Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer quickly! WILL GIVE THUMBS UP Problem One: 10 points Lockley Corporation purchased machinery on January 1, 2018. The following details relate to the

Please answer quickly! WILL GIVE THUMBS UP

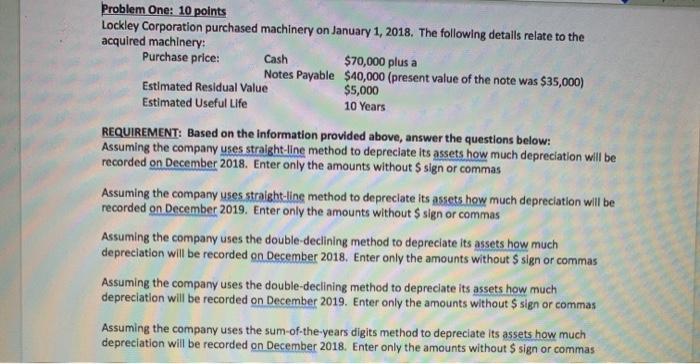

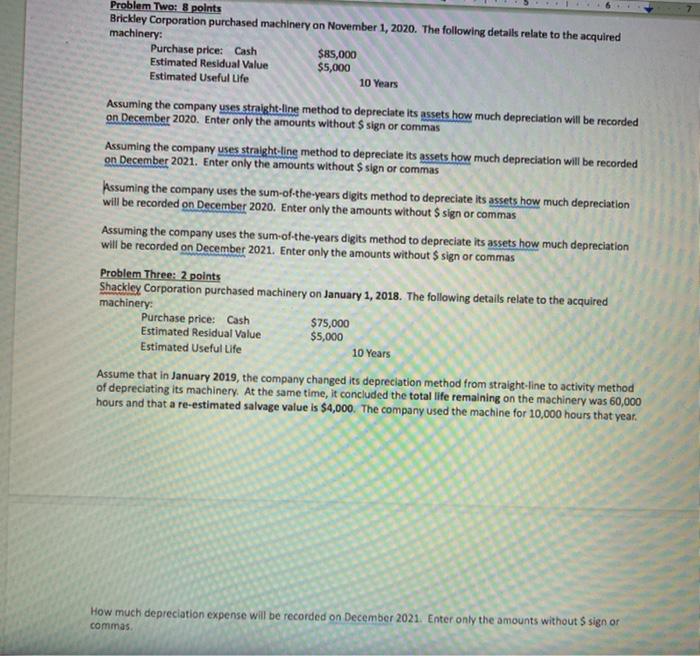

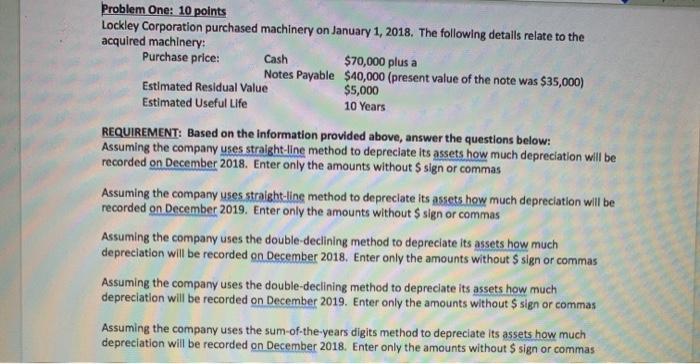

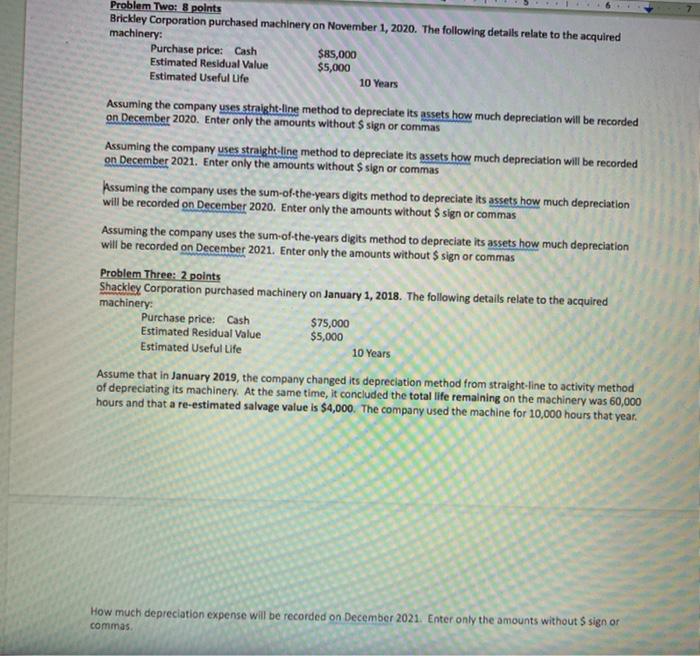

Problem One: 10 points Lockley Corporation purchased machinery on January 1, 2018. The following details relate to the acquired machinery: Purchase price: Cash $70,000 plus a Notes Payable $40,000 (present value of the note was $35,000) Estimated Residual Value $5,000 Estimated Useful Life 10 Years REQUIREMENT: Based on the information provided above, answer the questions below: Assuming the company uses straight line method to depreciate its assets how much depreciation will be recorded on December 2018. Enter only the amounts without $ sign or commas Assuming the company uses straight-line method to depreciate its assets how much depreciation will be recorded on December 2019. Enter only the amounts without sign or commas Assuming the company uses the double-declining method to depreciate its assets how much depreciation will be recorded on December 2018. Enter only the amounts without S sign or commas Assuming the company uses the double-declining method to depreciate its assets how much depreciation will be recorded on December 2019. Enter only the amounts without $ sign or commas Assuming the company uses the sum-of-the-years digits method to depreciate its assets how much depreciation will be recorded on December 2018. Enter only the amounts without $ sign or commas Problem Two: 8 points Brickley Corporation purchased machinery on November 1, 2020. The following details relate to the acquired machinery: Purchase price: Cash $85,000 Estimated Residual Value $5,000 Estimated Useful Life 10 Years Assuming the company uses straight-line method to depreciate its assets how much depreciation will be recorded on December 2020. Enter only the amounts without sign or commas Assuming the company uses straight-ling method to depreciate its assets how much depreciation will be recorded on December 2021. Enter only the amounts without $ sign or commas Assuming the company uses the sum-of-the-years digits method to depreciate its assets how much depreciation will be recorded on December 2020. Enter only the