Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER QUICKLY WITH SOLUTION. THANK YOU PLEASE USE THIS FORMAT FOR THE ANSWER Shevi Wells is a Business Analyst with a Canadian private company.

PLEASE ANSWER QUICKLY WITH SOLUTION. THANK YOU

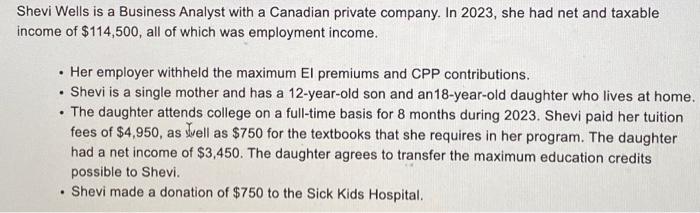

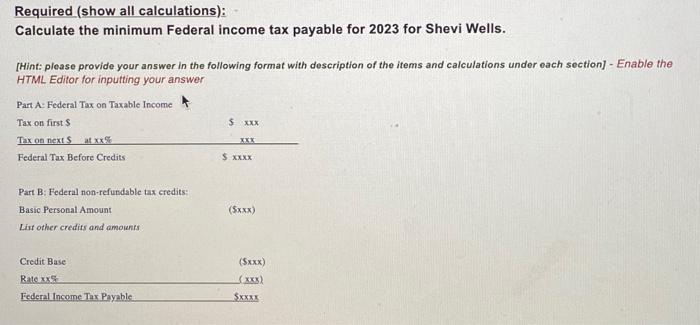

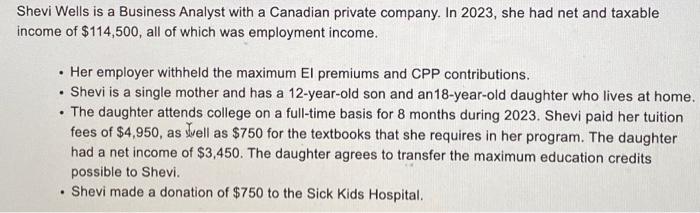

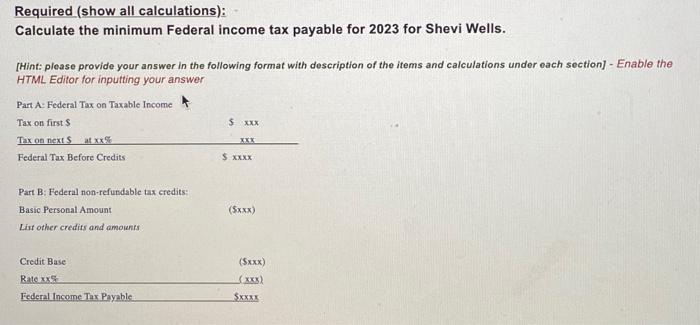

Shevi Wells is a Business Analyst with a Canadian private company. In 2023 , she had net and taxable income of $114,500, all of which was employment income. - Her employer withheld the maximum EI premiums and CPP contributions. - Shevi is a single mother and has a 12-year-old son and an18-year-old daughter who lives at home - The daughter attends college on a full-time basis for 8 months during 2023. Shevi paid her tuition fees of $4,950, as suell as $750 for the textbooks that she requires in her program. The daughter had a net income of $3,450. The daughter agrees to transfer the maximum education credits possible to Shevi. - Shevi made a donation of $750 to the Sick Kids Hospital. Required (show all calculations): Calculate the minimum Federal income tax payable for 2023 for Shevi Wells. [Hint: please provide your answer in the following format with description of the items and calculations under each section] - Enable the HTML Editor for inputting your answer Shevi Wells is a Business Analyst with a Canadian private company. In 2023 , she had net and taxable income of $114,500, all of which was employment income. - Her employer withheld the maximum EI premiums and CPP contributions. - Shevi is a single mother and has a 12-year-old son and an18-year-old daughter who lives at home - The daughter attends college on a full-time basis for 8 months during 2023. Shevi paid her tuition fees of $4,950, as suell as $750 for the textbooks that she requires in her program. The daughter had a net income of $3,450. The daughter agrees to transfer the maximum education credits possible to Shevi. - Shevi made a donation of $750 to the Sick Kids Hospital. Required (show all calculations): Calculate the minimum Federal income tax payable for 2023 for Shevi Wells. [Hint: please provide your answer in the following format with description of the items and calculations under each section] - Enable the HTML Editor for inputting your

PLEASE USE THIS FORMAT FOR THE ANSWER

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started