Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer questions 35, 1, & 4. I have an exam tomorrow and I cant figure these last three questions out! Which of the following

Please answer questions 35, 1, & 4. I have an exam tomorrow and I cant figure these last three questions out!

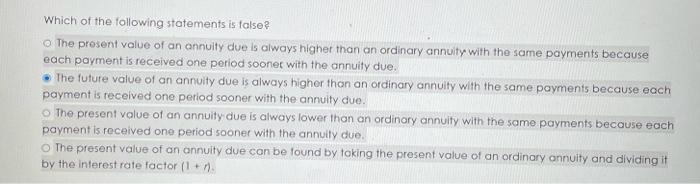

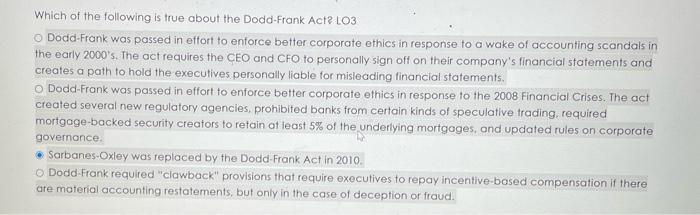

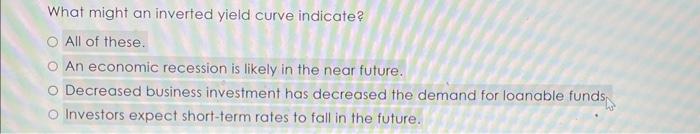

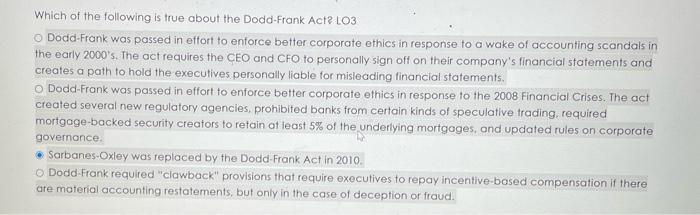

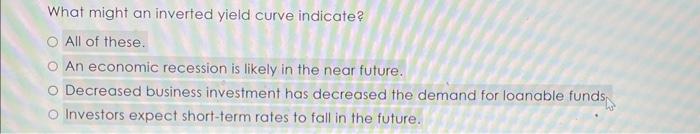

Which of the following statements is false? The present volue of an annuity due is always higher than an ordinary annuity with the same payments because each payment is received one period sooner with the annuity due. The future value of an annuity due is always higher than an ordinary annuity with the same payments because each. payment is received one period sooner with the annuity due. The present value of an annuity due is always lower than an ordinary annuity with the same payments because each payment is received one period sooner with the annuly due. The present value of an annuity due can be found by taking the present value of an ordinary annuity and dividing it by the interest rate factor (1+n). Which of the following is true about the Dodd-Frank Act? LO3 Dodd-Frank was passed in effort to entorce better corporate ethics in response to a wake of accounting scandals in the early 2000 's. The act requires the CEO and CFO to personally sign off on their company's financial statements and creates a path to hold the executives personally liable for misleading financial statements. Dodd-Frank was passed in effort to enforce better corporate ethics in response to the 2008 Financial Crises. The act created several new regulatory agencies, prohibited banks from certain kinds of speculative trading, required mortgage-backed security creators to retain at least 5% of the underlying mortgoges, and updated rules on corporate governance. Sarbanes-Oxley was replaced by the Dodd-Frank Act in 2010 . Dodd-Frank required "clawback" provisions that require executives to repay incentive-based compensation if there are material accounting restatements, but only in the case of deception or fraud. What might an inverted yield curve indicate? All of these. An economic recession is likely in the near future. Decreased business investment has decreased the demand for loanable funds. Investors expect short-term rates to fall in the future

Which of the following statements is false? The present volue of an annuity due is always higher than an ordinary annuity with the same payments because each payment is received one period sooner with the annuity due. The future value of an annuity due is always higher than an ordinary annuity with the same payments because each. payment is received one period sooner with the annuity due. The present value of an annuity due is always lower than an ordinary annuity with the same payments because each payment is received one period sooner with the annuly due. The present value of an annuity due can be found by taking the present value of an ordinary annuity and dividing it by the interest rate factor (1+n). Which of the following is true about the Dodd-Frank Act? LO3 Dodd-Frank was passed in effort to entorce better corporate ethics in response to a wake of accounting scandals in the early 2000 's. The act requires the CEO and CFO to personally sign off on their company's financial statements and creates a path to hold the executives personally liable for misleading financial statements. Dodd-Frank was passed in effort to enforce better corporate ethics in response to the 2008 Financial Crises. The act created several new regulatory agencies, prohibited banks from certain kinds of speculative trading, required mortgage-backed security creators to retain at least 5% of the underlying mortgoges, and updated rules on corporate governance. Sarbanes-Oxley was replaced by the Dodd-Frank Act in 2010 . Dodd-Frank required "clawback" provisions that require executives to repay incentive-based compensation if there are material accounting restatements, but only in the case of deception or fraud. What might an inverted yield curve indicate? All of these. An economic recession is likely in the near future. Decreased business investment has decreased the demand for loanable funds. Investors expect short-term rates to fall in the future

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started