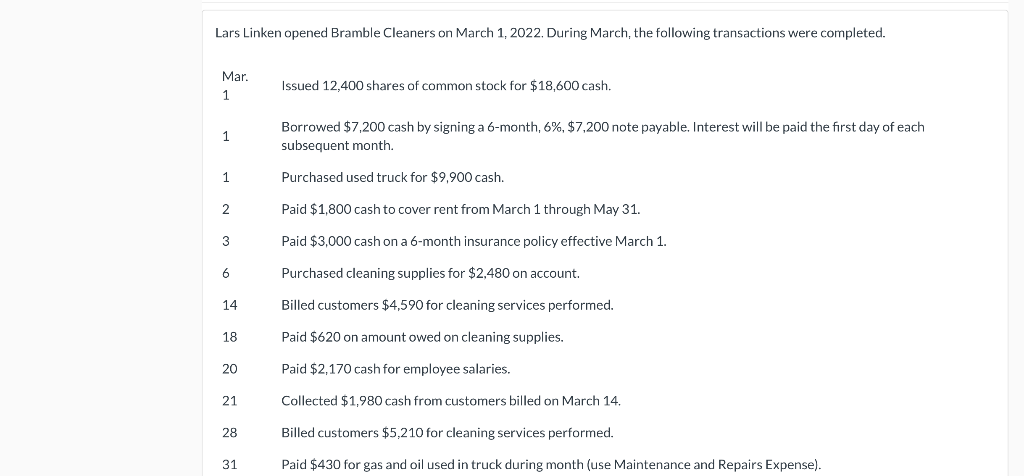

please answer questions unfilled in bottom sections

please answer questions unfilled in bottom sections

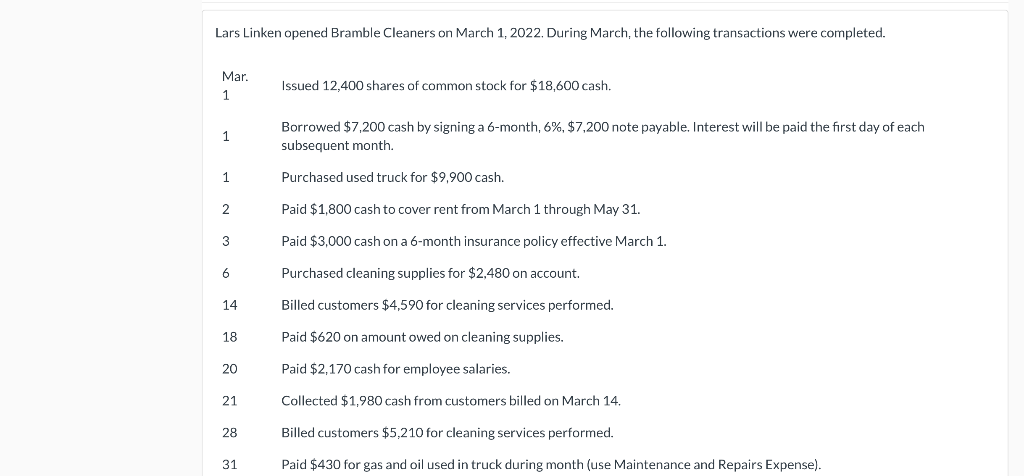

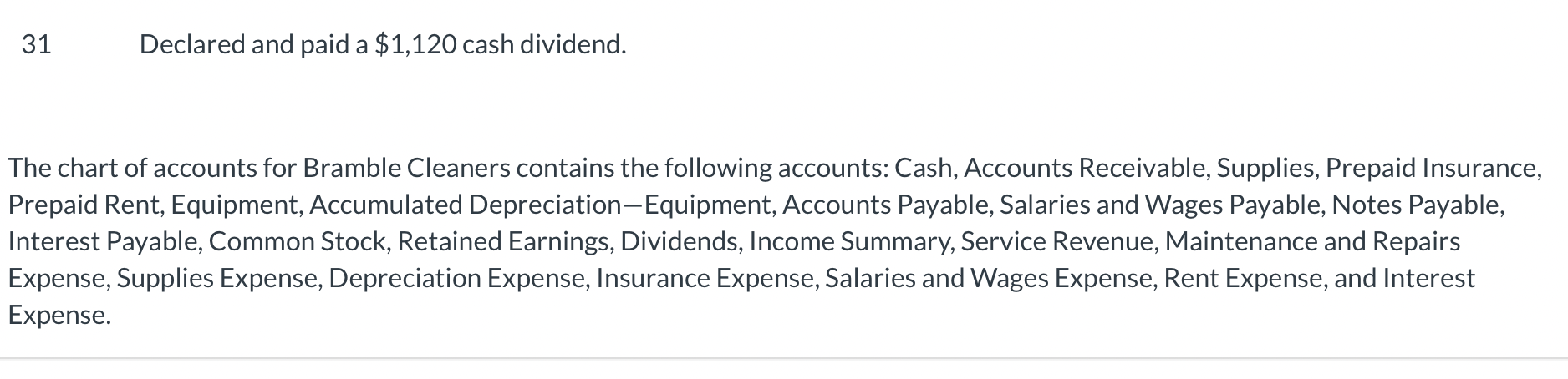

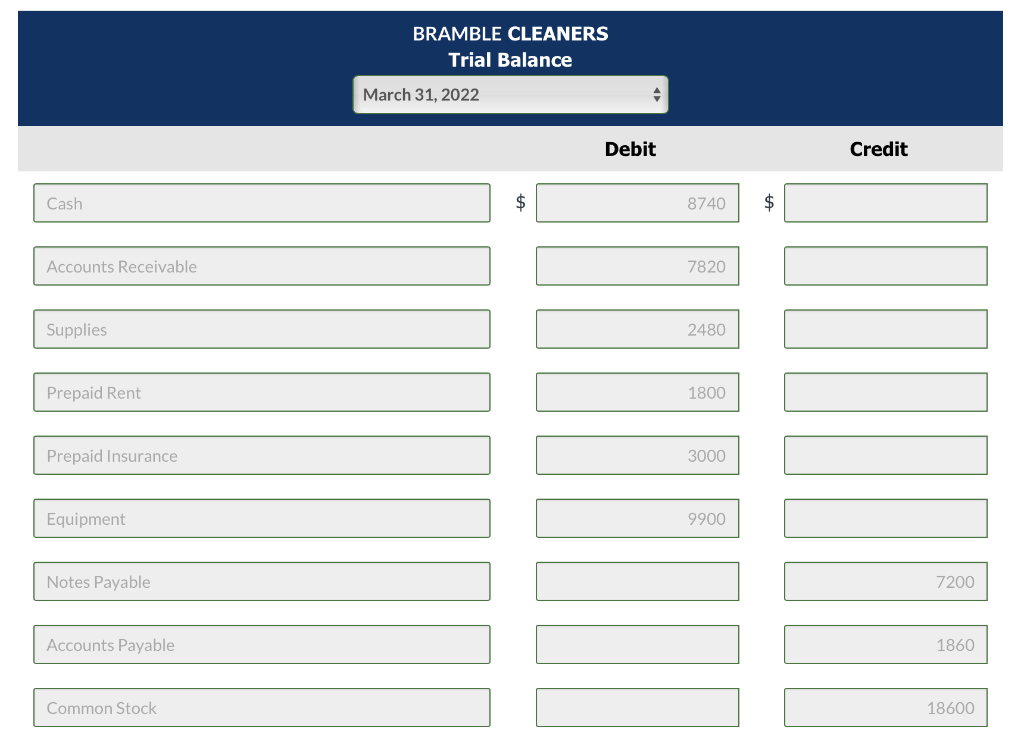

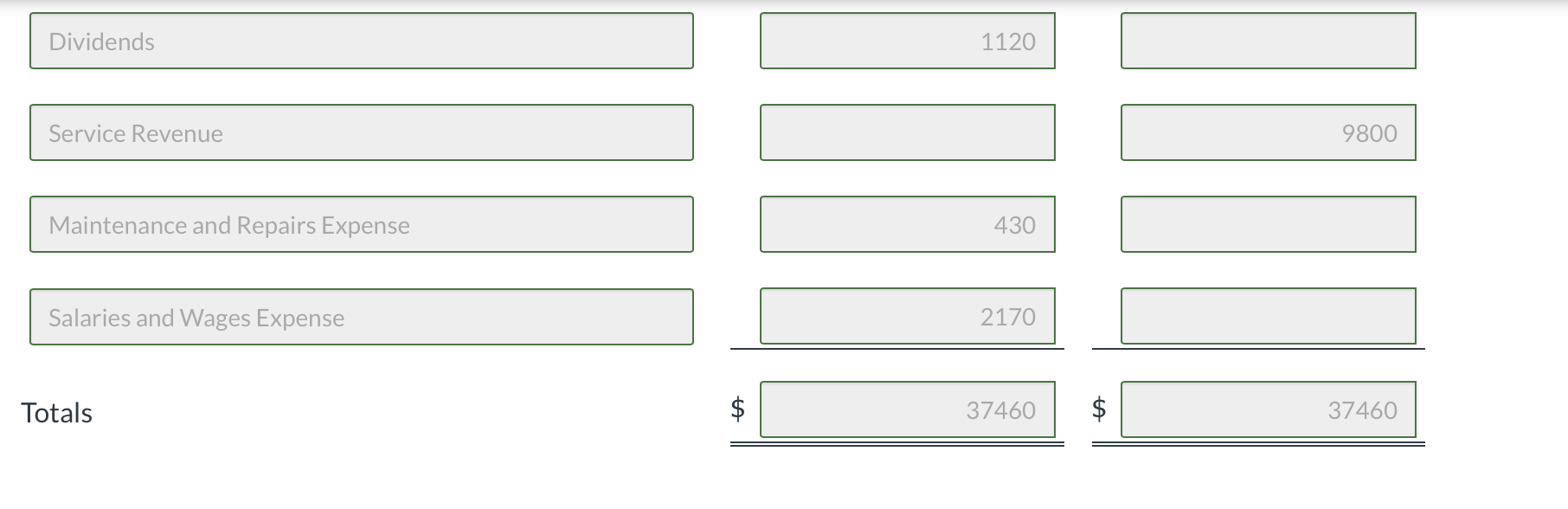

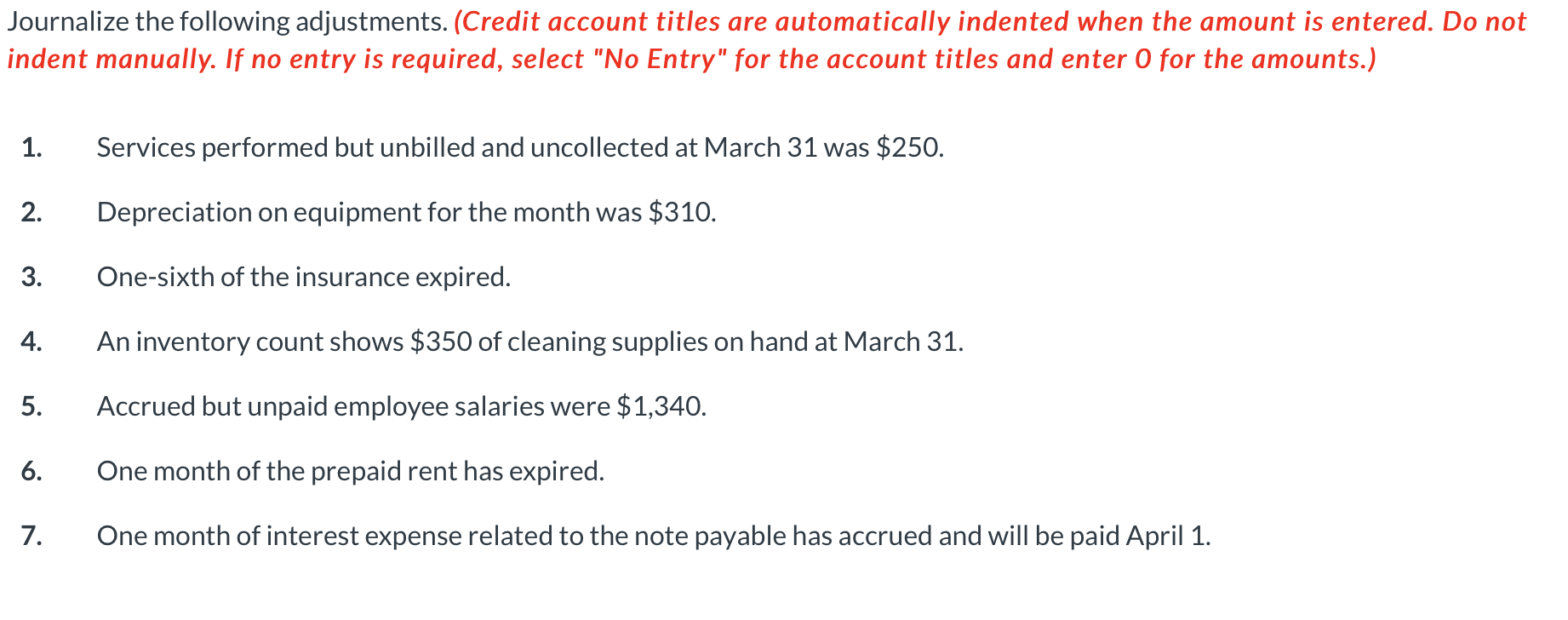

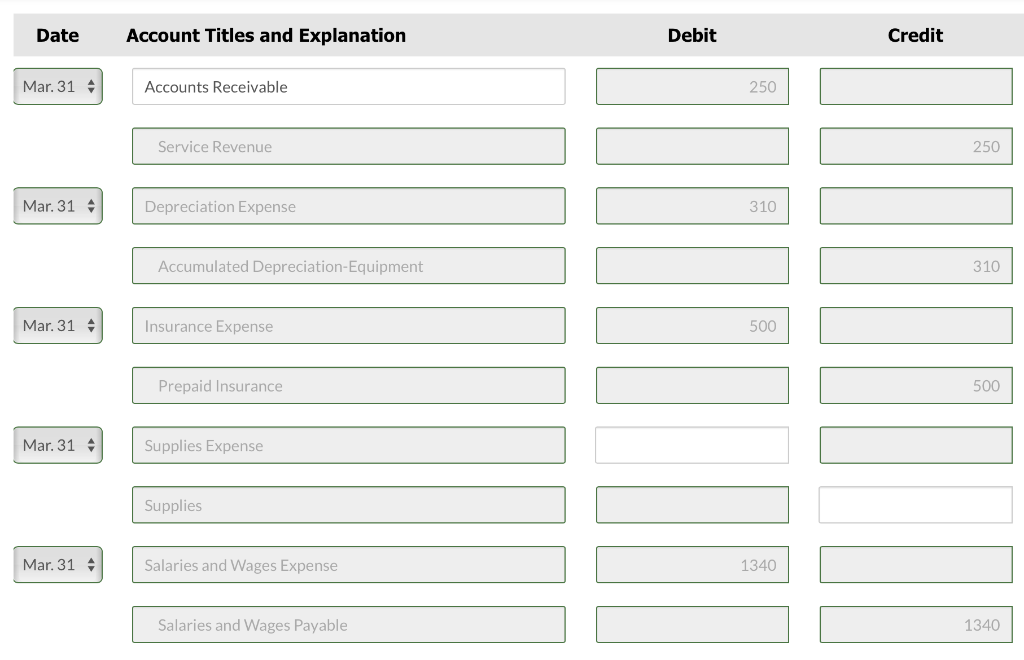

