Answered step by step

Verified Expert Solution

Question

1 Approved Answer

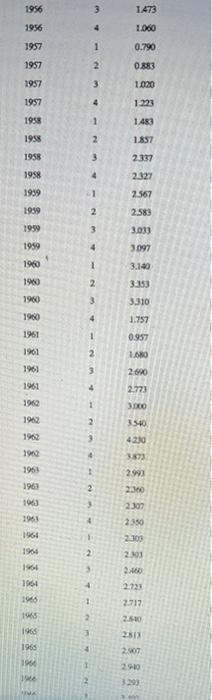

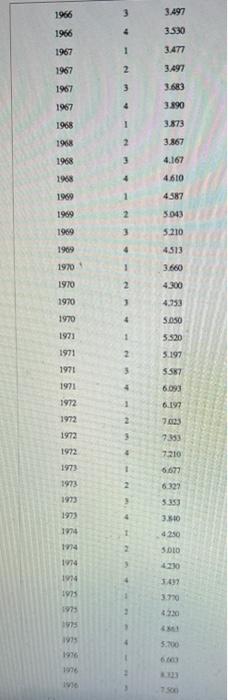

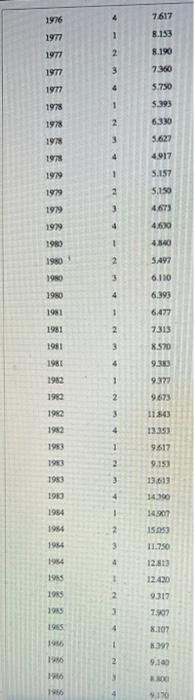

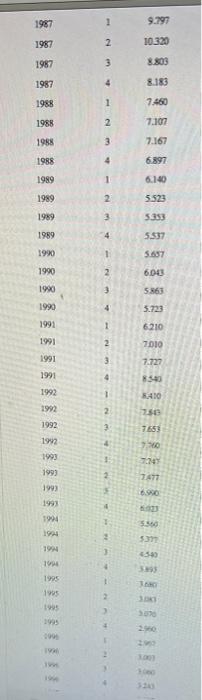

please answer questions. they go together. provided all data below. will rate treasury bill rates (TBILL). For these questions, I do not need to see

