Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer questions a & b Harold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable estate

Please answer questions a & b

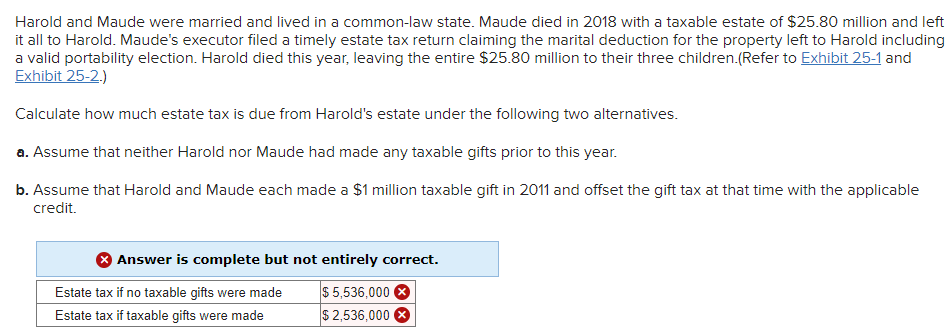

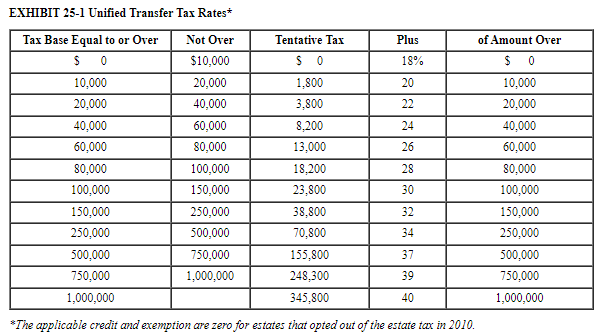

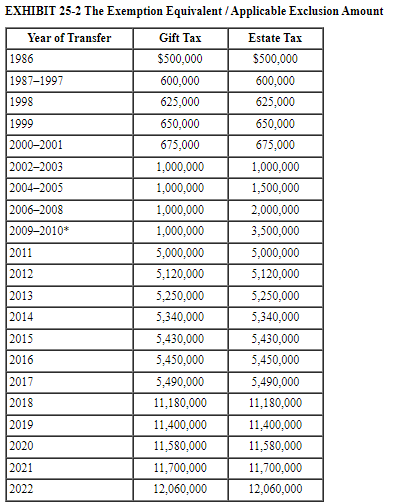

Harold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable estate of $25.80 million and left it all to Harold. Maude's executor filed a timely estate tax return claiming the marital deduction for the property left to Harold including a valid portability election. Harold died this year, leaving the entire $25.80 million to their three children.(Refer to and Exhibit 25-2.) Calculate how much estate tax is due from Harold's estate under the following two alternatives. a. Assume that neither Harold nor Maude had made any taxable gifts prior to this year. b. Assume that Harold and Maude each made a $1 million taxable gift in 2011 and offset the gift tax at that time with the applicable credit. EXHIBIT 25-1 Unified Transfer Tax Rates* mount Harold and Maude were married and lived in a common-law state. Maude died in 2018 with a taxable estate of $25.80 million and left it all to Harold. Maude's executor filed a timely estate tax return claiming the marital deduction for the property left to Harold including a valid portability election. Harold died this year, leaving the entire $25.80 million to their three children.(Refer to and Exhibit 25-2.) Calculate how much estate tax is due from Harold's estate under the following two alternatives. a. Assume that neither Harold nor Maude had made any taxable gifts prior to this year. b. Assume that Harold and Maude each made a $1 million taxable gift in 2011 and offset the gift tax at that time with the applicable credit. EXHIBIT 25-1 Unified Transfer Tax Rates* mountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started