Please answer question on here please

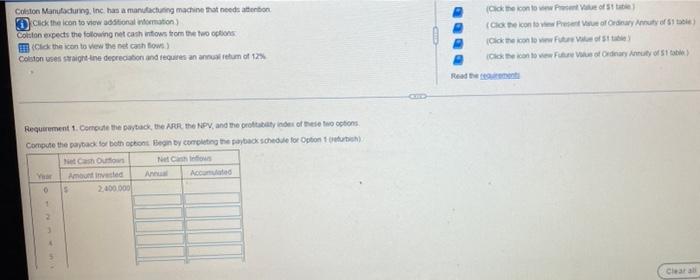

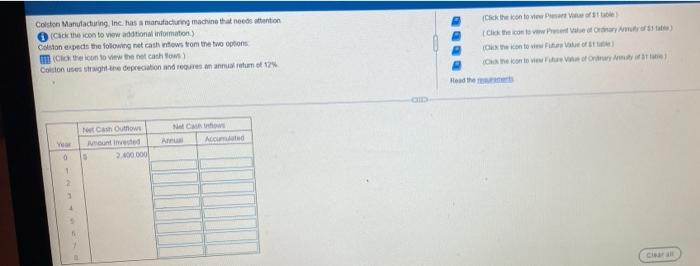

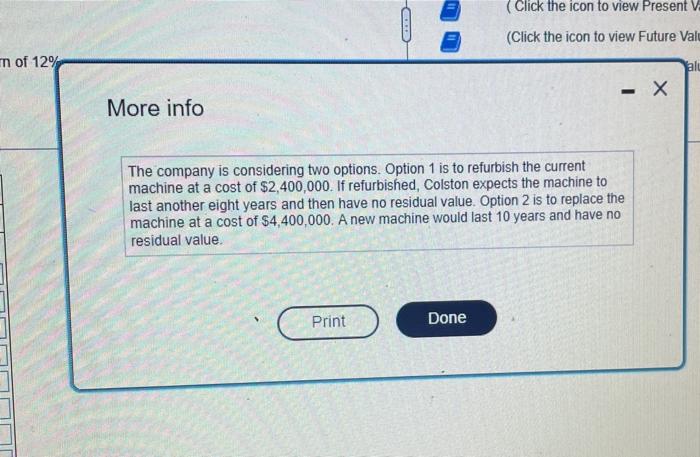

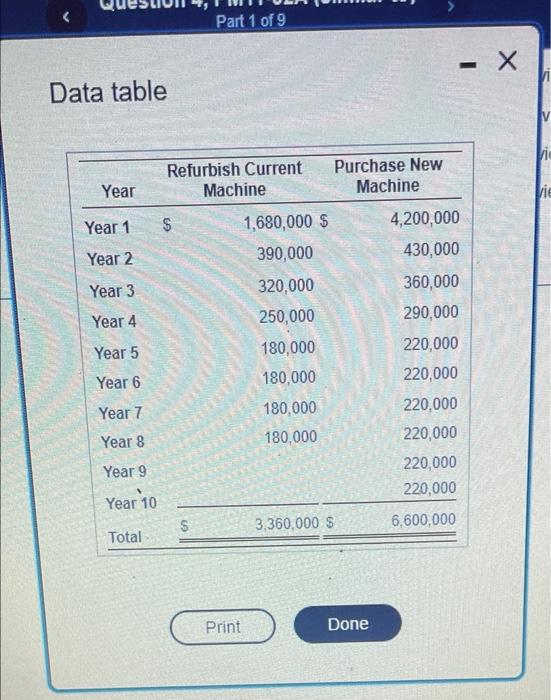

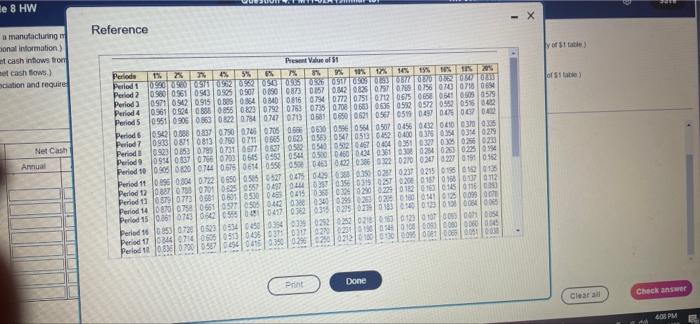

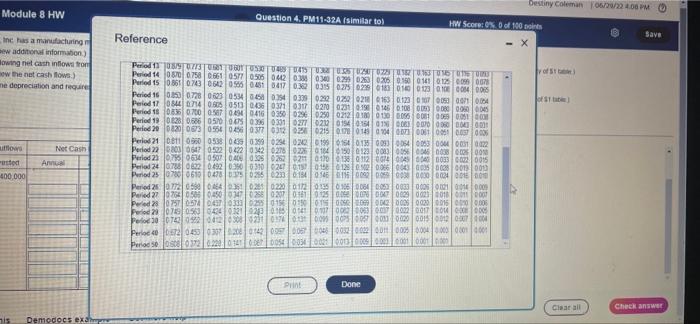

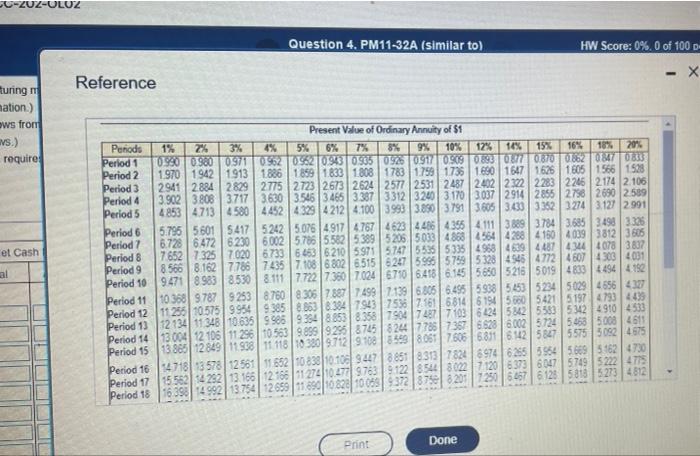

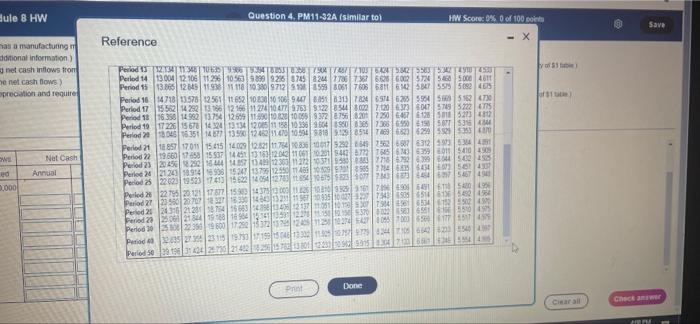

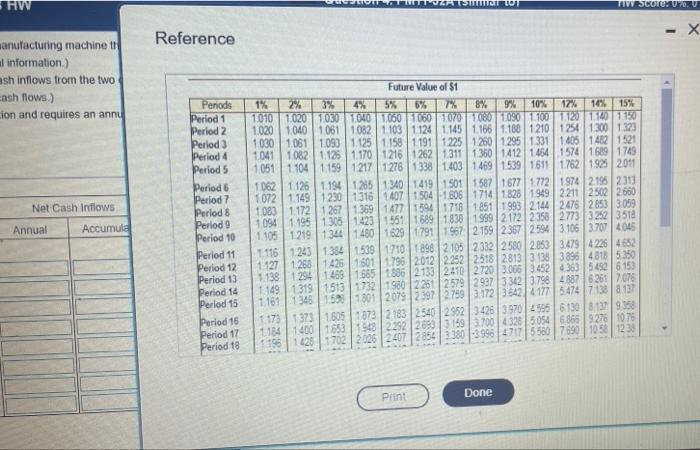

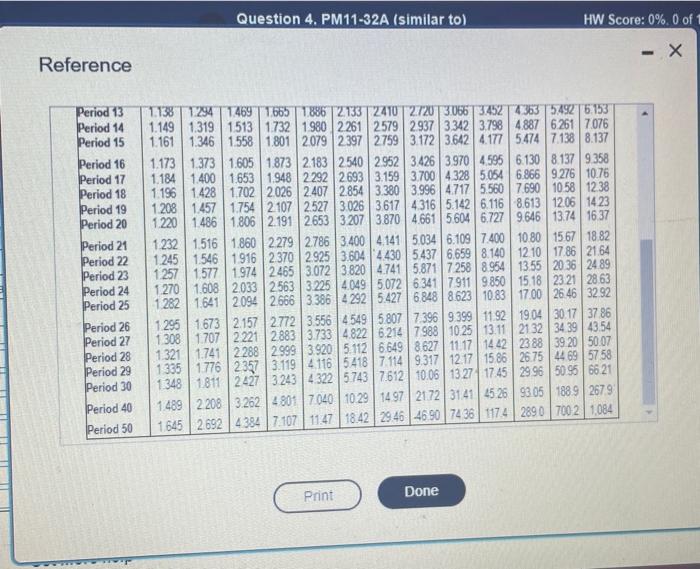

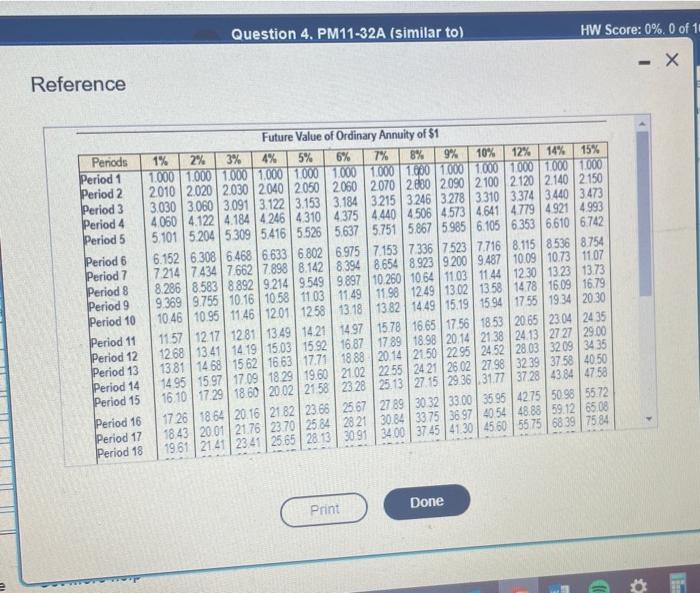

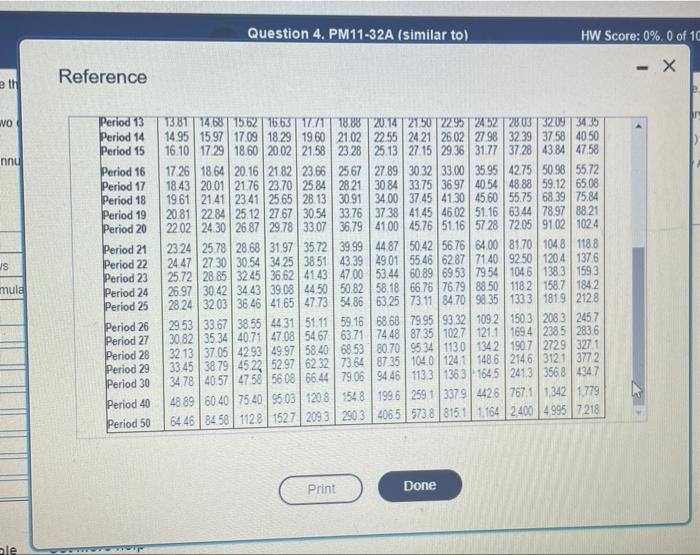

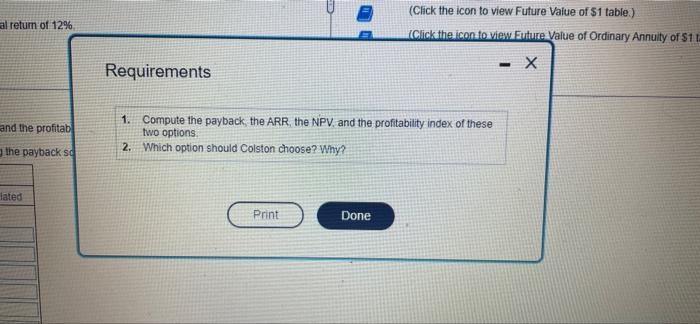

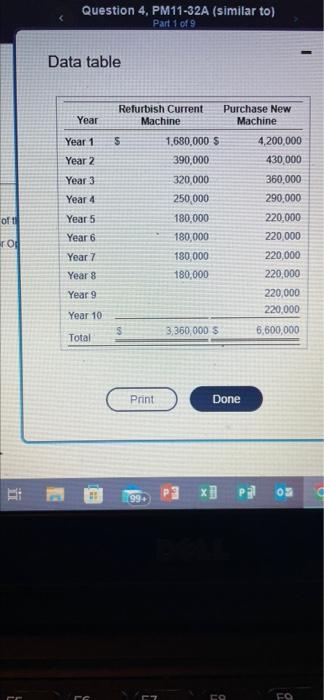

Colston Manufacturing, Inc. has a manufacturing machine that needs attention Click the icon to view additional information) Colston expects the following net cash inflows from the two options (Click the icon to view the net cash flows) Colston uses straight-line depreciation and requires an annual retum of 12% Requirement 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options Compute the payback for both options Begin by completing the payback schedule for Option 1 refurbish) Net Cash Inflows Year 0 1 Net Cash Outtons Amount invested 2.400.000 S Annual Accumulated (Click the icon to view Present Value of $1 table) (Click the icon to view Present Value of Ordinary Annuty of $1 table) (Click the icon to view Future Value of $1 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Clear all Colston Manufacturing, Inc. has a manufacturing machine that needs attention (Cack the icon to view additional information) Colston expects the following net cash intows from the two options (Click the icon to view the net cash flow) Coiston uses straight-the depreciation and requires an annual return of 12% Year O 1 2 3 Net Cash Outflows Jount invested 2.400.000 0 Net Cash Inhows Annual Accumulated OID (Click the icon to view Part Value of $1 table) (Click the icon to view Present Value of Ordinary Army of $3 tat) Click the icon to view Future Value of table Ck the icon to view Future Value of Ordinary Anuty of 31 table) Read the reamers Clear all n of 12% More info C Print (Click the icon to view Present V. (Click the icon to view Future Valu alu The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,400,000. If refurbished, Colston expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,400,000. A