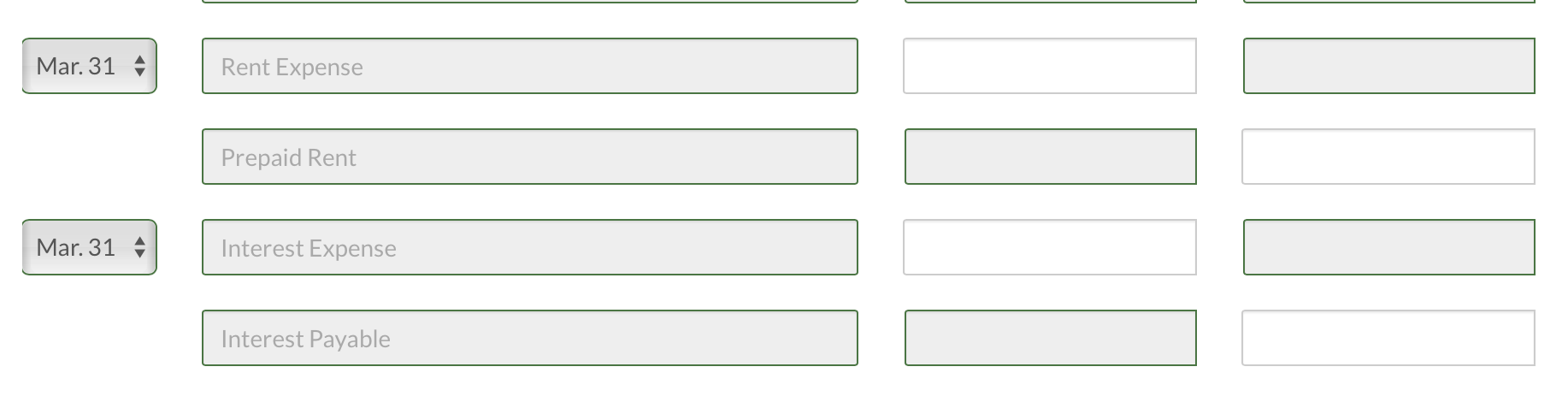

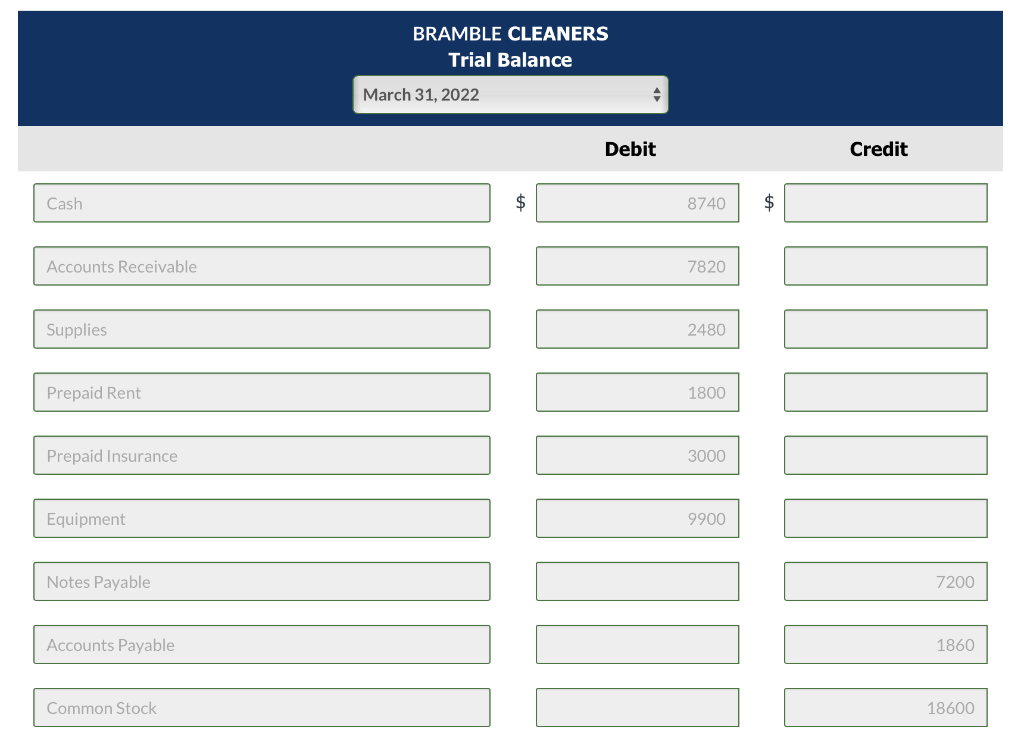

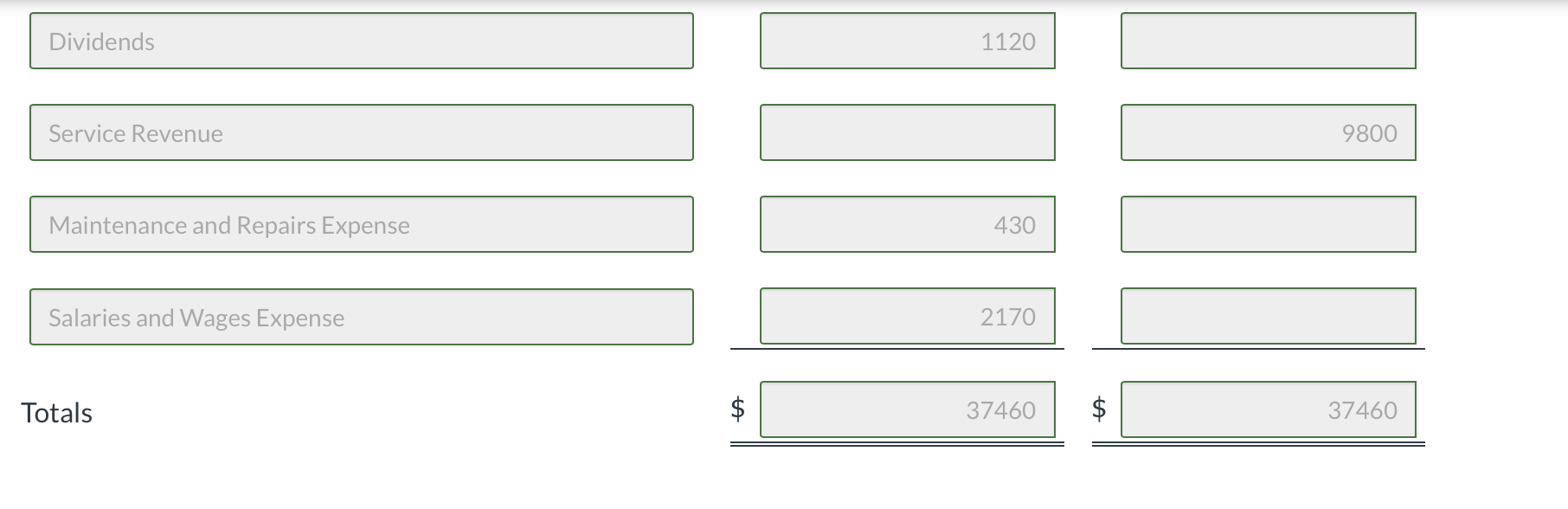

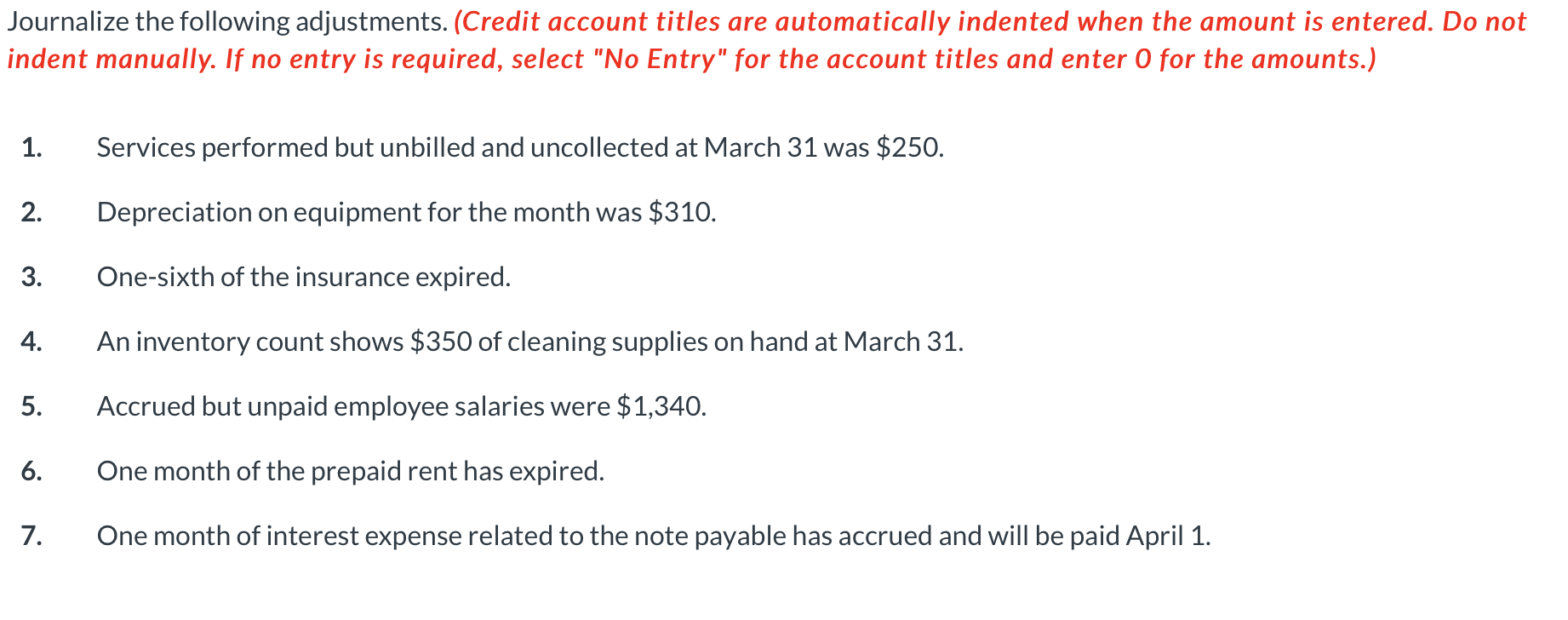

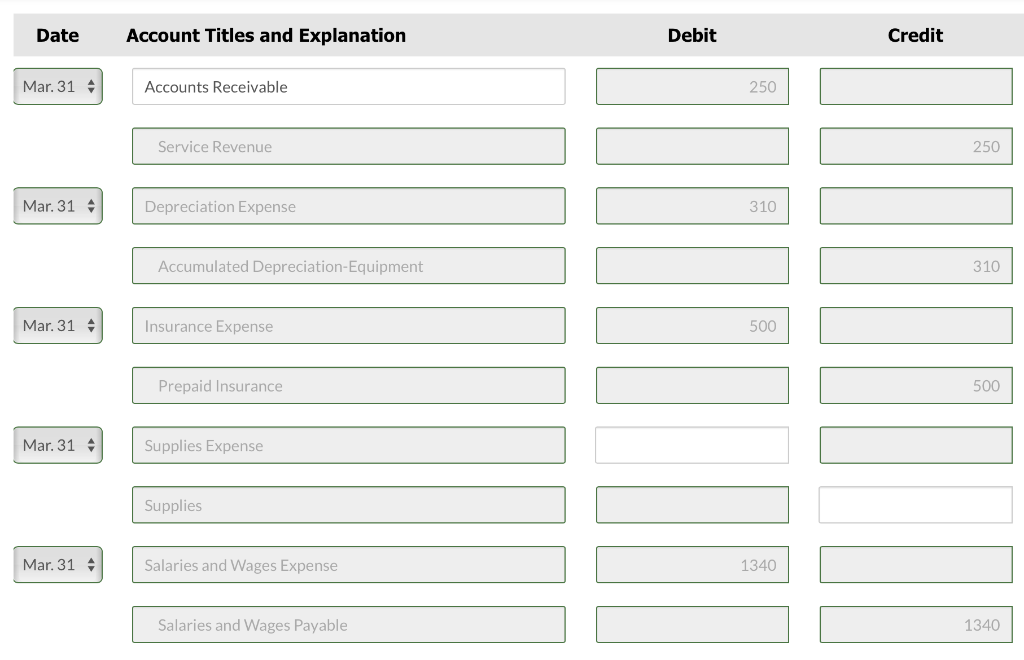

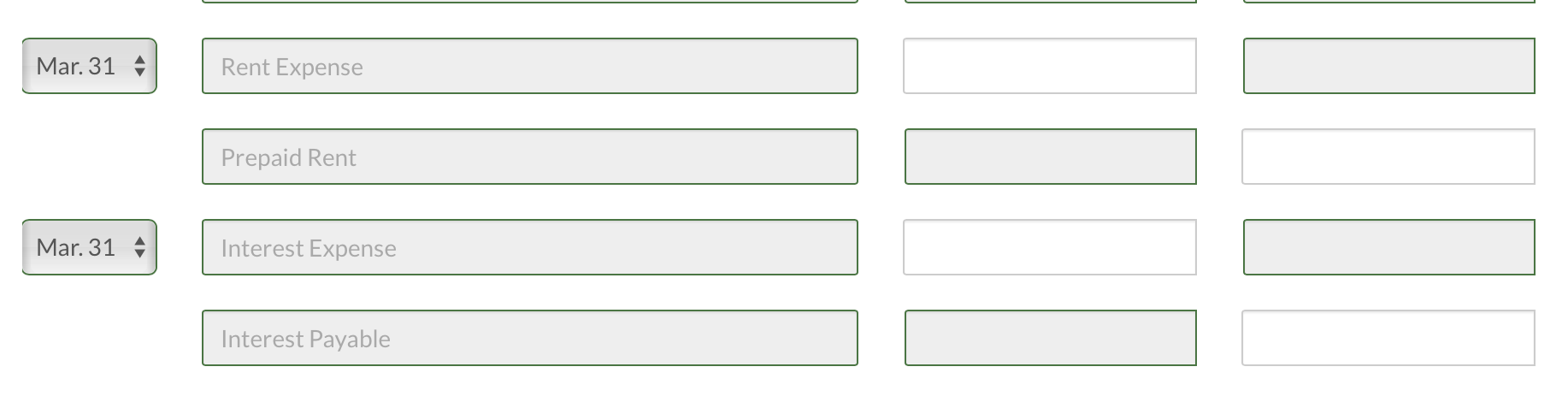

Lars Linken opened Bramble Cleaners on March 1, 2022. During March, the following transactions were completed. Mar. Issued 12,400 shares of common stock for $18,600 cash. 1 1 Borrowed $7,200 cash by signing a 6-month, 6%, $7,200 note payable. Interest will be paid the first day of each subsequent month. 1 Purchased used truck for $9,900 cash. 2 Paid $1,800 cash to cover rent from March 1 through May 31. 3 Paid $3,000 cash on a 6-month insurance policy effective March 1. 6 Purchased cleaning supplies for $2,480 on account. 14 Billed customers $4,590 for cleaning services performed. 18 Paid $620 on amount owed on cleaning supplies. 20 Paid $2,170 cash for employee salaries. 21 Collected $1,980 cash from customers billed on March 14. 28 Billed customers $5,210 for cleaning services performed. 31 Paid $430 for gas and oil used in truck during month (use Maintenance and Repairs Expense). 31 Declared and paid a $1,120 cash dividend. The chart of accounts for Bramble Cleaners contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Salaries and Wages Payable, Notes Payable, Interest Payable, Common Stock, Retained Earnings, Dividends, Income Summary, Service Revenue, Maintenance and Repairs Expense, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Rent Expense, and Interest Expense. Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Equipment Notes Payable Accounts Payable Common Stock BRAMBLE CLEANERS Trial Balance March 31, 2022 $ + Debit 8740 7820 2480 1800 3000 9900 $ Credit 7200 1860 18600 Dividends Service Revenue Maintenance and Repairs Expense Salaries and Wages Expense Totals tA 1120 430 2170 37460 WIND 9800 37460 Journalize the following adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 1. Services performed but unbilled and uncollected at March 31 was $250. 2. Depreciation on equipment for the month was $310. 3. One-sixth of the insurance expired. 4. An inventory count shows $350 of cleaning supplies on hand at March 31. 5. Accrued but unpaid employee salaries were $1,340. 6. One month of the prepaid rent has expired. 7. One month of interest expense related to the note payable has accrued and will be paid April 1. Date Mar. 31 Mar. 31 Mar. 31 Mar. 31 Mar. 31 Account Titles and Explanation Accounts Receivable Service Revenue Depreciation Expense Accumulated Depreciation-Equipment Insurance Expense Prepaid Insurance Supplies Expense Supplies Salaries and Wages Expense Salaries and Wages Payable Debit 250 310 500 [[ 1340 Credit 250 310 500 1340 Mar. 31 Mar. 31 Rent Expense Prepaid Rent Interest Expense Interest Payable

please answer questions unfilled in bottom sections

please answer questions unfilled in bottom sections