please answer questions 1 through 5 please!

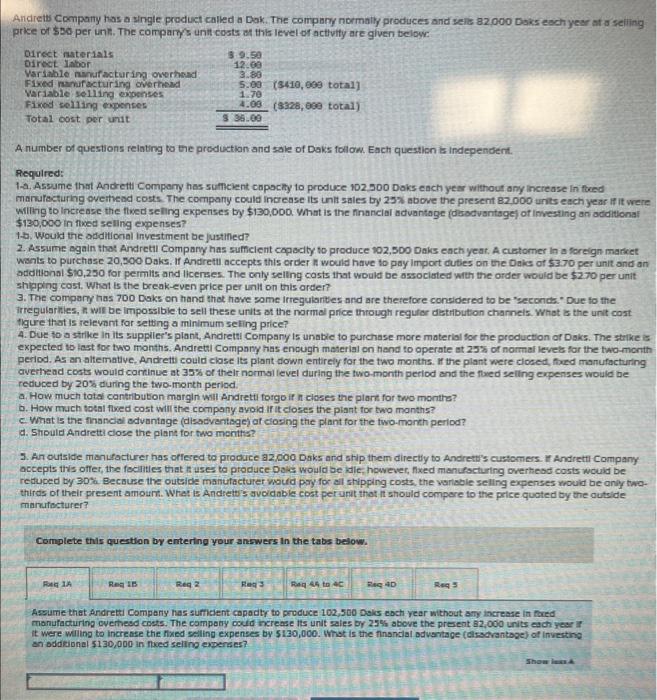

Ardrets Company has a single product called a Dok. The compary normally produces and sele 82,000 Doks esch year at as seiling prike of $ so per ink. The comparts unti costs at this level of actlvity are given belowe A number of questions relating to the productian and sale of Daks follom. Each question is independent. Required: 1-a. Assume that Andrett Company has sumeient copocty to produce 102.900 Daks each year without any increase in fleed manutacturing oveityead costs. The company could increase its unit sales by 25% above the present B2,000 units each year if it were Wilitg to increase the flwed seling expenses by $130,000. What is the financial aduantoge (desadvantsgej of investing an additional $130,000 in flwed selling expenses? 1.6. Woukd the odditional investment be justifed? 2. Assume again that Andretil Company has sufficient capselty to produce 102,500 Daks ench yeat. A customer in a forelgn market Wants to purchuse 20,500 Daks. If Andrett aceepts this order it would have to pay import duties on the Daic or 5370 per unit and an additional $10,250 for permits and licerses. The cnly selthg casts that would be assocloted with the order would be $270 per unit shiping cost. What is the break-even price per unlt on this arder? 3. The compary has 700 Daks on hand thet have some Irregularites and are theiefore considered to be "gecondz:" Due fo the irregularikies, n wir be impossibie to sell these units at the normel price through regular distibution chamnels. What is the unit cost Nigure that is reievant far setting a minimum seling price? 4. Due to a strike in its suppiler"s plant, Andretu Company Is unabie to purchase more material for the production or Daks. The strike is expected to last for two months. Andretal Company has enough material on hand to operate at 25% of normal levets for the two-month period. As an altemative. Andretti could close its piant down entirely for the tao months. If the plant were closed, fixed manufacturing averhead coats would carninue at 35% of their normal level during the two-month period and the flued selling expenses would be reduced by 20 s during the two-month period. a. How much tota cantributon margin will Andrett forgo if in cioses the plark for two monthe? b. How much total fived cost wili the company avoid if it eloses the piant for two manths? c. What is the financidi advantage (disadvantage) of elosing the plant for the two-month period? a. Should Andretti close the piant for two montts? 5. An outside manufacturer has offered to procuce a2,000 Daks and ship them directly to Andrett's customers. ir Andrettl Company occepts this ofter, the foclties that it uses to produce Dols would be idie, however, fxed manufscturing overhesd costs would be reduced ty 30\%i. Because the outside manufacturer woufd poy for all shipping costs, the variable selling expenses would be anly twothirds of their present amount. What is Andrets's avoidable cost per anit thot it should compere to the price quated by the autside marnufecturer? Complete this question by entertng your answers in the tabs below. Assume that Andretti Compeny has sumicient capadty to produce 102,500 Doks each year without any increase in fared monufadturing overthesd coets. The compony coud increase lts unit saies by 25\% above the present 82,000 units each year in it were wiling to increase the fxed selling expenses by 5130,000 . Whot is the fnnsnclat odvantage (disctrantoge) of Investing sn oddieional 5130,000 in nued seling expenses