amounts without $ sign or commas Assuming the company uses the sum-of-the-years digits method to depreciate its assets how much depreciation will be recorded on December 2021. Enter only the amounts without $ sign or commas Problem Three: 2 points Shackley Corporation purchased machinery on January 1, 2018. The following details relate to the acquired machinery: Purchase price: Cash $75,000 Estimated Residual Value $5,000 Estimated Useful Life 10 Years Assume that in January 2019, the company changed its depreciation method from straight-line to activity method of depreciating its machinery. At the same time, it concluded the total life remaining on the machinery was 60,000 hours and that a re-estimated salvage value is $4,000. The company used the machine for 10,000 hours that year. How much depreciation expense will be recorded on December 2021. Enter only the amounts without S sign on commas 10 + BIVA CD PROBLEM FOUR:20 points On January 1, 2017, Birdie Company purchased the Lady Bird Division of AnaSanta Corporation by paying $100,000 In cash and issuing a $100,000 short-term note payable. Presented below is condensed balance sheet of Lady Bird Division of AnaSanta Corporation on December 31, 2018 LadyBird Division Net Assets As of December 31, 2018 Accounts Receivable $22,000 Inventory 28,000 Equipment (net) 30,000 Land 100,000 Accounts Payable (25,000) Shareholders' Equity 155,000 (a) Prepare the January 1, 2018 journal entry to record the purchase of LadyBird Division Assume the book values shown all approximate current fair values except for accounts receivable (fair value of $20,000), and Inventory (fair value of $30,000). You may abbreviate the Debit to Dr. in your answer as in the following example: Dr Supplies 5500; Dr. Insurance $2,000; Cr Common stock $2,500 etc...) (b) Assume that three years after the purchase of LadyBird Division, the following net asset information related to that business is as shown below: LadyBird Division Net Assets As of December 31, 2020 Accounts Receivable $10,000 Inventory 40,000 Equipment (net) 20,000 Land 100,000 Goodwill 30,000 Accounts Payable (20,000) Net Assets 180,000 A recent business valuation of this division vielded a fair market value of $170,000. The carrying values above approximate fair values. Prepare the journal entry to record the impairment of goodwill if anyl at December 31 2018 MacBook AS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started