please answer questions. they go together. provided all data below. will rate

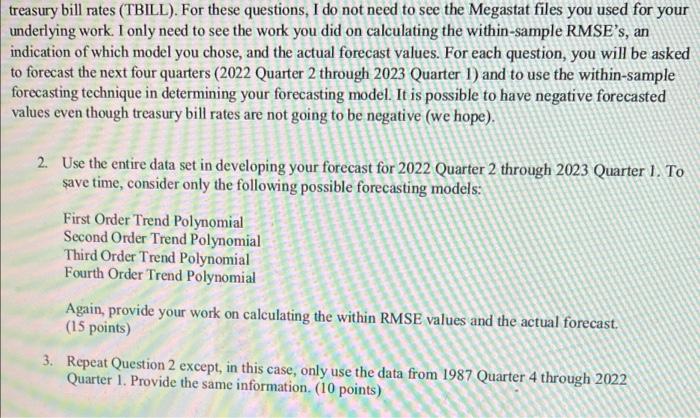

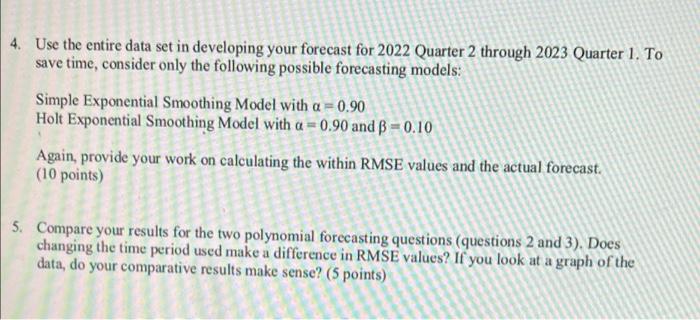

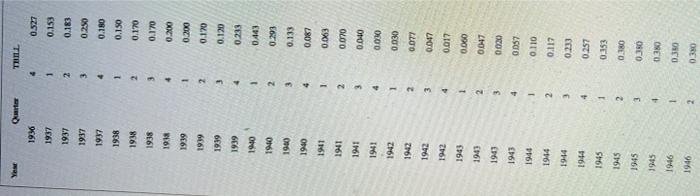

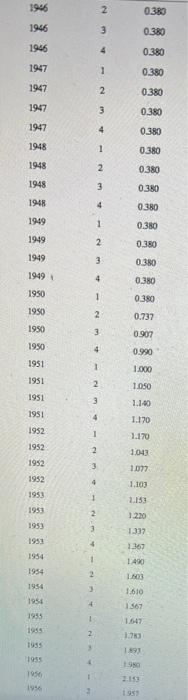

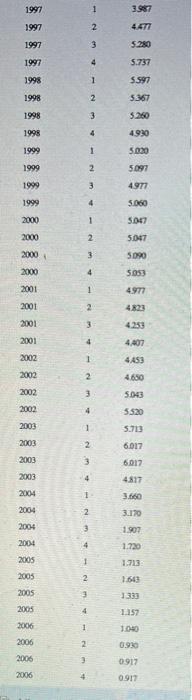

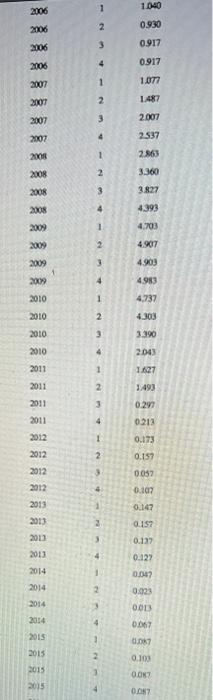

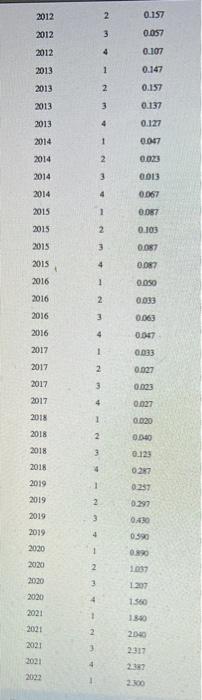

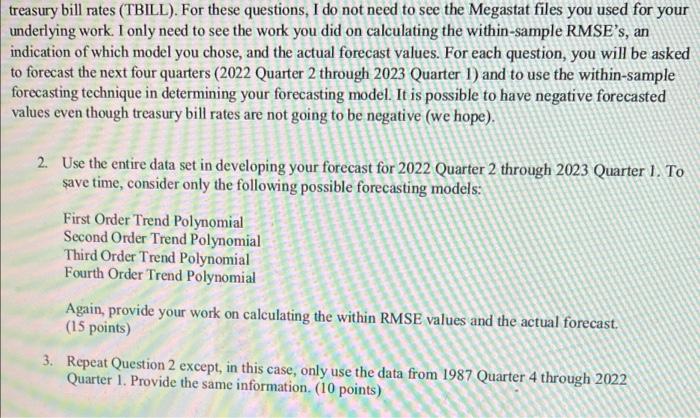

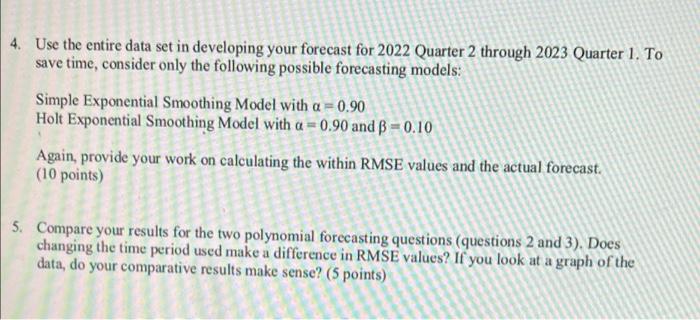

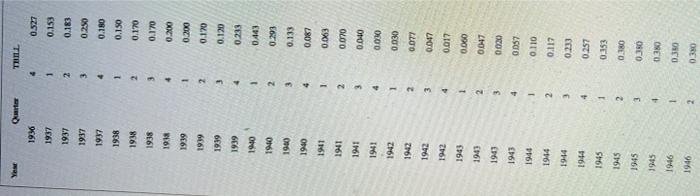

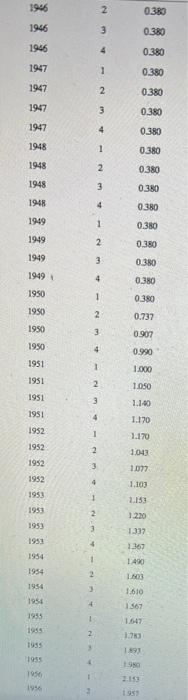

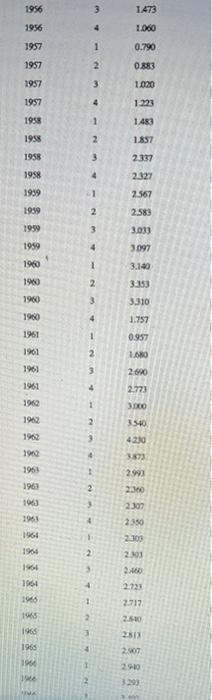

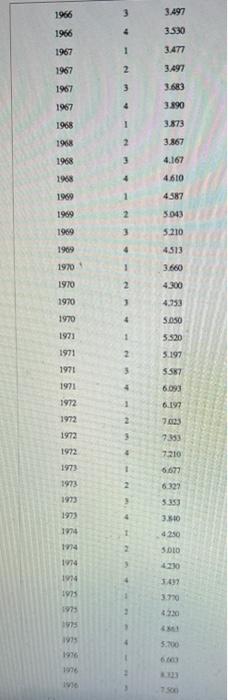

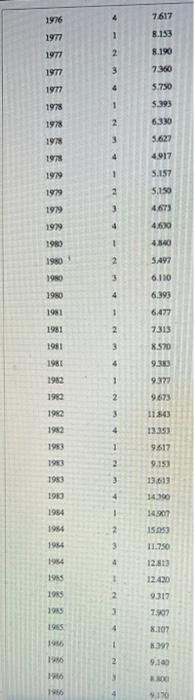

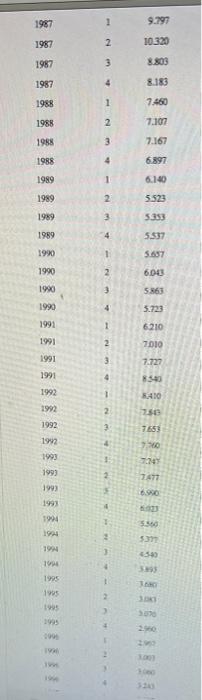

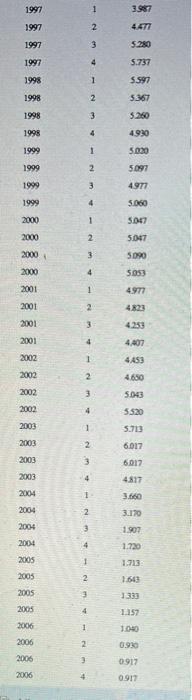

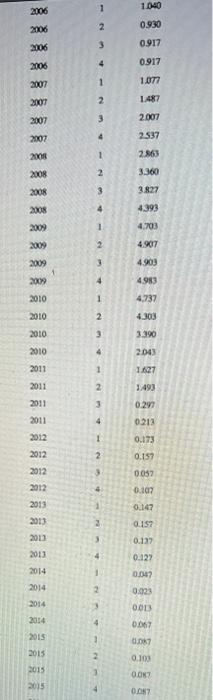

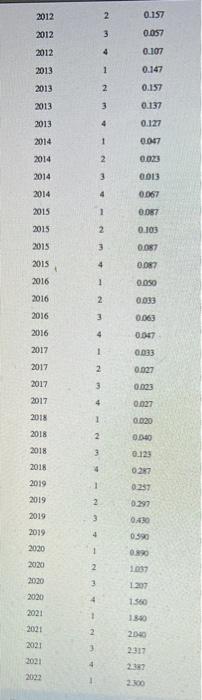

treasury bill rates (TBILL). For these questions, I do not need to see the Megastat files you used for your underlying work. I only need to see the work you did on calculating the within-sample RMSE's, an indication of which model you chose, and the actual forecast values. For each question, you will be asked to forecast the next four quarters (2022 Quarter 2 through 2023 Quarter 1) and to use the within-sample forecasting technique in determining your forecasting model. It is possible to have negative forecasted values even though treasury bill rates are not going to be negative (we hope). 2. Use the entire data set in developing your forecast for 2022 Quarter 2 through 2023 Quarter 1. To save time, consider only the following possible forecasting models: First Order Trend Polynomial Second Order Trend Polynomial Third Order Trend Polynomial Fourth Order Trend Polynomial Again, provide your work on calculating the within RMSE values and the actual forecast. (15 points) 3. Repeat Question 2 except, in this case, only use the data from 1987 Quarter 4 through 2022 Quarter 1. Provide the same information. (10 points) 4. Use the entire data set in developing your forecast for 2022 Quarter 2 through 2023 Quarter 1. To save time, consider only the following possible forecasting models: Simple Exponential Smoothing Model with a = 0.90 