Answered step by step

Verified Expert Solution

Question

1 Approved Answer

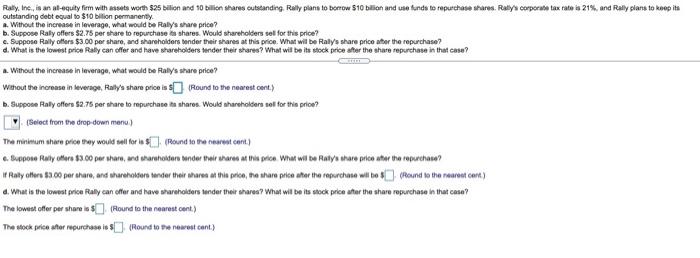

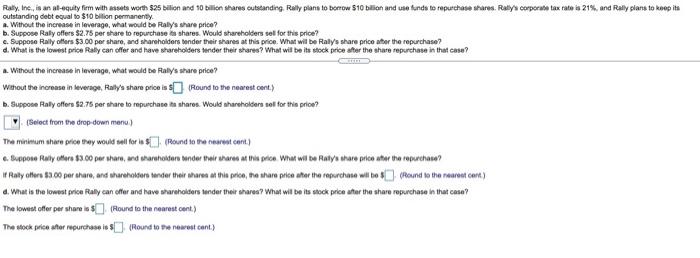

PLEASE ANSWER Raty, Inc. is an ul-equity firm with assets worth $25 billion and 90 billion shares outstanding. Rally plans to borrow S10 billion and

PLEASE ANSWER

Raty, Inc. is an ul-equity firm with assets worth $25 billion and 90 billion shares outstanding. Rally plans to borrow S10 billion and use funds to purchase shares Ralys corporate tax rate as 21%, and Rally plans to keep its outstanding debt equal to $10 billion permanently Without the increase in leverago, what would be Rally's share price? b. Suppose Rally offers $2.75 per Share to repurchase a shares. Would shareholders sel for this price? c. Suppose Rally offers $3.00 per share and shareholders onder their shares at this price. What will be Rally share price after the repurchase? d. What is the lowest price Rally can offer and have shareholders hinder their shares? What will be its stock price after the share repurchase in that case? Without the increase in leverage, what would be Ralys share price? Whout the increase in severage, Rally's share price is () (Round to the nearest cent.) 6. Suppose Rally offers $2.75 per share to purchase the shares would shareholders set for the price? Select from the drop down menu) The minimum share price they would tell for lo $Round to the nearest cont.) Suppose wly our $3.00 per share, and wareholder tender their shares at this pece What will be aty share poate the repurcha? If Raty offers 53.00 per here, and shareholdere tender their shared at the police, the share price her the repurchase will be $(Round to the nearest cent) d. What is the lowest price Rally can offer and have shareholders under their shared? What will be its stock price her the share repurchase in that came? The lowest offer per share is $(Round to the nearest cont.) The stock price for repurchase is (Round Hoe newest cont.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started