Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer qustion 2 and 3. typed answer. thanks Show work and cite any sources used; submit in Word or Excel. 1. During the first

please answer qustion 2 and 3. typed answer. thanks

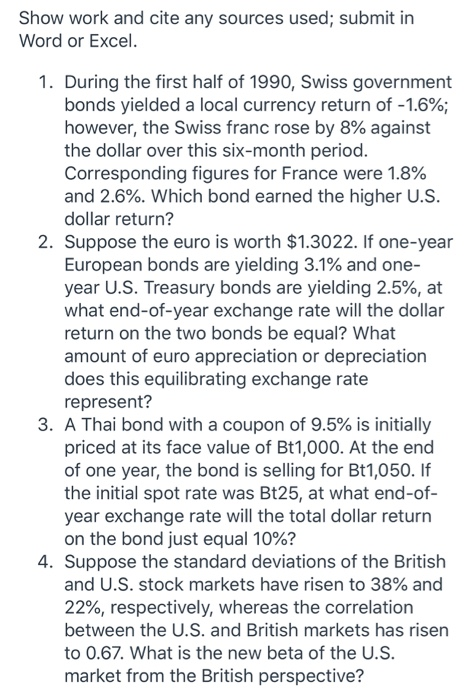

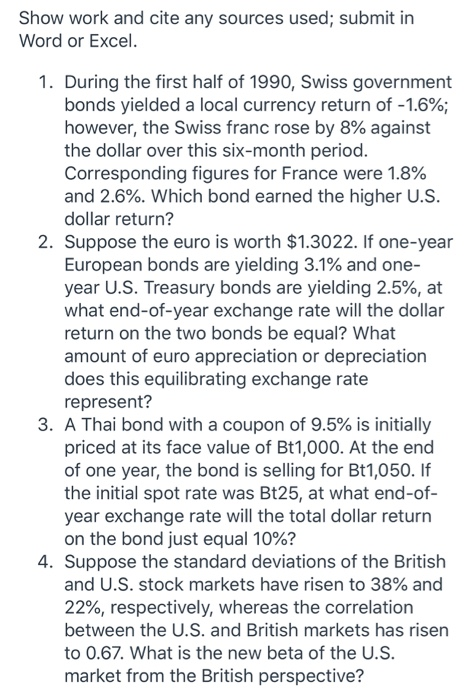

Show work and cite any sources used; submit in Word or Excel. 1. During the first half of 1990, Swiss government bonds yielded a local currency return of -1.6%; however, the Swiss franc rose by 8% against the dollar over this six-month period. Corresponding figures for France were 1.8% and 2.6%. Which bond earned the higher U.S. dollar return? 2. Suppose the euro is worth $1.3022. If one-year European bonds are yielding 3.1% and one- year U.S. Treasury bonds are yielding 2.5%, at what end-of-year exchange rate will the dollar return on the two bonds be equal? What amount of euro appreciation or depreciation does this equilibrating exchange rate represent? 3. A Thai bond with a coupon of 9.5% is initially priced at its face value of Bt1,000. At the end of one year, the bond is selling for Bt1,050. If the initial spot rate was Bt25, at what end-of- year exchange rate will the total dollar return on the bond just equal 10%? 4. Suppose the standard deviations of the British and U.S. stock markets have risen to 38% and 22%, respectively, whereas the correlation between the U.S. and British markets has risen to 0.67. What is the new beta of the U.S. market from the British perspective

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started