Holt Exponential Smoothing Model with a=0.90 and -0.10 Again, provide your work on calculating the within RMSE values and the actual forecast. (10 points) 5. Compare your results for the two polynomial forecasting questions (questions 2 and 3). Does changing the time period used make a difference in RMSE values? If you look at a graph of the data, do your comparative results make sense? (5 points) Year 6061 1939 6161 1939 1936 1937 1937 1937 1937 1938 1938 1938 1938 0161 0161 1940 1940 1941 1161 1941 1941 1942 1942 1942 2161 1943 1943 1943 1943 1944 1944 2161 1945 1945 1946 1946 1944 5161 5161 Quarter 4 2 E 3 4 1 2 1 1 2 3 4 4 3 4 1 4 1 2 z E 1 2 3 1 z E T 4 1 3 4 2 3 4 1 z THILL 0.527 0.153 0.183 OSTO 0.180 0.150 0.170 0.170 0000 0.200 0.170 021'0 0.233 0443 1670 0.133 0.087 900 0.070 0100 0000 0.030 0.077 LACTO 0.017 0.060 (10 0.020 0380 1900 0.110 2110 ESCO ORE O 0800 OREO ONE'O 0.233 0,257 1946 1946 1946 1947 1947 1947 1947 1948 1948 1948 1948 1949 1949 1949 1949 1950 1950 1950 1950 1951 1951 1951 1951 1952 1952 1952 1952 1953 1953 1953 1953 1954 1954 1954 1954 1955 1955 1955 1955 1956 1956 1 2 3 4 1 2 3 4 3 4 1 2 1 2 3 1 2 3 4 3 4 1 2 3 4 1 2 1 2 3 4 1 2 3 4 1 2 3 4 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.737 0.907 0.990 1.000 1.050 1.140 1.170 1.170 1.043 1.077 1.103 1.153 1.220 1.337 1367 1490 1.603 1.610 1.567 1647 1.783 1893 1980 2.153 1956 1956 1957 1957 1957 1957 1958 1958 1958 1958 1959 1959 1959 1959 1960 1960 1960 1960 1961 1961 1961 1961 1962 1962 1962 1962 1963 1963 1963 1961 1964 1964 1964 9961 1965 1965 1965 1966 1966 TIMA 3 4 1 2 3 4 1 2 3 4 -1 2 3 4 1 2 3 1 4 1 4 1 1.473 1.060 0.790 0.883 1.020 1.223 1.483 1.857 2.337 2.327 2.567 2.583 3.033 3.097 3.140 3.353 3.310 1.757 0.957 1,680 2600 2.773 3.000 3.540 4230 3.873 2.993 2.360 2.307 2.350 2.300 2.303 2.460 2.723 2717 2.640 2813 2.907 2940 3.293 am 1966 1966 1967 1967 1967 1967 1968 1968 1968 1968 1969 1969 1969 1969 1970 1970 1970 1970 1971 1971 1971 1971 1972 1972 1972 1972 1973 1973 1973 1973 1974 1974 1974 1974 1975 1975 1975 1975 1976 1976 1916 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 1 2 3 4 1 2 4 2 1 3.497 3.530 3.477 3.497 3.683 3.890 3.873 3.867 