new machine would last 10 years and have no residual value. Done - X Data table Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total Refurbish Current Machine $ Part 1 of 9 S Print 1,680,000 $ 390,000 320,000 250,000 180,000 180,000 180,000 180,000 Purchase New Machine 3,360,000 $ Done 4,200,000 430,000 360,000 290,000 220,000 220,000 220,000 220,000 220,000 220,000 6,600,000 . X - vic Vie le 8 HW a manufacturing m cional information) et cash inflows from met cash flows.) ciation and require Net Cash Annual Reference Periods Period 1 Period 2 Period 3 Present Value of $1 8% 4% 9% 5% 0571 0962 0562 65 0943 10% 10% 20% 10% 12% 14% 7% 0905 038 0917 0505 085368770870 08620847 0233 0943 0925 0907 0890 0873 0857 0842 0836 0797 0769 0756 0743 0718 0694 0915 0.885 0864 0840 0.816 0794 0772 0.751 0712 0675 0658 0641 0605 0579 0888 0855 0823 0792 0763 0735 0708 0683 0636 0.592 0572 0552 056 042 0863 0822 0784 0747 0713 0681 0650 0621 0567 0519 0497 046 0437 042 Period 14 Period 15 3% 2% 1% 0990 0900 0900 0961 0971 0942 Period 4 0961 0924 Period 5 0951 0906 Period 60542 0.888 0.837 0.750 0.746 0705 066 0630 0556 0564 0507 0456 0432 0410 0370 0335 Period 7 0933 0871 0813 0.760 0711 0665 0623 0563 0547 0513 0452 0400 0376 0354 0314 0279 Period 0923 0853 0789 0731 0677 0527 0582 0540 0502 04670404 0351 0327 0305 0266 0233 Period 90954 0837 0766 0703 0645 0552 0544 0500 0460 0424 0.361 0308 0284 0263 0225 0194 Period 10 0905 0820 0744 0676 0614 0556 050 0463 0422 0.386 0322 0270 0247 0227 0191 0162 Period 11 0996 0804 0722 0650 0.585 0527 0475 0887 0788 0701 0625 0557 0497 0444 6879 0773 0681 0601 0530 04890415 08700758 0661 0577 0505 0442 038 Period 12 Period 11 0.061 0743 0642 05550451 0417 0362 0315 0275 Period 16 0853 0720 0523 0534 0458 0354 03390292 Period 170844 0714 0605 0513 0436 0371 0317 0.29% Period 18 0836 0700 0587 0494 0415 Print 15% 0429 038 0350 0287 0237 0215 0195 01620135 0357 0356 0319 0257 0208 0157 0168 0137 0112 0366 0326 0 290 0229 0182 0163 0145 0116 0053 0205 0100 0141 0125 0.099 007 01030140 01230108 0084 005 0340 0299 Done 0163 0123 0 107 0063 00710054 100 0093 008000600045 0.051 X y of $1 table of $1 table) Clear all Check answer 400 PM Module 8 HW Inc has a manufacturing m sew additional information) owing net cash inflows from