Answered step by step

Verified Expert Solution

Question

1 Approved Answer

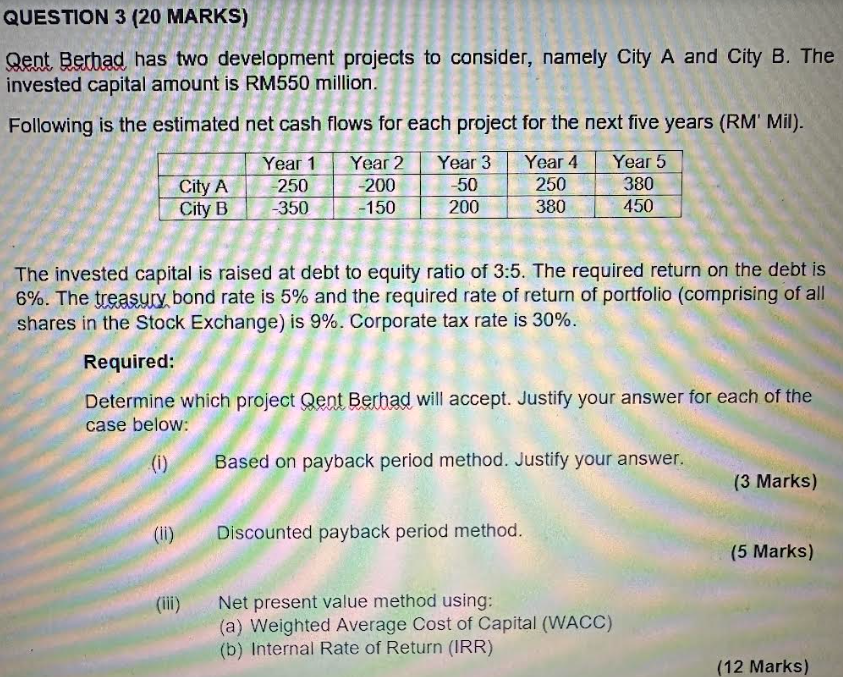

please answer question iii (a&b) only Qent Berhad has two development projects to consider, namely City A and City B. The invested capital amount is

please answer question iii (a&b) only

Qent Berhad has two development projects to consider, namely City A and City B. The invested capital amount is RM550 million. Following is the estimated net cash flows for each project for the next five years (RM' Mil). The invested capital is raised at debt to equity ratio of 3:5. The required return on the debt is 6%. The treasury bond rate is 5% and the required rate of return of portfolio (comprising of all shares in the Stock Exchange) is 9%. Corporate tax rate is 30%. Required: Determine which project Qent Berhad will accept. Justify your answer for each of the case below: (i) Based on payback period method. Justify your answer. (3 Marks) (ii) Discounted payback period method. (5 Marks) (iii) Net present value method using: (a) Weighted Average Cost of Capital (WACC) (b) Internal Rate of Return (IRR) (12 Marks) Qent Berhad has two development projects to consider, namely City A and City B. The invested capital amount is RM550 million. Following is the estimated net cash flows for each project for the next five years (RM' Mil). The invested capital is raised at debt to equity ratio of 3:5. The required return on the debt is 6%. The treasury bond rate is 5% and the required rate of return of portfolio (comprising of all shares in the Stock Exchange) is 9%. Corporate tax rate is 30%. Required: Determine which project Qent Berhad will accept. Justify your answer for each of the case below: (i) Based on payback period method. Justify your answer. (3 Marks) (ii) Discounted payback period method. (5 Marks) (iii) Net present value method using: (a) Weighted Average Cost of Capital (WACC) (b) Internal Rate of Return (IRR) (12 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started