4.167 4.610 4.587 5043 5.210 4513 3.660 4.300 4,753 5.050 5.520 5.197 5587 6.093 6.197 7.023 7353 7210 6.677 6.327 5.353 3.840 4250 5010 4230 3.770 5.300 6.003 1.500 1976 1977 1977 1977 1977 1978 1978 1978 1978 1979 1979 1979 1979 1983 1980 1980 1980 1981 1981 1981 1981 1982 1982 1982 1982 1983 1983 1983 1983 1984 1984 1984 1984 1985 1985 1985 1965 1996 1986 1956 1966 1 2 3 4 1 2 3 4 1 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2 3 4 1 2 3 4 7617 8.153 8.190 7.360 5.750 5.393 6.330 5.627 4917 5.157 5.150 4675 4.600 4.540 5,497 6.110 6.393 6.477 7.313 8.570 9.383 9.377 9.673 11.843 13353 9617 9.353 13613 14.390 14.907 15.0953 11.750 12.813 12.420 9.317 1.907 8.307 8.397 9.140 8.300 9.170 1987 1987 1987 1987 1988 1988 1988 1988 1989 1989 1989 1989 1990 1990 1990 1990 1991 1991 1991 1661 1992 1992 1992 1992 1993 1993 1993 1993 1994 1994 1994 1994 1995 1995 1995 1995 1996 1996 1996 1 2 3 4 1 2 3 4 1 2 3 4 2 3 4 2 4 4 L 2 3 4 1 2 4 1 9.797 10.320 8.803 8.183 7.460 7.107 7.167 6.897 6.140 5.523 5.353 5.537 5.657 6.043 5.863 5.723 6210 7010 7.727 8540 8410 750 7.653 7760 7247 7477 8:023 5.500 5317 4540 ERITE 3076 2960 2992 3001 1000 3243 1997 1997 1997 1997 1998 1998 1998 1998 6661 1999 1999 1999 2000 2000 2000 2000 2001 2001 2001 2001 2002 2002 2002 2002 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 2006 2006 2006 1 2 3 4 1 2 3 4 1 4 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 3.987 4.477 5.280 5.737 5.597 5.367 5.260 4.930 5.000 5.097 4977 5.060 5.047 5.047 5090 5.053 4977 4823 4.253 4,407 4453 4.650 5.043 5530 5.713 6017 6017 4.817 099/E 3.170 1.907 1.720 1.713 1.643 1:333 1.157 1.040 0.930 0917 0.917 9007 9002 9000 2006 2007 LOOT 2007 2007 BOOT 2008 2008 2008 2009 2009 2009 2009 010 0107 OTOC 2010 1102 1102 1100 1100 2012 2012 ZICE 2012 2013 Cice 2013 CTOC MOC M100 2014 $100 5100 2015 2015 2015 1 2 E 7 1 2 E 1 2 3 7 T 2 3 + T 2 3 4 1 2 3 D 1 2 1.040 0.930 0917 0917 1.077 1487 2.007 2.537 2.863 3.360 3.827 (667 4.703 4.907 4.903 4.983 4,737 COC 06 2043 LZWI 1493 0.297 0213 ELTO LSTO 0.057 0.107 0.147 LSTO 0.137 0.127 200 C200 0013 0.067 01087 coro 0.087 0.087 2012 2012 2012 2013 2013 2013 2013 2014 2014 2014 