Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer qustion number 10 8. Suppose Bank A has an assets-to-equity ratio of 10 and Bank B has a ratio of 20. If both

Please answer qustion number 10

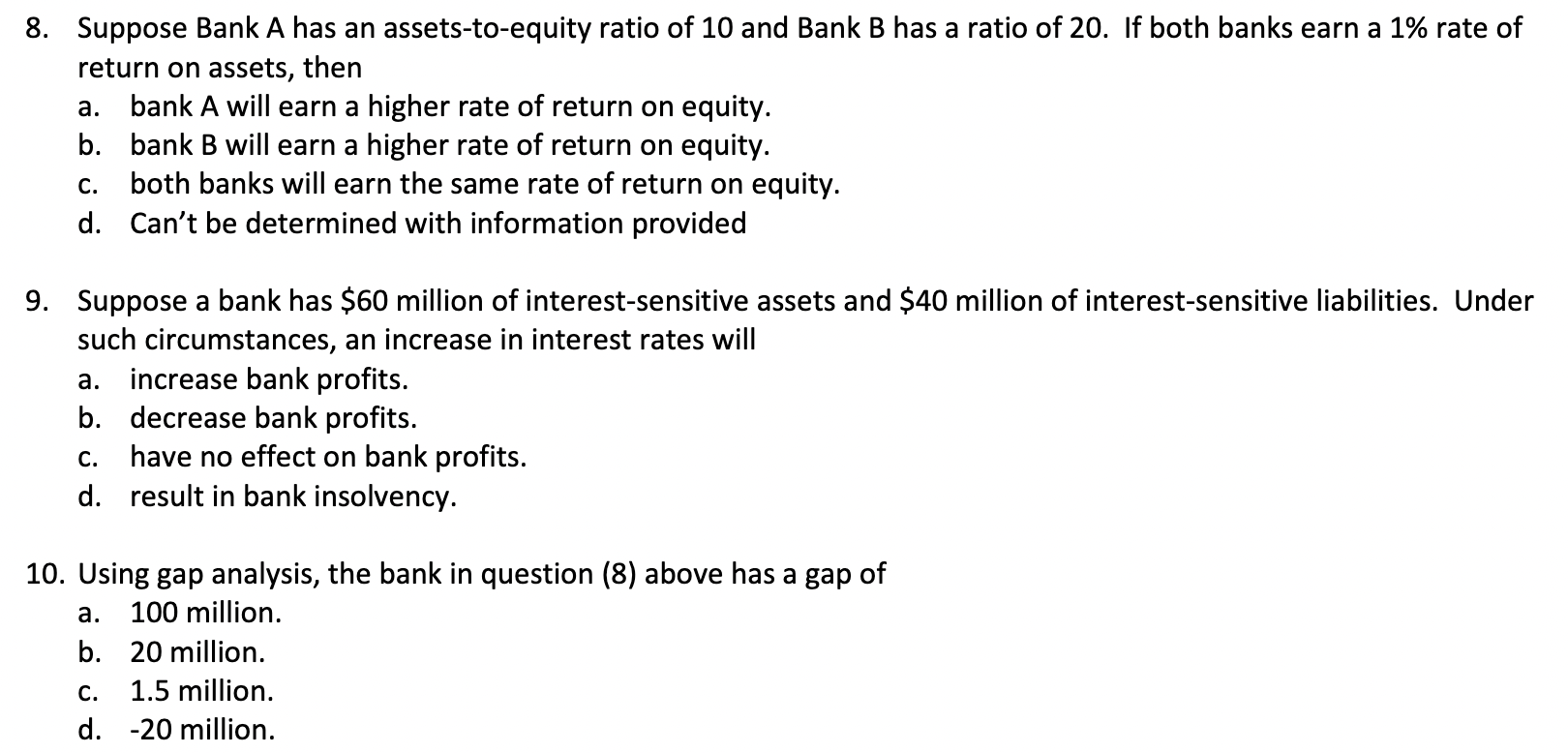

8. Suppose Bank A has an assets-to-equity ratio of 10 and Bank B has a ratio of 20. If both banks earn a 1% rate of return on assets, then a. bank A will earn a higher rate of return on equity. b. bank B will earn a higher rate of return on equity. both banks will earn the same rate of return on equity. d. Can't be determined with information provided c. 9. Suppose a bank has $60 million of interest-sensitive assets and $40 million of interest-sensitive liabilities. Under such circumstances, an increase in interest rates will a. increase bank profits. b. decrease bank profits. C. have no effect on bank profits. d. result in bank insolvency. 10. Using gap analysis, the bank in question (8) above has a gap of a. 100 million. b. 20 million. c. 1.5 million. d. -20 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started