Answered step by step

Verified Expert Solution

Question

1 Approved Answer

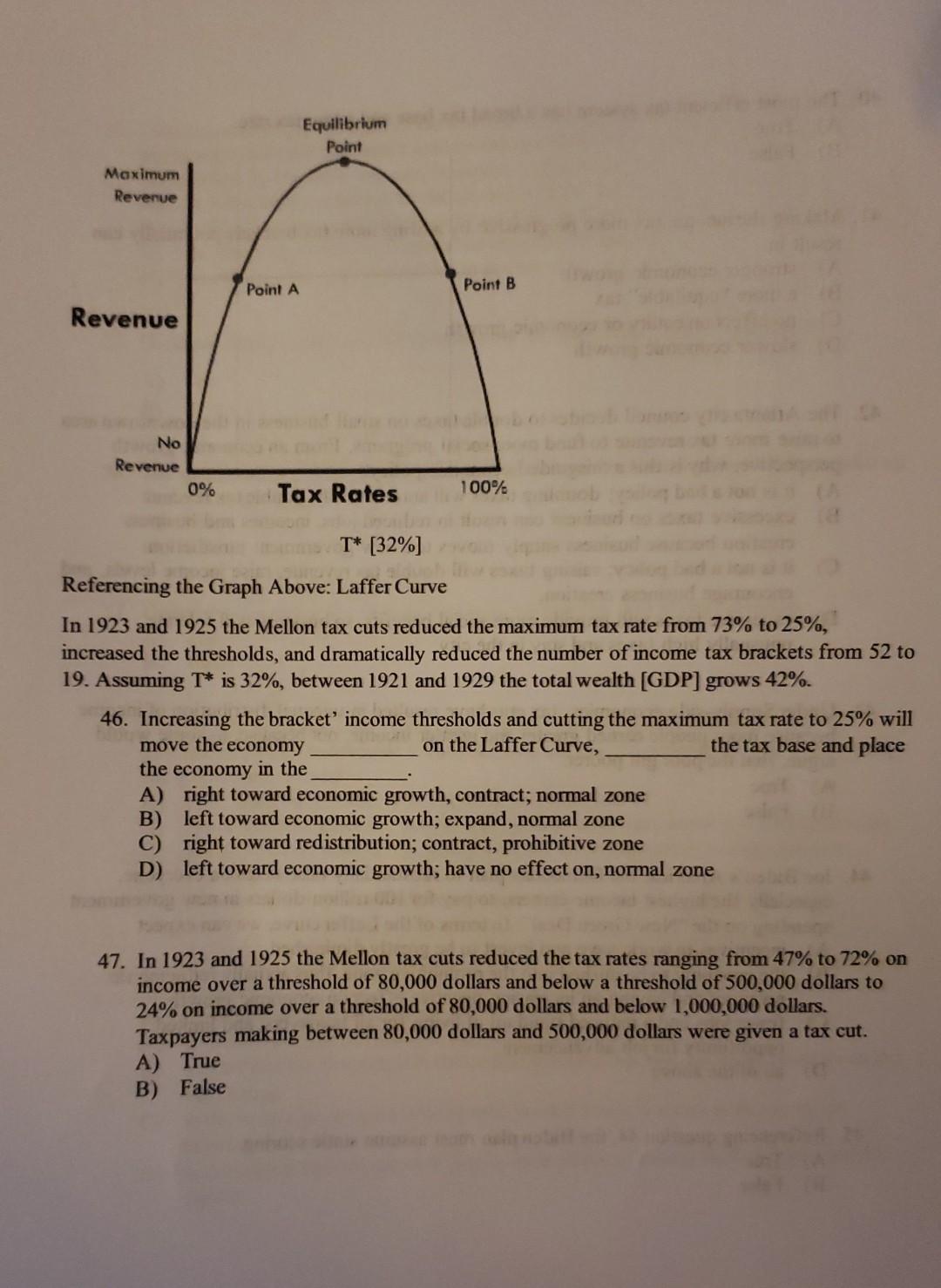

PLEASE ANSWER QUESTIONS #46 AND 47. THANK YOU! Equilibrium Point Maximum Revenue Point A Point B Revenue No Revenue 0% Tax Rates 100% T* [32%]

PLEASE ANSWER QUESTIONS #46 AND 47.

THANK YOU!

Equilibrium Point Maximum Revenue Point A Point B Revenue No Revenue 0% Tax Rates 100% T* [32%] Referencing the Graph Above: Laffer Curve In 1923 and 1925 the Mellon tax cuts reduced the maximum tax rate from 73% to 25%, increased the thresholds, and dramatically reduced the number of income tax brackets from 52 to 19. Assuming T* is 32%, between 1921 and 1929 the total wealth (GDP) grows 42%. 46. Increasing the bracket' income thresholds and cutting the maximum tax rate to 25% will move the economy on the Laffer Curve, the tax base and place the economy in the A) right toward economic growth, contract; normal zone B) left toward economic growth; expand, normal zone C) right toward redistribution; contract, prohibitive zone D) left toward economic growth; have no effect on, normal zone 47. In 1923 and 1925 the Mellon tax cuts reduced the tax rates ranging from 47% to 72% on income over a threshold of 80,000 dollars and below a threshold of 500,000 dollars to 24% on income over a threshold of 80,000 dollars and below 1,000,000 dollars. Taxpayers making between 80,000 dollars and 500,000 dollars were given a tax cut. A) True B) FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started