please answer questions 1&2, give explanation & show all work please thx

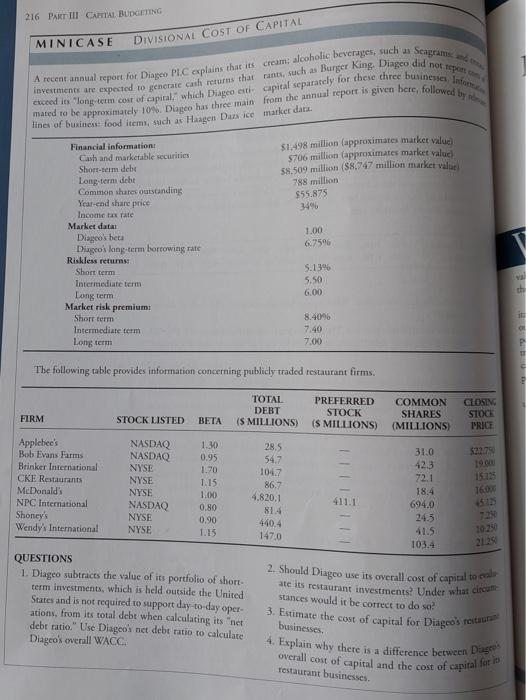

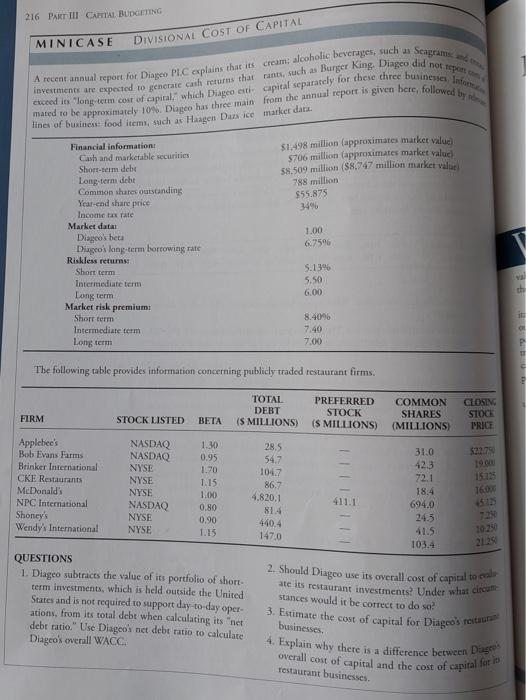

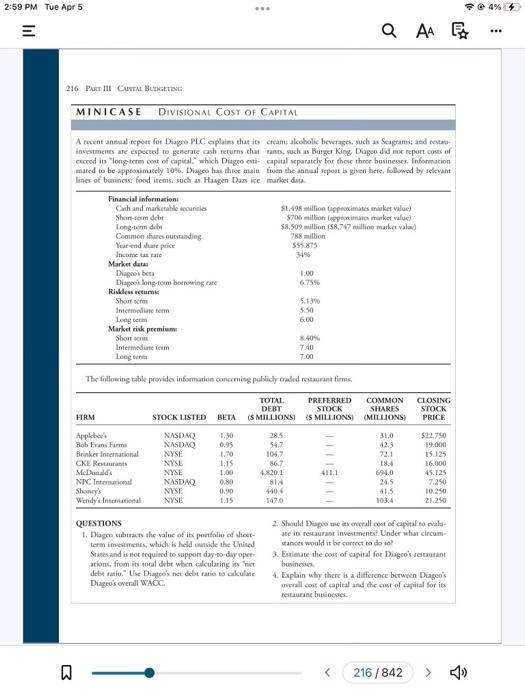

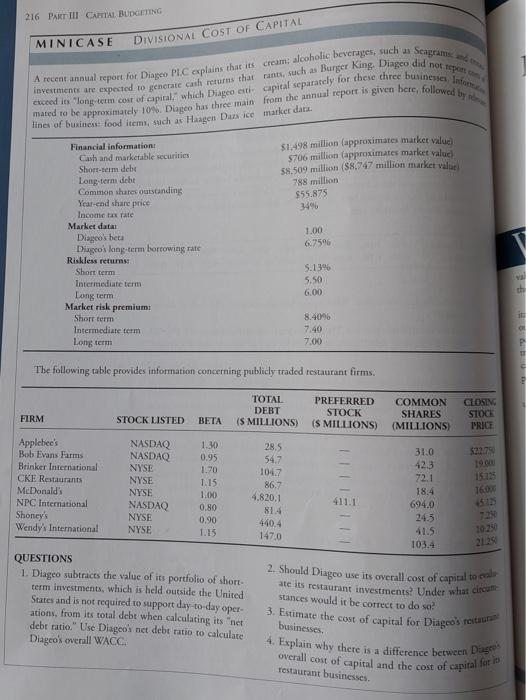

216 PART III CAPITAL BUDGETING DIVISIONAL COST OF CAPITAL Seaga MINICASE investments are expected to generare cash returns that rants, such as Burger King Diageo did not to A recent annual report for Diageo PLC explains that its cream; alcoholic beverages, such a cxceed its long-term cost of capital, which Diageo esticapital separately for these three businesses mated to be approximately 10. Diageo has three main from the annual report is given here, followed by the lines of business food items, such as Haagen Dars ice marker data. $1,498 million (approximates market value 5706 million (approximates market value $8.509 million (88.747 million market value 788 million $55.875 349 Financial information Cash and marketable securities Short-term debe Long-term debe Common shares outstanding Year-end share price Income tax rate Market data Diageo's beta Diageo long-term borrowing rate Riskless returns Short term Intermediate term Long term Market tisk premium Short term Intermediate term Long term 1.00 6.759 5.13% 5.50 6.00 th 8.4096 7.40 7.00 The following table provides information concerning publicly traded restaurant firms. TOTAL DEBT (S MILLIONS) FIRM PREFERRED STOCK (S MILLIONS) CLOSING STOCK PRICE STOCK LISTED COMMON SHARES (MILLIONS) BETA $22.79 1900 15.125 Applebee's Bob Evans Farms Brinker International CKE Restaurants McDonald's NPC International Shoney's Wendys International NASDAQ NASDAQ NYSE NYSE NYSE NASDAQ NYSE NYSE 1.30 0.95 1.70 1.15 1.00 0.80 0.90 28.5 547 104.7 86,7 4.820.1 81.4 440.4 411.1 31.0 423 72.1 18.4 694.0 24.5 41.5 103.4 160 1511 22 1.15 147.0 215 QUESTIONS 1. Diageo subtracts the value of its portfolio of short- term investments, which is held outside the United States and is not required to support day-to-day oper- ations, from its total debe when calculating its "net debe ratio." Use Diageo's net debt ratio to calculate Diageo's overall WACC. 2. Shoald Diageo use its overall cost of capital to cal ate its restaurant investments? Under what circum stances would it be correct to do so 3. Estimate the cost of capital for Diageo's restaur businesses, 4. Explain why there is a difference between Dingen overall cost of capital and the cost of capital for i restaurant businesses. 2:59 PM Tue Apr 5 ... 94% A A A ... 216 PART II CATTABUDGETING MINICASE DIVISIONAL COST OF CAPITAL A recent annual report for Diageo PLC aplains that it can alcoholic beverages, such as Seagrams and resta Investments are expected to generate cash returns that rants, such as Burger King Diago di me report costs of stered in long-term cost of capital, which Diagre esti capital separately for these three businesses. Information mated to be approximately 10%. Diageo has three main from the annual sport is given here. foBlowed by scevant lines of business food items, such