Answered step by step

Verified Expert Solution

Question

1 Approved Answer

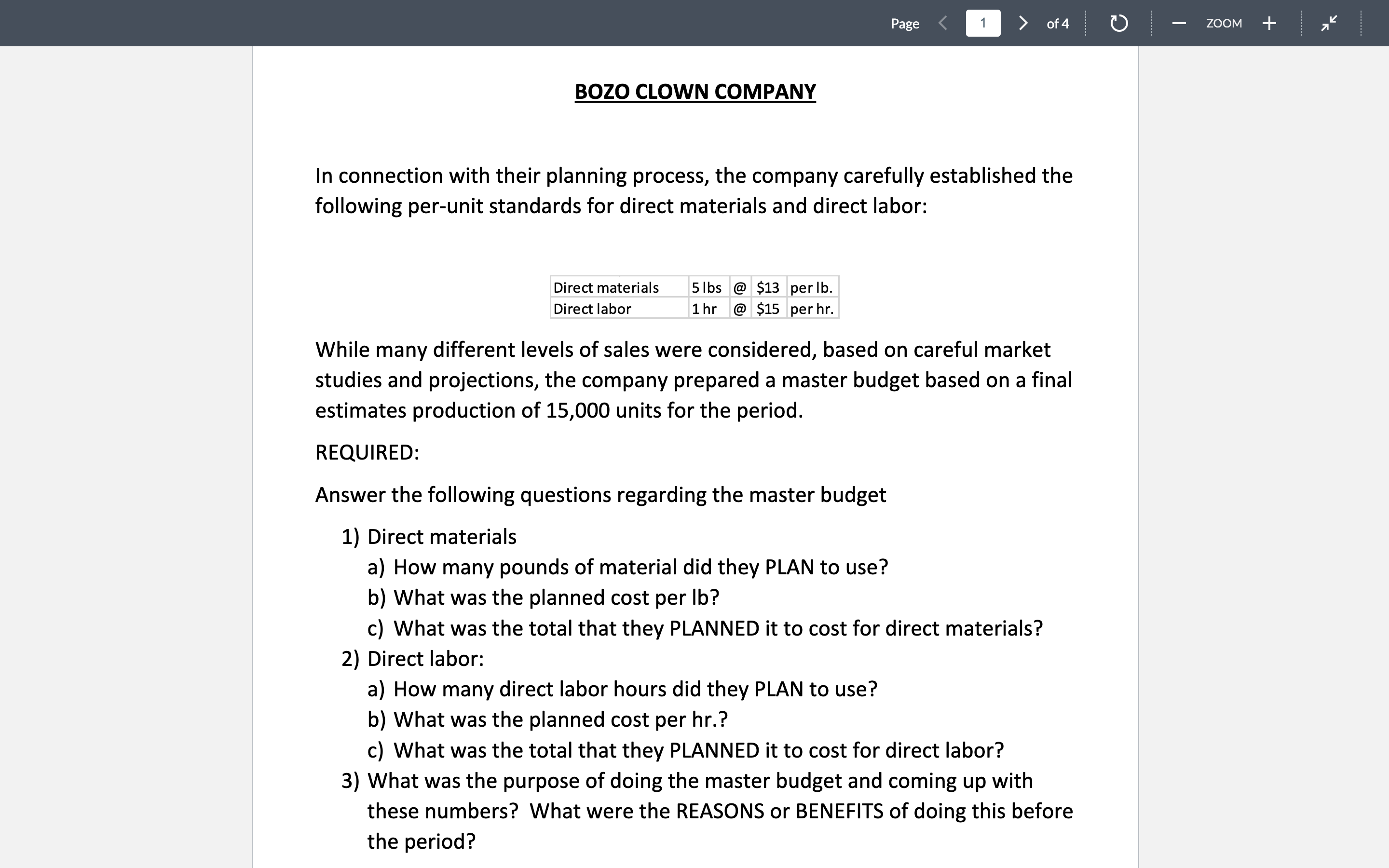

Please Answer Questions 1-10, Thank you:) In connection with their planning process, the company carefully established the following per-unit standards for direct materials and direct

Please Answer Questions 1-10, Thank you:)