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2000 2020 2021 2021 2021 2021 2022 2 3 4 1 2 3 4 1 2 3 1 2 3 4 1 4 1 2 3 4 1 2 3 4 3 1 2 3 4 1 2 3 2 4 3 4 0.157 0.057 0.107 0.147 0.157 0.137 0.127 0.047 0.023 0.013 0.067 0.087 0.103 0.087 0.087 0.050 0.033 0.063 0.047 0.033 0.027 0.023 0.027 0.020 0.040 0.123 0287 0.237 0.297 0.430 0.590 0.890 1037 1207 1560 1840 2040 2317 2.387 2.300 treasury bill rates (TBILL). For these questions, I do not need to see the Megastat files you used for your underlying work. I only need to see the work you did on calculating the within-sample RMSE's, an indication of which model you chose, and the actual forecast values. For each question, you will be asked to forecast the next four quarters (2022 Quarter 2 through 2023 Quarter 1) and to use the within-sample forecasting technique in determining your forecasting model. It is possible to have negative forecasted values even though treasury bill rates are not going to be negative (we hope). 2. Use the entire data set in developing your forecast for 2022 Quarter 2 through 2023 Quarter 1. To save time, consider only the following possible forecasting models: First Order Trend Polynomial Second Order Trend Polynomial Third Order Trend Polynomial Fourth Order Trend Polynomial Again, provide your work on calculating the within RMSE values and the actual forecast. (15 points) 3. Repeat Question 2 except, in this case, only use the data from 1987 Quarter 4 through 2022 Quarter 1. Provide the same information. (10 points) 4. Use the entire data set in developing your forecast for 2022 Quarter 2 through 2023 Quarter 1. To save time, consider only the following possible forecasting models: Simple Exponential Smoothing Model with a = 0.90 Holt Exponential Smoothing Model with a=0.90 and -0.10 Again, provide your work on calculating the within RMSE values and the actual forecast. (10 points) 5. Compare your results for the two polynomial forecasting questions (questions 2 and 3). Does changing the time period used make a difference in RMSE values? If you look at a graph of the data, do your comparative results make sense? (5 points) Year 6061 1939 6161 1939 1936 1937 1937 1937 1937 1938 