now the net cash flows) me depreciation and require utflows usted Annual 400,000 Net Cash nis Demodocs exa Reference Period 13 08/90773 Period 14 0570 0.758 Period 15 0.861 0743 Question 4. PM11-32A (similar tol 0681 0601053004890415030350200285|U382 0163545016 0661 0577 0505 0442 038 0300 0.299 0263 0205 0160 0141 0125 009 0642 0555 0451 0417 0.362 0315 0275 029 0183 0140 0123 010 0004 0065 0078 Period 16 0253 0728 Period 17 Period 18 055 0081 0069 005100M 0154 0164 013 0083 0070 0060 0043 0031 0.178 0149 0104 0073 0061 00510037 0006 0164 0135 0093 0064 0053 0004 0031 0.022 0623 0534 0458 0354 0339 0292 0252 0218 0163 0123 007 0053 001 0054 0844 0714 0.605 0513 0436 0321 0317 0270 0231 0190 0146 0108 003 008000600045 0836 0700 0.587 0.494 0416 0350 0296 0.250 0212 0180 0130 Period 19 0828 0.686 0570 0475 0396 0331 0277 0232 Period 20 0820 0673 0554 0456 0377 0312 0258 0215 Period 21 0811 0960 0538 0439 0399 0294 0242 0199 Period 220203 0647 0522 0422 0342 02780226 0184 Period 23 0795 0634 0507 0406 0305 0262 211 0110 Period 24 0788 0622 0492 0390 0330 0247 0157 Period 25 0780 0610 0478 0375 0255 6233 0184 0546 0772 560 0464 0351 0281 0220 0172 0135 076 0506 0450 0347 0258 0207 0181 0.125 757 0574 0333 0295 01560150 01H 03219283 041037 03084231 0174 013 0:09500P5005700330000 0015 0012 00070004 0038 000 00 0033 002 0015 0035 0038 00130013 0.030 0024001600 1060064 0:053 0033 0.006 0021 00140009 0.0000076 0047 0029 0023 2018 0011 000 0042 0026 0020 0015 000 0006 0022 0.017 2014000005 HW Score: 0% 0 of 100 points - X Period 25 Period 27 Pred 28 Period 20 Period 30 0742 Perioc 40 072 0453 0307 02080142 0067 0057 0046 003200220011 0005 0004 0000 000 4001 Period 50 0808 0372 0.229 0141 006 0054 0034 0021 00131 000 0001000100010000 Print Done Destiny Coleman 06/29/224.00 PM of St table) of $1 table) Clear all Save Check answer CC-202-OLUZ turing m mation.) ews from NS.) require et Cash al Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 1% 2% 3% 0.990 0.980 0.971 0962 1886 2829 2.775 1.970 1942 1913 2941 2884 3.902 3.808 3.717 4.853 4713 4580 5.795 5601 5417 6.728 6472 6230 7.652 7.325 7020 8.566 8.162 7.786 9471 8983 8.530 14718 13 578 15 562 14 292 16 398 14 992 Present Value of Ordinary Annuity of $1 16% 20% 8% 9% 10% 0926 0917 0909 1783 1.759 1.736 15% 18% 0.870 0862 0847 0833 