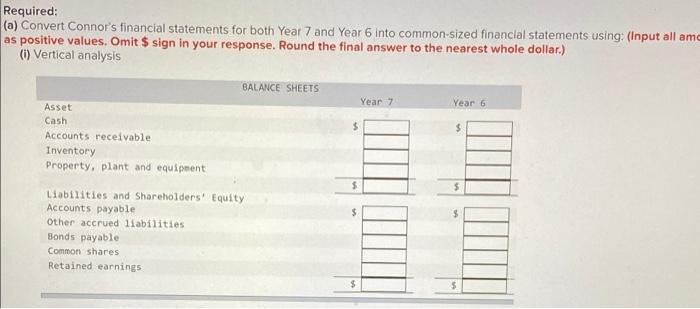

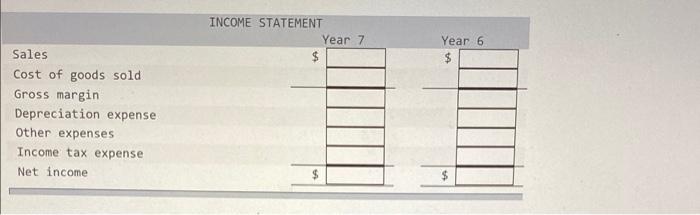

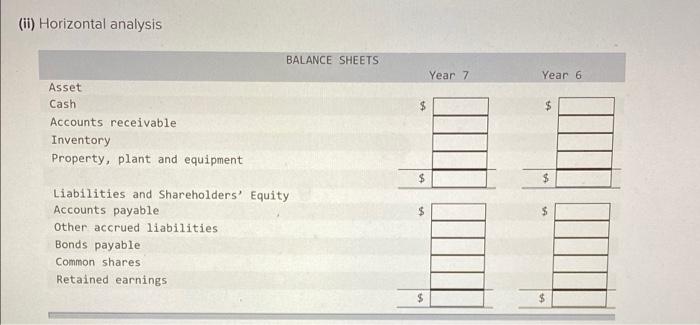

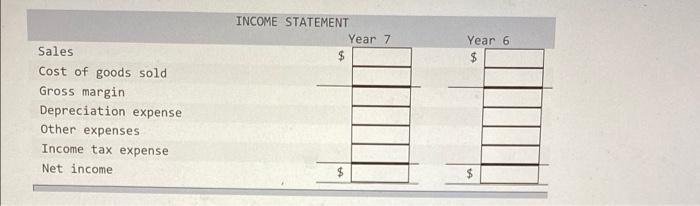

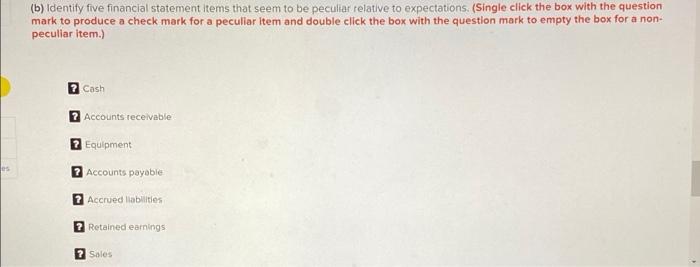

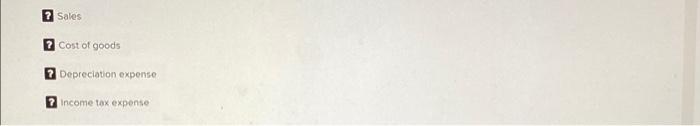

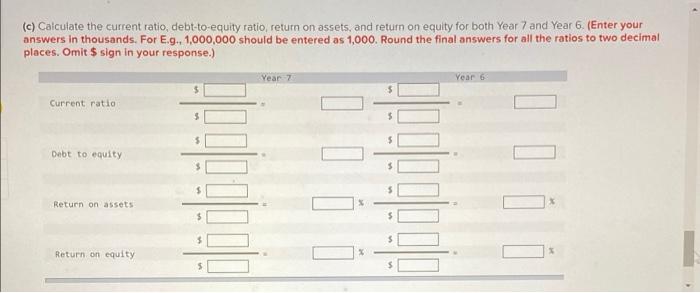

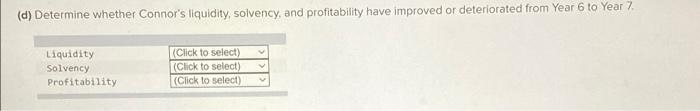

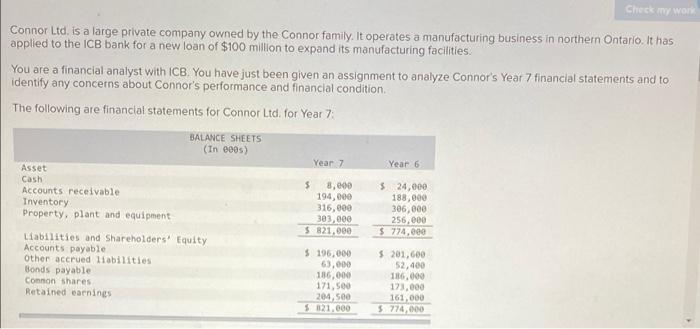

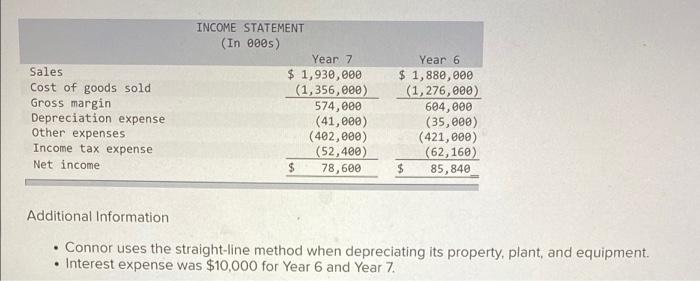

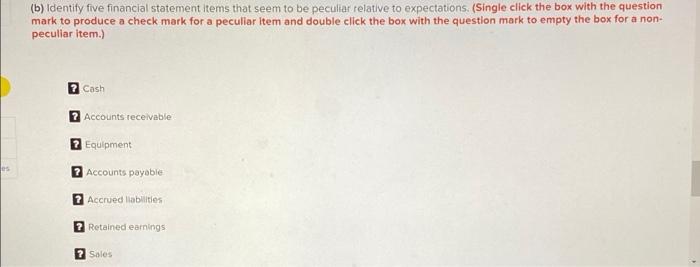

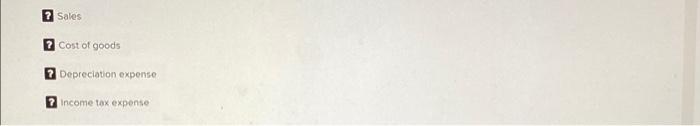

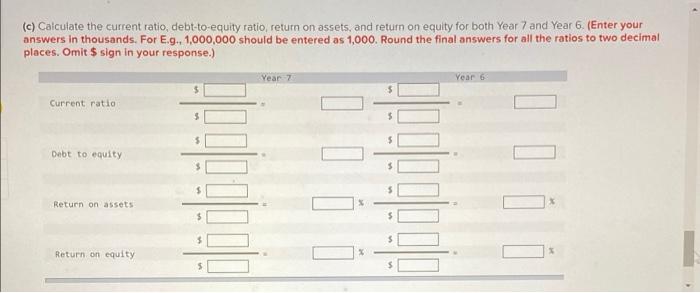

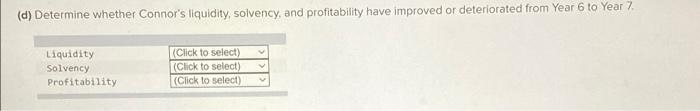

Check my won Connor Ltd. is a large private company owned by the Connor family. It operates a manufacturing business in northern Ontario. It has applied to the ICB bank for a new loan of $100 million to expand its manufacturing facilities. You are a financial analyst with ICB. You have just been given an assignment to analyze Connor's Year 7 financial statements and to identify any concerns about Connor's performance and financial condition The following are financial statements for Connor Ltd. for Year 7: BALANCE SHEETS (In 200s) Year 7 Year 6 Asset Cash Accounts receivable Inventory Property, plant and equipment $ 8,00 194,000 316,000 303,000 $ 821,000 $ 24,000 188,000 306,000 256,000 $ 774.000 Liabilities and Shareholders' Equity Accounts payable Other accrued liabilities Bonds payable Connon shares Retained earnings $ 196,000 63,000 186,000 171,500 204,500 5121.000 $ 201,600 52,400 186.000 173,000 161.000 5774,000 Sales Cost of goods sold Gross margin Depreciation expense Other expenses Income tax expense Net income INCOME STATEMENT (In 2005) Year 7 $ 1,930,000 (1,356,000) 574,000 (41,000) (402,000) (52,400) 78,600 Year 6 $ 1,880,000 (1,276,000) 604,000 (35,000) (421, 800) (62,160) $ 85,840 Additional Information Connor uses the straight-line method when depreciating its property, plant, and equipment. Interest expense was $10,000 for Year 6 and Year 7 Required: (a) Convert Connor's financial statements for both Year 7 and Year 