an Haagen Danske market data Financial information Cath and marketable oil $1.498 million appecocimates market value) Sheinem debet 5706 million approximate market value Long-term debet $8.509 million (58.747 million market value Common shares outstanding 788 million Year-end dhe price 555.875 Income state 319 Market data Diago bet 1.00 Dispook long-term borrowing rate 6799 Riskless retums Short som 5.13 Intermodine term Long term 6.00 Market risk premium Shorts 3,40% Intermodine form 7.40 Long term 7.00 550 The following table provide information concerning publicly traded restaurant tims. TOTAL DEBT (S MILLIONS PREFERRED STOCK (S MILLIONS) COMMON SHARES (MILLIONS) CLOSING STOCK PRICE HRM STOCK LISTED BETA 31.0 Apple Bob Frans Harm Brinker International CKER McDonald's NTC International Sheney's Windy Internacional 72.1 18.4 NASDAQ NASDAQ NYSE NYSE NYSE NASDAQ NYSE NYSE 1.50 0.95 1.70 1.15 1.00 0.80 0.90 28.5 547 104 867 4201 814 4404 1470 620 $22.750 19.000 15.125 16.000 45.125 7.250 10.250 21.250 245 41.5 103.4 QUESTIONS 1. Diagro subtract the value of its panfolio of short term investments, which is held outside the United States and is not required to support day-to-day opet ation, from its total debt when calculating its net debt ratio. Use Disco's net debt ration to calculate Diageo's overall WAOC 2. Should pole is call cost of capital to evalu ate i restaurant investments Under what circum- stances would it be correct to do so 3. Estimate the cost of capital for Diageo rescura businesses 4. Explain why there is a difference between Diageo's werall cost of capital and the cost of capital for it restaurant businesses 216 PART III CAPITAL BUDGETING DIVISIONAL COST OF CAPITAL Seaga MINICASE investments are expected to generare cash returns that rants, such as Burger King Diageo did not to A recent annual report for Diageo PLC explains that its cream; alcoholic beverages, such a cxceed its long-term cost of capital, which Diageo esticapital separately for these three businesses mated to be approximately 10. Diageo has three main from the annual report is given here, followed by the lines of business food items, such as Haagen Dars ice marker data. $1,498 million (approximates market value 5706 million (approximates market value $8.509 million (88.747 million market value 788 million $55.875 349 Financial information Cash and marketable securities Short-term debe Long-term debe Common shares outstanding Year-end share price Income tax rate Market data Diageo's beta Diageo long-term borrowing rate Riskless returns Short term Intermediate term Long term Market tisk premium Short term Intermediate term Long term 1.00 6.759 5.13% 5.50 6.00 th 8.4096 7.40 7.00 The following table provides information concerning publicly traded restaurant firms. TOTAL DEBT (S MILLIONS) FIRM PREFERRED STOCK (S MILLIONS) CLOSING STOCK PRICE STOCK LISTED COMMON SHARES (MILLIONS) BETA $22.79 1900 15.125 Applebee's Bob Evans Farms Brinker International CKE Restaurants McDonald's NPC International Shoney's Wendys International