1.605 1.566 1.528 2577 2531 2487 2402 2322 2283 2.723 2673 2624 2246 2174 2.106 3.630 3.546 3.465 3.387 3312 3240 3.170 3.037 2.914 2855 2798 2690 2.589 4452 4.329 4212 4.100 3993 3.890 3.791 3.605 3433 3352 3274 3.127 2.991 6.002 6733 7435 8.111 10.368 9.787 9253 8.760 9 385 12 134 11.348 11.255 10.575 9954 10.635 9 986 11 296 10.563 13 004 12 106 13 865 12849 11.938 11.118 Question 4. PM11-32A (similar to) 5242 5.076 4.917 4.767 5.786 5.582 5.389 6 463 6210 5971 7.108 6802 6515 7.722 7.360 7.024 12 561 11 652 12 166 13.166 13.754 12 659 7% 5% 6% 0962 0943 0.935 1859 1.833 1.808 Print HW Score: 0%, 0 of 100 p X 12% 14% 0893 0877 1.690 1647 1626 4623 4.486 4.355 4111 3889 3784 3.685 3498 3.326 5206 5033 4.868 4564 4288 4150 4.039 3812 3605 5747 5535 5335 4968 4639 4487 4344 4078 3837 5328 4546 4772 4 607 4303 4031 6247 5995 5759 6710 6.418 6.145 5.650 5216 5019 4833 4494 4192 7.139 6.805 6.495 8.306 7.887 7499 5938 5453 5234 5029 4656 4327 8863 8.384 7943 7536 7.161 6814 6194 5660 5421 5197 4793 4439 9.394 8853 8.358 7904 7487 7103 6424 5842 5583 5342 4910 4533 9.899 9.295 8745 8244 7 786 7.367 6.628 6.002 5724 5468 5008 4611 10 380 9.712 9108 8559 8061 7.606 6.811 6.142 5847 5575 5082 4675 6974 6265 5954 5.669 5162 4730 11 274 10.477 9763 9.122 8544 8022 7120 6373 6047 5749 5222 4775 690 10 828 10 059 9:372 875 8201 7.250 6467 6128 5818 5273 4812 10 838 10.106 9447 8851 8313 7824 Done 4 Hule 8 HW has a manufacturing m dditional information) net cash inflows from he net.cash ios) preciation and require T Net Cash Annual 3.oool Reference 10635 Period 1312134 11 348 996693548853835879874877103 5424 5842 5583 5342 490 450 Period 14 13.004 12 106 11 296 10 563 9899 9296 8745 8244 7786 7367 6625 6002 5724 5468 5.000 4611 Period 15 13.865 12649 11.936 11 118 10.300 9712 51388559 8061 7606 6811 6142 5847 5575 5082 4675 Perload 21 18857 17011 15415 14.009 Perlod 22 1966017-658 15537141 Period 25 2015 22306 21.243 18914| Question 4. PM11-32A (similar tol RETR756653) Perlee 26 Period 25 220209523 1743 5622 Period 16 14718 13.578 12 561 11 652 10 830 10 106 9 447 8851 8313 7824 6974 6265 5954 5665 5162 4730 Period 171552828051612166 11.24 9763 9122 8544 8022 7.120 6373 6047 5749 5222 4775 Period 18 16.350 1992 13754 129 16 Period 19 17228 15678 32 15134 Perlod 2016.045 16351 1487713500 820 