1938 1938 1938 0161 0161 1940 1940 1941 1161 1941 1941 1942 1942 1942 2161 1943 1943 1943 1943 1944 1944 2161 1945 1945 1946 1946 1944 5161 5161 Quarter 4 2 E 3 4 1 2 1 1 2 3 4 4 3 4 1 4 1 2 z E 1 2 3 1 z E T 4 1 3 4 2 3 4 1 z THILL 0.527 0.153 0.183 OSTO 0.180 0.150 0.170 0.170 0000 0.200 0.170 021'0 0.233 0443 1670 0.133 0.087 900 0.070 0100 0000 0.030 0.077 LACTO 0.017 0.060 (10 0.020 0380 1900 0.110 2110 ESCO ORE O 0800 OREO ONE'O 0.233 0,257 1946 1946 1946 1947 1947 1947 1947 1948 1948 1948 1948 1949 1949 1949 1949 1950 1950 1950 1950 1951 1951 1951 1951 1952 1952 1952 1952 1953 1953 1953 1953 1954 1954 1954 1954 1955 1955 1955 1955 1956 1956 1 2 3 4 1 2 3 4 3 4 1 2 1 2 3 1 2 3 4 3 4 1 2 3 4 1 2 1 2 3 4 1 2 3 4 1 2 3 4 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.380 0.737 0.907 0.990 1.000 1.050 1.140 1.170 1.170 1.043 1.077 1.103 1.153 1.220 1.337 1367 1490 1.603 1.610 1.567 1647 1.783 1893 1980 2.153 1956 1956 1957 1957 1957 1957 1958 1958 1958 1958 1959 1959 1959 1959 1960 1960 1960 1960 1961 1961 1961 1961 1962 1962 1962 1962 1963 1963 1963 1961 1964 1964 1964 9961 1965 1965 1965 1966 1966 TIMA 3 4 1 2 3 4 1 2 3 4 -1 2 3 4 1 2 3 1 4 1 4 1 1.473 1.060 0.790 0.883 1.020 1.223 1.483 1.857 2.337 2.327 2.567 2.583 3.033 3.097 3.140 3.353 3.310 1.757 0.957 1,680 2600 2.773 3.000 3.540 4230 3.873 2.993 2.360 2.307 2.350 2.300 2.303 2.460 2.723 2717 2.640 2813 2.907 2940 3.293 am 1966 1966 1967 1967 1967 1967 1968 1968 1968 1968 1969 1969 1969 1969 1970 1970 1970 1970 1971 1971 1971 1971 1972 1972 1972 1972 1973 1973 1973 1973 1974 1974 1974 1974 1975 1975 1975 1975 1976 1976 1916 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 1 2 3 4 1 2 4 2 1 3.497 3.530 3.477 3.497 3.683 3.890 3.873 3.867 4.167 4.610 4.587 5043 5.210 4513 3.660 4.300 4,753 5.050 5.520 5.197 5587 6.093 6.197 7.023 7353 7210 6.677 6.327 5.353 3.840 4250 5010 4230 3.770 5.300 6.003 1.500 1976 1977 1977 1977 1977 1978 1978 1978 1978 1979 1979 1979 1979 1983 1980 1980 1980 1981 1981 1981 1981 1982 1982 1982 1982 1983 1983 1983 1983 1984 1984 1984 1984 1985 1985 1985 1965 1996 1986 1956 1966 1 2 3 4 1 2 3 4 1 3 4 1 2 3 4 1 2 3 4 1 2 3 4 2 3 4 1 2 3 4 7617 8.153 8.190 