6 into common-sized financial statements using: (Input all am as positive values. Omit $ sign in your response. Round the final answer to the nearest whole dollar.) (0) Vertical analysis BALANCE SHEETS Year 7 Year 6 $ $ Asset Cash Accounts receivable Inventory Property, plant and equipment $ Liabilities and Shareholders' Equity Accounts payable Other accrued liabilities Bonds payable Common shares Retained earnings $ $ INCOME STATEMENT Year 7 $ Year 6 Sales Cost of goods sold Gross margin Depreciation expense Other expenses Income tax expense Net income $ (ii) Horizontal analysis BALANCE SHEETS Year 7 Year 6 $ $ VA Asset Cash Accounts receivable Inventory Property, plant and equipment $ $ $ $ Liabilities and Shareholders' Equity Accounts payable Other accrued liabilities Bonds payable Common shares Retained earnings INCOME STATEMENT Year 7 $ Year 6 $ Sales Cost of goods sold Gross margin Depreciation expense Other expenses Income tax expense Net income $ (b) Identity five financial statement items that seem to be peculiar relative to expectations. (Single click the box with the question mark to produce a check mark for a peculiar item and double click the box with the question mark to empty the box for a non- peculiar item.) Cash ? Accounts receivable 2 Equipment 2 Accounts payable ? Accrued liabilities 2 Retained earnings 2 Sales Sales Cost of goods 2 Depreciation expense 2 Income tax expense (c) Calculate the current ratio, debt-to-equity ratio, return on assets, and return on equity for both Year 7 and Year 6. (Enter your answers in thousands. For E... 1,000,000 should be entered as 1,000. Round the final answers for all the ratios to two decimal places. Omit $ sign in your response.) Year 7 Year 6 Current ratio Debt to equity Return on assets Return on equity (d) Determine whether Connor's liquidity, solvency, and profitability have improved or deteriorated from Year 6 to Year 7 Liquidity Solvency Profitability (Click to select) (Click to select) (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started