Question

**********Please answer question number 7*************** Using the spreadsheet provided, please run the following sensitivities: 1. Please take sales up to $630,000 and down to $570,000

**********Please answer question number 7***************

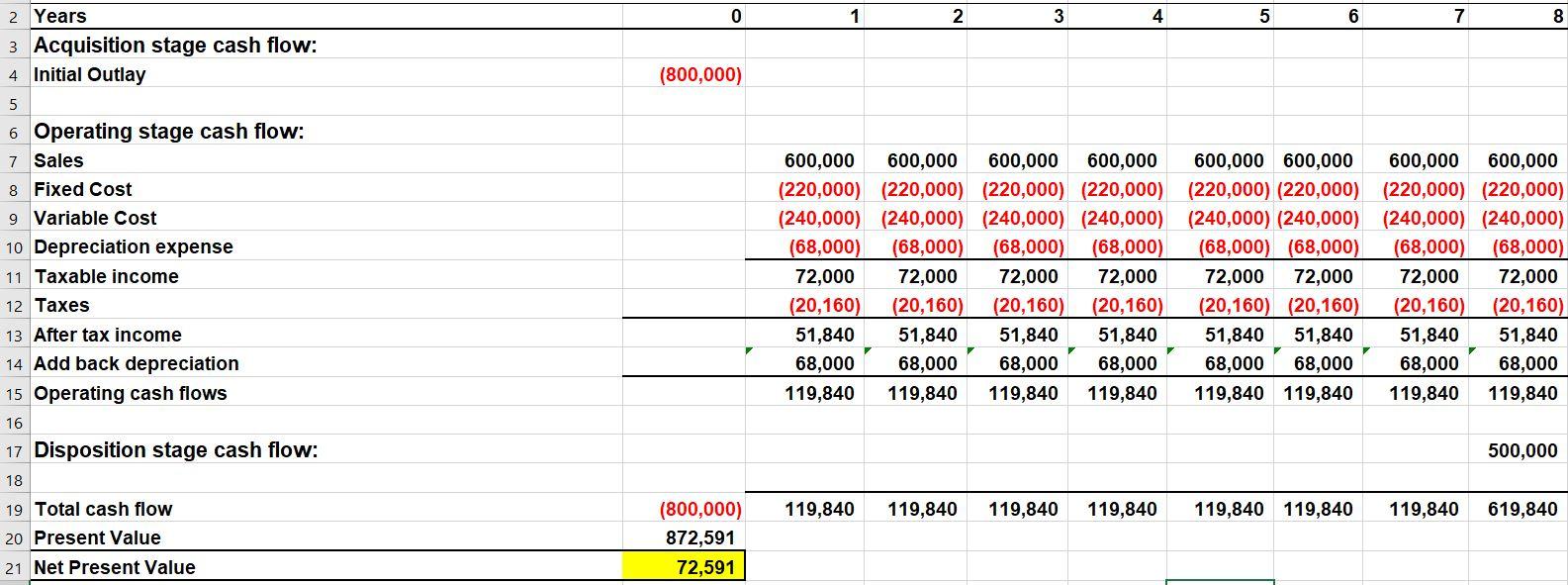

Using the spreadsheet provided, please run the following sensitivities:

1. Please take sales up to $630,000 and down to $570,000 (up by 5% and down by 5%) and record the new net present value numbers.

2. Returning to the original numbers, please take disposition value up to $525,000 and down to $475,000 (up by 5% and down by 5%) and record the new net present value numbers.

3. Returning to the original numbers, please take variable costs up for all years to 42% and down to 38% (up by 5% and down by 5%) and record the new net present value numbers.

4. Returning to the original numbers, please take fixed costs up for all years to $231,000 and down to $209,000 (up by 5% and down by 5%) and record the new net present value numbers.

5. Returning to the original numbers, please take the tax rate to up to 29.4% and down to 26.6% (up by 5% and down by 5%) and record the new net present value numbers.

6. Returning to the original numbers, please take the weighted average cost of capital for this project up to 10.5% and down to 9.5% (up by 5% and down by 5%) and record the new net present value numbers.

7. From the answer to the prior six problems using the resulting range of outcome after making the 5% changes to the variables, which variable has the greatest influence on the net present value of this project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started