NASDAQ NASDAQ NYSE NYSE NYSE NASDAQ NYSE NYSE 1.30 0.95 1.70 1.15 1.00 0.80 0.90 28.5 547 104.7 86,7 4.820.1 81.4 440.4 411.1 31.0 423 72.1 18.4 694.0 24.5 41.5 103.4 160 1511 22 1.15 147.0 215 QUESTIONS 1. Diageo subtracts the value of its portfolio of short- term investments, which is held outside the United States and is not required to support day-to-day oper- ations, from its total debe when calculating its "net debe ratio." Use Diageo's net debt ratio to calculate Diageo's overall WACC. 2. Shoald Diageo use its overall cost of capital to cal ate its restaurant investments? Under what circum stances would it be correct to do so 3. Estimate the cost of capital for Diageo's restaur businesses, 4. Explain why there is a difference between Dingen overall cost of capital and the cost of capital for i restaurant businesses. 2:59 PM Tue Apr 5 ... 94% A A A ... 216 PART II CATTABUDGETING MINICASE DIVISIONAL COST OF CAPITAL A recent annual report for Diageo PLC aplains that it can alcoholic beverages, such as Seagrams and resta Investments are expected to generate cash returns that rants, such as Burger King Diago di me report costs of stered in long-term cost of capital, which Diagre esti capital separately for these three businesses. Information mated to be approximately 10%. Diageo has three main from the annual sport is given here. foBlowed by scevant lines of business food items, such an Haagen Danske market data Financial information Cath and marketable oil $1.498 million appecocimates market value) Sheinem debet 5706 million approximate market value Long-term debet $8.509 million (58.747 million market value Common shares outstanding 788 million Year-end dhe price 555.875 Income state 319 Market data Diago bet 1.00 Dispook long-term borrowing rate 6799 Riskless retums Short som 5.13 Intermodine term Long term 6.00 Market risk premium Shorts 3,40% Intermodine form 7.40 Long term 7.00 550 The following table provide information concerning publicly traded restaurant tims. TOTAL DEBT (S MILLIONS PREFERRED STOCK (S MILLIONS) COMMON SHARES (MILLIONS) CLOSING STOCK PRICE HRM STOCK LISTED BETA 31.0 Apple Bob Frans Harm Brinker International CKER McDonald's NTC International Sheney's Windy Internacional 72.1 18.4 NASDAQ NASDAQ NYSE NYSE NYSE NASDAQ NYSE NYSE 1.50 0.95 1.70 1.15 1.00 0.80 0.90 28.5 547 104 867 4201 814 4404 1470 620 $22.750 19.000 15.125 16.000 45.125 7.250 10.250 21.250 245 41.5 103.4 QUESTIONS 1. Diagro subtract the value of its panfolio of short term investments, which is held outside the United States and is not required to support day-to-day opet ation, from its total debt when calculating its net debt ratio. Use Disco's net debt ration to calculate Diageo's overall WAOC 2. Should pole is call cost of capital to evalu ate i restaurant investments Under what circum- stances would it be correct to do so 3. Estimate the cost of capital for Diageo rescura businesses 4. Explain why there is a difference between Diageo's werall cost of capital and the cost of capital for it restaurant businesses