7.360 5.750 5.393 6.330 5.627 4917 5.157 5.150 4675 4.600 4.540 5,497 6.110 6.393 6.477 7.313 8.570 9.383 9.377 9.673 11.843 13353 9617 9.353 13613 14.390 14.907 15.0953 11.750 12.813 12.420 9.317 1.907 8.307 8.397 9.140 8.300 9.170 1987 1987 1987 1987 1988 1988 1988 1988 1989 1989 1989 1989 1990 1990 1990 1990 1991 1991 1991 1661 1992 1992 1992 1992 1993 1993 1993 1993 1994 1994 1994 1994 1995 1995 1995 1995 1996 1996 1996 1 2 3 4 1 2 3 4 1 2 3 4 2 3 4 2 4 4 L 2 3 4 1 2 4 1 9.797 10.320 8.803 8.183 7.460 7.107 7.167 6.897 6.140 5.523 5.353 5.537 5.657 6.043 5.863 5.723 6210 7010 7.727 8540 8410 750 7.653 7760 7247 7477 8:023 5.500 5317 4540 ERITE 3076 2960 2992 3001 1000 3243 1997 1997 1997 1997 1998 1998 1998 1998 6661 1999 1999 1999 2000 2000 2000 2000 2001 2001 2001 2001 2002 2002 2002 2002 2003 2003 2003 2003 2004 2004 2004 2004 2005 2005 2005 2005 2006 2006 2006 2006 1 2 3 4 1 2 3 4 1 4 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 3.987 4.477 5.280 5.737 5.597 5.367 5.260 4.930 5.000 5.097 4977 5.060 5.047 5.047 5090 5.053 4977 4823 4.253 4,407 4453 4.650 5.043 5530 5.713 6017 6017 4.817 099/E 3.170 1.907 1.720 1.713 1.643 1:333 1.157 1.040 0.930 0917 0.917 9007 9002 9000 2006 2007 LOOT 2007 2007 BOOT 2008 2008 2008 2009 2009 2009 2009 010 0107 OTOC 2010 1102 1102 1100 1100 2012 2012 ZICE 2012 2013 Cice 2013 CTOC MOC M100 2014 $100 5100 2015 2015 2015 1 2 E 7 1 2 E 1 2 3 7 T 2 3 + T 2 3 4 1 2 3 D 1 2 1.040 0.930 0917 0917 1.077 1487 2.007 2.537 2.863 3.360 3.827 (667 4.703 4.907 4.903 4.983 4,737 COC 06 2043 LZWI 1493 0.297 0213 ELTO LSTO 0.057 0.107 0.147 LSTO 0.137 0.127 200 C200 0013 0.067 01087 coro 0.087 0.087 2012 2012 2012 2013 2013 2013 2013 2014 2014 2014 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019 2019 2019 2020 2020 2000 2020 2021 2021 2021 2021 2022 2 3 4 1 2 3 4 1 2 3 1 2 3 4 1 4 1 2 3 4 1 2 3 4 3 1 2 3 4 1 2 3 2 4 3 4 0.157 0.057 0.107 0.147 0.157 0.137 0.127 0.047 0.023 0.013 0.067 0.087 0.103 0.087 0.087 0.050 0.033 0.063 0.047 0.033 0.027 0.023 0.027 0.020 0.040 0.123 0287 0.237 0.297 0.430 0.590 0.890 1037 1207 1560 1840 2040 2317 2.387 2.300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started