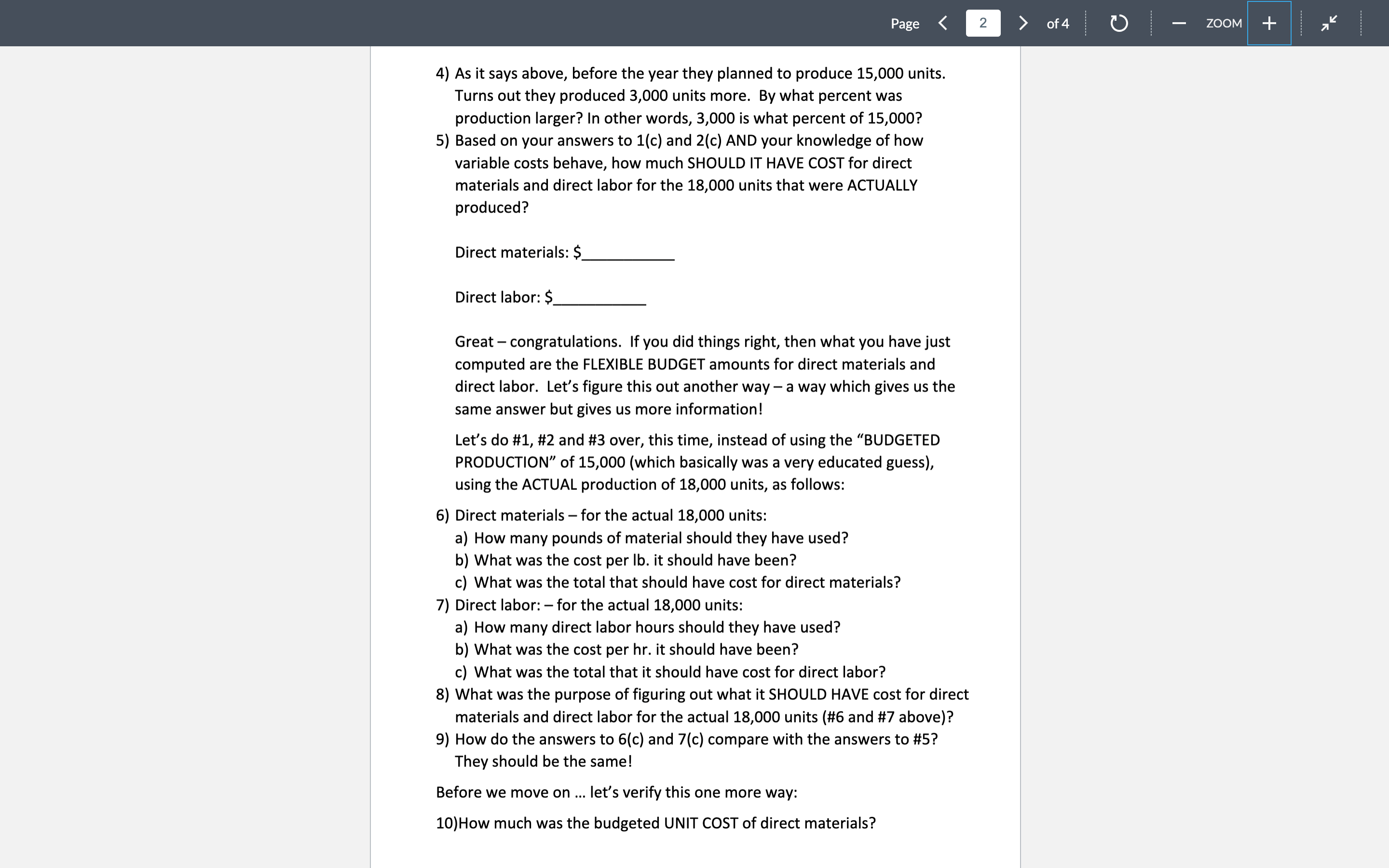

In connection with their planning process, the company carefully established the following per-unit standards for direct materials and direct labor: While many different levels of sales were considered, based on careful market studies and projections, the company prepared a master budget based on a final estimates production of 15,000 units for the period. REQUIRED: Answer the following questions regarding the master budget 1) Direct materials a) How many pounds of material did they PLAN to use? b) What was the planned cost per lb? c) What was the total that they PLANNED it to cost for direct materials? 2) Direct labor: a) How many direct labor hours did they PLAN to use? b) What was the planned cost per hr.? c) What was the total that they PLANNED it to cost for direct labor? 3) What was the purpose of doing the master budget and coming up with these numbers? What were the REASONS or BENEFITS of doing this before the period? 4) As it says above, before the year they planned to produce 15,000 units. Turns out they produced 3,000 units more. By what percent was production larger? In other words, 3,000 is what percent of 15,000? 5) Based on your answers to 1(c) and 2(c) AND your knowledge of how variable costs behave, how much SHOULD IT HAVE COST for direct materials and direct labor for the 18,000 units that were ACTUALLY produced? Direct materials: \$ Direct labor: \$ Great - congratulations. If you did things right, then what you have just computed are the FLEXIBLE BUDGET amounts for direct materials and direct labor. Let's figure this out another way - a way which gives us the same answer but gives us more information! Let's do #1,#2 and #3 over, this time, instead of using the "BUDGETED PRODUCTION" of 15,000 (which basically was a very educated guess), using the ACTUAL production of 18,000 units, as follows: 6) Direct materials - for the actual 18,000 units: a) How many pounds of material should they have used? b) What was the cost per lb. it should have been? c) What was the total that should have cost for direct materials? 7) Direct labor: - for the actual 18,000 units: a) How many direct labor hours should they have used? b) What was the cost per hr. it should have been? c) What was the total that it should have cost for direct labor? 8) What was the purpose of figuring out what it SHOULD HAVE cost for direct materials and direct labor for the actual 18,000 units ( #6 and #7 above)? 9) How do the answers to 6(c) and 7(c) compare with the answers to \#5? They should be the same! Before we move on ... let's verify this one more way: 10)How much was the budgeted UNIT COST of direct materialsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started