7250 6467 6128 50185273 4812 7.366 65506198 5877 5356 4844 8514 7409 6623 6259 5529 5353 4870 86497562 6607 6312 5973 5384 431 6.743 6359 60115410 6792 4.399 6644 5432 6835 6.434 6073 545 6373 6464 6217 5467 Pokeds22.75 2012 17877 1590 Period 27 2155020707 Perled 25 21306 Period 29 2506 Period 30 25 0 Period 4332835 27356 Perloud 503019 EBC DYLE CENSE 16 330 146 16964 17.250 EN GE 730 21482 1825 15 3594 9818 9129 SEE BENDY25 Print PER REEF = HW Score: 0% 0 of 100 -x 4906 641 6118 5480 495 7543 4505 6514 6136 5410 4.5964 7504 501 6534 6152 552 4500 550 8065 000 6177 5517 4579 11.52517579729 4244 305 6642 6233 5540 4367 12233 30 962 9915 304 7130 60 9246 5554 490 11.250 10.274 427 Done or of st table ) ForState) Clear all Save Check answer M HW manufacturing machine th al information.) ash inflows from the two- cash flows.) ion and requires an annu Net Cash Inflows Annual Accumula Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 1.030 1.041 MTT-07 Future Value of $1 10% 15% 1.020 1% 2% 3% 4% 5% 6% 1% 8% 9% 12% 14% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 1.040 1061 1.082 1.103 1.124 1.145 1.166 1.188 1210 1254 1.300 1.323 1.405 1482 1.521 1574 1689 1.749 1.762 1.925 2011 1.061 1.093 1.125 1.158 1.191 1.225 1.082 1.125 1.170 1216 1262 1.311 1.051 1.104 1.159 1.217 1276 1338 1.403 1260 1.295 1331 1.360 1.412 1.464 1.469 1.539 1.611 1.062 1.126 1.194 1.265 1.340 1419 1501 1.083 1072 1.149 1230 1316 1.172 1267 1.369 1195 1.305 1423 1551 1689 1.838 1.105 1219 1.344 1480 1629 1791 1967 1407 1504 -1.606 1477 1594 1718 1094 1,116 1127 1.138 1.243 1.384 1539 1710 1898 2 105 1268 1426 1.601 1.796 2012 2252 1.294 1469 1.665 1886 2133 2410 1.149 1319 1513 1732 1980 2251 2579 1161 1345 1590 1301 2079 2397 2.759 Print TW Score: 0%, 0 1587 1.677 1.772 1828 1.949 1993 2.144 1714 1851 1999 2172 2 358 1974 2195 2313 2211 2502 2.660 2476 2853 3.059 2773 3252 3518 2159 2367 2594 3.106 3.707 4046 1.173 1373 1.605 1873 2183 2540 2952 3426 3970 4595 1.184 1400 1653 1548 2292 2653 3159 3.700 4.326 5.054 3380 -3 996 4717 5 560 1196 1428 1702 2026 2407 2854 2332 2 580 2.853 3.479 4226 4652 2518 2813 3 138 3896 4818 5.350 2720 3.066 3.452 4.363 5 492 6153 2937 3.342 3.798 4887 6261 7076 3.172 3 642 4177 5.474 7.138 8.137 Done 6130 8137 9358 6.865 9276 10 76 7 690 10.58 1238 - X