Please answer questions 1-6.

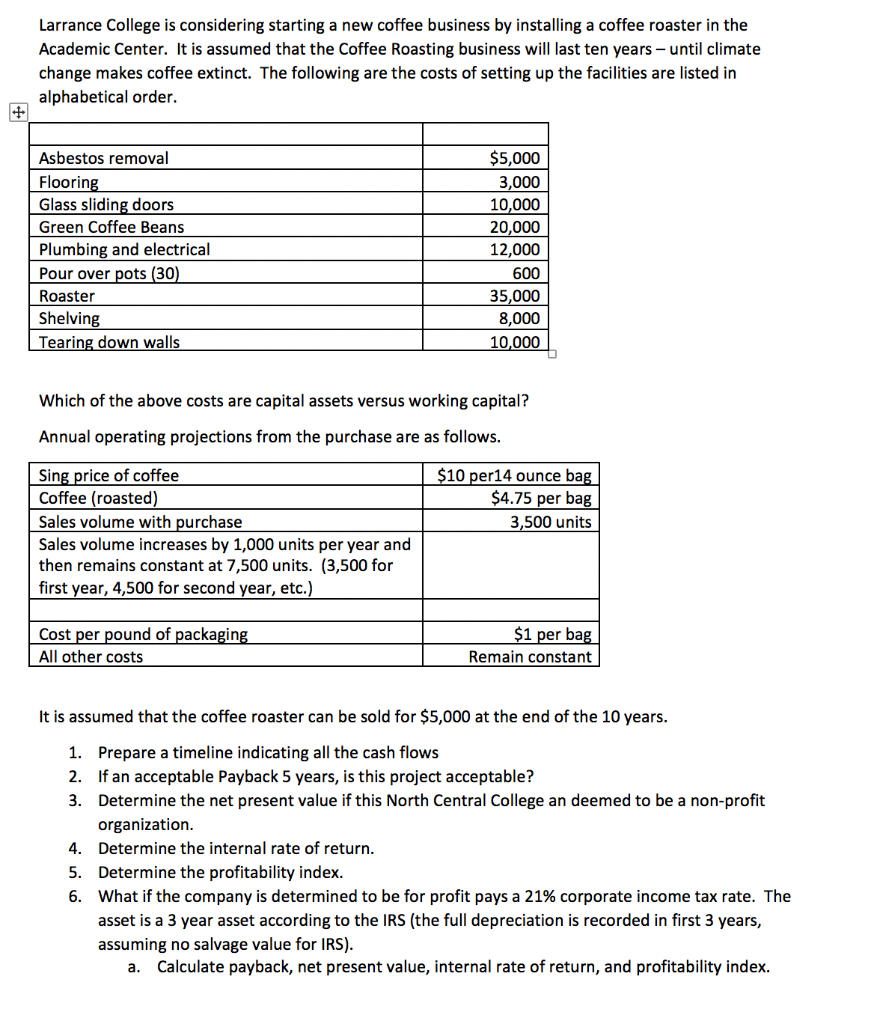

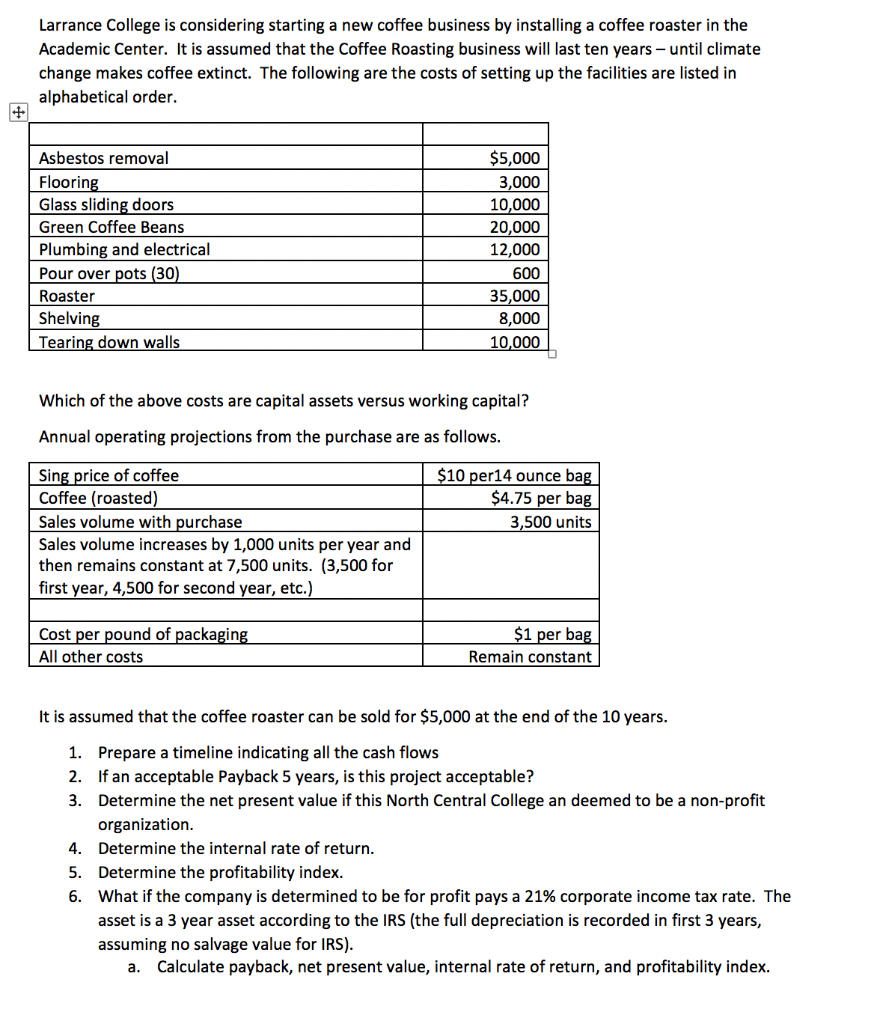

Larrance College is considering starting a new coffee business by installing a coffee roaster in the Academic Center. It is assumed that the Coffee Roasting business will last ten years - until climate change makes coffee extinct. The following are the costs of setting up the facilities are listed in alphabetical order. Asbestos removal Flooring Glass sliding doors Green Coffee Beans Plumbing and electrical Pour over pots (30) Roaster Shelving Tearing down walls $5,000 3,000 10,000 20,000 12,000 600 35,000 8,000 10,000 Which of the above costs are capital assets versus working capital? Annual operating projections from the purchase are as follows. $10 per14 ounce bag $4.75 per bag 3,500 units Sing price of coffee Coffee (roasted) Sales volume with purchase Sales volume increases by 1,000 units per year and then remains constant at 7,500 units. (3,500 for first year, 4,500 for second year, etc.) Cost per pound of packaging All other costs $1 per bag Remain constant It is assumed that the coffee roaster can be sold for $5,000 at the end of the 10 years. 1. Prepare a timeline indicating all the cash flows 2. If an acceptable Payback 5 years, is this project acceptable? 3. Determine the net present value if this North Central College an deemed to be a non-profit organization. 4. Determine the internal rate of return. 5. Determine the profitability index. 6. What if the company is determined to be for profit pays a 21% corporate income tax rate. The asset is a 3 year asset according to the IRS (the full depreciation is recorded in first 3 years, assuming no salvage value for IRS). a. Calculate payback, net present