Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer question using the template provided. please follow instructions attached Cost of Owning and Cost of Leasing The Morton Clinic needs to replace its

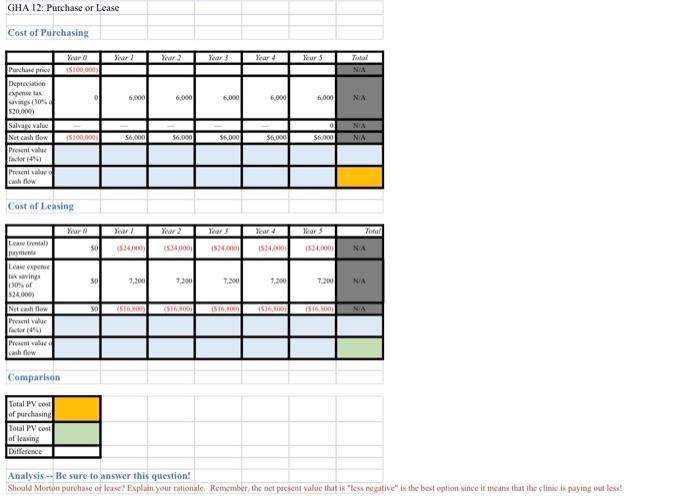

please answer question using the template provided. please follow instructions attached

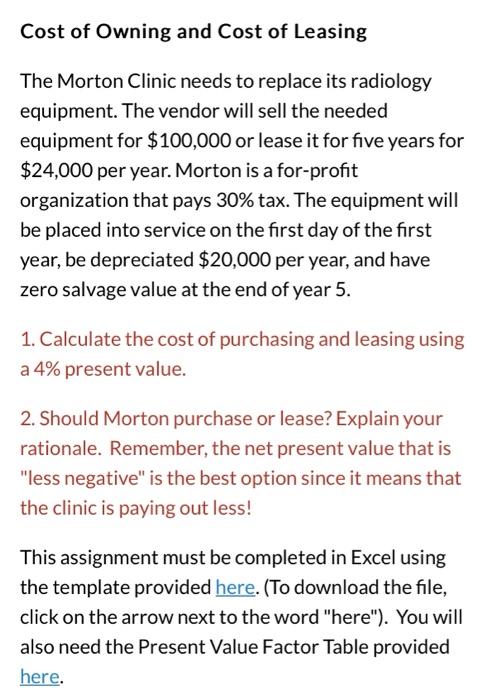

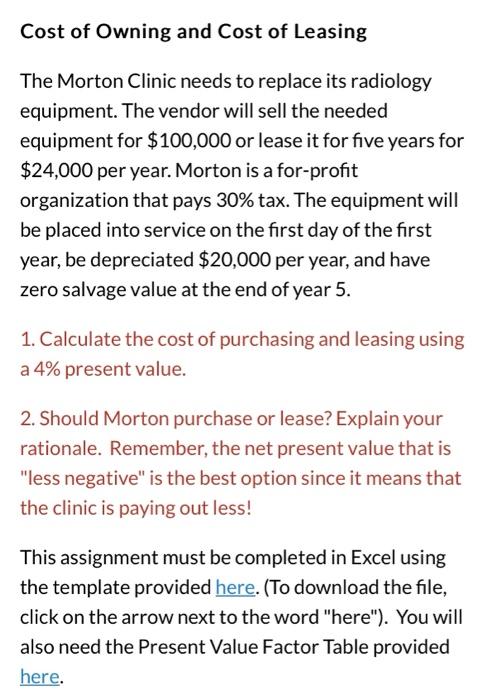

Cost of Owning and Cost of Leasing The Morton Clinic needs to replace its radiology equipment. The vendor will sell the needed equipment for $100,000 or lease it for five years for $24,000 per year. Morton is a for-profit organization that pays 30% tax. The equipment will be placed into service on the first day of the first year, be depreciated $20,000 per year, and have zero salvage value at the end of year 5 . 1. Calculate the cost of purchasing and leasing using a 4% present value. 2. Should Morton purchase or lease? Explain your rationale. Remember, the net present value that is "less negative" is the best option since it means that the clinic is paying out less! This assignment must be completed in Excel using the template provided here. (To download the file, click on the arrow next to the word "here"). You will also need the Present Value Factor Table provided here. Cost of Leasing Comparisen Cost of Owning and Cost of Leasing The Morton Clinic needs to replace its radiology equipment. The vendor will sell the needed equipment for $100,000 or lease it for five years for $24,000 per year. Morton is a for-profit organization that pays 30% tax. The equipment will be placed into service on the first day of the first year, be depreciated $20,000 per year, and have zero salvage value at the end of year 5 . 1. Calculate the cost of purchasing and leasing using a 4% present value. 2. Should Morton purchase or lease? Explain your rationale. Remember, the net present value that is "less negative" is the best option since it means that the clinic is paying out less! This assignment must be completed in Excel using the template provided here. (To download the file, click on the arrow next to the word "here"). You will also need the Present Value Factor Table provided here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started