Reference Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Period 50 r Question 4. PM11-32A (similar to) 1.138 1.294 1469 1.665 1886 2133 2410 2720 3.0663452 4.363 5492 6.153 1.149 1.319 1.513 1.732 1.980 2261 2579 2.937 3.342 3.798 4.887 6.261 7.076 1.161 1.346 1.558 1.801 2.079 2.397 2759 3.172 3.642 4.177 5.474 7.138 8.137 1.270 1.282 1.873 2.183 2540 2.952 3.426 3.970 4.595 6.130 8.137 9.358 1.948 2.292 2.693 3.159 3.700 4.328 5.054 6.866 9.276 10.76 1.173 1.373 1.605 1.184 1.400 1.653 1.196 1.428 1.702 1.208 1.457 1.754 2.026 2407 2.854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 2107 2.527 3.026 3.617 4.316 5.142 6.116 8.613 12.06 1423 1.220 1.486 1.806 2.191 2.653 3.207 3.870 4.661 5.604 6.727 9.646 13.74 16.37 1.232 1.516 1.860 2.279 2786 3.400 4.141 5.034 6.109 7.400 10.80 15.67 18.82 1.245 1.546 1.916 2.370 2.925 3.604 4.430 5.437 6.659 8.140 12.10 17.86 21.64 1.257 1.577 1.974 2465 3.072 3.820 4.741 5.871 7.258 8.954 13.55 20.36 24.89 1.608 2.033 2563 3.225 4.049 5.072 6.341 7.911 9.850 15.18 23.21 28.63 1.641 2.094 2.666 3.386 4 292 5.427 6.848 8.623 10.83 17.00 26.46 32.92 1.295 1.673 2.157 1.308 1.707 2221 1.321 1.741 1.335 1.348 1.811 2.288 2.999 3.920 5.112 6.649 8.627 11.17 14 42 3.119 4.116 5418 7.114 9.317 12.17 15.86 2427 3.243 4.322 5.743 7.612 10.06 13.27 17.45 4.801 7.040 10.29 14.97 21.72 31.41 45 26 7.107 11.47 18.42 29 46 46.90 74 36 117.4 1.776 2357 1.489 2.208 3.262 1.645 2.692 4.384 HW Score: 0%, 0 of 1 - X 2772 3.556 4549 5.807 7.396 9.399 11.92 19.04 2.883 3.733 4.822 6214 7.988 10.25 13.11 21 32 23 88 26.75 29.96 50.96 66.21 Print Done 30.17 37.86 34.39 43.54 39 20 50.07 44 69 57 58 93 05 188.9 267.9 2890 700 2 1,084 4 Reference Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 www.p Question 4. PM11-32A (similar to) Future Value of Ordinary Annuity of $1 1% 3% 4% 5% 8% 9% 6% 7% 2% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2010 2020 2030 2040 2050 2060 2070 2800 2.090 3.060 3.091 3.122 3.153 3.184 4.184 4.246 4.310 5.309 5.416 5.526 3.030 4.060 4.122 5.101 5.204 11.57 12 17 12.68 13 41 13.81 14.68 6.152 6.308 6.468 6.633 6.802 6.975 7.214 7.434 7.662 7.898 8.142 8.394 8.286 8.583 8.892 9.214 9.549 9.897 9.369 9.755 10.16 10.58 11.03 11.49 10.46 10.95 11:46 12:01 1258 13 18 13.49 14.21 14.97 15.03 15.92 16.63 17.71 19.60 21.02 21.58 23 