value, internal rate of return, and profitability index. Larrance College is considering starting a new coffee business by installing a coffee roaster in the Academic Center. It is assumed that the Coffee Roasting business will last ten years - until climate change makes coffee extinct. The following are the costs of setting up the facilities are listed in alphabetical order. Asbestos removal Flooring Glass sliding doors Green Coffee Beans Plumbing and electrical Pour over pots (30) Roaster Shelving Tearing down walls $5,000 3,000 10,000 20,000 12,000 600 35,000 8,000 10,000 Which of the above costs are capital assets versus working capital? Annual operating projections from the purchase are as follows. $10 per14 ounce bag $4.75 per bag 3,500 units Sing price of coffee Coffee (roasted) Sales volume with purchase Sales volume increases by 1,000 units per year and then remains constant at 7,500 units. (3,500 for first year, 4,500 for second year, etc.) Cost per pound of packaging All other costs $1 per bag Remain constant It is assumed that the coffee roaster can be sold for $5,000 at the end of the 10 years. 1. Prepare a timeline indicating all the cash flows 2. If an acceptable Payback 5 years, is this project acceptable? 3. Determine the net present value if this North Central College an deemed to be a non-profit organization. 4. Determine the internal rate of return. 5. Determine the profitability index. 6. What if the company is determined to be for profit pays a 21% corporate income tax rate. The asset is a 3 year asset according to the IRS (the full depreciation is recorded in first 3 years, assuming no salvage value for IRS). a. Calculate payback, net present value, internal rate of return, and profitability index