28 12 81 14 19 15 62 14.95 15.97 17.09 18 29 16.10 17.29 18.60 20.02 10% 15% 5.637 12% 14% 1.000 1.000 1.000 1.000 2100 2120 2.140 2.150 3215 3246 3.278 3.310 3.374 3440 3.473 4.375 4.440 4.506 4.573 4.641 4.779 4.921 4.993 5.751 5.867 5.985 6.105 6.353 6.610 6.742 7.153 7.336 7523 7.716 8.115 8536 8.754 8.654 8.923 9200 9.487 10.09 10.73 11.07 10.260 10.64 11.03 11.44 12.30 13.23 13.73 11.98 12.49 13.02 13.58 14.78 16.09 16.79 13.82 14.49 15.19 15.94 17.55 19.34 20.30 16.87 17.89 18.88 20.14 22.55 25.13 17.26 18.64 20.16 21.82 23 66 25.67 18.43 20.01 21.76 23.70 19.61 21.41 23 41 25 65 25.84 28 13 Print 15.78 16.65 17.56 18.53 20 65 23.04 18.98 20.14 21.38 24.13 21.50 22.95 24.52 28.03 24 21 26.02 27.15 29.36 27.98 31.77 28 21 30 91 35 95 40 54 37.45 41.30 45.60 27.89 30 32 33.00 30.84 33.75 36 97 34.00 Done HW Score: 0%, 0 of 1 X 27 27 32 09 24 35 29.00 34 35 32 39 37.58 40,50 37.28 43.84 47.58 42.75 50.98 55.72 48.88 59.12 65.08 55 75 68 39 75.84 :)) - th WO nnu S mula ble Reference Period 13 Period 14 Period 15 Period 16 Period 17 Period 18 Period 19 Period 20 Period 21 Period 22 Period 23 Period 24 Period 25 Period 26 Period 27 Period 28 Period 29 Period 30 Period 40 Period 50 Sup Question 4. PM11-32A (similar to) 13.81 14.68 34 35 14.95 16.10 15.62 1663 17.71 18.88 20.14 21.50 22.95 24 52 28.03 32.09 15.97 17.09 18.29 19.60 21.02 22.55 24.21 26.02 27.98 32.39 37.58 40.50 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 31.77 37.28 43.84 47.58 27.89 30.32 33.00 35.95 42.75 50.98 55.72 30 84 33.75 36.97 40.54 48.88 59.12 65.08 34.00 37.45 41.30 45.60 55.75 68.39 75.84 41.45 46.02 51.16 63.44 78.97 88.21 45.76 51.16 57 28 72.05 91.02 102.4 17:26 18.64 20.16 21.82 23.66 18.43 20.01 21.76 23.70 25.84 19.61 21.41 23.41 25.65 28 13 20.81 22.02 22.84 25.12 27.67 30.54 24.30 26.87 29.78 33.07 23 24 25.78 28.68 31.97 35.72 24.47 27.30 30.54 38 51 25.72 28.85 32 45 41.43 26.97 30.42 34 43 28.24 32.03 36.46 48.89 60 40 64.46 84 58 34 25 36.62 29.53 33.67 38.55 44 31 51.11 30.82 35.34 40.71 47.08 54.67 32.13 37.05 42.93 49.97 58.40 33.45 38.79 52.97 62 32 34.78 40 57 56 08 66.44 95 03 1527 45 22 47 58 75 40 112.8 39.08 44.50 41.65 47.73 120 8 2093 25.67 28 21 30.91 33.76 37 38 36.79 41.00 Print 39.99 43.39 47.00 50.82 54.86 59.16 63.71 68.53 73.64 79.06 154 8 290 3 44.87 50.42 56.76 64.00 81.70 104.8 118.8 29.01 55.46 62.87 71.40 92.50 120 4 137.6 79.54 104.6 138.3 159.3 53.44 60.89 69 53 118.2 158.7 184.2 133.3 181.9 212.8 58.18 63.25 87.35 94 46 66.76 76.79 88.50 73.11 84.70 98.35 68.68 79.95 93.32 109.2 74 48 87.35 102.7 121.1 80.70 95.34 1130 134 2 104.0 1241 1486 113.3 1363 199 6 4065 HW Score: 0%. 0 of 10 X 150.3 208.3 245.7 169.4 238.5 283.6 190.7 2729 327.1 214.6 3121 377 2 164.5 241.3 3568 434.7 Done 259 1 337.9 4426 767.1 1,342 1,779 573.8 815.1 1.164 2.400 4.995 7.218 - 4 apreciation and requires an annual return of 12% VS nd 000 Net Cash Inflows Annual Accumulated Requirements A Print 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Colston choose? Why? (Click the icon to view Future Value of 51 table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) - X Done al return of 12% and the profitab the payback so lated Requirements B Print 1. Compute the payback, the ARR, the NPV, and the profitability index of these two options. 2. Which option should Colston choose? Why? (Click the icon to view Future Value of $1 table.) (Click the icon to view Future Value of Ordinary Annuity of $11 - X Done of t ro !!!! Question 4, PM11-32A (similar to) Part 1 of 9 Data table 13 Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total Refurbish Current S S Machine Print 994 1,680,000 $ 390,000 320,000 250,000 180,000 180,000 180,000 180,000 3,360,000 $ P Purchase New Machine Done CO 4,200,000 430,000 360,000 290,000 220,000 220,000 220,000 220,000 220,000 220,000 6,600,000 Pil 85 C FO 12% ofitab ck sc More info Print - X The company is considering two options. Option 1 is to refurbish the current machine at a cost of $2,400,000. If refurbished, Colston expects the machine to last another eight years and then have no residual value. Option 2 is to replace the machine at a cost of $4,400,000. A'new machine would last 10 years and have no residual value. Done - alue (Click the icon to view additional information.) Colston expects the following net cash inflows from the two options: (Click the icon to view the net cash flows.) Colston uses straight-line depreciation and requires an annual return of 12%. Requirement 1. Compute the payback, the ARR, the NPV, and the profitability in Compute the payback for both options. Begin by completing the payback schedu